X You are participating in international payment transactions and need to learn about what is ISSUing Bank?

X You want to know in international payment, what role Issuing Bank plays and what support for import -export enterprises?

x You do not understand the procedures, applications for l/c credit letter, what is the process of implementation at ISSUing Bank?

Let Proship.vn read the content of the following sharing to understand what Issuing Bank International Payment method is? What role does Issuing Bank play for businesses? How is the LC application process done at Isatuing Bank?

What is Issuing Bank in international payment?

What is Issuing Bank? Issuing Bank is a issuing bank. In international payment, Issuing Bank is understood as a bank representing the importer and is responsible for issuing a letter of credit (L/C) at their request. The issuing bank also ensures payment according to L/C.

The issuing bank is responsible for issuing L/C, confirming that the importer is financially capable for payment. The issuing bank is also known as Open Bank. (According to commercial bank curriculum, Statistical Publishing House)

* For example, an importer wants to buy goods from a foreign exporter. They will go to their issuing banks to request L/C issuance. After that, the issuing bank will send L/C to the bank's notice. When the exporter receives L/C, they can deliver goods and produce documents to the bank notification to receive payment.

The role and risk of the issuing bank for businesses

The role and the risk that the issuing the Issuing Bank face is:

The role and nature of the issue bank Issuing Bank

For businesses, what is the role of Issuing Bank issuing bank? Currently, the trade with foreign countries is increasing but not all units ensure international payment. The introduction of the issuing bank has solved the issues of payment and financial risks to businesses exporting its products.

The issuing bank plays an important role in ensuring payment on time according to the prescribed time, helping businesses feel secure about money and goods. In addition, the issuing bank also ensures commitment to delivery and receipt of goods, supporting companies and businesses to carry out export and import activities on an international scope.

However, in import and export activities, risks not only come from payment but also from product quality. The opening of a letter of credit at the issuing bank helps businesses feel more secure about goods and money.

Risk of Issuing Bank issuing bank

Issuing Bank issuing bank faces many risks in the transaction process including:

- Transaction cheating:

When the legal account is fraudulent, credit card fraud through stolen accounts, online transactions, cardholders are not responsible for fraudulent fees, the bank is subject to loss.

- Account fraud:

This may be a fake account holder, an account using another person's name to buy or service but then disappear without paying for the bank;

- Credit risk:

The issuing bank also faces many credit risks including objective and subjective risks.

* Whatever the cause of risks, the bank is still responsible and may be financially loss.

Documents, subjects applying for LC LC Mail at Issuing Bank issuing bank

Next, with Proship learn about the records and subjects applying for LC Mails at the issuing bank:

Application for LC at Issuing Bank

Each bank has its own regulations on records and procedures when customers want to request a letter of credit. But the general procedure includes the following documents:

- Application for opening L/C;

- Decision to establish business, business registration, import and export code;

- Foreign trade contracts;

- Import license;

- Commitment to payment.

Subjects applying for LC at Issuing Bank

When you want to participate in the LC LC letter at the issuing bank, the subjects participated are:

- The person who applied to open a letter of credit voucher: buyers, goods importer;

- Beneficiaries from letters of credit: Seller, exporter of goods;

- The bank opens the letter of credit (ISSUing Bank);

- Bank notifies the letter of credit;

- Bank confirmed.

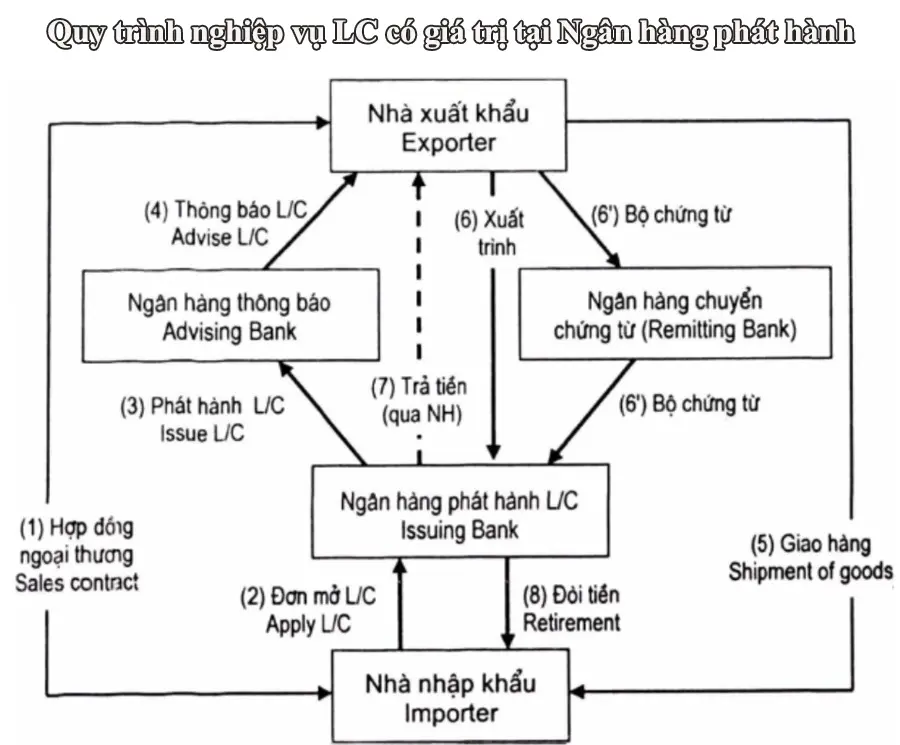

The LC professional process is valid at the issuing bank

The LC professional performance process is valid at the Issuing Bank issuing bank as follows:

Step 1

The two sides buy and sell foreign trade contracts with the terms of payment by L/C method.

Step 2

Based on the terms and conditions of foreign trade contracts and importers to submit to the bank to serve them, ask this bank to issue a L/C for the exporter to enjoy.

Step 3

Based on the application of L/C, if agreed, the issuing bank set up L/C and through the agent bank or its branch in the exporter to notify the L/C to the exporter.

Step 4

Upon receiving L/C, the bank notified the L/C to the exporter.

Step 5

The exporter checks the L/C, if in accordance with the signed contract, the delivery is informed, if it is not suitable, the proposal to amend and supplement the L/C to suit the foreign trade contract.

Step 6

Step (6) and (6 ′) After delivery, the exporter set up a set of documents at the request of L/C and present (via the notice bank or another bank) to the issuing bank for payment.

Step 7

The bank issued after checking the documents, if the appropriate presentation will be paid. If not suitable, it will refuse to pay, send the whole and intact documents to the exporter.

Step 8

The issuing bank demands importers and transfers the documents to the importer after receiving the money or accepts the payment.

What is Issuing Bank and the relevant knowledge has been answered above. The issuing bank (ISSUing Bank) plays an important role in ensuring payment and helps businesses carry out international import and export activities safely and reliably. Any questions about the process of international goods trading or transporting goods to international, contact 0909 344 247 for advice and best quotes.