x You are a business, organization, sender, recipient, ... in international payment and hear the term Cash in Advance, do not understand how it is a payment method?

x You want to know the role, advantages, challenges, ... and whether or not the options to replace the Cash in Advance method?

x You are interested and want to learn about Cash in Advance payment process?

Join Proship.vn we find out what is Cash in Advance? What is the advantage of Cash in Advance CIA, how important is it? Is Cash in Advance really safe for the seller?

International payment concept

International payment is understood as the payment process between parties in two different countries, in which senders and the recipients may be in two different locations and use two different currencies to pay for goods, transfer money or other transactions.

When performing international payment, the parties must use the appropriate payment methods. These methods are related to legal processes and regulations related to international transactions, and may have fees related to monetary conversion or transfer fees between banks in different countries.

Subjects involved in international payment include:

- The sender: is the subject of money transfer to the recipient in another country;

- Recipients: is the receiver from the sender in another country;

- Bank: Bank is an essential partner in international payment;

- Money transfer companies: are international money transfer services;

- Financial management agencies: are the financial management agencies of countries that play an important role in managing and supervising international payment activities.

Should read: Support for transporting container good price

What is Cash in Advance and have any advantages?

The following is the content related to the concept and advantages of Cash in Advance need to know:

What is Cash in Advance?

What is Cash in Advance? Cash in Advance is a prepaid cash (abbreviated as CIA). This is the payment method that the buyer paid in advance to the goods or services, before the seller made an order.

The CIA method is often used in transactions related to new buyers and orders with high value.

The term related to Cash Advance

With Cash in Advance, there are related terms such as:

- Interest rates: The percentage of the loan amount that the borrower must pay extra when repaying the loan;

- Debit card: The card allows users to use money already in their bank accounts;

- Credit card: A type of card allows users to borrow money from the bank to pay for expenses;

- Fee: The costs incurred when using loan service, cash withdrawal.

Advantages and roles of Cash in Advance

Advantages and roles of the CIA must mention:

- Cash flow management: Immediately payment support for better financial planning;

- Simplifying transactions: No need to check credit or complex financial agreement;

- Reducing risks for the seller: Sellers eliminate non -payment risks.

Does the CIA apply to all industries?

Cash in Advance is popular in the field of international trade, but the CIA is also used in production as required and specialized services.

Popular situations and options to replace Cash in Advance

Whether or not the common situations when using Cash in Advance are and which options to replace in advance cash? Read the following content to get the answer:

Popular situations when using cash prepaid CIA

Popular situations when using cash prepaid CIA:

- The buyer has not been verified: transacting with new customers without credit history;

- Product customization: With goods produced according to orders, minimizing non -payment risks;

- High risk market: When sold to countries with unstable economy or currency.

Choosing to replace cash prepaid CIA

Choose to replace cash in advance CIA:

- Partial payment: Buyers pay a percentage and pay the following balance;

- Letter of credit (LC): Bank for guarantee payment, risk balance for both parties;

- Open accounts: Payment after delivery, often applied to reliable buyers.

READ MORE: Get refrigerated Container shipping at good prices

Is Cash in Advance safe for the seller and has any challenges to use?

Join Proship to find out if Cash in Advance is safe for the seller, whether or not the challenge is and how to effectively use the CIA:

Is the CIA payment safe for the seller?

Paying Cash in Advance is safe because of ensuring the seller is paid before transporting goods and reducing financial risks.

Challenge when advance cash

What is challenge in advance cash cash in Advance? That is:

- Competitive disadvantage:

Competitors offer flexible terms to attract many buyers.

- The buyer hesitated:

Pre -payment can make buyers frustrated, especially new customers.

- Potential cheating:

Faith problems may arise, especially in cross -border transactions.

How to make small businesses effectively use advance cash?

Clear communication, confidence building and providing value -added incentives can help small businesses deploy the CIA without losing customers.

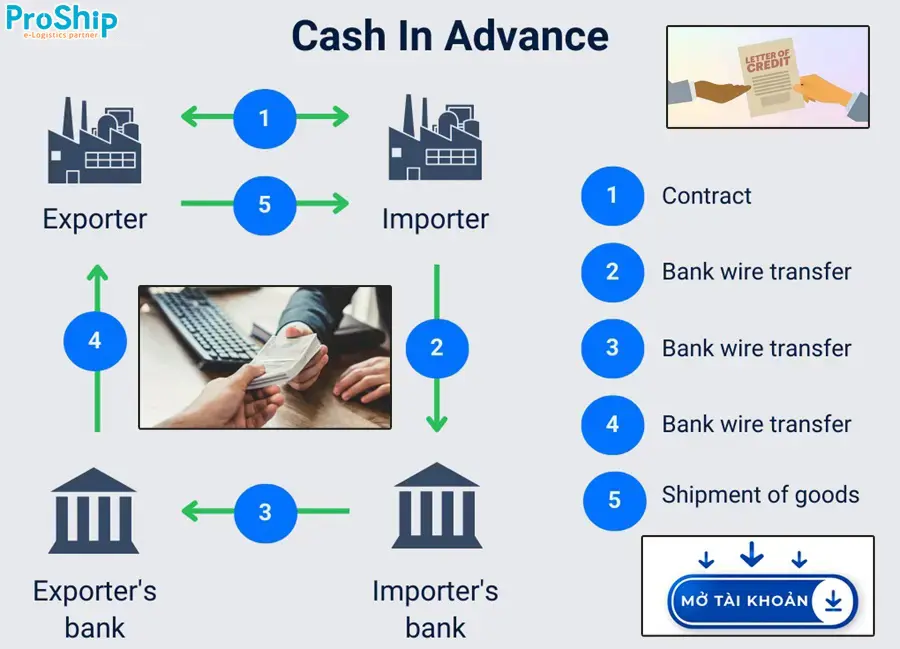

The process of payment steps for Cash in Advance

Cash in advance Cash in Advance operates according to the following process:

- Agreement: Seller and buyers agree on terms of the amount and payment schedule;

- Payment: buyers transfer money through the agreement method;

- Completing orders: After the seller receives payment, will transport goods or provide services;

- Confirmation of delivery: The seller ensures the buyer receives the order and completes the transaction.

What is Cash in Advance payment and the relevant knowledge in prepaid cash that Proship Logistics has just conveyed, hoping to be a useful reference for goods import and export enterprises.

In short, Cash in Advance is a powerful payment method, bringing safety for the seller but it is necessary to have an appropriate implementation strategy to receive the trust from the buyer. Any questions, contact 0909 344 247 for any questions and advice on cheap multimodal shipping services.