Các bên liên quan trong giao dịch Thanh toán quốc tế cần tìm hiểu về phương thức L/C Usance là gì, có ưu điểm, đặc điểm gì, nên sử dụng khi nào? Bạn chưa có nhiều kinh nghiệm trong việc xin LC nên cần tìm hiểu về hồ sơ cần chuẩn bị gồm những gì? Bạn muốn biết quy trình thực hiện Usance L/C trải qua bao nhiêu bước?

Những kiến thức cần biết về LC Usance là gì và quy định liên quan sẽ được Proship.vn chúng tôi làm rõ trong khuôn khổ bài viết này. Đồng thời qua đây, các nhà nhập khẩu, nhà xuất khẩu hàng hóa cũng nắm được quy trình các bước thanh toán Usance L/C được thực hiện ra sao.

Đặc điểm chung của thanh toán L/C là gì? L/C Usance là gì?

Muốn biết LC Usance là gì, trước tiên cần tìm hiểu xem đặc điểm của LC trong Thanh toán quốc tế là gì:

Đặc điểm chung của L/C

L/C là Hợp đồng kinh tế giữa Ngân hàng phát hành và Người thụ hưởng (người xuất khẩu), thể hiện một cam kết chắc chắn, không hủy ngang của ngân hàng phát hành về việc thanh toán cho người xuất khẩu khi người này xuất trình bộ chứng từ phù hợp với các điều kiện và điều khoản của L/C với UCP (The Uniform Custom and Practice for Documentary Credit) và với ISBP (International Standard Banking Practice).

L/C độc lập với Hợp đồng cơ sở (Hợp đồng ngoại thương) và hàng hóa, việc thanh toán của ngân hàng phát hành chỉ căn cứ vào chứng từ xuất trình mà không phụ thuộc vào việc thực hiện hợp đồng ngoại thương (là cơ sở để mở L/C), tình trạng thực tế của hàng hóa, hay các thực hiện khác.

Trong giao dịch L/C, các chức năng (nghiệp vụ) cơ bản của các ngân hàng được đề cập trong UCP gồm: phát hành, thông báo, trả tiền, thương lượng chiết khấu, chấp nhận hối phiếu, cam kết trả chậm, xác nhận, chuyển nhượng và hoàn trả.

LC Usance là gì?

UPAS L/C = Usance paid at sight = Usance L/C. Vậy, Usance hay UPAS LC là Thư tín dụng trả chậm có điều khoản đặc biệt cho phép người thụ hưởng thư tín dụng (Bên xuất khẩu) được thanh toán ngay (Normal UPAS LC) hoặc thanh toán một ngày cụ thể trước ngày đáo hạn (Deferred UPAS LC).

XEM THÊM: Nhận vận chuyển Container giá tốt

LC Usance có ưu điểm, đặc điểm gì? Nên sử dụng Usance L/C khi nào?

Đặc điểm, ưu điểm của LC Usance là gì và nên sử dụng thanh toán Usance L/C khi nào? Nội dung Proship tổng được sau đây sẽ cho bạn lời giải đáp:

Đặc điểm của Usance LC

- Điều khoản có thể thương lượng:

Thời hạn trả chậm có thể thương lượng và thay đổi tùy thỏa thuận giữa người mua và người bán. Thời hạn trả chậm thường dao động từ 30 – 120 ngày.

- Thanh toán hoãn lại:

LC trả chậm cho phép người mua hoãn thanh toán đến khi thời hạn trả chậm đã thỏa thuận hết hạn.

- Công cụ tài chính:

LC thanh toán nhanh có thể sử dụng như một công cụ tài chính cho người mua, cho phép họ sử dụng thời hạn tín dụng để tạo ra thu nhập từ hàng hóa đã mua trước khi thanh toán.

- Tính linh hoạt:

LC thanh toán nhanh rất linh hoạt cho người mua bằng cách cho họ thời gian kiểm tra hàng hóa trước khi thanh toán.

Ưu điểm của L/C Usance

Ưu điểm của thanh toán LC Usance:

- Bên mua (bên nhập khẩu) được hưởng chính sách mua hàng trả chậm với chi phí hợp lý;

- Bên bán (bên xuất khẩu) được thanh toán tiền ngay, không phải trả bất kỳ khoản phí nào;

- Thanh toán LC Usance an toàn cho cả bên xuất khẩu và nhập khẩu. Nếu khách hàng là bên nhập khẩu sẽ có thêm nhiều cơ hội hợp tác với những nhà cung cấp uy tín với giá cả cạnh tranh;

- Mức phí cạnh tranh so với các phương thức thanh toán khác, xử lý nhanh, đảm bảo bảo mật thông tin;

- Giải chi phí tài chính cho doanh nghiệp trong bối cảnh bị hạn chế tiếp cận vốn vay bằng ngoại tệ.

Sử dụng L/C Usance khi nào?

Nên sử dụng thanh toán L/C Usance KHI:

- Bên nhập khẩu có tài chính hạn chế, cần thời gian gom tiền trước khi thanh toán. L/C Usance linh hoạt trong việc trả tiền theo thời gian;

- Cần thỏa thuận thời gian thanh toán linh hoạt giữa Nhà xuất khẩu và Nhà nhập khẩu.

Bộ hồ sơ mở LC gồm những gì? Quy trình thực hiện LC Usance thế nào?

Proship liệt kê hồ sơ cần chuẩn bị khi xin LC và quy trình Usance LC được thực hiện như sau:

Hồ sơ xin mở L/C gồm những gì?

Hồ sơ mở L/C gồm:

- Đơn xin mở L/C trả ngay hay L/C trả chậm;

- Các chứng từ thanh toán kèm theo như UNC;

- Đơn xin bảo lãnh kiêm giấy nhận nợ nếu được ngân hàng nhận bảo lãnh đối với L/C có mức kí quĩ dưới 100%, hay bộ hồ sơ thế chấp tài sản,…

ĐỌC THÊM: Nhận vận chuyển Container Lạnh giá tốt, uy tín

Quy trình thực hiện L/C Usance

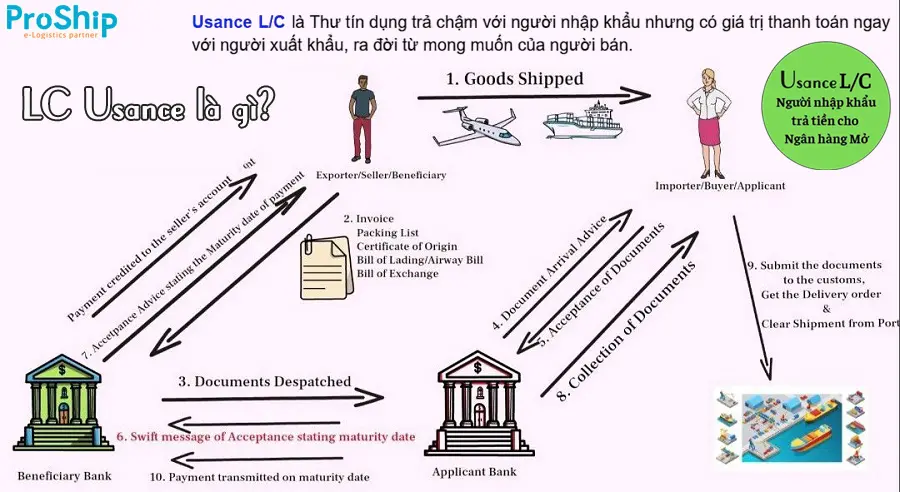

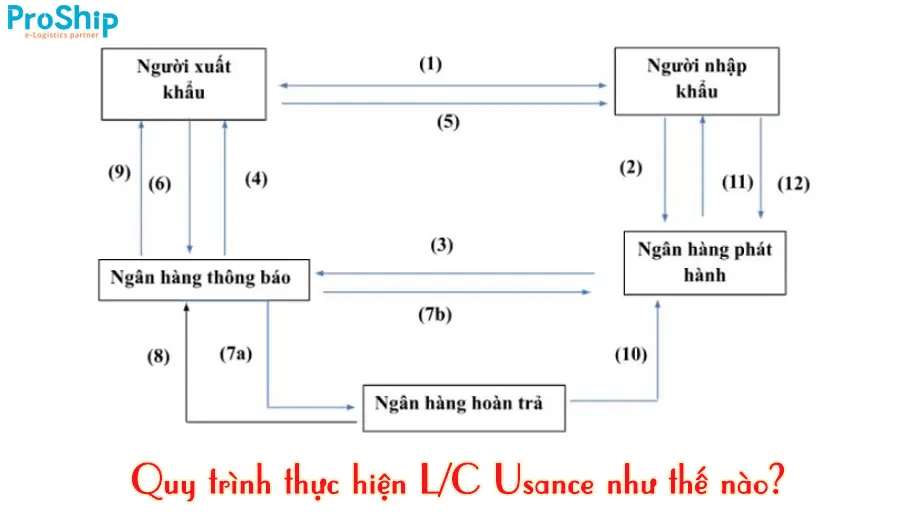

Quy trình thực hiện UPAS/Usance LC như sau:

- Bước 1:

Ký kết Hợp đồng ngoại thương giữa nhà xuất khẩu và nhập khẩu, 2 bên thỏa thuận sử dụng phương thức thanh toán UPAS hay Usance L/C.

- Bước 2:

Mở UPAS hay Usance L/C: Bên nhập khẩu yêu cầu Ngân hàng phát hành UPAS hay Usance L/C theo các điều khoản đã thỏa thuận cho bên xuất khẩu (người thụ hưởng).

- Bước 3:

Ngân hàng phát hành thông báo việc lập UPAS hay Usance L/C cho ngân hàng thông báo.

- Bước 4:

Ngân hàng thông báo thông báo UPAS hay Usance L/C cho nhà xuất khẩu.

- Bước 5:

Nhà xuất khẩu giao hàng cho nhà nhập khẩu.

- Bước 6:

Nhà xuất khẩu lập bộ chứng từ theo yêu cầu của UPAS hay Usance L/C và xuất trình bộ chứng từ hợp lệ cho Ngân hàng thông báo.

- Bước 7:

Nếu chứng từ phù hợp:

(7a): Ngân hàng thông báo thực hiện một yêu cầu hoàn trả gửi đến cho Ngân hàng hoàn trả.

(7b): Ngân hàng thông báo sẽ gửi cho Ngân hàng phát hành UPAS hay Usance L/C các chứng từ gốc của lô hàng.

- Bước 8:

Ngân hàng hoàn trả nhận được hối phiếu sẽ thực hiện theo ủy quyền hoàn trả với Ngân hàng phát hành, tức là chiết khấu hối phiếu, trả ngay tiền cho người xuất khẩu thông qua Ngân hàng thông báo.

- Bước 9:

Ngân hàng thông báo báo có tiền vào tài khoản người xuất khẩu.

- Bước 10:

Ngân hàng hoàn trả gửi điện thông báo với Ngân hàng phát hành rằng, hối phiếu đã được xuất trình và chiết khấu. Đồng thời cũng thông báo ngày đáo hạn của hối phiếu và các loại phí liên quan đến việc chiết khấu hối phiếu cho Ngân hàng phát hành.

- Bước 11:

Ngân hàng phát hành kiểm tra chứng từ và thông báo cho người nhập khẩu ngày đáo hạn và tất cả các loại phí. Ngân hàng phát hành giao chứng từ cho người nhập khẩu để nhận hàng. Ở bước này, người nhập khẩu chưa phải thanh toán hối phiếu và phí ngân hàng.

- Bước 12:

Khi hối phiếu đáo hạn thanh toán, Ngân hàng phát hành sẽ thanh toán cho Ngân hàng hoàn trả số tiền trên hối phiếu và phí phát sinh. Sau đó, Ngân hàng phát hành sẽ yêu cầu người nhập khẩu thanh toán hối phiếu và các chi phí phát sinh.

Phương thức thanh toán LC Usance là gì, có ưu điểm đặc điểm gì nổi bật, quy trình thực hiện Usance L/C thế nào, cần chuẩn bị các chứng từ hồ sơ gì khi xin LC,…đã được chia sẻ ở trên. Mọi thắc mắc liên quan tới các phương thức thanh toán quốc tế thông dụng, liên hệ 0909 344 247 để được giải đáp và tư vấn, báo giá nhanh các Dịch vụ vận chuyển Đa phương thức trọn gói giá rẻ chỉ có tại Proship Logistics.