x Do domestic enterprises and business households need to import electronic scales in large quantities to Vietnam?

x Do you still have many problems and are not familiar with the process and procedures for importing foreign electronic scales into your country?

x Do you need to connect with a unit specializing in importing electronic devices, electronic scales, etc. to support warehousing and delivery to businesses?

Proship.vn will update detailed procedures for importing electronic scales from abroad to Vietnam so that business households and large and small businesses know what types of documents and records they need to prepare before carrying out the procedures. import goods. At the same time, we also list the types of taxes, tax rates payable, and HS Code corresponding to each electronic scale product. Along with that is the cheap, reputable and safe Import-Export Entrusted Service only available at Proship Logistics for any unit that needs to conveniently consult and consider choosing us to ensure the highest service benefits.

📦 Hotline contact shipping

🧭 Central

Why is the need to import electronic scales to Vietnam increasing?

Electronic scales are electronic devices used to determine the weight of an object. When we put an object on the electronic scale, the sensor will sense the actual weight of the object and then forward it to the processing chip and put the signal on the scale display screen in just 2 - 5 seconds. Electronic scales consist of two main parts: Force sensor, also known as Loadcell, and Scale display screen.

Importing electronic scales is currently becoming an important need in the fields of production, processing, and trade. Electronic scales with modern technology help with quick and accurate measurements, increasing efficiency and accuracy in the mass measurement process. Importing electronic scales requires attention to quality, measurement and safety regulations as well as customs and import tax processes.

Electronic scales are divided into products with different functions such as:

- Counting scale: A specialized electronic scale for counting the quantity of goods and products;

- Electronic floor scale: An electronic scale used for goods and appliances with large weights such as in the import-export sector;

- Electronic bench scale: An electronic scale used for commercial purposes and applied in production with goods of moderate weight;

- Gold scale: An electronic scale used in the gold and precious metal industry. The scale has extremely small errors, helping to accurately weigh the actual weight of the product;

- Cash register scale: An electronic scale used in supermarkets and stores with the main function of weighing weight and calculating prices;

- Car scale, truck scale: A specialized electronic scale for weighing the load of cars and trucks, calculating the weight of goods on the vehicle, the scale can weigh large weights of 100 tons, 200 tons. ,…;

- Technical scale: A type of scale used in technical industries;

- Electronic analytical balance: A new type of electronic balance used for weighing and measuring, with accuracy to 0.1mg.

As the country's economy is growing, more and more domestic production and business enterprises are also participating in exchange and trade in the international market. Import-export activities in Vietnam are extremely exciting and increase every year. However, there are many domestic import-export enterprises that lack experience because for each different product, import/export in different countries will require different procedures.

In general, the process of making customs clearance papers for all types of goods is currently quite strict, so problems arising during the customs clearance process are not uncommon. This not only delays work progress but also causes many other major economic losses. Therefore, Business Households and Enterprises should find a unit that specializes in taking care of all customs procedures from A - Z so that the process of importing electronic scales can take place quickly and smoothly.

Detailed procedures for importing electronic scales, updated in 2023

Proship Logistics will share details about Import Policy, HS Code, Taxes payable, Documents to prepare, Procedures for importing electronic scales to Vietnam for Business Households and Enterprises to clearly understand and understand. understand correctly:

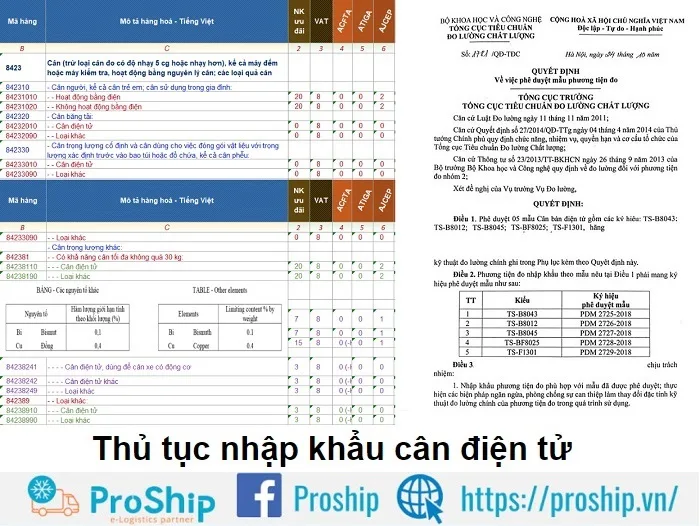

Electronic scale import policy

- Official dispatch No. 2538/GSQL-GQ1 regulates issues of importing electronic scales for medical use;

- Circular No. 23/2013/TT-BKHCN dated September 26, 2013. Measurement regulations for group 2 measuring instruments;

- Official Dispatch No. 2177/TD-Đl guiding the implementation of Circular No. 23/2013/TT-BKHCN;

- Decision 2284/QD-BKHCN dated August 15, 2018. about the HS code table for group 2 measuring devices;

- Circular 38/2015/TT-BTC dated March 25, 2015, amended and supplemented 39/2018/TT-BTC dated April 20, 2018;

- Decree No. 69/2018/ND-CP dated May 15, 2018;

- Decree 128/2020/ND-CP dated October 19, 2020;

- Decree No. 43/2017 ND-CP dated April 14, 2017.

HS code and import tax on electronic scales

HS code code for imported electronic scales

When imported to Vietnam, electronic scales have HS code of group 8423. Depending on the type of scale, there will be different subgroups, specifically:

| V | PLU | Description of goods – Vietnamese | Preferential import tax | ACFTA | ATIGA | AJCEP | AKFTA |

| 8423 | Balances (other than weighing scales with a sensitivity of 5 cg or more), including counting or checking machines, operating on the weighing principle; types of weights. | ||||||

| 1 | 842310 | – Human scales, including children's scales; Scales for household use: | |||||

| 2 | 84231010 | – – Electrically operated | 20 | 0 | 0 | 9 | 0 (-KH, LA) |

| 2 | 84231020 | – – Not electrically operated | 20 | 0 | 0 | 9 | 0 (-KH, LA) |

| 1 | 842320 | – Conveyor scales: | |||||

| 2 | 84232010 | – – Electrically operated | 0 | 0 | 0 | 0 | 0 (-LA) |

| 2 | 84232020 | – – Not electrically operated | 0 | 0 | 0 | 0 | 0 (-LA) |

| 1 | 842330 | – Fixed weight scales and scales used for packing materials with predetermined weights into bags or containers, including hopper scales: | |||||

| 2 | 84233010 | – – Electrically operated | 0 | 0 | 0 | 0 | 0 (-LA) |

| 2 | 84233020 | – – Not electrically operated | 0 | 0 | 0 | 0 | 0 (-LA) |

| 1 | – Other weight scales: | ||||||

| 2 | 842381 | – – Capable of weighing no more than 30 kg: | |||||

| 3 | 84238110 | – – – Electrically operated | 20 | 0 | 0 | 9 | 0 (-LA) |

| 3 | 84238120 | – – – Not electrically operated | 20 | 0 | 0 | 9 | 0 (-LA) |

| 2 | 842382 | – – Capable of weighing a maximum of over 30 kg but not exceeding 5,000 kg: | |||||

| 3 | – – – Electric operation: | ||||||

| 4 | 84238211 | – – – Able to weigh a maximum of no more than 1,000 kg | 7 | 0 | 0 | 0 | 0 |

| 4 | 84238219 | - - - - Others | 3 | 0 (-KH) | 0 | 0 | 0 (-LA) |

| 3 | – – – Non-electrical operation: | ||||||

| 4 | 84238221 | – – – – Able to weigh a maximum of no more than 1,000 kg | 15 | 0 (-KH) | 0 | 6 | 0 (-LA) |

| 4 | 84238229 | - - - - Others | 3 | 0 (-KH) | 0 | 0 | 0 (-LA) |

| 2 | 842389 | - - - - Others | |||||

| 3 | 84238910 | – – – Electrically operated | 3 | 0 (-KH) | 0 | 0 | 0 (-LA) |

| 3 | 84238920 | – – – Not electrically operated | 3 | 0 (-KH) | 0 | 0 | 0 (-LA) |

Tax payable when importing electronic scales

Below are the tax rates payable when importing electronic scales:

- Common import tax: Ranging from 4.5% - 30%;

- Preferential import tax: Ranging from 3%-20%;

- Value added tax VAT: 10%;

- Electronic scales imported from China have C/O form E: 0%.

Documentation for importing electronic scales

Before carrying out procedures to import electronic scales, you need to prepare the following documents:

- Purchase Order or Contract: 01 true copy;

- Commercial Invoice: 01 photocopy;

- Bill of lading (Airway Bill/Bill of lading): 01 photocopy;

- Packing List: 01 photocopy;

- Certificate of Origin (if any): 01 original;

- Freight invoice (in case of delivery under FOB, Exwork, etc. terms): 01 photocopy;

- Registration for specialized inspection (if inspection is required): original;

- Photocopies of other documents (if any)...;

- License (if any): 01 original;

- Other documents required by Customs (if any)....: images, related documents, catalogs,... of the shipment.

Procedure for importing electronic scales

The import process takes place according to the following steps:

Step 1: Fill out the customs declaration

Enterprises fill out customs declarations on the Electronic Information Portal. The declared information needs to be based on the existing import dossier and wait for the results of channeling.

Step 2: Register to check the quality of electronic scales

Enterprises register for quality inspection for imported electronic scales, this item is under the management of the General Department of Metrology. Quality inspection registration dossier includes:

- Quality Inspection registration form according to the form;

- Sales contract;

- Commercial invoice;

- Packing list;

- Bill of Lading;

- Certificate of Origin (C/O): Photocopy of the importing organization or individual.

Step 3: Open the customs declaration

Enterprises bring import dossiers along with classified declarations to submit at the customs branch. Customs officers will check the documents and return the classification results. Depending on the results of goods flow, businesses continue to process:

- Goods in the green channel: Will be cleared immediately;

- Goods in the yellow channel: Customs officers will check the details of the documents and will not check the actual goods;

- Goods in the red channel: Customs officers will re-check goods details and physically inspect the goods.

The quality inspection process will take place in parallel with the goods import process.

Step 4: Customs clearance of goods

After checking the goods documents, if there are no problems, the declaration will be cleared. Enterprises pay taxes to customs so that goods can be cleared.

Step 5: Receive goods and transport them to the warehouse to prepare for distribution to the market

📦 Hotline contact shipping

🧭 Central

A few things to keep in mind when importing electronic scales

Businesses need to pay taxes when importing goods. Taxes and percentages are clearly specified for each type of goods. Businesses can refer to the import and export tax schedule. Goods are only cleared through customs when businesses have fulfilled their tax obligations. Each type of goods will have a different corresponding HS code, that's why businesses need to determine the correct HS Code of the goods to make the correct documents and procedures. At the same time, avoid being fined for applying the wrong HS Code.

Normal import tax will be very high, so businesses should apply for a certificate of origin (C/O) from the exporter to enjoy special preferential import tax rates. Electronic scales as well as other imported items need to be labeled. All import documents need to be prepared accurately and completely to avoid additional cases that will take time and can cost a lot of money for storage and storage.

>>See more: Procedures for importing medical equipment

Does Proship Logistics accept the import of electronic scales and entrust the import and export of other items?

Proship Joint Stock Company has many years of experience in carrying out procedures for importing goods from abroad to Vietnam, including procedures for importing electronic scales. We are always ready to help you carry out customs clearance of goods. Electronic scales and measuring devices are easier. At the same time, Proship Logistics will also advise customers on necessary notes and documents to quickly complete all import procedures for this item.

As a Customs Agent, we use a valid DIGITAL SIGNATURE to declare customs and are responsible for the content declared on the declaration along with the Import-Export Enterprise; On behalf of the enterprise, carry out import and export procedures according to the Customs Warehouse Contract signed between the two parties; The name and code of the Proship Customs Agent are shown on the declaration and on the HQ system. As the HQ Clearance Unit, Proship will NOT APPEAR on any documents of the customs declaration dossier. Our task is to create a declaration using our own software, then use the Customer Token to sign the declaration, and use the goods owner's introduction letter to complete customs procedures.

The import-export trust service is also a safe solution for import-export businesses, especially businesses that do not have experience negotiating and working with foreign traders. Therefore, if you choose PROSHIP LOGISTICS as an entrusted import and export unit, we will carry out a variety of transportation methods by sea, road, air, railway,...committed to competitively cheap prices. paintings, professional processes, and simple procedures to support businesses from A - Z until delivery to the recipient. And also in order to speed up the door-to-door delivery process, Proship is equipped with small trucks and long-distance trucks, multi-load containers, customers can easily choose the type of vehicle suitable for the current quantity of goods.

Proship accepts imports of electronic scales and many items

We specialize in shipping and importing the following types of electronic scales:

- Beurer electronic scale;

- Laica electronic scale;

- Microlife electronic scale;

- Omron electronic scale;

- Tanita electronic scale;

- Rapido electronic scale;

- Xiaomi electronic scale;

- Kachi electronic scale;

- Lanaform electronic scale.

In addition, Proship also provides full customs declaration at border gates, airports, and seaports for many other items such as:

- USED machinery product group (goods that are easy to complete customs procedures and documents): Industrial and civil machines, excavators, excavators, bulldozers, lathes, milling machines...;

- Group of aquatic feed, animal feed, poultry feed;

- Group of fertilizers and plant protection drugs;

- Group of specialized equipment items: Industrial equipment, Aviation and defense equipment, Color printer equipment, printing industry;

- Handicrafts: bamboo and rattan...;

- Electronic components, industrial machinery spare parts;

- Fertilizer, children's toys, elevators, escalators, construction materials, toilets, cups,...

Proship's target customers

For Transportation Services, we have been aiming to serve the following customers:

- Forwarding agent;

- Importing unit;

- Product supplier.

For full customs services, Proship also focuses on the following customers:

- Customers wishing to use full-service Customs Logistics Services;

- Import-Export Companies entering and leaving Industrial Parks and Non-Tariff Zones;

- Import-Export Companies through Vietnamese and International Airports and Seaports.

Advantages of import and export entrusted service at Proship

Here are the reasons why you should choose the export and import entrusted service at Proship:

- Full service, only have to pay once, no additional costs;

- Reasonable entrustment costs for each item, commitment to the most competitive prices;

- Customers do not need to register their names to export or import goods;

- Buy and sell international goods but only through regular VAT invoices;

- Reputation – Responsibility – Confidentiality of customer information as well as shipments;

- Businesses do not encounter problems with customs procedures, taxes, etc.

Other types of services at Proship when importing and exporting goods

Proship Logistics provides consulting and other services such as:

- Analyze and classify goods;

- Plant/animal quarantine service (about 700,000 VND) (note: price will change according to market prices);

- Food hygiene and safety inspection service;

- Quality inspection and goods inspection services;

- Certificate of Origin (C/O) application service (about 1,000,000 - 2,000,000 VND) (note: price will change according to market prices);

- Service of applying for a certificate of conformity and declaration of conformity (about 2,000,000 VND) (note: price will change according to market prices);

- Cosmetic announcement service (about 2,500,000 million - 3,000,000 VND) (note: price will change according to market prices);

- Regular food declaration service (about 2,000,000 VND) (note: price will change according to market prices);

- Services for applying for licenses from ministries and branches;

- Fumigation service (about 350,000 VND) (note: price will change according to market prices).

detailed information you need to know about new and most detailed procedures for importing electronic scales to Vietnam Accordingly, businesses, private individuals, and business households who are interested in learning about this issue should retain their knowledge to effectively serve the upcoming plan to import large quantities of Genuine electronic scales. Contact us immediately at 0909 344 247 when you need to use transportation services - import and export entrustment - customs clearance to import electronic scales and other electronic devices.