X your business is having imported shipments and many terms in the process of making goods, declaring documents such as Customs Duty, ... but do not fully understand the meaning of it?

X Do you want to learn more about the impact, the object and the role and impact of customs Duty on the economy of a country?

X You want to know how many types of Customs Duty is divided into?

Let Proship.vn we update the most complete knowledge about Customs Duty including Customs Duty? How is the effect of customs duty on import and export activities? Customs Duty tax subjects? The role of Customs Duty on the economy of a country ?, ... shortly.

Custom Duty: Concept and types of customs duty

Read the following content to understand what customs duty are and how many types of customs duty:

What is Customs Duty?

Customs Duty translates Vietnamese as a tariff. Customs Duty is an imposed fee on goods or products when they cross the national border or imported into a country.

Tariffs are often used to protect a country's domestic economy by creating a gap between the price of domestic goods and imported goods. One of the important terms in transporting sea containers today.

Tariffs

There are the following forms of tax classification:

Classification by tax subject

According to taxable subjects, there will be:

- Export tariffs: Applicable to goods exported to foreign countries;

- Import tariffs: Applicable to imported goods into the country.

Classification by tax calculation

According to tax calculation, there will be:

- Specific tariffs: is tax calculated by unit, volume or commodity size;

- Tariffs according to goods unit prices: is the tax calculated according to the percentage of the value of goods;

- Mixed tariffs: A combination of tariffs according to the price of goods and specific taxes.

Classification by applicable properties

According to the applicable properties, there will be:

- Permanent tariffs: long -term and stable application in the national tax system;

- Temporary tariffs: Applicable in a short time to solve urgent issues.

Classification by preferential level

According to the preferential level, there will be:

- Tariffs without incentives: Applicable to goods imported from countries without trade incentive agreements;

- Preferential tariffs: Applicable to low levels for countries or regions with trade incentive agreements.

Customs Duty impact with imported goods

What is the impact of the customs duty? Custom Duty can affect imported goods in the following ways:

Customs Duty affects product prices

Tariffs increase the price of imported products, so consumers have to pay more when buying this product. This can affect consumer forces, causing objections from manufacturers and consumers.

Customs Duty reduces import flow

When imported goods are subject to tariffs, imported flow may decrease. This can make domestic goods more competitive and create conditions for domestic manufacturers to expand production.

Customs Duty creates injustice in trade

Tariffs make imported products become not competitive and unfair compared to domestic products. This can lead to opposition from exporters and cause unfair competition in international trade.

Customs Duty affects external relations

The application of tariffs is easy to stress and affect foreign relations between nations. Countries can respond by applying tariffs on such products, resulting in a trade war and affecting the global economy.

Good refrigerated container shipping service

Subjects subject to customs duty and the role of customs duty to the national economy

What is the role of Customs Duty and who is subject to this tariff? The answer is as follows:

Subjects subject to custom duty

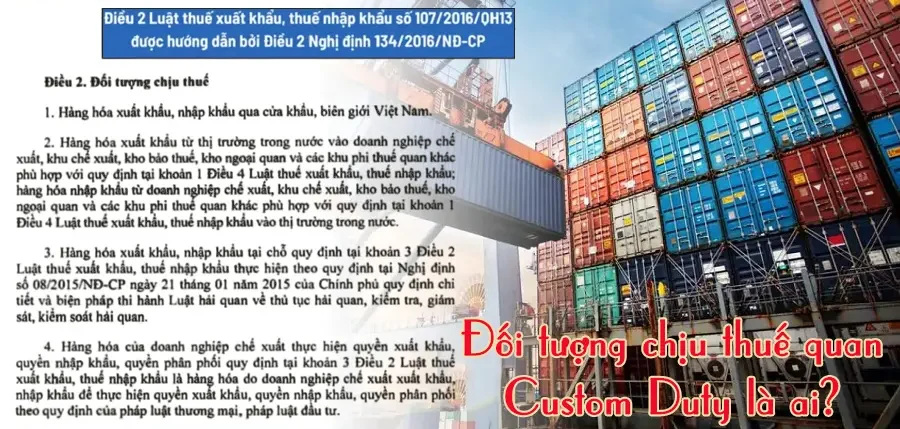

Pursuant to Article 2 of the Law on Export Tax, Import Tax No. 107/2016/QH13 guided by Article 2 of Decree 134/2016/ND-CP stipulating the following tariff subjects:

Article 2. Subjects subject to tax

1. Goods exported and imported via border gates and borders of Vietnam.

2. Goods exported from the domestic market to export processing enterprises, export processing zones, tax warehouses, bonded warehouses and other non -tariff zones in accordance with Clause 1, Article 4 of the Law on Export and Import Tax; Goods imported from export processing enterprises, export processing zones, tax warehouses, bonded warehouses and other non -tariff areas are in accordance with the provisions of Clause 1, Article 4 of the Law on Export Tax and Import Tax into the domestic market.

3. On-spot export and import goods prescribed in Clause 3, Article 2 of the Law on Export and Import Tax shall comply with the Government's Decree No. 08/2015/ND-CP of January 21, 2015, detailing the implementation of Customs Law on customs procedures, inspection, supervision and control of customs.

4. Goods of export processing enterprises exercising export rights, import rights, distribution rights prescribed in Clause 3, Article 2 of the Law on Export Tax and Import Tax are goods that are exported and imported by enterprises for export and imports to implement export rights, import rights and distribution rights in accordance with commercial law or investment law.

The role of Customs Duty on the national economy

What is the role of Customs Duty? Custom Duty plays a particularly important role in the national economy. Specifically:

- Domestic production protection:

Tariffs will protect domestic products and industries from unfair competition from imported products. This helps protect domestic industries and ensures their development.

- Create revenue for the Government:

Tariffs provide a revenue for the Government to pay the necessary expenses to protect and develop the domestic economy.

- Control imported flow:

Tariffs to control the import of some products, especially sensitive products or related to national security.

- Promoting economic development:

Tariffs promote economic development by creating conditions for domestic and developed domestic enterprises.

- Uniformly regulating competition:

Tariffs regulating are equally competitive among domestic manufacturers and foreign manufacturers. Thereby helping to prevent foreign businesses dominate the market and hinder the healthy competition among manufacturers.

What is Customs Duty and the most basic knowledge about tariffs applied to imported goods that Proship Logistics has just mentioned above, hoping to be useful for many shippers, private and import -export enterprises. Any questions, immediately contact 0909 344 247 for us to answer, advise on multimodal transport solutions cheap and cost -effective.