x Import-export enterprises need to apply on-site import and export but it is not clear how it works and what the procedures are?

x You wonder what benefits it will bring if you replace the traditional method with on-site import and export, are there any taxes?

x Do you need to hire a specialized unit for customs declaration of export and import goods at Cat Lai Port and Tan Son Nhat SB?

Besides traditional export forms, on-site import and export is the choice of many Vietnamese businesses. To help readers better understand this form, Proship.vn has compiled knowledge from many sources to answer questions about what on-site import and export is and some new regulations on on-site import and export. Based on this, businesses that do not have much experience in on-site import and export can refer to and apply to minimize costs and shipping time, thereby increasing business efficiency.

📦 Hotline contact shipping

🧭 Central

Cheap Container shipping service

What is on-site import and export? What are the advantages? Is it taxable?

What does on-site import and export mean?

Currently, instead of importing and exporting goods in the traditional direction, Vietnamese businesses are tending to shift to on-site import and export. With this form, businesses can save maximum time and costs, and will also enjoy some tax incentives. So specifically, what is on-site import and export?

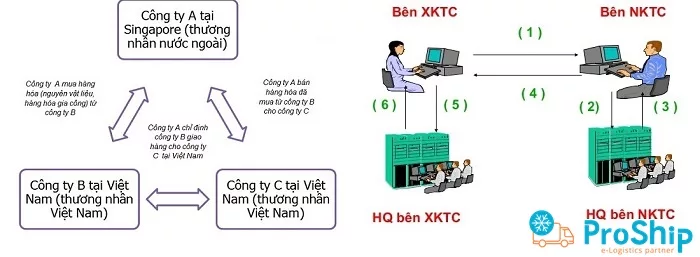

On-site import and export is a form in which businesses in Vietnam (can be purely Vietnamese businesses or businesses with foreign investment capital) sell goods to foreign businesses, but all transactions and delivery procedures are carried out. on Vietnamese territory. The consignee will be an Enterprise based in Vietnam, directly designated by the buyer. It can be a Partner Company, Authorized Company or Affiliate Company of the buyer.

The basic characteristics of on-site export are:

- Delivery to a designated Enterprise in the territory of Vietnam;

- Vietnamese enterprises sell goods to foreign enterprises;

- All information related to the consignee will be provided by the foreign company.

Advantages of on-site import and export

On-site import and export is increasingly popular with businesses with the following advantages:

- Providing businesses with attractive incentives on import and export taxes;

- Helps businesses save a lot of costs for the import and export process of goods;

- Maximum savings on fees, shipping time, package quality during transportation,...

Is on-site import and export taxable?

On-site import and export are also import and export activities, so taxes are still applied similar to goods purchased from abroad. For domestic importers, the seller can be required to provide C/O form D to enjoy tax incentives, but this only applies to purchases of goods from companies in the non-customs zone, or Processing enterprises. Currently, some domestic businesses still have trouble enjoying tax incentives while completing customs procedures.

>>See more: What is an import-export trust?

Procedures, regulations and things you need to know when importing and exporting on the spot

What is the form of on-site import and export, what are the advantages, is it taxable, etc. were answered by Proship. The next content is new regulations on on-site import and export, customs procedures for on-site import and export goods (location, time limit for procedures, on-site import and export process,...) and applicable types of goods. export spot. Details are as follows:

General regulations on on-site import and export goods

For on-spot import and export goods, this applies to goods exported by Vietnamese traders (including foreign-invested enterprises; export processing enterprises) to foreign traders but as designated by the traders. Foreign goods are delivered in Vietnam to other Vietnamese traders.

1. Goods exported on the spot are considered export goods; Goods imported on the spot are considered imported goods and must comply with the provisions of law on management of exported and imported goods and tax policies for exported and imported goods.

2. The basis for determining on-site export and import of goods is that the goods must have 2 separate contracts:

- Export contracts, processing contracts, and leasing contracts have provisions clearly stating that the goods are delivered to the consignee in Vietnam;

- Import contracts, processing contracts, and rental contracts have provisions clearly stating that the goods are received from the shipper in Vietnam.

3. On-site exporter (Export enterprise): A person designated by a foreign trader to deliver goods in Vietnam.

4. On-site importer (Importing enterprise): A person who purchases goods from a foreign trader but is designated by the foreign trader to receive goods in Vietnam from the on-site exporter.

Types of on-site import and export goods

According to Article 86 - Circular No. 38/2015/TT-BTC on "Customs procedures for on-spot export and import goods", on-spot export goods include the following 3 common types:

1/ Processed products; rented or borrowed machinery and equipment; surplus raw materials and supplies; scrap and defective products under processing contracts as prescribed in Clause 3, Article 32 of Decree No. 187/2013/ND-CP;

2/ Goods traded between domestic enterprises and export processing enterprises, enterprises in non-tariff zones;

3/ Goods purchased and sold between Vietnamese Enterprises and foreign organizations and individuals that are not present in Vietnam and are designated by foreign traders to deliver and receive goods with other Enterprises in Vietnam.

Customs procedures for on-site import and export goods

Customs documents need to be prepared

- Customs declaration: Used to declare goods information during the import and export process;

- Sales contract: Proof of origin and authentication of goods;

- Commercial invoice, or VAT invoice, transport documents;

- Goods quality inspection card: ensures the goods are allowed for business. Business owners should learn about goods that are banned from import and export according to regulations to minimize possible risks;

- Other relevant documents depending on each specific case,...

Location for customs procedures for on-site import and export goods

According to Clause 2, Article 86 of Circular 38/2015/TT-BTC, on-site export and import customs procedures are carried out at convenient Customs Branches selected by the customs declarant and according to the regulations of each type. .

Time limit for customs clearance

The time limit for carrying out customs procedures for on-site export and import goods according to Clause 4, Article 86 of Circular 38/2015/TT-BTC (amended in Circular 39/2018/TT-BTC) is as follows: During Within 15 working days from the date of customs clearance of exported goods, on-site importers must complete customs procedures.

Process of on-site import and export steps

For exporters

- Step 1: The declarant will fill in all required information on the export goods declaration and combined transportation declaration. The location code of the Customs Branch carrying out import customs procedures must be clearly and accurately recorded. in the box "Destination for tax-protected shipping";

- Step 2: The exporter will carry out procedures for exporting goods according to regulations or instructions of the agency;

- Step 3: After the exported goods have been cleared through customs, deliver the package to the importer.

For importers

- Step 1: The importer must declare information on the import goods declaration, note that it is necessary to clearly state the corresponding on-site export goods declaration number in the "Notes" box on the import goods declaration or box. “Other notes” on the paper customs declaration. In this step, you must seriously implement it within the prescribed time limit;

- Step 2: Carry out goods import procedures accurately and on time according to regulations.

For Customs authorities to carry out import procedures

- Step 1: The agency will monitor on-site export goods declaration documents. If the documents are fully completed, customs procedures for imported goods will be carried out;

- Step 2: Receive and check the declared information based on the channeling results of the Customs System;

- Step 3: Based on the foreign trader's instructions, on-spot export and import goods will be compiled monthly and a list of on-spot imported goods declarations that have been cleared through customs will be compiled.

📦 Hotline contact shipping

🧭 Central

Cheap Refrigerated Container shipping service

Things to keep in mind when importing and exporting on the spot

1. In case the customs declarant is a priority enterprise and the partners buying and selling goods with the priority enterprise; Enterprises that comply with customs laws and partners who buy and sell goods are also enterprises that comply with customs laws and have on-site export and import goods that are delivered and received multiple times within a certain period of time under a contract. Orders with the same buyer or seller will receive goods first and customs declaration later. Customs declaration is carried out within a maximum period of 30 days from the date of delivery of goods.

Customs declarants can register export and import goods declarations on the spot at a convenient Customs Branch; Tax policies, export and import goods management policies are implemented at the time of customs declaration registration. Customs authorities only check documents related to the delivery of goods (not check the actual goods). For each delivery, the exporter and importer must have documents proving the delivery of goods (such as commercial invoices or VAT invoices or sales invoices, warehouse delivery notes cum internal transportation bills, etc.) ...), responsible for keeping at the enterprise and presenting it when the customs authority conducts inspection.

2. In case the export and import declarations are opened at the same customs office, if the export declaration is red-channeled and the actual goods have been inspected and customs clearance procedures have been completed, the import declaration shall be the same. The applicant may be exempted from physical inspection of goods according to regulations.

3. In case the deadline for opening a reciprocal import declaration is overdue, refer to the penalties for violating regulations on the time limit for customs procedures and tax dossier submission specified in Clause 3, Article 1 of Decree No. 45/ 2016/ND-CP dated May 26, 2016 of the Government "Amending and supplementing a number of articles of Decree No. 127/2013/ND-CP dated October 15, 2013 of the Government stipulating sanctions for administrative violations." administration and enforcement of administrative decisions in the field of customs" .

Should import-export businesses choose Proship, FadoExpress to carry out customs declaration for Air goods at Tan Son Nhat SB and Sea goods at Cat Lai Port?

Faced with the increasing need to hire units to perform customs declaration for Air and Sea goods for import and export, Proship Logistics and FadoExpress have connected with relevant units, improving the customs professional qualifications of personnel. ,...meets all the necessary and sufficient elements to officially become a specialized KBHQ Agent at Cat Lai Port and Tan Son Nhat SB. If previously, we only operated as a Customs Broker, then in our new role as Agent, the Shipper/Business does not need to use their digital signature to approve (remotely), or send false papers as before. Instead, our customs agent will use our digital signature to declare and transmit declarations for export and import Sea/Air shipments.

In the Import-Export - Logistics Industry, choosing a professional and reliable Customs Service Provider is very important. Because this unit and its staff knowledgeable about customs operations will complete all customs clearance procedures from A - Z until the goods are delivered to the recipient, minimizing any errors and problems. problems during the process of working with airport and seaport customs. Therefore, if your unit does not have much experience in this issue, please trust and choose Proship Customs Agent, FadoExpress to ensure the best, most accurate, and most timely export customs clearance plan. , imported goods by sea and air.

Proship, FadoExpress is planning to deploy diverse types of KBHQ

Warehouse Services at SB Tan Son Nhat (can be done)

Some customs declaration services that can be performed at SB Tan Son Nhat are:

- Service of declaring business type, non-commercial;

- Service of declaring types of export production, types of processing and investment;

- Declaring services: Types of transit, tax-free investment goods,...

Warehouse Services at Cat Lai Port (can be done)

Some customs declaration services that can be performed at Cat Lai Port are:

- Full customs clearance service;

- Import and export customs declaration services from LCL packaged goods to FCL raw goods;

- Freight transportation services with flexible, fast and safe forms;

- Services for applying for full C/O samples, export quarantine certificates, etc.;

- Tax refund service for businesses.

Advantages and benefits of Customs declaration service at Cat Lai Port, Tan Son Nhat SB

Enterprises and export/import business units that choose KBHQ Proship and FadoExpress agents will receive many benefits:

- The name and code of our Customs Agent will appear on the Declaration and Customs System;

- Customs agents Proship and FadoExpress are responsible for the content declared on the HQ Declaration along with import-export enterprises;

- KBHQ agents Proship Logistics and FadoExpress carry out import and export procedures on behalf of businesses according to the contract signed between the two parties;

- Understand and update the latest Customs Circulars, Decrees, etc. to advise customers;

- Understand the customs clearance process of goods at TSN Airport and Cat Lai Port;

- We do not aim to provide the CHEAPEST price Service, but rather the quality that ensures the MOST REASONABLE cost;

- Complete the KBHQ process according to the criteria: "Fast - Accurate - Cheap - Professional" ;

- There is a representative office in Ho Chi Minh City/Hanoi/Da Nang, convenient for customers' needs to hire customs clearance services;

- You will receive dedicated advice on documents, procedures, application of HS codes, etc. by a team of knowledgeable customs staff;

- Skills to quickly handle import and export shipments that are difficult to declare at customs at Tan Son Nhat SB, Cat Lai Port;

- Have enough means to effectively serve all Logistics activities;

- Commitment to confidentiality of goods information + information provided by customers when using Customs warehousing services at airports and seaports;

- Adequate compensation policy for customers if there is a delay in customs declaration;

- Commit to delivering goods to customers as requested (accurate time and location).

Thus, with the knowledge you need to know about on-site import and export, import-export enterprises have an answer to the question of what is on-site import and export , and the current new regulations on on-site import and export. How is it now? At the same time, Proship Logistics and FadoExpress also want to introduce to customers a full package of cheap customs clearance services at Cat Lai Port and Tan Son Nhat Airport. Any shippers/businesses who are interested and need our support Specialized customs agent, contact immediately 0909 344 247 .