x Exporters, importers carry out procedures for declaring customs clearance of goods and encountered many terms and English vocabulary such as Bill of Entry?

X You want to find out the role, content, ... Classify Bill of Entry?

X You need to understand the process of making import invoices Bill of Entry?

Proship.vn we will approve this sharing to answer the question of what is Bill of Entry? How is Bill of Entry procedure procedure? Why is Bill of Entry important?

What is Bill of Entry? Concept, classification and content on BoE

The following is a relevant knowledge to help you understand Bill of Entry, including the concept, classification and content on the BoE slip:

Concept Bill of Entry

What is Bill of Entry? Bill of Entry (abbreviated as Boe) is a entry card and a legal document submitted by the importer or customs agent when the goods are easily damaged.

This document needs to be filled with strict limits and submitted to the customs office at the importing country so that the shipment can clear it without fines or delays. There is this paper, the transportation of cargo containers will take place more smoothly.

Sort of imported boe invoice

The Central Tax Council and the Customs Department classify BoE imported invoices:

- Entry invoice for family consumption;

- Entry invoice for ex-bond goods;

- Inventory.

Content on the entry voucher Boe

On the boe import card includes the following content:

- Name and business address of importer and export;

- Import -export code (IEC);

- Customs agent (Father);

- Shipping company name;

- Name of destination port;

- Import license number;

- Description of imported goods;

- The ratio and value of imported import tax;

- Value of the shipment;

- Gate code, ...

Good price container shipping service

Who should use BoE entry cards and any other related terms other than Bill of Entry?

The following information will help you know who should use the BoE entry card and in addition to Bill of Entry, there is any term related to customs declaration:

Subjects should use boe

Subjects should apply for Bill of Entry (BoE):

- Importers;

- Exporter;

- The owner of the company (companies) purchases goods from the special economic zone (SEZ) and sells them within India;

- The owner of the company imports products from other countries.

Some vocabulary when doing customs declaration

In addition to Bill of Entry, there are some other English vocabulary and terms that mean:

- Customs Entry: Importing goods;

- Customs Forms: Customs papers;

- Customs Accounting: Customs accounting;

- Declared at customs: declaration at customs;

- Traveler Declaration: Transport declaration (goods);

- Goods Declaration: Declare goods.

Bill of entry entry invoice (BoE) is important, why?

Why is Bill of Entry important? Boe plays a very important role in the import and export process, because:

Boe is a goods movement record

The government can store the exact records about moving goods in and out of the country through BoE entry invoices.

Boe meets legal needs

The importer must have a boe entry invoice so that imported goods can be clearly cleared.

Boe facilitates customs clearance

Boe performs the role of providing the official documents needed to clear the product and ensure compliance with the import law.

Boe helps prevent illegal imports

Transparent trade transactions are guaranteed by accurate information provided in BoE entry cards, helping to prevent illegal imports and smuggling.

Boe helps determine taxes and fees

Taxes and fees applied to imported products are calculated and hit by using data in the import duties.

Boe helps analyze commercial activities

In the field of import and export, the Government uses information mentioned in the Immigration Law to monitor commercial activities.

Boe supports commercial statistics

Information collected from documents of import tax expressions used to compile commercial statistics, useful for economic research and formulate public policies.

Boe helps trade vouchers easily and conveniently

Boe entry invoices are legal evidence for commercial transactions and is an important part of commercial documents.

Boe shows the explanation and transparency

BOE entry invoices and customs staff are required to ensure that the goods are imported and treated legally, allowing trade between countries.

Boe ensures compliance with commercial laws and customs policies

Immigration forms to ensure compliance with commercial laws and customs policies by recording information about imported goods.

See also: Support for good refrigerating container transportation

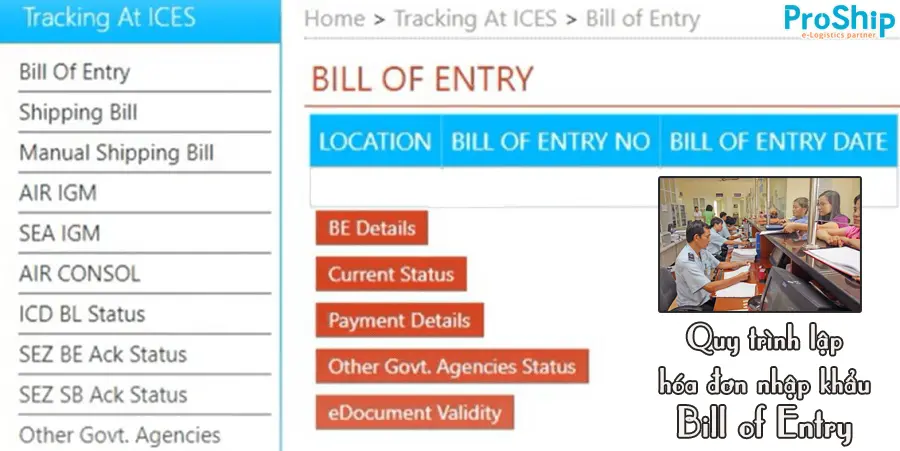

Procedure of the Bill of Entry Import Procedure

Join Proship to find out the procedures for making import invoices Bill of Entry in the following sequence:

Step 1 - Register

To submit electronic customs declarations, importers and exports need to be registered on the Icegate portal.

Step 2 - Prepare the necessary documents

Collect support vouchers, invoices and packaging lists.

Step 3 - Fill in the import declaration form

Visit the Icegate website ( https://www.icegate.gov.in/ ) and enter the correct information about the product imported into the prescribed form.

Step 4 - Must pay taxes and obligations

Online payments or through banks are approved for the necessary taxes, customs fees and GST.

Step 5 - Customs inspection

Goods may be checked by customs staff to ensure they comply with regulations.

Step 6 - Customs

Depending on the type of entry invoice submitted, customs staff will release goods for domestic use or store after completing all procedures.

Step 7 - Comply with GST

GST will automatically receive boe imported invoice data to calculate and comply.

What is the Bill of Entry and how the procedure of licensing, is it complicated as well as the role of BoE entry cards during the customs declaration of import and export goods, which has been shared by Proship ... Any questions, contact 0909 344 247 for answers and direct advice on the best cheap multi -cost shipping services.