x Private individuals and import-export enterprises need to update Vietnam's preferential import and export tariff schedule 2023?

x Do you want to know the detailed content, special symbols,... along with some adjustments and additions to taxes applicable to each item/product group/industry?

x Does your unit need to declare customs of imported and exported goods at Cat Lai Port and Tan Son Nhat SB, and need the support of a specialized HQ Agent?

The trend of expanding the commodity exchange market is increasingly growing, so import-export activities also have certain changes and adjustments to suit the general situation. Therefore, updating the latest tariff schedule is really necessary to serve the goods trade plan between Vietnam and other countries. Proship.vn quickly updates the 2023 Import-Export Tariff, relevant individuals and units should save it to apply effectively in their work. Thereby also understanding what conditions you need to meet to enjoy preferential import tax as well as preferential export tax.

📦 Hotline contact shipping

🧭 Central

What is the import and export tariff schedule? Content?

Import-export tax is an indirect tax, collected on goods that are allowed to be exported and imported across Vietnam's borders, independent of the tax legal system of Vietnam and other countries in the world. Import-export tax is currently of special interest to many businesses and organizations practicing import and export of goods. Because this is a tax with a special role and many special points that need attention. So, what is the import and export tariff?

What does the Import-Export Tariff mean?

Import-export tariff is a table that collects all types of tax rates on imported and exported goods prescribed by the State to calculate tax for taxable objects such as goods, income services, property, etc. The tax schedule is expressed in two forms: proportional tax rate and fixed tax rate. In English, the export - import tariff is translated as "Import - Export Tariff" .

Contents of import and export tariffs

1. List of Vietnam's import and export goods

2. Tariffs related to exported and imported goods

3. There are a total of 25 tax schedules, including:

- Export tariff schedule;

- Preferential import tariff schedule;

- Regular import tariff schedule;

- Special consumption tax schedule;

- Environmental protection tariff;

- 16 Special preferential import tariffs,

- Value Added Tax Schedule,

- 03 preferential export tariffs of Vietnam participating in bilateral and multilateral trade agreements.

Proship Logistics updates the latest Vietnam's preferential import and export tariff schedule in 2023

Decree 44/2023/ND-CP dated June 30, 2023 of the Government regulating tax exemption and reduction policies according to Resolution No. 101/2023/QH15 dated June 24, 2023 of the National Assembly

On June 30, 2023, the Government issued Decree 44/2023/ND-CP dated June 30, 2023 stipulating tax exemption and reduction policies according to Resolution No. 101/2023/QH15 dated June 24 /2023 of the National Assembly. In order to help people and businesses promptly access and implement tax exemption and reduction policies specified in Decree No. 44/2023/ND-CP, including the following basic contents:

1. Regarding value added tax reduction

a) Groups of goods and services eligible for VAT reduction

Decree 44/2023/ND-CP stipulates VAT reduction for groups of goods and services currently subject to a tax rate of 10%, except for the following groups of goods and services:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, oil refined mines, chemical products. Details are in Appendix I issued with the Decree.

- Goods and services are subject to special consumption tax. Details are in Appendix II issued with the Decree.

- Information technology according to the law on information technology. Details are in Appendix III issued with the Decree.

- The value added tax reduction for each type of goods and services specified in Clause 1 of this Article is applied uniformly at all stages of import, production, processing, and commercial business. For sold coal products (including cases where coal is then screened and classified according to a closed process before being sold) are subject to value added tax reduction. Coal products included in Appendix I issued with the Decree, at stages other than the exploitation and sale stage, are not eligible for value added tax reduction.

Corporations and economic groups that carry out a closed process to sell are also subject to value added tax reduction on sold coal products.

- In case the goods and services listed in Appendixes I, II and III issued with Decree 44/2023/ND-CP are not subject to value-added tax or are subject to value-added tax 5 % according to the provisions of the Law on Value Added Tax shall comply with the provisions of the Law on Value Added Tax and no reduction in value added tax is allowed.

b) VAT reduction rate

- Business establishments that calculate value-added tax using the deduction method may apply the 8% value-added tax rate for the goods and services specified above.

- Business establishments (including business households and individual businesses) that calculate value-added tax using the percentage-on-revenue method are entitled to a 20% reduction in the percentage rate to calculate value-added tax when doing so. Issue invoices for goods and services eligible for value added tax reduction as prescribed above.

c) Implementation order and procedures

- For business establishments specified in Point a, Clause 2, Article 3 of Decree 44/2023/ND-CP, when issuing value-added invoices providing goods and services subject to value-added tax reduction, In the value added tax tax rate line, write "8%"; value added tax; total amount the buyer must pay. Based on the value-added invoice, business establishments selling goods and services declare output value-added tax, business establishments purchasing goods and services declare input value-added tax deduction. according to the reduced tax amount recorded on the value-added invoice.

- For business establishments specified in Point b, Clause 2, Article 3 of Decree 44/2023/ND-CP, when preparing sales invoices for providing goods and services subject to value added tax reduction, in the column “Total amount” record the full cost of goods and services before reduction, in the line “Total amount of goods and services” write down the amount that has been reduced by 20% as a percentage of revenue, and also note: “has been reduce...(amount) corresponding to 20% of the percentage to calculate value added tax according to Resolution No. 101/2023/QH15".

- In case a business establishment as prescribed in Point a, Clause 2, Article 3 of Decree 44/2023/ND-CP, when selling goods or providing services, applies different tax rates, then on the value-added invoice must clearly state the tax rate of each good and service as prescribed in Clause 3 of this Article.

In the case of a business establishment as prescribed in Point b, Clause 2, Article 3 of Decree 44/2023/ND-CP, when selling goods or providing services, the sales invoice must clearly state the reduced amount according to regulations. in Clause 3, Article 3 of Decree 44/2023/ND-CP.

- In case the business establishment has issued an invoice and declared the tax rate or percentage to calculate value added tax that has not been reduced according to the provisions of Decree 44/2023/ND-CP, the seller and The buyer processes the invoice in accordance with the law on invoices and documents. Based on the invoice after processing, the seller declares output tax adjustments, and the buyer declares input tax adjustments (if any).

- Business establishments specified in Article 3 of Decree 44/2023/ND-CP shall declare goods and services eligible for VAT reduction according to Form No. 01 in Appendix IV issued with Decree 44/2023/ ND-CP together with Value Added Tax Declaration.

2. The policy on value added tax reduction is effective from July 1, 2023 to December 31, 2023.

Principles for promulgating import and export tariffs

The following are the principles for promulgating import and export tariffs that you need to know:

- Encourage the import of raw materials, giving priority to domestic types that cannot meet demand, focusing on developing high-tech fields, saving and protecting the environment;

- Stabilize the market and State budget revenue;

- Consistent with the State's development orientation and export tax commitments in the international treaties we have signed;

- Transparency, simplicity, convenience for taxpayers and implementation of a number of tax-related reforms.

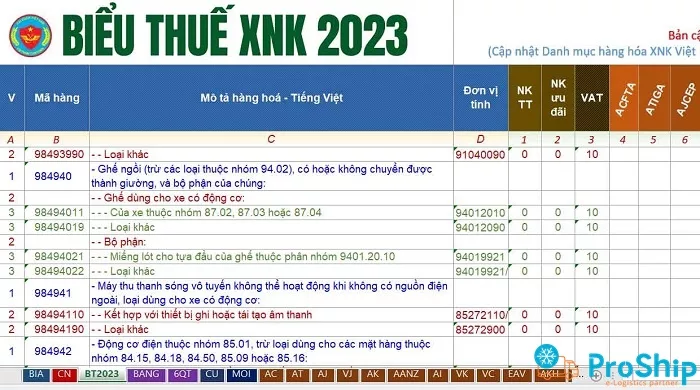

What does the 2023 import-export tax schedule file include?

- List of import and export goods according to current regulations;

- Information searched on the tariff includes operations: Export Tariff, Regular Import Tariff, Preferential Import Tariff, VAT Tariff, Special Consumption Tariff, Environmental Protection Tariff & 12 Special Preferential Import Tariffs In particular, Vietnam's preferential exports participate in bilateral and multilateral trade agreements;

- Specific product rules accompanied by special preferential import tariffs;

- Summary of 55 types of management policies applied to import and export goods into the Vietnamese market, applied to each item.

Explanation of special symbols on the import-export tariff (*, 5, 10, KH, LA, MM, MY, SG, TH)

When looking at the tax table, if you look up the item through the VAT column, you will see that the export tax has an asterisk (*) in the Value Added Tax Table column, meaning that the above items are not subject to Value Added Tax:

=> Symbol (5) in the tax table column applies to items subject to the VAT rate of 5% at the stage of import, production or commercial business. In case an enterprise or cooperative pays VAT according to the deduction method and sells preprocessed natural rubber latex to an enterprise or cooperative at the commercial business stage and is subject to the application of the value-added tax rate. increase is 5%.

=> The symbol (*,5) in the tax rate column in the Value Added Tax Schedule is specified for items that are not subject to value added tax at the stage of self-production, fishing for sale, import and export. Apply a value-added tax rate of 5% at the commercial business stage, except for the cases stated in Point b, Clause 3, Article 4 of Circular 83/2014/TT-BTC.

=> The symbol (*,10) in the tax rate column in the Value Added Tax Schedule is specified for imported gold ingots and pieces that have not been processed into fine arts, jewelry or other products. Other products (group 71.08) are not subject to value added tax at the import stage but are subject to value added tax at the production, processing or commercial business stage with a value added tax rate of 10 %.

=> The symbol (*) in the special preferential import tax columns stipulates that imported goods do not enjoy special preferential tax rates.

Explanation of abbreviated symbols for countries in the list of countries not eligible for special tax incentives according to the tariff schedule:

- BN's symbol is Brunei Darussalam;

- The symbol KH is the Kingdom of Cambodia;

- ID symbol is Republic of Indonesia;

- The symbol LA is the Lao People's Democratic Republic;

- The symbol MY is Malaysia;

- The symbol MM is the Federal Republic of Myanmar;

- The symbol PH is the Republic of the Philippines;

- The symbol SG is the Republic of Singapore;

- The symbol TH is the Kingdom of Thailand;

- The symbol CN is the People's Republic of China.

Socialist Republic of Vietnam (Goods from the non-tariff zone imported into the domestic market), symbol VN.

Proship updates details of the latest applicable import and export tariff schedule in 2023:

See link on PC with Excel software: BIEU THUE IMPORT EXPORT FULL 2023

See the attached Import-Export Tariff link HERE: VN IMPORT-EXPORT TAX BIEU 2023

📦 Hotline contact shipping

🧭 Central

Proship guides businesses on how to look up import-export tariffs quickly and accurately

Look up according to the rules by row then look up by column. Looking up goods helps us know the product name and then line up the column to know what taxes this product is subject to. Specifically, how to look up for cases where the product code is known and unknown is as follows:

If you know the product code

How to look up if the product code is known:

- Type the command Ctrl + F;

- Enter the product code you need to search;

- Press Enter or Find Next.

If you don't know the product code

How to look up if the product code is unknown:

- Need to have knowledge about classifying goods, using the list of import and export goods, explaining HS codes, etc.

- After having the above knowledge, you need to use the tax schedule file to determine the correct product code, tax rate and policies related to that good.

- Then, you base on the Certificate of Origin - C/O to choose the appropriate tariff.

* For example: If you import from Singapore and have C/O Form D (according to ATIGA - Asean Trade In Goods Agreement), you will choose the ATIGA tariff. In ECUS5 software, the tariff code is B04.

=> Thus, the intersection between the horizontal (HS code) and vertical (C/O) is the tax rate applied to import and export shipments.

>>See more: What is on-site import and export?

Proship Logistics and FadoExpress accept customs declaration for AIR goods at SB Tan Son Nhat and SEA goods at Cat Lai Port. Prestigious - Professional - Cheap

PROSHIP LOGISTICS and FADOEXPRESS OFFICIALLY become customs declaration agents at Cat Lai Port and Tan Son Nhat SB with professional and methodical customs qualifications, personnel with experience in seaport, airport, self-declaration customs declaration. information to best complete all necessary processes for customs clearance of export/import goods of enterprises. In the new role as Agent, Shippers/Businesses do not need to use their digital signature to approve (remotely) or send false documents as before. Our customs agent will use a valid digital signature to declare and transmit the declaration for the customer's export and import Sea/Air shipments.

If your unit does not have much experience in this issue, please choose Proship, FadoExpress customs agents to ensure the best price, most accurate, and most timely customs clearance plan for export and import goods by sea. and airways. Tasks such as: International transportation - Customs declaration - Customs clearance procedures - Domestic transportation and door-to-door delivery, we will take care of. This has helped save maximum effort, cost and time for businesses.

Our KBHQ agent will make a number of commitments to customers:

- The name and code of our Customs Agent will appear on the Declaration and Customs System;

- KBHQ agents Proship Logistics and FadoExpress carry out import and export procedures on behalf of businesses according to the contract signed between the two parties;

- Customs agents Proship, FadoExpress are responsible for the content declared on the HQ Declaration along with import-export enterprises.

Customs declaration address at Cat Lai Port and Tan Son Nhat SB

At Cat Lai Port

KBHQ at Cat Lai Port (Address: Saigon Port Border Gate Customs Branch, Area 1, Gate B, Cat Lai Port Area, Le Phung Hieu, Cat Lai Ward, District 2).

At SB Tan Son Nhat

- TCS Warehouse: 46 - 48 Hau Giang, Ward 4, Tan Binh District, City. Ho Chi Minh.

- SCSC Warehouse: 30 Phan Thuc Duyen, Ward 4, Tan Binh District, City. Ho Chi Minh.

Ho Chi Minh

No. 161/1-3 Cong Hoa, Bay Hien Ward, TP. HCM

Customers using customs declaration services at seaports and airports

Proship Logistics and FadoExpress target the following customers:

- Customers wishing to use full-service Customs Logistics Services;

- Companies exporting and importing in and out of Industrial Parks and Non-tariff Zones;

- Companies export and import through Vietnamese and International Airports and Seaports.

Type of HQ Service at Cat Lai Port and Tan Son Nhat SB (possible)

Customs declaration service at Cat Lai Port

Some customs declaration services that we can perform at Cat Lai Port:

- Full customs clearance service;

- Import and export customs declaration services from LCL packaged goods to FCL raw goods;

- Services for applying for full C/O samples, export quarantine certificates, etc.;

- Freight transportation services with flexible, fast and safe forms;

- Tax refund service for businesses.

Customs declaration service at SB Tan Son Nhat

Proship and FadoExpress are planning to deploy the following types of KBHQ at the airport:

- Service of declaring business type, non-commercial;

- Services for declaring transit types and tax-free investment goods;

- Service of declaring type of export production, type of processing, investment, etc.

The latest information about the latest Import-Export Tariff 2023 has been updated by Proship Logistics. Accordingly, if you are an Individual or an Enterprise specializing in export and import goods on the List receiving preferential tax rates according to Vietnam's current regulations, you should save the information and Excel file of the tax schedule to apply. Effective use for upcoming business and product and goods transactions. And when you need to use KBHQ Services at Cat Lai Port and Tan Son Nhat Airport, please contact Hotline 0909 344 247 for the fastest advice and quote.