x Bạn đang làm trong lĩnh vực xuất nhập khẩu, cần tìm hiểu rõ hơn về C/O form E?

x Bạn muốn biết quy định cũng như cách tra cứu C/O form E chuẩn mới nhất?

x Bạn muốn biết quy trình xin cấp C/O form E hiện nay ra sao?

x Bạn cần tìm Nhà vận chuyển hàng xuất nhập khẩu Trung – Việt uy tín, giá tốt?

Việc nhập khẩu hàng Trung Quốc được ưu đãi thuế rất nhiều khi có C/O form E. Vậy nên trong bài chia sẻ này, PROSHIP.VN chúng tôi sẽ cập nhật tất tần tật kiến thức cần biết về C/O form E là gì, mẫu mới nhất, quy định cụ thể cũng như cách tra cứu vận đơn C/O form E chuẩn nhất. Song song đó, Proship cũng chỉ ra những thế mạnh nổi bật của đơn vị mình khi chuyển gửi hàng từ Trung Quốc về Việt Nam (và ngược lại). Bạn quan tâm nên tìm hiểu để có sự lựa chọn phù hợp nhất.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

C/O form E được hiểu là gì?

C/O form E là gì? C/O form E là giấy chứng nhận được sử dụng cho những loại hàng hóa nhập khẩu từ Trung Quốc vào thị trường ASEAN và hưởng ưu đãi thuế theo Hiệp định ACFTA. Nó giúp xác nhận lô hàng có được hưởng mức ưu đãi giảm thuế theo đúng cam kết trong Hiệp định ASEAN – Trung Quốc (ACFTA).

C/O Form E sử dụng cho những loại hàng hóa nhập khẩu từ Trung Quốc vào thị trường ASEAN và hưởng ưu đãi thuế theo Hiệp định khung về hợp tác kinh tế toàn diện ASEAN – Trung Quốc (ACFTA). Mục đích chính của C/O form E là để xác nhận xuất xứ hàng hóa xem lô hàng có được hưởng mức ưu đãi giảm thuế theo cam kết trong Hiệp định hay không. Có nghĩa mức thuế nhập khẩu sẽ theo từng mặt hàng và căn cứ vào mã HS Code. Tương tự như vậy, mẫu C/O Form E cũng sẽ xác nhận hàng hóa xuất xứ Việt Nam hay ASEAN. Nhờ đó người nhập khẩu Trung Quốc cũng sẽ được hưởng ưu đãi thuế quan tương tự khi nhập hàng vào trong nước.

Khi làm C/O form E sẽ có một vài sai xót hay gặp phải cần xử lý như:

- Không đủ điều kiện để thuộc trường hợp hóa đơn phát hành tại bên thứ ba;

- Thiếu dấu tick “Issued Restroactively” khi ngày cấp CO quá 3 ngày sau khi tàu chạy;

- CO form E ủy quyền: do một số nhà sản xuất ở Trung Quốc không có chức năng xin CO, mà phải ủy quyền cho công ty dịch vụ đứng tên xin CO và làm thủ tục xuất khẩu. Theo quy định của Trung Quốc, người được ủy quyền phải đứng tên trên C/O form E (chứ không phải là nhà xuất khẩu thực sự). Nhưng về Việt Nam, trường hợp này CO sẽ xem như bị bất hợp lệ (công văn 5467/TCHQ-GSQL nêu trên);

- Số liệu trên CO không khớp với chứng từ khác, chẳng hạn như Số/ngày Invoice, giá trị hàng hóa, ngày tàu chạy…Những lỗi này cần được kiểm tra đối chiếu cẩn thận để chỉnh sửa sớm, tránh những hệ lụy về sau.

Mẫu và quy định của C/O form E hiện nay như thế nào?

Mẫu C/O form E mới nhất

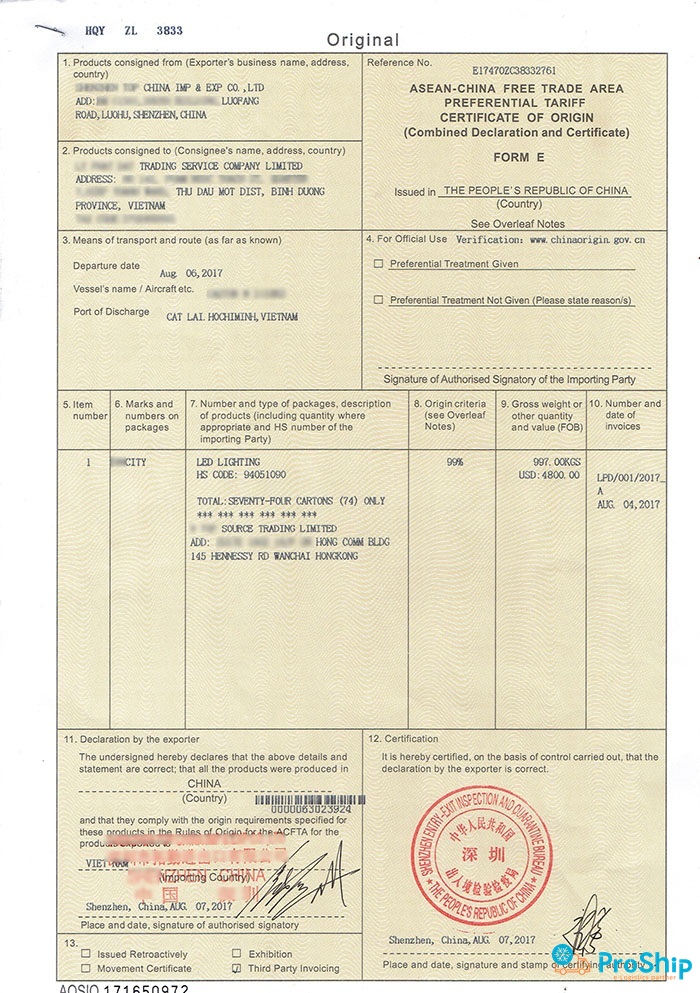

- Ô 1: Thông tin của nhà xuất khẩu như tên Công ty, địa chỉ Công ty;

- Ô 2; Thông tin của người mua;

- Ô 3: Tên phương tiện chuyển hàng như tên tàu, tên máy bay,..;

- Ô 4: Có thể bỏ trống k cần điền;

- Ô 5: Thứ tự Item;

- Ô 6: Thường dùng để viết thông tin của Đơn vị vận chuyển;

- Ô 7: Số lượng, chủng loại đóng gói và mô tả hàng hóa;

- Ô 8: Tiêu chí về xuất xứ;

- Ô 9: Trọng lượng của lô hàng phải được ghi rõ ràng;

- Ô 10: Số và ngày Invoice phải được ghi chính xác không được nhầm lẫn;

- Ô 11: Tên của nước nhập khẩu, địa điểm xin CO, ngày xin CO và dấu của Công ty xin;

- Ô 12: Xác nhận của đơn vị ủy quyền, dấu của nơi cấp CO, ngày cấp, địa chỉ;

- Ô 13: Dùng để chọn đánh dấu những thông tin tùy vào từng trường hợp.

Quy định đối với C/O form E

Theo Thông tư 12/2019/TT-BCT của Bộ Công Thương quy định C/O form E như sau:

- C/O form E được làm trên giấy trắng, khổ A4 theo tiêu chuẩn ISO, phù hợp với mẫu quy định. C/O form E gồm 1 bản gốc (Original) và 2 bản sao (Duplicate và Triplicate). C/O form E phải được kê khai bằng Tiếng Anh;

- Nếu C/O form E có nhiều trang, các trang tiếp theo phải có cùng chữ ký, con dấu, số tham chiếu như trang đầu tiên;

- Mỗi C/O form E có một số tham chiếu riêng. Được cấp cho một lô hàng và có thể bao gồm một hay nhiều mặt hàng;

- Bản gốc C/O form E được nhà xuất khẩu gửi nhà nhập khẩu nộp cho cơ quan hải quan tại cảng hoặc nơi nhập khẩu. Bản sao Duplicate do cơ quan, tổ chức cấp C/O của nước thành viên xuất khẩu lưu. Bản sao Triplicate do nhà xuất khẩu lưu;

- Nếu từ chối C/O form E, cơ quan hải quan Nước thành viên nhập khẩu đánh dấu vào tại Ô số 4 trên C/O form E;

- Trường hợp C/O form E bị từ chối như nêu tại khoản 5 Điều này, cơ quan hải quan Nước thành viên nhập khẩu có thể chấp nhận và xem xét các giải trình của cơ quan, tổ chức cấp C/O để xem xét cho hưởng ưu đãi thuế quan. Các giải trình của cơ quan, tổ chức cấp C/O phải chi tiết và lý giải được những vấn đề mà nước thành viên nhập khẩu đưa ra.

>>Xem thêm: Hiệp định EVFTA là gì?

Cách tra cứu C/O form E chuẩn chính xác nhất 2023

HƯỚNG DẪN KIỂM TRA ONLINE C/O FORM E ĐƯỢC CẤP BỞI CCPIT

Bước 1: Để tra cứu C/O form E, truy cập vào web http://www.co-ccpit.org/

Bước 2: Nhập thông tin vào các mục như sau:

- Mục CO Certificate No (申请号): Nhập vào số Certificate No;

- Mục CO Serial No (印刷号): Nhập vào 11 số cuối (như hình bên dưới);

- Mục Security Code (验证码): Nhập vào verification code.

Bước 3: Nhất nút Search. Khi đó, kết quả trả về sẽ bao gồm những thông tin sau: Exporter (出口 商), Invoice No (发票号), Country (目的国), H.S.Code (税则号), Authorized by (签证人名 称), Issue date (签证日期).

HƯỚNG DẪN KIỂM TRA ONLINE C/O FORM E ĐƯỢC CẤP BỞI HẢI QUAN ĐỊA PHƯƠNGTRUNG QUỐC

Bước 1: Truy cập vào web http://origin.customs.gov.cn/

Bước 2: Vào Tab Certificate Info Search và điền các thông tin sau:

- Mục Certificate No.: điền số Reference No. trên C/O form E

- Mục Invoice No.: điền số invoice trên C/O form E.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

🧭 Miền Nam

Quy trình xin cấp C/O mẫu E áp dụng cho hàng xuất khẩu

Các Doanh nghiệp muốn xin cấp C/O mẫu E, bạn có thể xin cấp online hoặc đến trực tiếp Sở công thương để xin cấp. Theo đó, các bước xin cấp C/O mẫu E được thực hiện theo quy trình sau:

- Bước 1: Đăng ký tài khoản mới cho Doanh nghiệp đối với những người mới xin C/O lần đầu;

- Bước 2: Truy cập vào hệ thống ecosys.gov.vn để tiến hành khai báo hồ sơ C/O online;

- Bước 3: Tiếp theo là tải các thông tin chứng từ bắt buộc bao gồm tờ khai hải quan, vận đơn, bảng kê hàm lượng, C.Inv;

- Bước 4: Sau khi khai thông tin hoàn tất, người đề xuất sẽ thực hiện các thao tác ký điện tử và gửi hồ sơ online;

- Bước 5: Hồ sơ được duyệt, kết xuất, doanh nghiệp sẽ in đơn xin C/O đã cấp số và nộp cùng bộ hồ sơ;

- Bước 6: Cán bộ kiểm tra, duyệt hồ sơ giấy, cấp C/O gốc (Original) bản bằng giấy nếu hồ sơ của doanh nghiệp chính xác.

Dịch vụ vận tải hàng hóa 2 chiều Trung – Việt bằng container đường sắt, đường biển An toàn, Giá tốt, Chất lượng cao tại Proship

Về thị trường nhập khẩu, Trung Quốc tiếp tục là đối tác nhập khẩu lớn nhất của Việt Nam, với kim ngạch nhập khẩu đạt 91,2 tỷ USD tăng 12,1% so với cùng kỳ năm trước; Tiếp đến là Hàn Quốc và ASEAN với tổng kim ngạch nhập khẩu lần lượt là 48,1 tỷ USD, tăng 18,8% và 35,6 tỷ USD, tăng 17,5%. Trung Quốc vẫn là một trong số ít những quốc gia áp dụng chính sách Zero-COVID, khi các biến thể mới của COVID-19 không ngừng xuất hiện. Việc phong tỏa các khu vực dân cư tại những Thành phố lớn như Thượng Hải, Thâm Quyến,…đã gây ra tình trạng tắc nghẽn cảng. Tuy nhiên, tác động gây đứt gãy chuỗi cung ứng đã có phần giảm so với năm 2021.

Với Hiệp định thương mại tự do ASEAN – Trung Quốc, đa phần các mặt hàng nhập khẩu từ Trung Quốc vào Việt Nam được hưởng thuế nhập khẩu suất ưu đãi 0%, điều kiện tiên quyết là bộ chứng từ nhập khẩu phải có C/O FORM E. PROSHIP.VN sẽ là lựa chọn hàng đầu cho Quý doanh nghiệp khi cần tìm đối tác về Logistics, Forwarding. Chúng tôi chuyên nhận tư vấn hỗ trợ Doanh nghiệp về C/O form E cho hàng hóa các loại nhập khẩu từ thị trường Trung Quốc. Hình thức vận chuyển hàng hóa tại đây là đường sắt, đường biển kết hợp đường bộ giao hàng tận nơi cho khách nhanh chuẩn xác.

Vận tải đường sắt ngày càng hoàn thiện và gia tăng hơn về mặt chất lượng. Đây chính là cơ sở quan trọng để Proship tiến hành nâng cao chất lượng vận chuyển. Hàng hóa khi được vận chuyển bằng đường sắt từ Trung Quốc về Việt Nam sẽ đảm bảo chất lượng, tiến độ nhanh chóng và an toàn hơn các hình thức vận chuyển khác. Còn việc chuyển hàng từ Trung Quốc về Việt Nam bằng đường biển tuy tốn thời gian hơn nhưng ít xảy ra tình trạng ách tắc, kẹt đường.

Nhận chuyển hàng từ Trung Quốc về Việt Nam đến khắp các tỉnh, thành

- Miền Bắc: Hà Nội, Bắc Ninh, Hà Nam, Hải Dương, Hải Phòng, Hưng Yên, Nam Định, Thái Bình, Vĩnh Phúc, Ninh Bình, Hòa Bình, Sơn La, Điện Biên, Lai Châu, Lào Cai, Yên Bái, Phú Thọ, Hà Giang, Tuyên Quang, Cao Bằng, Bắc Kạn, Thái Nguyên, Lạng Sơn, Bắc Giang, Quảng Ninh,…;

- Miền Trung: Đà Nẵng, Thanh Hóa, Nghệ An, Hà Tĩnh, Quảng Bình, Quảng Trị, Thừa Thiên Huế, Quảng Nam, Quảng Ngãi, Bình Định, Phú Yên, Khánh Hòa, Ninh Thuận, Bình Thuận,…;

- Miền Nam: TPHCM, Bà Rịa – Vũng Tàu, Bình Dương, Bình Phước, Đồng Nai, Tây Ninh, An Giang, Bạc Liêu, Bến Tre, Cà Mau, Đồng Tháp, Hậu Giang, Kiên Giang, Long An, Sóc Trăng, Tiền Giang, Trà Vinh, Vĩnh Long, Cần Thơ,…;

- Các khu vực Tây Nguyên: Kon Tum, Gia Lai, Đắc Lắc, Đắc Nông, Lâm Đồng, Buôn Mê Thuột,…;

- Hoặc từ các KCN lớn ở Việt Nam: Phước Đông, Đức Hòa III, Nhơn Hội Bình Định, Mỹ Phước 3, Tân Khai, Minh Hưng, Đồng Xoài, Tân Phú Trung, Hàm Kiệm, Bình Thuận, Bàu Xéo, Lộc An – Bình Sơn, Giang Điền, An Tây, Bỉm Sơn, Long Đức, Du Long, An Hòa; Long Hương, Tam Điệp II, Trâm Vàng, Cát Trinh, Mỹ Yên – Tân Bửu – Long Hiệp; Khánh Phú, Bá Thiện 2, Nhơn Hòa, Yên Phong II, Cộng Hoà, Đông Anh, Sóc Sơn, Long Khánh, Dầu Giây, Tân Thành, Tàu thủy Soài Rạp, Khai Quang Vĩnh Phúc, Gián Khẩu, KCN Thạnh Đức, KCN Sông Công 2, KCN Bắc Đồng Phú, KCN Thuận Yên,…và các Khu chế xuất, Cụm Công nghiệp tiềm năng trải dài từ Bắc chí Nam.

* Nhận gom hàng các khu vực tại Trung Quốc để chuyển về Việt Nam:

- Hồ Bắc (Hubei), Hồ Nam (Hunan), Liêu Ninh (Liaoning), Phúc Kiến (Fujian), Quảng Đông (Guangdong);

- Quý Châu (Guizhou), Sơn Đông (Shandong), Sơn Tây (Shanxi), Thanh Hải (Qinghai), Thiểm Tây (Shanxi);

- Thiên Tân (Tianjin), Thượng Hải (Shanghai), Trùng Khánh (Chongqing),…;

- Tứ Xuyên (Sichuan), Vân Nam (Yunnan), Đài Loan (Taiwan), Ninh Hạ (Ningxia), Nội Mông Cổ (Neimenggu);

- Quảng Tây (Guangxi), Tân Cương (Xinjiang), Tây Tạng (Xizang), Bắc Kinh (Beijing);

- Giang Tây (Jiangxi), Hà Bắc (Hebei), Hà Nam (Henan), Hải Nam (Hainan), Hắc Long Giang (Heilongjiang);

- An Huy (Anhui), Cam Túc (Gansu), Cát Lâm (Jilin), Chiết Giang (Zhejiang), Giang Tô (Jiangsu).

Nhận vận tải hàng hóa từ Trung Quốc về Việt Nam các mặt hàng

- Hàng thực phẩm: thực phẩm khô như bánh kẹo, trái cây sấy khô, thực phẩm nước như sữa, nước sốt,…;

- Hàng cá nhân: quần áo, giày dép, mũ nón, sách vở,…;

- Hàng mỹ phẩm: Dạng kem, dạng lỏng, dạng xịt như toner, nước hoa, serum…;

- Hàng thuốc và thực phẩm chức năng: dạng viên, lỏng và dạng bột,…;

- Hàng chứa pin, nam châm, từ tính: bộ đàm, máy tính, điện thoại, máy in,…;

- Các thiết bị điện tử, linh kiện điện tử, đồ gia dụng,…;

- Và các loại hàng khác: keo dán, bản mạch, dầu nhớt, hàng mẫu…

Các loại Container Proship phục vụ việc chuyển hàng 2 chiều Trung – Việt

- Container bảo ôn: Dùng để chuyển chở các loại hàng hóa đòi hỏi trong quá trình chuyên chở phải giữ nhiệt độ ổn định;

- Container bồn: Được dùng để chuyển chở các mặt hàng ở dạng lỏng (dầu, hóa chất, khí, rượu,..);

- Container bách hóa: Dùng để chuyển chở hàng khô, hàng bách hóa;

- Container chuyên dụng: Được dùng để chuyển chở các loại hàng hóa đặc thù, như ô tô, gia súc,…;

- Container mặt bằng: Dùng để chuyển chở những mặt hàng siêu trường, siêu trọng, sắt thép,…;

- Container hở mái: Được dùng để chuyển chở được dùng để chuyên chở các loại hàng hóa máy móc, thiết bị;

- Container hàng rời: Dùng để chuyển chở đối với hàng rời (xi măng, ngũ cốc, quặng,…).

Các phương thức giao nhận hàng 2 chiều Trung – Việt

- Vận chuyển Container từ Ga đến Ga;

- Vận chuyển hàng Container từ Ga đến Kho;

- Chuyển gửi hàng Container từ Kho cho đến Kho;

- Các dịch vụ đi kèm khác nếu như quý khách yêu cầu.

Đối tượng khách hàng Proship hướng đến

- Đại lý giao nhận hàng Forwarding;

- Đơn vị nhập hàng;

- Đơn vị cung cấp hàng.

Các dịch vụ vận tải hỗ trợ đi kèm

- Hỗ trợ đóng gói, đóng kiện hàng;

- Miễn phí lưu kho (nếu thời gian lưu trữ hàng không quá dài ngày);

- Hỗ trợ bốc xếp hàng hóa tại kho bãi.

Proship đã chuyển tải đến bạn những thông tin cần biết về quy định C/O form E, C/O form E là gì cũng như cách tra cứu C/O form E online chuẩn nhất. Vậy các đơn vị kinh doanh, Nhà nhập khẩu hàng hóa nào đang có nhu cầu tìm hiểu hoặc chưa rõ về quy trình xin cấp C/O mẫu E nên lưu lại để hỗ trợ hiệu quả cho công việc kinh doanh của mình. Và khi bạn cần thuê Dịch vụ vận chuyển hàng tuyến Trung – Việt 2 chiều, liên hệ 0909 344 247 để được tư vấn, báo giá sớm nhất.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung