x Do shippers and import-export businesses need to update the Vietnam Logistics Report in the past year to effectively serve business, production, supply of goods, raw materials, etc.?

x Do you need a detailed overview of Vietnam's logistics situation in general and the development of the FTZ Free Trade Zone in the context of logistics globalization?

x Investors are interested and want to know what the potential and solutions for developing a Free Trade Zone are?

PROSHIP.VN will update the newly officially announced Vietnam Logistics Report 2024 by the Ministry of Industry and Trade. This Vietnam logistics report also extensively covers the Free Trade Zone model, opportunities, challenges and solutions to develop Vietnam's logistics industry through FTZs,...

Vietnam's import and export situation of goods and services and global Logistics market trends

Vietnam Logistics is currently one of the extremely hot industries and in 2024, many achievements have been recorded in the field of export and import of goods and services in general. Specifically, the statistics are as follows:

Situation of import and export of goods and services in Vietnam

Situation of export and import of goods

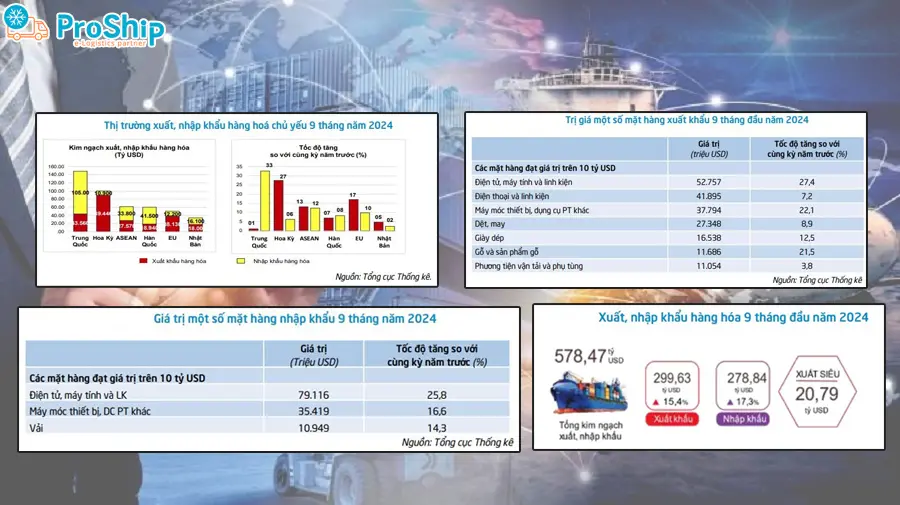

In the first 9 months of 2024, the total preliminary import and export turnover of goods reached 578.47 billion USD, an increase of 16.3% over the same period last year, of which, exports increased by 15.4%; Imports increased by 17.3%. The trade balance of goods had a surplus of 20.79 billion USD.

- Export:

The preliminary export turnover of goods in September 2024 reached 34.05 billion USD, down 9.9% compared to the previous month. Of which, the domestic economic sector reached 9.39 billion USD, down 14.4%; The foreign invested sector (including crude oil) reached 24.66 billion USD, down 8.1%.

There are 30 items with export turnover of over 1 billion USD, accounting for 92.3% of total export turnover (there are 7 export items with export turnover of over 10 billion USD, accounting for 66.4%). Regarding the structure of export goods in the first 9 months of 2024, processed industrial goods account for the largest proportion, initially reaching 263.47 billion USD, accounting for 87.9% of the total value of export goods.

- Import:

In the first 9 months of 2024, preliminary import turnover of goods reached 278.84 billion USD, an increase of 17.3% over the same period last year, of which, the domestic economic sector reached 100.85 billion USD, an increase of 18.3% over the same period last year. .8%; The foreign investment sector reached 177.99 billion USD, an increase of 16.5%. There are 40 imported items with a value of over 1 billion USD, accounting for 91.5% of total import turnover (there are 3 imported items with a value of over 10 billion USD, accounting for 45%).

Regarding the structure of imported goods in the first 9 months of 2024, the group of preliminary production materials reached 261.5 billion USD, accounting for 93.8%, of which the group of machinery, equipment, tools and spare parts accounted for 47. 3%; The group of raw materials, fuel, and materials accounts for 46.5%.

Regarding the export and import market of goods in the first 9 months of 2024, the United States is Vietnam's largest export market, with an estimated turnover of 89.4 billion USD. China is Vietnam's largest import market, with an estimated turnover of 105 billion USD.

Situation of export and import of services

In the first 9 months of 2024, service export turnover is estimated to reach 17.4 billion USD, up 18.8% over the same period in 2023, of which tourism services reach 8.8 billion USD (accounting for 50% of the total revenue). .6% of total turnover), an increase of 33.4% over the same period last year; Transportation services reached 4.9 billion USD (accounting for 28.1%), an increase of 7.9%.

Service import turnover in the first 9 months of 2024 is estimated to reach 26.6 billion USD (of which, included in transportation and insurance service fees for imported goods is 8.8 billion USD), an increase of 26.8% compared to 2024. Compared to the same period last year, transportation services reached 10.7 billion USD (accounting for 40.2% of total turnover), an increase of 17.7%; Tourism services reached 9.3 billion USD (accounting for 34.7%), an increase of 68%. The service trade deficit in the first 9 months of 2024 is 9.2 billion USD.

Trends in the global logistics market

Firstly , the development of artificial intelligence (AI) and e-commerce. The outstanding growth of global e-commerce, which is one of the biggest drivers of the logistics market, has even greater resonance when logistics solutions use AI. AI allows e-commerce platforms to analyze large-scale data, optimize pricing strategies and enhance customer experience and loyalty.

Second , develop green and sustainable logistics. This is one of the prominent trends in the logistics industry in the near future, through the use of alternative fuels, electric vehicles and carbon emission reduction programs.

Third , reshore and nearshore strategies continue to shape global supply chains. Accordingly, the global supply chain will be less fragmented and geographically dispersed. This trend may happen in high-tech industries that are heavily related to the supply chain such as machinery, electronics and the auto industry.

Fourth , in 2024 suppliers will face a shortage of goods, especially essential agricultural products, due to a number of converging challenges, including rising input prices. , concerns about farmer profits, rising protectionism and extreme weather events.

Vietnam Logistics Report 2024 with the potential to develop the Logistics industry through the Free Trade Zone

We at Proship have recorded the latest Logistics Report 2024 in Vietnam with the following summary content:

Summary of Vietnam logistics report in 2024

Vietnam Logistics Report 2024 is structured in 07 chapters. Specifically:

- Chapter 1: Logistics service business environment;

- Chapter 2: Logistics infrastructure;

- Chapter 3: Logistics services;

- Chapter 4: Logistics at manufacturing and trading enterprises;

- Chapter 5: Activities related to logistics;

- Chapter 6: Developing local logistics;

- Chapter 7: Topic: Free trade zone.

The report was developed with the participation of experts from ministries, branches, associations, training and research organizations, etc. on the basis of a reliable and updated information and data system from relevant agencies. Official information sources and actual survey results.

This logistics report aims to plan, orient and provide solutions for the coming years, thereby bringing the entire Vietnamese Logistics industry into the flow of goods trade in the era of Vietnam's expansion. …

Logistics report with the theme of Free Trade Zone

Implementing Decision No. 200/QD-TTg dated February 14, 2017 of the Prime Minister approving the Action Plan to improve competitiveness and develop Vietnam's logistics services to 2025 and Decision No. 221/ Decision-TTg dated February 22, 2021 amending and supplementing Decision No. 200, starting from 2017, the Ministry of Industry and Trade coordinates with experts Logistics develops an annual Vietnam Logistics Report to review, evaluate, and provide information on the situation and prospects of Vietnamese and international logistics and related policy regulations, etc., contributing to management. State management, production, business and investment activities of enterprises, scientific research and communication in the field of logistics.

On June 26, 2024, the National Assembly passed a Resolution on urban government organization and piloting a number of specific mechanisms and policies to develop Da Nang City. Accordingly, the National Assembly agreed to establish the Da Nang free trade zone associated with Lien Chieu seaport, with the goal of attracting investment, finance, trade, tourism and high quality services.

Along with that, free trade zones are also proposed in the planning of many provinces and cities. With the expansion of free trade zones, Vietnam not only enhances its competitiveness in the region but also promises to become an attractive destination for global investors, especially in the context of international agreements. Free trade agreements (FTAs) are increasingly being signed and implemented.

In addition to providing information about the development of Vietnam's logistics services in the past year, the Vietnam Logistics Report 2024 with the theme "Free Trade Zone" will focus on analyzing the importance and potential of logistics services. The potential of FTZs for the development of the logistics industry, while also providing comments and recommendations on sustainable development strategies.

The Vietnam logistics report will also evaluate successful FTZ development models in the world, thereby drawing lessons and suggesting appropriate policies for Vietnam in the future.

>>See details of Vietnam Logistics Report 2024 pdf here: VIETNAM LOGISTICS REPORT 2024

Opportunities, challenges and solutions for developing FTZ Free Trade Zone in Vietnam

Let's discuss with Proship Logistics the following challenges, opportunities and solutions for developing a Free Trade Zone (FTZ) in Vietnam:

Concept of Free Trade Zone

What is a free trade zone? Free Trade Zone (FTZ) is a type of Free Zone, often confused with other classifications.

According to economist Herbert G. Grubel, a Free Trade Zone is a closed, specially designated area of land within a country where goods can be imported, stored, used in production, displayed, assembled, graded and sold without the same restrictions on quotas, tariffs, excise taxes, exchange controls and consumer protection regulations as outside the zone. this area. These areas are often separated from the rest of the country by physical barriers such as fences.

Challenges and opportunities when developing Free Trade Zones in Vietnam

Challenges when developing a Free Trade Zone in Vietnam

- Regional competition:

Vietnam must compete with countries in the region that have developed FTZs such as Singapore, Thailand and Malaysia. These countries have complete legal frameworks, modern infrastructure and attractive preferential policies, creating great competitive pressure for Vietnam in attracting investment and developing FTZs.

In addition, these countries also have experience in effectively managing and operating FTZs, making competition more difficult.

- Incomplete legal framework:

Currently, Vietnam does not have a clear and specific legal framework for the establishment and management of FTZs. Current regulations mainly focus on economic zones (EZs) and export processing zones (EPZs), not mentioning FTZs in detail.

The lack of a legal framework makes it difficult for businesses and investors to access and develop FTZs, and at the same time, reduces the transparency and effectiveness of State management of these areas.

- Quality of human resources:

The quality of human resources in the field of Vietnamese logistics and FTZ management is still limited. Although Vietnam has a large and young workforce, the skills and expertise of this human resource do not meet the requirements of businesses in FTZs.

Training and improving the quality of human resources is necessary to meet the needs of businesses and investors, while improving the operational efficiency of FTZs.

- Logistics infrastructure:

Although the infrastructure has been improved, additional investment in logistics support services such as warehousing, cargo handling and other ancillary services is still needed to improve the operational efficiency of the FTZ.

The transportation system connecting key economic areas and FTZs needs to be upgraded and expanded, ensuring smooth and efficient transportation of goods.

Opportunities to develop Free Trade Zones in Vietnam

- Strategic geographical location:

Vietnam is located in the heart of Southeast Asia, a strategic geographical location near important international maritime routes. This location allows Vietnam to become an important goods transit point in the region, easily connecting with China, Japan, Korea and other ASEAN countries.

- Seaport system and infrastructure:

Vietnam owns many large and modern seaports such as Hai Phong port, Da Nang port and Cai Mep - Thi Vai port in Ba Ria - Vung Tau. These ports are capable of receiving large container ships, creating favorable conditions for import and export of goods. The transportation system connecting the seaport with industrial parks and export processing zones is also being upgraded and expanded.

- Economic development potential:

Vietnam's economy is developing strongly with a stable GDP growth rate. The rise of the middle class and high domestic consumer demand create a potential market for businesses investing in FTZs.

- Investment incentive policies:

The Vietnamese government has issued many investment incentive policies to attract domestic and foreign businesses. These policies include exemption and reduction of corporate income tax, import tax exemption for goods imported from abroad for production and business in FTZs and VAT exemption for goods and services consumed in FTZs. FTZ. Preferential policies on land and loan support with preferential interest rates are also applied to create favorable conditions for investors.

Solutions for developing Vietnam Free Trade Zone

Some solutions for developing free trade zones in Vietnam proposed in the Vietnam Logistics Report are highlighted as follows:

1. Firstly, the province/city proactively proposes a draft Free Trade Zone Pilot Mechanism through an amended and supplemented Resolution to submit to the National Assembly for approval. Proactively seek opinions from relevant ministries such as: Ministry of Construction, Ministry of Industry and Trade, Ministry of Natural Resources and Environment, Ministry of Labor, War Invalids and Social Affairs,...

2. Second, invest in modern transportation infrastructure, including road systems, seaports, airports and facilities in the province/city.

3. Third, apply advanced technology from two sides: State management agencies and businesses. Use a management system to connect state management agencies and businesses. The business side will proactively apply smart technology, automate production processes and apply information technology in management and operations.

4. Fourth, the draft proposes to improve the business environment in the FTZ. Provinces/cities need to research and propose simplification of customs procedures and management, enhancing transparency and efficiency in administrative processes...

5. Fifth, train and develop high quality human resources. Investing in training programs and improving skills for workers, etc. contributes to promoting business performance and the overall development of FTZ.

Above is Vietnam Logistics Report 2024 to help you understand more about the Free Trade Zone with opportunities, challenges and solutions for sustainable, long-term development. Likewise, Proship Logistics has attached a full detailed Vietnam logistics report 2024 pdf for interested businesses, private individuals, and investors to download for reference to effectively serve related tasks. related to Vietnam's logistics industry...If you have any questions, please contact us at 0909 344 247 .