Bạn là DN, cá nhân, tổ chức, đơn vị sản xuất kinh doanh, cung ứng hàng hóa sản phẩm,…cần tìm hiểu hóa đơn VAT và hóa đơn trực tiếp? Bạn muốn biết hóa đơn GTGT và hóa đơn bán hàng có điểm gì giống , khác nhau? Nội dung chính của hai loại hóa đơn gồm những gì? Bạn chưa có kinh nghiệm chuẩn bị giấy tờ, chứng từ, thủ tục mua hóa đơn trực tiếp và hóa đơn đỏ VAT ra sao? Có phức tạp không?

PROSHIP.VN sẽ giải đáp thắc mắc về sự giống, khác nhau cơ bản giữa hóa đơn trực tiếp và hóa đơn vat cho những cá nhân, đơn vị kinh doanh, DN xuất khẩu hàng hóa hiểu rõ về hai loại hóa đơn thông dụng này trong giao dịch – mua bán hàng hóa/sản phẩm. Từ đây, nếu bạn chưa có kinh nghiệm hoặc đang gặp vướng mắc liên quan tới xuất trình hóa đơn bán hàng hoặc hóa đơn GTGT thì có thể áp dụng một cách hiệu quả vào công việc.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Khái niệm hóa đơn bán hàng trực tiếp và hóa đơn VAT là gì?

Khái niệm hóa đơn trực tiếp và hóa đơn VAT là gì, nội dung cơ bản cần có trong mỗi hóa đơn gồm những gì sẽ được Proship giải đáp như sau:

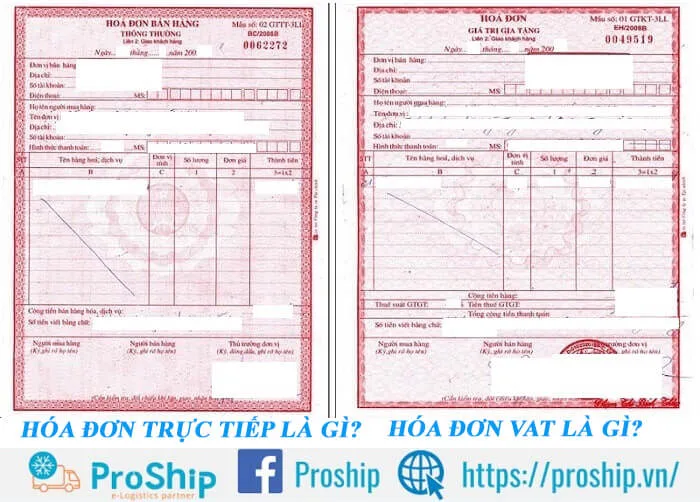

Hóa đơn trực tiếp là gì?

Hóa đơn trực tiếp (hay hóa đơn bán hàng trực tiếp/hóa đơn bán hàng/hóa đơn thông thường) là loại hóa đơn do chi cục Thuế cấp cho cá nhân/tổ chức kinh doanh sử dụng phương pháp nộp thuế trực tiếp khi giao dịch mua bán, cung ứng hàng hóa, dịch vụ.

Loại hóa đơn này còn được coi là hóa đơn bán lẻ dành cho các cửa hàng, hộ cá nhân kinh doanh (không phải các Công ty). Theo đó, những cá nhân/tổ chức khi chọn phương pháp nộp thuế trực tiếp không được sử dụng hóa đơn GTGT (hóa đơn đỏ).

Mua hóa đơn trực tiếp ở đâu? Thực tế, nhiều đơn vị cung cấp hóa đơn thông thường vi phạm pháp luật và việc mua những hóa đơn này có thể đưa bạn vào tình thế pháp lý khó khăn. Hóa đơn trực tiếp từ Chi cục Thuế mới được xem xét hợp pháp nên hãy mua hóa đơn từ cơ quan thuế chính thống vì nó giúp tránh rủi ro pháp lý và duy trì uy tín trong ngành. Tuân thủ pháp luật và sử dụng hóa đơn hợp pháp cũng giúp đảm bảo sự phát triển bền vững của doanh nghiệp và xây dựng lòng tin với khách hàng.

Nội dung cơ bản cần có trên một mẫu hóa đơn trực tiếp, gồm:

- Tên, ký hiệu, số và tên liên hóa đơn. Đối với hóa đơn trực tiếp đặt in, phải ghi tên tổ chức nhận in hóa đơn;

- Tên, địa chỉ và mã số thuế của người bán và người mua;

- Tên, đơn vị tính, đơn giá, số lượng và thành tiền hàng hóa, dịch vụ (chưa có VAT);

- Tổng số tiền cần thanh toán, chữ ký của người mua – bán và thời gian lập hóa đơn.

Hóa đơn VAT là gì?

Hóa đơn đỏ hay Value Added tax invoice (VAT) là một loại chứng từ do Bộ tài chính phát hành hoặc doanh nghiệp tiến hàng tự in trong trường hợp đã đăng ký mẫu trước với cơ quan thuế. Cơ quan thuế hiện chỉ chịu trách nhiệm phát hành các hóa đơn lẻ và biên lai thu phí, lệ phí theo pháp luật. Việc quản lý hoạt động in và sử dụng hóa đơn đỏ được cơ quan thuế giám sát.

Hóa đơn đỏ là một loại chứng từ nhằm thể hiện giá trị hàng hóa bán/cung cấp cho người mua. Hóa đơn đỏ thể hiện thông tin của hai bên người bán, mua do bên cung cấp dịch vụ xuất và là căn cứ để xác định số thuế cần nộp.

Nội dung cơ bản cần có trên một mẫu hóa đơn GTGT, gồm:

- Tên;

- Địa chỉ;

- Mã số thuế;

- Danh mục hàng hóa dịch vụ;

- Ngày thực hiện giao dịch;

- Tổng giá trị hàng hóa dịch vụ;

- Giá trị tính thuế GTGT;

- Thuế suất GTGT;

- Giá trị thuế GTGT.

>>Xem thêm: Hóa đơn giá trị gia tăng là gì?

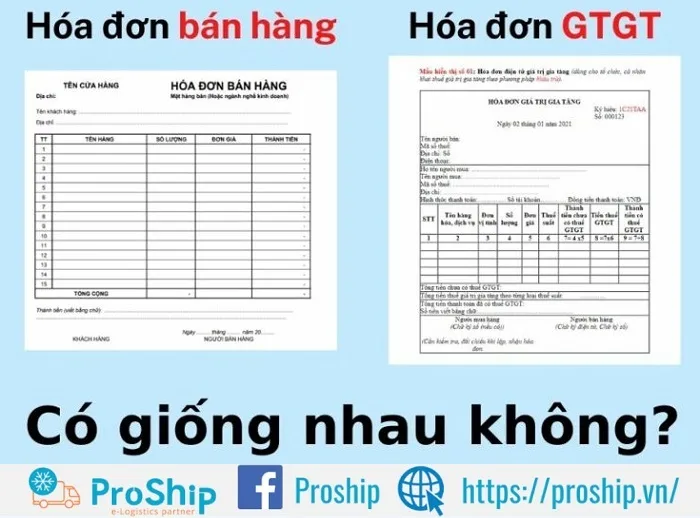

Hóa đơn VAT và hóa đơn trực tiếp có gì giống nhau, khác nhau?

Điểm giống nhau giữa hóa đơn VAT và hóa đơn trực tiếp

Hóa đơn trực tiếp và hóa đơn vat có gì giống, khác nhau? Điểm giống nhau giữa hóa đơn trực tiếp và hóa đơn giá trị gia tăng đó là đều được ghi nhận vào chi phí hợp lý khi tính thuế thu nhập doanh nghiệp nếu đảm bảo được tính hợp lý, hợp lệ, hợp pháp của hóa đơn đó và có đủ chứng từ đi kèm.

Điểm khác nhau giữa hóa đơn VAT và hóa đơn trực tiếp

Căn cứ Luật Thuế giá trị gia tăng 2008 và các văn bản hướng dẫn, có thể phân biệt sự khác nhau của hóa đơn bán hàng và hóa đơn GTGT dựa trên các tiêu chí sau:

| TIÊU CHÍ | HÓA ĐƠN BÁN HÀNG TRỰC TIẾP | HÓA ĐƠN GTGT VAT |

| Đối tượng sử dụng | Dành cho các tổ chức, cá nhân như: Tổ chức, cá nhân khai, tính thuế giá trị gia tăng theo phương pháp trực tiếp sử dụng cho các hoạt động:

Tổ chức, cá nhân trong khu phi thuế quan khi bán hàng hoá, cung cấp dịch vụ vào nội địa và khi bán hàng hoá, cung ứng dịch vụ giữa các tổ chức, cá nhân trong khu phi thuế quan với nhau, xuất khẩu hàng hóa, cung cấp dịch vụ ra nước ngoài. |

Dành cho các tổ chức khai thuế giá trị gia tăng theo phương pháp khấu trừ sử dụng cho các hoạt động:

|

| Mẫu | Mẫu hóa đơn bán hàng do Cục Thuế phát hành – mẫu tham khảo số 7 ban hành kèm theo Thông tư 78/2021/TT-BTC. | Mẫu hóa đơn GTGT do cục Thuế phát hành – mẫu tham khảo số 6 ban hành kèm theo Thông tư 78/2021/TT-BTC. |

| Nội dung hóa đơn | Không có dòng thuế suất và tiền thuế GTGT. |

|

| Kê khai hóa đơn |

|

|

| Hạch toán | Phần thuế trên hóa đơn đầu vào sẽ được cộng trực tiếp vào nguyên giá tài sản | Phải hạch toán tách biệt thuế GTGT đầu vào, đầu ra và nguyên giá tài sản để tính khấu trừ |

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

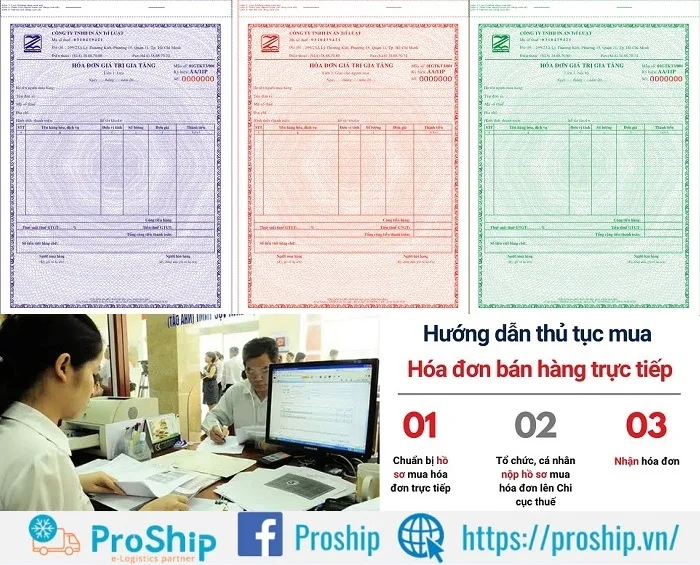

Hướng dẫn thủ tục mua hóa đơn bán hàng trực tiếp và hóa đơn VAT

Với nhiều năm kinh nghiệm trong lĩnh vực vận chuyển hàng hóa, cung ứng dịch vụ vận tải – logistics, xuất trình hóa đơn cho DN,…Proship Logistics xin chia sẻ chi tiết các bước thủ tục mua hóa đơn trực tiếp và hóa đơn VAT giá trị gia tăng chuẩn xác như sau:

Thủ tục mua hóa đơn trực tiếp

Chỉ có hóa đơn được cấp trực tiếp tại Cơ quan thuế mới hợp lệ nên DN cần mua hóa đơn trực tiếp ở Cơ quan thuế để tránh nhiều rủi ro không đáng có. Cá nhân, tổ chức tiến hành nộp hồ sơ tại Phòng Ấn chỉ của Chi cục thuế trực tiếp quản lý doanh nghiệp mình.

Theo Điều 12 Thông tư 39/2014/TT-BTC, hồ sơ mua hóa đơn trực tiếp lần đầu, bao gồm:

- Đơn đề nghị mua hóa đơn theo mẫu số 3.3 phụ lục 3 ban hành kèm theo Thông tư 39/2014 của Bộ Tài chính;

- Bản cam kết mẫu số CK01/AC theo mẫu số 3.16 phụ lục 3 ban hành kèm theo Thông tư 39/2014 của Bộ Tài chính;

- Bản sao giấy phép kinh doanh;

- Giấy ủy quyền của giám đốc;

- Chứng minh thư của người đi mua;

- Dấu mộc vuông.

(* Lưu ý: Thông tin của người được ủy quyền và thông tin trong đơn đề nghị mua phải khớp nhau).

Số lượng hóa đơn bán hàng bán cho các tổ chức, hộ và cá nhân kinh doanh lần đầu sẽ không vượt quá một quyển năm mươi cho mỗi loại hóa đơn. Từ lần hai, hồ sơ mua hóa đơn bán hàng trực tiếp gồm:

- Đơn đề nghị mua hóa đơn;

- Giấy ủy quyền của giám đốc;

- Chứng minh thư của người mua;

- Sổ mua hóa đơn (được phát khi mua lần đầu);

- Quyển hóa đơn mua trước liền kề (quyển hóa đơn sắp hết mà doanh nghiệp đang sử dụng);

- Dấu mộc vuông.

Thủ tục mua hóa đơn GTGT VAT

Bước 1: Chuẩn bị giấy tờ, hồ sơ mua hóa đơn GTGT của cơ quan thuế

Trước tiên, các cá nhân kinh doanh cần chuẩn bị 02 bộ hồ sơ gồm đầy đủ giấy tờ theo Công văn 2025/TCT-TVQT quy định về hồ sơ mua hóa đơn của cơ quan thuế:

- Đơn đề nghị mua hóa đơn theo mẫu của cơ quan thuế (mẫu đơn được trình bày ở dưới);

- Giấy phép đăng ký kinh doanh;

- Chứng minh thư nhân dân hoặc thẻ căn cước công dân của người đại diện trong đề nghị mua hóa đơn;

- Văn bản cam kết về địa chỉ sản xuất kinh doanh hiện tại trùng khớp với giấy chứng nhận đăng ký kinh doanh của cá nhân, trùng khớp với thông tin trên giấy phép đầu tư hoặc quyết định cấp phép kinh doanh của cơ quan có thẩm quyền.

- Hợp đồng cung cấp sản phẩm dịch vụ hoặc giấy mua bán hàng hóa (02 bản trong đó có ít nhất 01 bản chính);

- Tờ khai thuế GTGT, thu nhập cá nhân (02 bản);

- Tờ khai thuế thu nhập doanh nghiệp (đối với doanh nghiệp, tổ chức – 03 bản);

- Biên lai nộp thuế (02 bản photo).

* Lưu ý: Theo Điều 6, Khoản 2, Thông tư 156/2013/TT-BTC, các cá nhân khác thay mặt người nộp thuế để thực hiện công tác đăng ký, nộp hồ sơ kê khai thuế, nhận hóa đơn lẻ phải có văn bản ủy quyền theo Bộ Luật dân sự.

Đối với Doanh nghiệp đã từng mua hóa đơn đỏ tại Chi cục thuế, cần chuẩn bị các giấy tờ:

- Giấy giới thiệu doanh nghiệp;

- Tờ đăng ký mua hóa đơn GTGT tại Cơ quan thuế;

- Mộc vuông;

- Chứng minh nhân dân của đại diện doanh nghiệp.

Bước 2: Nộp hồ sơ lên Cơ quan thuế trực thuộc

Sau bước chuẩn bị đầy đủ các loại giấy tờ để làm hồ sơ, cá nhân kinh doanh cần gửi hồ sơ tới cơ quan thuế mà cá nhân trực thuộc.

Bước 3: Nhận hóa đơn đã đăng ký mua từ Cơ quan thuế

Sau khi hồ sơ được nộp đến cơ quan thuế, các cá nhân kinh doanh sẽ được cơ quan thuế xác nhận trực tiếp và phát hành hóa đơn GTGT đã đăng ký mua.

Các cá nhân kinh doanh phải kiểm tra và tự chịu trách nhiệm ghi hoặc là đóng dấu các thông tin sau khi nhận được hóa đơn: Tên, địa chỉ, mã số thuế được in trên liên 2 của mỗi số hóa đơn.

Tóm lại, giữa hóa đơn trực tiếp và hóa đơn VAT sẽ có điểm giống, khác nhau cơ bản và tất nhiên là quy trình thủ tục mua hai loại hóa đơn này cũng khác nhau. Do đó, các đối tượng sử dụng cần nắm rõ kiến thức chuyên ngành trên để có sự phân biệt dễ dàng giữa hai hóa đơn trong mua bán – trao đổi hàng hóa….Và khi có nhu cầu sử dụng Dịch vụ vận chuyển bưu kiện, xe máy Bắc Nam giá rẻ, liên hệ ngay 0909 344 247 để được tư vấn, báo giá nhanh trực tiếp.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung