x New businesses participating in the import-export field do not clearly understand what a commercial invoice is?

x Are you wondering what content a commercial invoice includes? What regulations?

x Do you want to know what role a commercial invoice plays? What should you keep in mind when making an invoice?

Commercial invoice is an indispensable document in import and export. And here, at Proship.vn, we will answer questions about what a commercial invoice is, its role, regulations on commercial invoices,... as well as update the latest export commercial invoice template for your business. reference.

What is a commercial invoice? What role does it play?

The following is the concept and role of commercial invoice:

Commercial invoice concept

What is a commercial invoice? Commercial Invoice ((Commercial Invoice in English) is a commercial document issued by the seller to the buyer to receive a certain amount of money that the buyer of goods or services is obligated to pay to the buyer. Sales under specific conditions. Commercial invoices are usually issued by the Manufacturer.

The role of commercial invoices

Commercial invoices have important significance in import and export activities, specifically:

- Payment between seller and buyer, exporter and importer, is the basis for the seller to request payment and the buyer to make payment;

- Determine import and export taxes and provide necessary information for customs clearance;

- Compare information with other documents during contract implementation and import-export procedures.

>>See more: What is Logistics? Role of Logistics

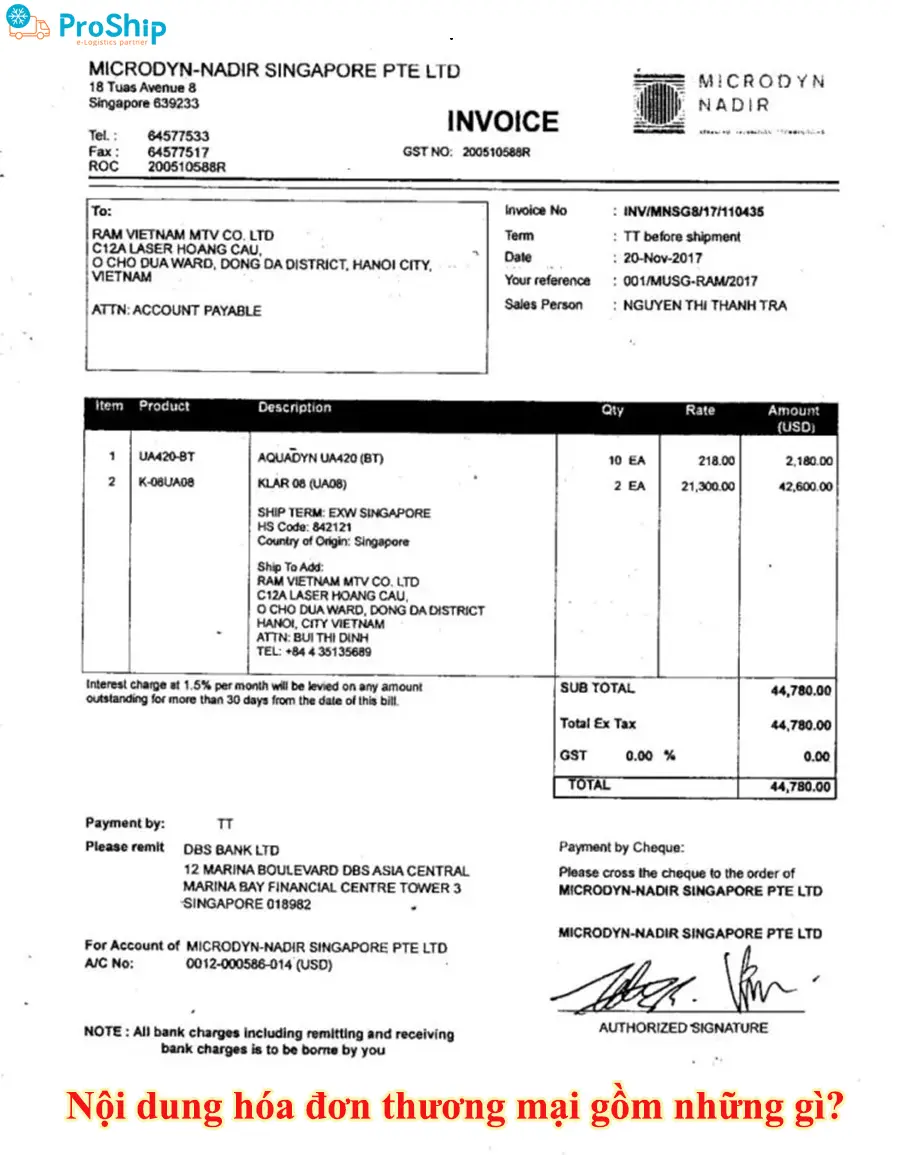

Detailed content of commercial invoice

To understand what a commercial invoice is, it is also necessary to clearly understand the content in a commercial invoice:

- Buyer: Includes buyer's company name, address, email, phone number, fax, representative,...;

- Seller: Seller company name, address, email, fax number, seller phone number, representative information, VAT number, seller country;

- Invoice number: Invoice number helps businesses easily look up and confirm invoice information as well as business transactions;

- Invoice date: Invoice is created after the contract is signed by the parties and before the export date to match the export documents;

- Payment method: T/T remittance payment; Payment of letters of credit and L/C documents; Payment for collection of documents D/A, D/P;

- Incoterm conditions: Clearly stated, accompanied by specific location;

- Detailed product description: Common name of the product, grade or quality, code, number and symbol of the goods when circulating in the domestic market of the exporting country along with the code and packaging code of the goods;

- Quantity: Calculated according to the weight/dimension of the shipping country or the United States;

- Price of each item;

- Total amount: Total invoice value recorded in numbers and words, along with the face value of the payment currency;

- Currency;

- Related costs: International freight charges, insurance fees, commissions, packaging costs, container costs, packaging costs and other related costs.

What are the provisions of a commercial invoice?

Pursuant to Decree No. 123/2020/TT-BTC on preparing VAT invoices for exported goods, regulations on commercial invoices for exporting goods are as follows:

- “The time of preparing the export invoice according to 78/2021/TT-BTC is the time of completing customs procedures (customs clearance confirmation date).” (Point c, Clause 3, Article 13 of Decree 123/2020/TT-BTC);

- The currency listed on the invoice is Vietnamese Dong with the symbol "d". In case economic transactions arise in foreign currency, the unit price, amount, total VAT amount according to each tax rate, total payment, etc. are recorded in the currency unit of the foreign currency." (Point C Clause 13 Article 10 Decree 123/2020/TT-BTC);

- In case a domestic enterprise exports goods to the non-tariff area: Use a value-added invoice or sales invoice according to the provisions of Circular No. 39/2014/TT-BTC;

- If an enterprise needs to write foreign words on the invoice, the foreign words will be placed on the right and in parentheses () or right below the Vietnamese words with a smaller font size than Vietnamese;

- When exporting goods and services, on the invoice, businesses do not need to fill in the tax code box;

- The electronic invoice does not necessarily have the buyer's electronic signature. Therefore, the export invoice does not require the signature of the customer purchasing goods or services abroad.

The Government's Decree and the Ministry of Finance's Circular on regulations on writing export invoices are detailed as follows:

According to Clause 1 and Clause 2, Article 8 of Decree No. 123 stipulates:

- VAT invoice is an invoice for organizations declaring VAT using the deduction method for the following activities:

a) Selling goods and providing services domestically;

b) International transport activities;

c) Export to non-tariff zones and cases considered as exports;

d) Exporting goods and providing services abroad.

2. Sales invoices are invoices for the following organizations and individuals:

a) Organizations and individuals declare and calculate VAT using the direct method used for the following activities:

- Selling goods and providing services domestically;

- International transport activities;

- Export to non-tariff zones and cases considered as exports;

- Exporting goods and providing services abroad.

b) Organizations and individuals in the non-tariff zone when selling goods and providing services to the domestic market and when selling goods and providing services between organizations and individuals in the non-tariff zone and exporting goods to each other. Exporting goods and providing services abroad, the invoice clearly states "For organizations and individuals in the non-tariff zone."

Commercial invoice sample and notes you need to know

Join Proship to update the latest Commercial invoice template and note when creating commercial invoices:

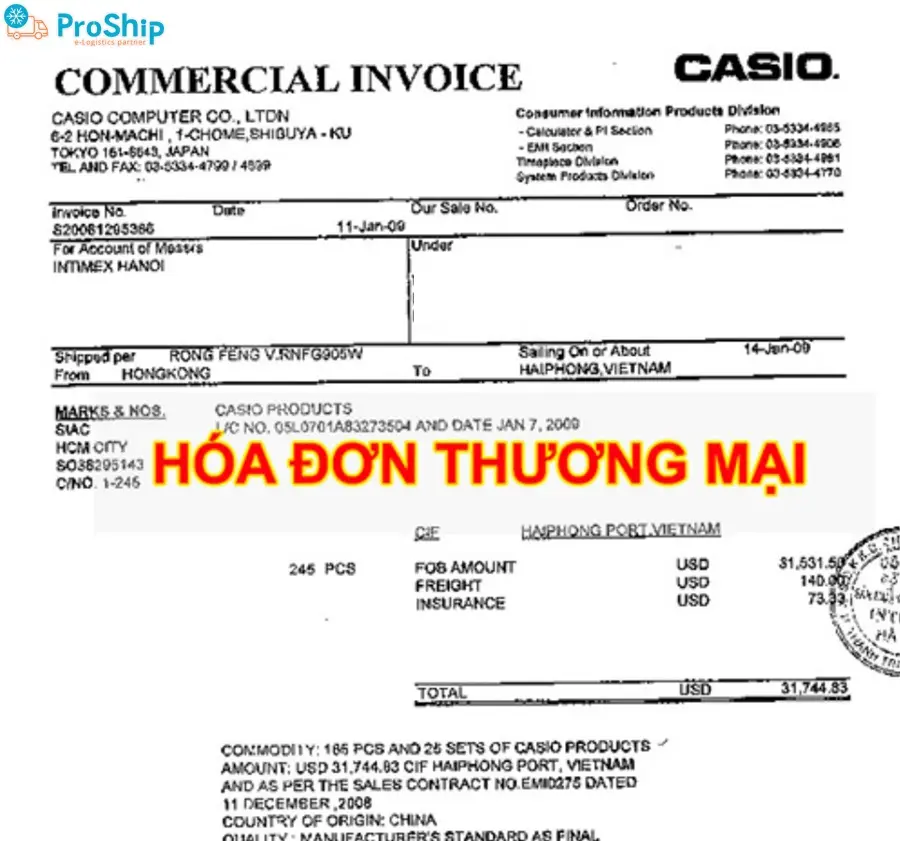

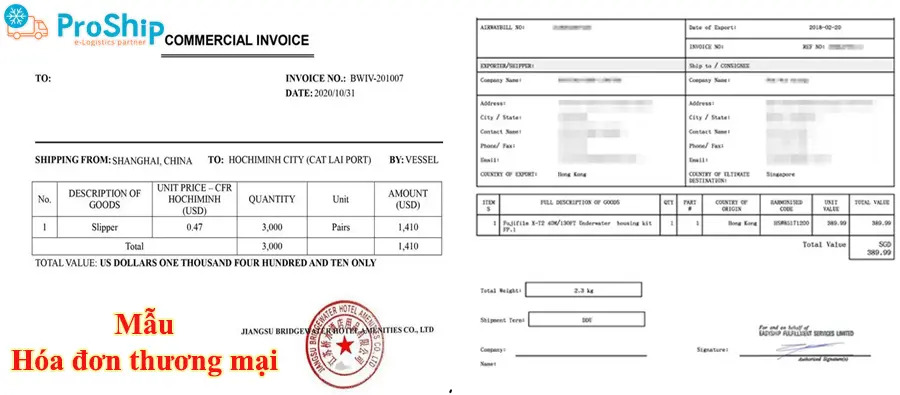

Commercial invoice template

Currently, commercial invoices are often issued by manufacturers and export commercial invoice templates in Vietnam are very diverse and rich.

Note when creating commercial invoices

Before creating a commercial invoice, note common errors:

- Confusion with documents with similar content: Make sure the content is accurate, avoid confusion with documents with similar content such as import-export invoices or Packing List invoices;

- Insufficient declaration of information: Incomplete and inaccurate declaration of goods information, affecting the customs clearance process;

- Failure to clearly state delivery conditions: Whether CIF or FOB on the commercial invoice causes misunderstanding when determining responsibility and shipping costs;

- Issuance time: Commercial invoice is prepared as a basis for calculating the total invoice value and determining export value tax, usually prepared when the origin, type, quantity, etc. are complete.

Proship Logistics has clarified what a commercial invoice is , what are the regulations on commercial invoices, and what is included in the export commercial invoice form. Commercial invoices are important in international trade. This is considered one of the basic documents to carry out customs procedures for international shipments as well as handle possible disputes. For any related questions, contact 0909 344 247 for answers.