X You are the one who applied to open a letter of credit (Applicant), the beneficiary (Beneficiarry), the Bank for issuing a letter of credit (ISSUing Bank), the bank notifying the letter of credit, ... are participating in LC transactions to learn about the Advising Bank subject?

X You want to know in international payment, what role does Advising Bank play? Why is Advising Bank?

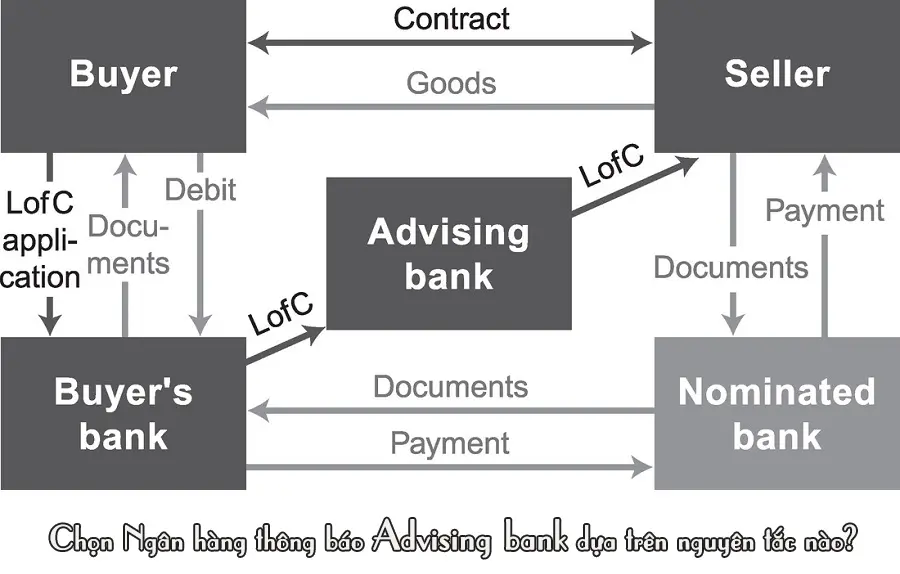

X You want to choose an appropriate and reputable Advising Bank but do not know which principle this choice is?

Join Proship.vn we find out what Advising Bank is? What is the role of Advising Bank in import -export trade? Why should I have Advising Bank? The choice of Advising Bank based on what principles?

What is Advising Bank in international payment?

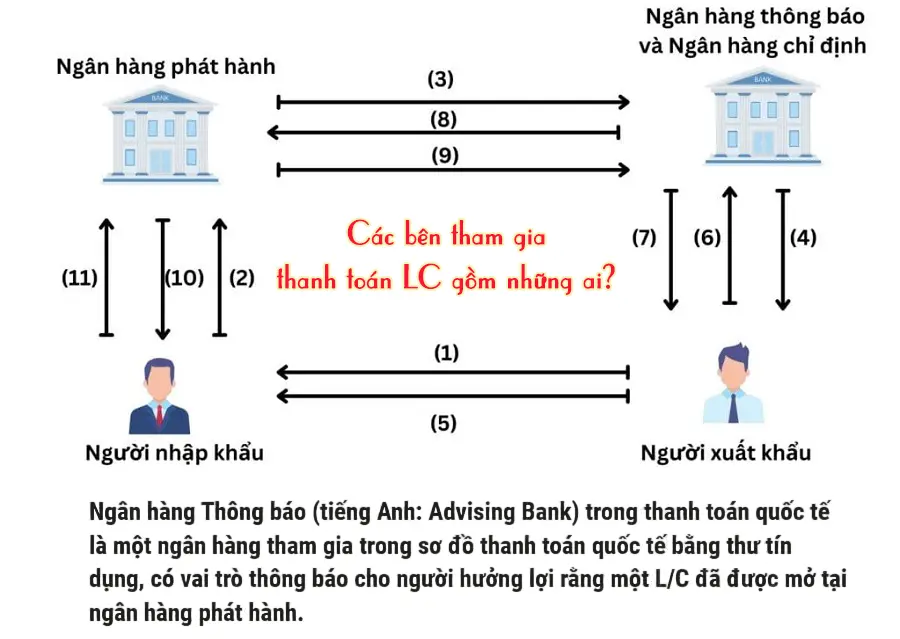

What is Advising Bank? Advising Bank is the notice bank. In international payment, Advising Bank is a bank involved in an international payment diagram with a letter of credit that will notify the beneficiary that - an L/C was opened at the issuing bank.

What role does Advising Bank play in import and export trade? Why do banks need notice?

What is Advising Bank's role in import -export trade and why the bank needs to notify the following answer:

The role of Advising Bank

Although L/C is a commitment of the issuing bank with the beneficiary, to ensure the safety of the beneficiary, avoid receiving a fake L/C causing serious consequences, L/C must be notified through a bank. That is why the bank announced that it plays a central role in import and export trade.

Advising Bank, through verifying the appearance of L/C (Authentication), helps exporters believe in the payment commitment of the issuing bank. When receiving L/C transferred, the bank informed and verified the honesty of L/C before notifying the beneficiary.

The reason is that the bank needs to notify Advising Bank

The reason for the bank to notify that is:

- Safety: The notification of L/C through a bank helps reduce the likelihood of fraud and ensure the accuracy of L/C;

- Transaction authentication: The bank notifies the transaction authentication, helps the exporter trust and take the next steps in payment;

- International trade: The bank announced that it plays an important role in international trade, helping to ensure payment on time for exporters.

6 Principles of selecting bank notifications Advising Bank

What is the principle of choosing Advising Bank? When choosing a bank to notify Advising Bank for a letter of credit, attention should be paid to the following principles:

Principle 1

The bank informed the issuing bank only when the basis required to open the L/C from customers. If the L/C is required does not specify, the issuing bank is selected to notify the bank.

Principle 2

The notice bank must be designated by the issuing bank, usually the exporter regularly transacted. This is also a branch or agency of the issuing bank.

Principle 3

If the bank is not a confirmation from the bank, only the notice of L/C or the L/C modification will not be responsible for any responsibility related to payment or discount of L/C documents.

Principle 4

If the first notice does not have a customer relationship with the beneficiary, the issuing bank appoints the bank to notify the second. In case the issuing bank is not specified, the first notice is allowed to choose the second notice.

Principle 5

If the bank is loved by the L/C notice but refuses, it must not be delayed to decide for the issuing bank.

Principle 6

All L/C payment commitments are notified at which bank, when the L/C modified must be approved through that bank.

Who are the parties involved in the LC credit payment?

Together with the bank informing Advising Bank, the parties involved in LC payment transactions include the subjects:

Opening Bank (Opening Bank)

As a bank representing importers, granting credit to importers.

Applicant (Applicant)

Being the importer of the goods: the importer of the goods or the importer of the goods entrusted to others

Beneficiarry beneficiaries (Beneficry)

Being an exporter: exporter or anyone who benefits specifies.

There are also some other subjects such as:

Confirming Bank (Confirming Bank)

As a bank, at the request of the issuing bank, it is committed to paying with the issuing bank in case the exporter does not trust the issuing bank, they want a more sure guarantee of L/C, they can request a letter to be confirmed by another bank.

Payment Bank (The Paying Bank)

As a bank to open a letter of credit or other banks, the bank is opened for a letter of credit that I pay for paying or discount the bill of exchange for the exporter.

Nominated Bank (Nominated Bank)

As a confirmation bank or any other bank authorized by the bank so that when receiving the presentation, the provisions in accordance with the provisions of the L/C will pay, accept the bill of exchange, negotiate payment. After that, these banks will stand out to demand money for issuing banks.

The Negotiating Bank (The Negotiating Bank)

As a bank to negotiate for the normally, the bank is also the L/C notification bank. If LC stipulates free negotiation, any bank can be a negotiating bank.

What is Advising Bank and the knowledge related to the bank has been answered and shared by Proship Logistics. In international trade transactions, choosing an appropriate ADVISING Bank notification bank will save you time, cost and reduce risks. Businesses are interested in bonded warehouse leasing services, multimodal freight services, ... Contact immediately 0909 344 247 to receive the fastest service quotation.