Biểu thuế xuất nhập khẩu hàng hóa mới nhất hiện nay đã được tung ra thị trường. Làng logistics được một phen ngạc nhiên với những con số đầy hấp dẫn. Nhưng, đáng quan tâm nhất phải kể đến những sự thay đổi về biểu thuế xuất nhập khẩu hàng hóa. Vậy, đối với năm 2022, biểu thuế được tính như như thế nào? Bạn hãy cùng Proship chúng tôi tìm hiểu chi tiết ngay trong nội dung dưới đây.

Tham khảo thêm:

– Bảng giá giao hàng nội thành

– Bảng giá giao hàng toàn quốc

Thuế xuất nhập khẩu là gì?

Thuế xuất nhập khẩu là gì bạn có thể tham khảo dưới đây

Thuế xuất nhập khẩu là gì bạn có thể tham khảo dưới đây

Thuế xuất nhập khẩu Là loại thuế gián thu, thu vào các loại hàng hóa được phép xuất, nhập khẩu qua biên giới Việt Nam, độc lập trong hệ thống pháp luật thuế Việt Nam và các nước trên thế giới. Mục đích quan trọng của thuế xuất nhập khẩu là gì? Chính là bảo hộ nền sản xuất trong nước nhưng không thể áp dụng các biện pháp hành chính. Thuế xuất nhập khẩu chỉ thu một lần, áp dụng cho hàng hóa mậu dịch và phi mậu dịch.

Tham khảo biểu thuế cụ thể của các loại hàng hóa xuất nhập khẩu phổ biến hiện nay

- Biểu thuế xuất nhập khẩu các loại hải sản: Dowload biểu thuế chi tiết tại đây.

- Biểu thuế xuất nhập khẩu các sản phẩm gốc động vật: Dowload biểu thuế chi tiết tại đây.

- Biểu thuế xuất nhập khẩu các sản phẩm thực vật: Dowload biểu thuế chi tiết tại đây.

- Biểu thuế xuất nhập khẩu các loại trái cây, hoa quả: Dowload biểu thuế chi tiết tại đây.

Thuế xuất nhập khẩu được áp dụng cho những đối tượng nào?

+ Hàng hóa xuất, nhập khẩu của các tổ chức kinh tế Việt Nam thuộc các thành phần kinh tế được phép trao đổi, mua, bán, vay nợ với nước ngoài.

+ Hàng hóa xuất, nhập khẩu của các tổ chức kinh tế nước ngoài, các hình thức đầu tư nước ngoài tại Việt Nam.

+ Hàng hóa được phép xuất khẩu vào khu chế xuất tại Việt Nam và doanh nghiệp trong khu chế xuất được phép nhập khẩu vào thị trường Việt Nam.

+ Hàng hóa xuất, nhập khẩu để làm hàng mẫu, quảng cáo, dự hội chợ triển lãm, viện trợ hoàn lại và không hoàn lại.

+ Hàng hóa hoặc quà biếu, tặng, tài sản di chuyển vượt tiêu chuẩn hành lý được miễn thuế.

Thuế xuất nhập khẩu được miễn cho những đối tượng nào?

+ Hàng hóa vận chuyển quá cảnh hoặc chuyển khẩu qua cửa khẩu Việt Nam.

+ Hàng hóa viện trợ nhân đạo hoặc viện trợ không hoàn lại của các chính phủ, tổ chức liên hợp quốc, tổ chức liên chính phủ, tổ chức quốc tế, phi chính phủ…. Cho Việt Nam và ngược lại.

+ Hàng hóa từ khu phi thuế quan xuất khẩu ra nước ngoài và ngược lại nhưng chỉ sử dụng trong khu phi thuế quan đó hoặc từ khu phi thuế quan này qua khu phi thuế quan khác.

+ Hàng hóa là phần dầu khí thuộc thuế tài nguyên của nhà nước phi xuất khẩu.

Những đối tượng cần nộp thuế xuất nhập khẩu

+ Chủ hàng hóa xuất, nhập khẩu.

+ Tổ chức nhận ủy thác xuất, nhập khẩu hàng hóa.

+ Cá nhân có hàng hóa xuất, nhập khẩu khi xuất, nhập cảnh, gửi hoặc nhận hàng qua cửa khẩu, biên giới Việt Nam.

+ Đại lý làm thủ tục hải quan được những đối tượng trên ủy quyền nộp thuế xuất, nhập khẩu.

+ Doanh nghiệp cung cấp dịch vụ bưu chính, chuyển phát nhanh quốc tế nộp thay thuế cho đối tượng nộp thuế.

+ Tổ chức tín dụng hoạt động theo quy định của luật các tổ chức tín dụng nộp thay thuế theo quy định của pháp luật quản lý thuế.

Những đối tượng được miễn thuế xuất nhập khẩu

+ Hàng tạm nhập tái xuất và ngược lại để tham dự hội chợ, triển lãm, giới thiệu sản phẩm, máy móc, thiết bị dụng cụ nghề nghiệp phục vụ công việc trong thời hạn nhất định.

+ Tài sản di chuyển của tổ chức, cá nhân Việt Nam hoặc nước ngoài mang vào Việt Nam, hoặc mang ra nước ngoài theo quy định.

+ Hàng hóa nhập khẩu để gia công cho phía nước ngoài hoặc hàng hóa Việt Nam xuất khẩu ra nước ngoài gia công.

+ Giống cây trồng, vật nuôi được phép nhập khẩu để thực hiện dự án đầu tư lĩnh vực nông, lâm, ngư nghiệp.

Cách tra biểu thuế và cách tính thuế xuất nhập khẩu

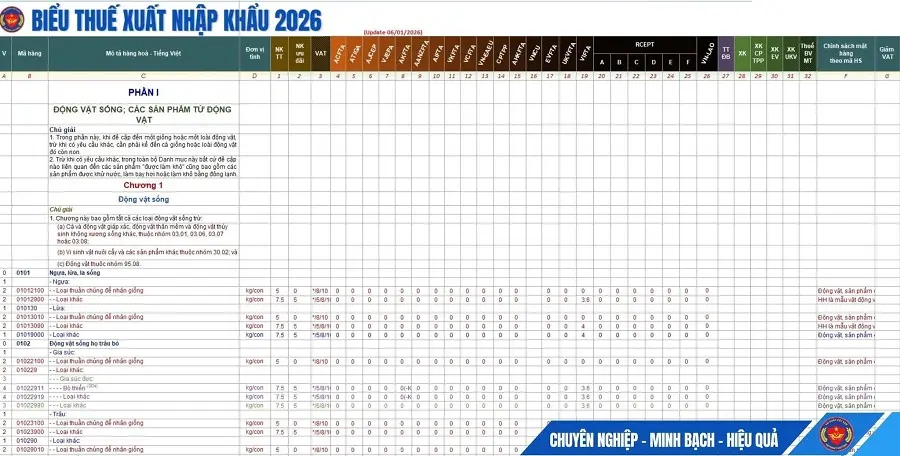

Biểu thuế xuất nhập khẩu 2022 (File excel): Là bảng tập hợp các loại thuế suất do Nhà nước quy định để tính thuế cho các đối tượng chịu thuế (hàng hóa, dịch vụ, thu nhập, tài sản…). Thuế suất được quy định trong biểu thuế dưới hai hình thức: thuế suất tỉ lệ và thuế suất cố định.

Cách tra biểu thuế

Phân theo chương, phân chương

Tra theo chức năng

Tra theo chất lượng

Để biết rõ cách tra biểu thuế, tra mã HS code, bạn có thể xem thêm bài viết chuyên môn: Cách tra mã HS code trong Biểu thuế xuất nhập khẩu

Các kí hiệu trong biểu thuế

(*): Không chịu VAT

(*,5): Không chịu thuế NK, bán ra VAT 5%

(*,10): Không chịu thuế NK, bán ra VAT 10%

(5): VAT NK 5%

(10): VAT NK 10%

Cách tính thuế hàng hóa xuất nhập khẩu

Thuế NK = Trị giá tính thuế hàng NK * Thuế suất thuế NK

Thuế TTĐB = Thuế suất thuế TTĐB * (Trị giá tính thuế NK + Thuế NK)

Thuế BVMT = Thuế suất tuyệt đối thuế BVMT * Lượng hàng

Thuế GTGT= (Giá tính thuế hàng nhập + Thuế NK + Thuế TTĐB + Thuế BVMT)* Thuế suất thuế GTGT

Trên đây là biểu thuế xuất nhập khẩu hàng hóa mới nhất hiện nay. Bạn nên tham khảo để nắm bắt thêm một số thông tin cần biết. Bạn vừa cùng Proship.vn điểm qua biểu thuế xuất nhập khẩu hàng hóa 2022. Dựa trên biểu thuế đó bạn có thêm cho mình nhiều kiến thức cần biết.