x Bạn đang tham gia vào thương mại quốc tế và phải thực hiện thanh toán các giao dịch LC nhưng chưa biết hiện có các loại LC hợp lệ nào?

x Bạn chưa có kinh nghiệm thanh toán LC và muốn tìm hiểu thực chất nó là gì? Thanh toán quốc tế bằng hình thức này có ưu nhược điểm gì?

x Bạn cần cập nhật chi tiết quy trình thanh toán LC trong các giao dịch thương mại quốc tế?

Trong bối cảnh kinh doanh quốc tế ngày càng phức tạp, việc chọn loại Thư tín dụng (L/C) phù hợp có thể giúp doanh nghiệp giảm thiểu rủi ro và tối ưu hóa lợi nhuận. Cùng Proship.vn chúng tôi tìm hiểu xem có các loại LC trong thanh toán quốc tế nào? Ưu nhược điểm của LC là gì? Quy trình thanh toán LC ra sao?…sau đây nhé.

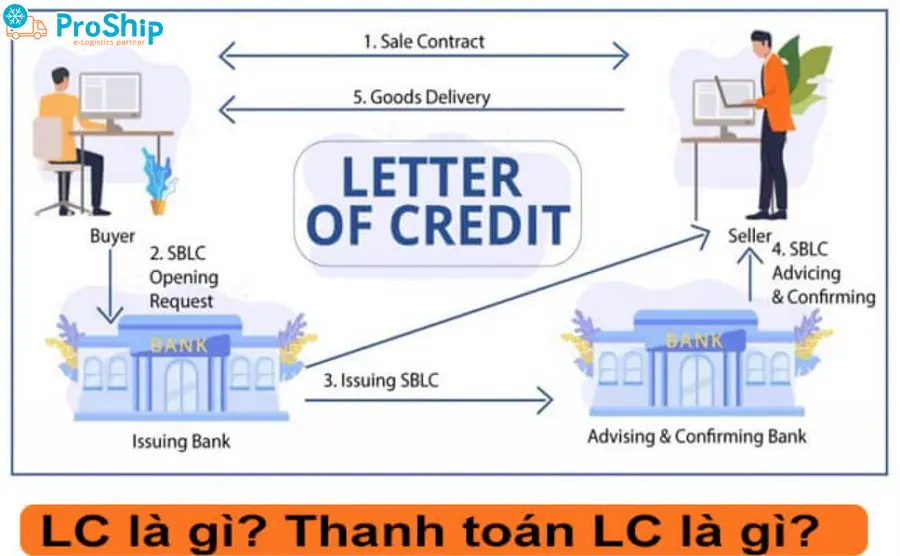

Thanh toán L/C là gì?

Thanh toán L/C là viết tắt của “Letter of Credit” còn gọi là Thư tín dụng. Là bức thư do ngân hàng phát hành theo yêu cầu của bên nhập khẩu. Nội dung thư là cam kết trả một số tiền nhất định cho người xuất khẩu ở thời điểm nhất định, nếu người xuất khẩu xuất trình được bộ chứng từ thanh toán phù có điều khoản phù hợp thông tin được nêu trong thư tín dụng.

Bên xuất khẩu có ngân hàng đại diện và khi thực hiện giao dịch mua bán, nhà xuất khẩu sẽ chuyển bộ chứng từ hợp lệ cho ngân hàng đại diện của mình.

Các loại LC trong thanh toán quốc tế hiện nay

Các loại LC trong thanh toán quốc tế bao gồm:

L/C có thể hủy ngang (Revocable LC)

Là phương thức thanh toán L/C có thể tùy chỉnh nội dung bên trong hoặc tự sửa mà không cần thông báo cho nhà xuất khẩu. Với loại thư tín dụng này, nhà xuất khẩu dễ gặp rủi ro khi hàng được vận chuyển trước thời điểm người nhập khẩu chuyển tiền.

L/C không thể hủy ngang (Re-revocable LC)

Là hình thức áp dụng rộng rãi trong các giao dịch xuất nhập khẩu. Thư tín dụng này không được phép sửa đổi, bổ sung hay hủy bỏ trong thời hạn hiệu lực L/C nếu các bên chưa thỏa thuận xong.

L/C tuần hoàn (Revolving LC)

L/C tuần hoàn được sử dụng nhiều lần do có thể tự khôi phục lại giá trị sau khi hết hạn. Đây cũng là một trong các loại LC không được phép hủy ngang.

L/C giáp lưng (Back to Back Re-revocable L/C)

L/C giáp lưng áp dụng khi các nhà xuất khẩu mua hàng (thường là nguyên liệu, linh kiện) từ nhà xuất khẩu khác. Nhà xuất khẩu sẽ gửi cho ngân hàng của mình thư tín dụng mà nhà nhập khẩu gửi cho mình để làm căn cứ mở L/C cho nhà cung cấp hàng hóa.

Một khi L/C giáp lưng được mở thì 2 bộ L/C sẽ độc lập nhau, lúc này ngân hàng mở L/C giáp lưng có nghĩa vụ thanh toán tiền hàng cho nhà xuất khẩu.

L/C chuyển nhượng (Re-revocable Transferable LC)

Thanh toán L/C chuyển nhượng là phương thức không thể hủy ngang. Trong giao dịch này, người thụ hưởng đầu tiên được phép chuyển nhượng cho người thứ 2 (người thứ 2 không được phép chuyển nhượng cho người khác). Giá trị L/C được chuyển nhượng có thể là toàn bộ hoặc một phần.

L/C trả chậm (Deferred payment L/C)

Thanh toán L/C trả chậm sẽ không được hủy ngang, theo đó ngân hàng phát hành sẽ phải cam kết với nhà xuất khẩu sẽ thanh toán trong một khoảng thời gian quy định cụ thể trong bộ chứng từ gốc mà không cần hối phiếu.

L/C trả ngay (L/C at sight)

Thanh toán L/C trả ngay là khi người xuất khẩu nhận được tiền ngay xuất trình bộ chứng từ đúng quy định cho ngân hàng thông báo. Đồng thời, người xuất khẩu phải thực hiện phát hành hối phiếu để trả ngay cho người nhập khẩu.

L/C dự phòng (Standby L/C) và L/C xác nhận (Confirmed Re-revocable L/C)

Hiện có rất ít giao dịch XNK sử dụng L/C dự phòng và L/C xác nhận. Bởi 2 loại L/C này chỉ có tác dụng đảm bảo cam kết thanh toán từ ngân hàng hoặc các bên nghi ngờ năng lực thanh toán của ngân hàng chiết khấu.

L/C đặc biệt (điều khoản đỏ – Red Clause LC)

Loại L/C này không được sử dụng rộng rãi, bởi sử dụng L/C này người xuất khẩu sẽ được hưởng một số tiền nhất định theo tỷ lệ % giá trị L/C. Lúc này, ngân hàng phát hành sẽ ủy quyền cho ngân hàng chiết khấu thanh toán cho nhà xuất khẩu một số tiền dựa trên chứng từ xuất khẩu của nhà xuất khẩu.

Nhà xuất khẩu sẽ phải bồi hoàn nếu không xuất trình được bộ chứng từ hợp lệ và số tiền ứng trước vẫn dựa trên yêu cầu của nhà xuất khẩu.

Đánh giá ưu điểm và nhược điểm của L/C

Các loại LC trong thanh toán quốc tế có ưu và nhược điểm gì hay không?

Ưu điểm của L/C

Lợi ích của các loại LC mang lại:

- Có thể giúp cải thiện mối quan hệ giữa các bên trong giao dịch;

- Đảm bảo an toàn cho giao dịch thanh toán quốc tế;

- Tăng tính minh bạchvà sự tin tưởng giữa các bên.

Nhược điểm của L/C

LC còn tồn tại vài nhược điểm:

- Thời gian xử lý L/C có thể kéo dài, khiến giao dịch trở nên chậm chạp;

- Chi phí phát hành và xử lý L/C có thể rất đắt;

- L/C không bảo vệ hoàn toàn cho người mua hàng hoặc người bán hàng (nếu phát sinh tranh chấp).

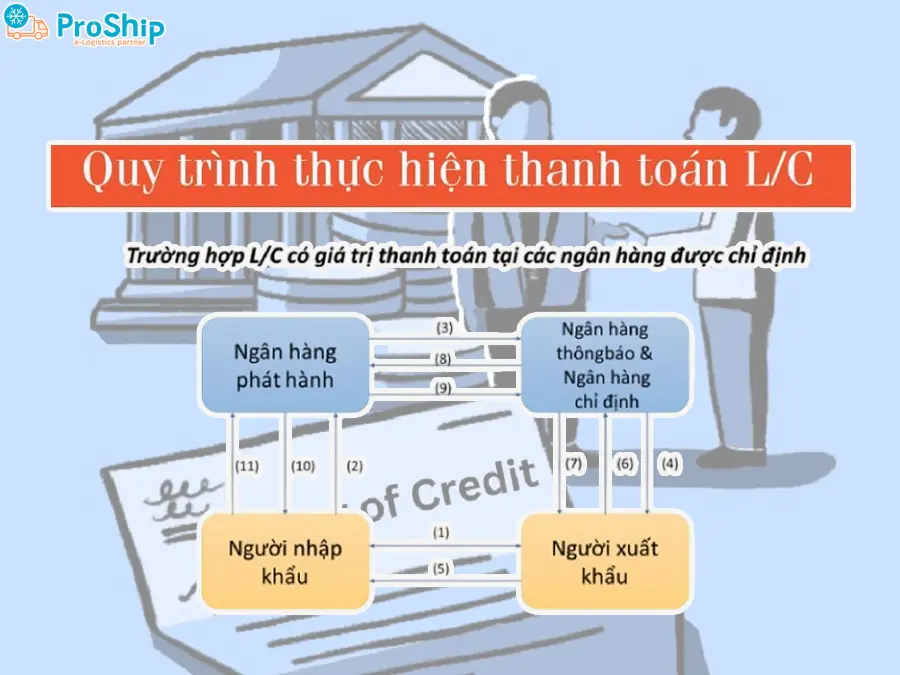

Quy trình thanh toán L/C trong giao dịch thương mại quốc tế

Quy trình thanh toán các loại LC được tiến hành qua các bước sau:

- Bước 1:

Người xuất khẩu và người nhập khẩu khi ký kết hợp đồng sẽ kèm theo điều khoản thanh toán bằng phương thức L/C.

- Bước 2:

Người nhập khẩu sẽ gửi yêu cầu ngân hàng mình sử dụng phát hành thanh toán L/C.

- Bước 3:

Ngân hàng phát hành lập L/C và gửi thông báo cho nhà xuất khẩu thông qua ngân hàng đại lý hoặc chi nhánh của người xuất khẩu.

- Bước 4:

Sau khi nhận thông tin, ngân hàng thông báo sẽ kiểm tra thông tin L/C, nếu đúng quy định ngân hàng này sẽ thông báo cho người xuất khẩu.

- Bước 5:

Nhà xuất khẩu sẽ kiểm tra lại thông tin thư tín dụng, nếu không có vấn đề gì sẽ giao hàng cho người nhập khẩu đúng quy định. Nếu thư tín dụng có sai sót, sẽ được người nhập khẩu yêu cầu sửa lại.

- Bước 6:

Khi giao hàng thành công, người xuất khẩu sẽ lập bộ chứng từ và xuất trình cho ngân hàng của mình để yêu cầu thanh toán.

- Bước 7:

Lúc này, ngân hàng sẽ kiểm tra bộ chứng từ, nếu hợp lệ sẽ thanh toán đúng yêu cầu. Nếu có sai sót sẽ từ chối thanh toán tiền hàng.

- Bước 8:

Nếu thông tin hợp lệ, ngân hàng được chỉ định sẽ gửi bộ chứng từ này sang cho bên ngân hàng phát hành để yêu cầu hoàn trả tiền đã chi.

- Bước 9:

Ngân hàng phát hành sẽ đứng ra kiểm tra thông tin chứng từ, nếu hợp lệ sẽ tiến hành thanh toán cho ngân hàng chỉ định.

- Bước 10:

Sau khi chuyển tiền xong, ngân hàng phát hành sẽ đòi tiền nhà người nhập khẩu. Lúc này, người nhập khẩu sẽ thanh toán tiền và nhận bộ chứng từ từ ngân hàng này.

- Bước 11:

Nhà nhập khẩu sẽ kiểm tra bộ chứng từ, nếu thông tin đầy đủ sẽ thanh toán tiền cho ngân hàng hoặc chấp nhận hối phiếu.

Như trên, Proship Logistics chúng tôi đã liệt kê các loại LC trong thanh toán quốc tế thông dụng nhất hiện nay. Đồng thời, qua đây bạn cũng hiểu được thanh toán các loại LC là gì, ưu nhược điểm của LC là gì, quy trình thanh toán LC trong các giao dịch thương mại quốc tế có thực sự phức tạp không,…Mọi thắc mắc liên quan, liên hệ ngay 0909 344 247 để được giải đáp.