What are the import and export enterprises interested in international payment methods such as Documents Against Payment?

X You are an exporter, importer but have not grasped the payment process of Documents Against Payment?

X and you want to find out what is the advantage of Documents Against Payment's payment, what risks and what should be noted when using it?

What is the Documents Against Payment and how the payment process will be Proship.vn in a detailed and complete way in the following article ... At the same time, the import -exports also know how many types of Documents Against Payment are available.

What is Documents Against Payment? How many types of payment?

The following knowledge will help you understand what the payment document payment means and how to classify:

What is Documents Against Payment?

What is Documents Against Payment? Documents Against Payment (abbreviated as D/P) is a payment method in international trade. This is a method of payment of vouchers when delivering money.

This means that the exporter will instruct the bank to present only documents to the importer if the importer pays the full invoice or the exchange invoice. In other words, the importer will not receive a set of documents until the payment is completed for the bank.

Classification of payment method d/p

Payment method D/P has two forms:

- D/p at sight:

Is the payment method immediately. Buyers must pay by billions is the value of the shipment, the bank will assign the original voucher.

- D/p at x days sight:

Is a temporary method of payment of billions from the time of exporting the voucher. Buyers do not need to pay immediately but still receive a set of documents from the bank. But the buyer must pay on time stated in the paperwork to accept the term.

Proship good container shipping service

Payment d/p who are the parties involved and are there any risks?

Exporters and imports have questions about the risk when participating in Documents Against Payment and who are the parties involved? Join Proship to read the following content to get the answer:

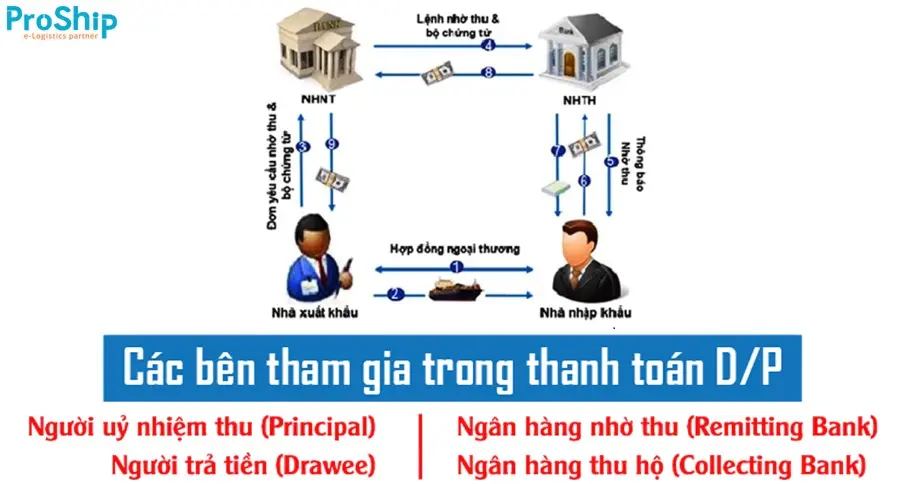

Participants in payment d/p

In payment D/P, there is the participation of:

- Principal (Principal):

As the one who issued an order for collecting money, maybe an importer or beneficiary. When the goods are completed, the authorized collector asks the bank to collect money for themselves.

- Payer (Drawee):

Is the person who directly pays or accepts payment to the exporter on time for the prescribed time in d/p. The payer in this case is the importer.

- Review bank (remission bank):

The bank will serve the needs of the exporter of the goods.

- Collection Bank (Collecting Bank):

The bank serves the needs of the importer. This bank will directly collect money from the importer and transfer it to the bank for collection to transfer to the exporter.

Risk of payment d/p

From the point of view of the seller, the D/P payment transaction is safe but in fact there is risk:

Payment risk D/P with importers

When paying D/P, importers are not allowed to check the status of goods and information on the voucher. Therefore, it will be easy to have risks if the importer shines wrong, poor quality goods or information errors in the voucher.

Payment risk D/P with the exporter

The method of d/p is safe for exporters because of ensuring maximum benefits when importing goods. But it is only true when the importer complies with the voucher set within the validity period of d/p.

It is not uncommon for the importer to extend the payment through the failure to receive the goods, not to pay when the price fluctuates. This will significantly affect the business of the exporter.

Advantages of payment documents against payment and note need to know

Proship will point out the advantages and note it is necessary to know when using the form of payment d/p:

Advantages of payment d/p

What is the advantage of payment documents Against Payment? That is:

Advantages of payment D/P for importers

Advantages of payment d/p with importer:

- Importers do not need to set credit limits with the bank;

- The cost of payment D/P is less expensive, simpler than the LC payment method.

Advantages of payment D/P for exporters

Advantages of payment D/P with exporter:

- Payment D/P is more beneficial for exporters;

- Pay D/P is less expensive, simpler than LC payment;

- Exporters can use the documents as a tool to complain to the importer if the importer does not pay;

- According to this method D/P, the voucher is only transferred to the importer to receive goods when the importer completes the payment procedure, so the payment is guaranteed for the exporter, which is safer than the TTR payment method;

- D/P has faster payment speed than CAD.

Note when paying d/p

Using the documents again Payment payment method, it should be noted:

- Carefully understand the regulations and practices of goods delivery and receipt of goods in the country of buyers to gain control of goods;

- Before signing a trade contract, you should carefully learn about partners through reputable websites;

- Payment D/P should be used for partners who have long -term cooperation, trust, not applicable to newly cooperated customers;

- Consider using appropriate bill of lading. Should use the bill of bill of lading, should not use the bill of lading or empty because it may be lost/swapping, causing a situation when there is a bill of lading can receive the goods without making payment.

Reference: Support for good cold container transportation

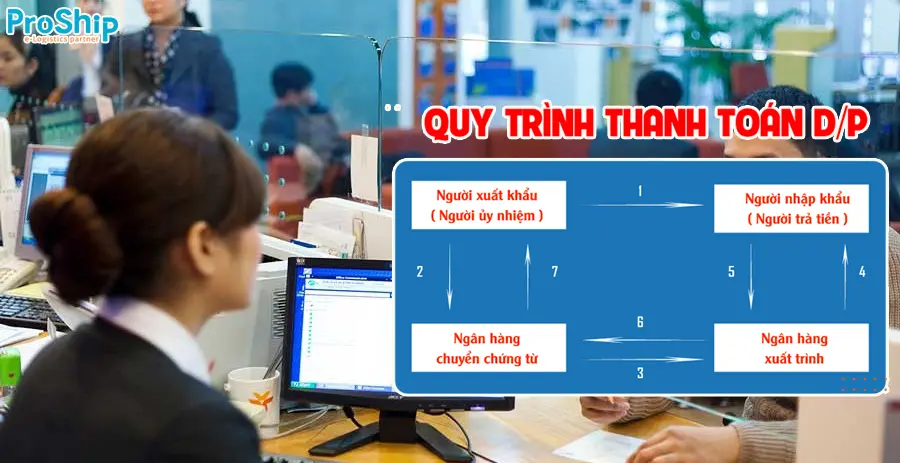

Payment process Documents Against Payment

The payment process is as follows:

- Step 1: The buyer, the seller agrees the delivery and payment conditions in the Sales Contract (Sales Contract);

- Step 2: Seller sends goods through shipping units (shipping lines, NVOCC, or Forwarding Company);

- Step 3: Seller prepare documents documents as contracted;

- Step 4: The seller sends documents to the bank's bank to collect money. The bank checks documents, ensures the validity;

- Step 5: The Seller Bank will notify the Bank's bank about receiving documents;

- Step 6: The Bank Bank will notify the buyer about receiving documents and payment requirements;

- Step 7: The buyer performs payment for the bank and receives a set of documents. The bank receives payment and money transfer to the seller bank;

- Step 8: The seller will transfer money to the seller's account;

- Step 9: The buyer can carry out the goods.

* Note: The payment process thanks to D/P will end when the buyer confirms the goods and the seller receives the payment.

What is Documents Against Payment and other knowledge that need to know about D/P payments in international trade that we have just answered above, hoping to be a useful reference for exporters and importers. Any questions related, contact 0909 344 247 for answers and direct advice on multimodal package shipping services cheap only at Proship Logistics.