x Doanh nghiệp bạn đang tham gia vào lĩnh vực XNK, vận tải quốc tế,…cần tìm hiểu về Letter Of Indemnity?

x Bạn chưa hiểu rõ định nghĩa Letter Of Indemnity là gì? Sử dụng khi nào?

x Bạn thắc mắc về thành phần nội dung, rủi ro, chức năng của LOI là gì?

Sau đây, Proship.vn chúng tôi sẽ giải đáp nhanh letter of indemnity là gì, khi nào nên sử dụng letter of indemnity, rủi ro, chức năng của letter of indemnity, nội dung letter of indemnity gồm những gì,…và những kiến thức khác liên quan.

Letter of indemnity là gì? Nội dung gồm gì?

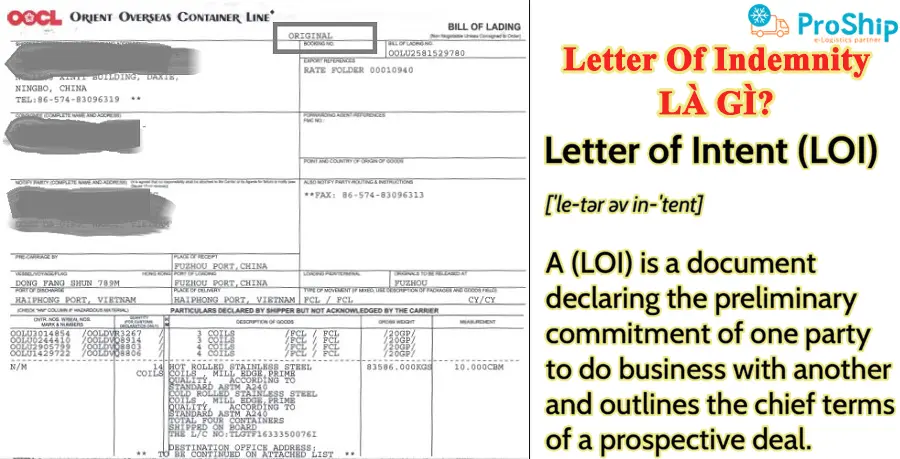

Khái niệm Letter of indemnity

Letter of indemnity là gì? LOI (viết tắt của Letter of Indemnity) là Thư bồi thường, được sử dụng cho bên mua và bên bán nhưng được soạn thảo bởi bên thứ ba (có thể là công ty bảo hiểm/ngân hàng) và chấp nhận trả tiền bồi thường tài chính cho một bên trong trường hợp bên còn lại không hoàn thành nghĩa vụ của mình.

Các nội dung có trong LOI

Nội dung quan trọng có trong LOI gồm:

- Thông tin chi tiết (tên, địa chỉ,…) của hai bên mua và bán;

- Thông tin chi tiết (tên, địa chỉ,…) của tổ chức bên thứ 3 đứng ra đảm bảo bồi thường;

- Các điều khoản được các bên thống nhất;

- Lời cam đoan, ngày ký kết và chữ ký của các bên.

Letter of indemnity dùng cho trường hợp nào?

Giấy bảo đảm, bảo lãnh thường cần đến trong các trường hợp:

Cam kết để nhận vận đơn sạch (hoàn hảo)

Khi giao hàng xuất khẩu, đôi lúc xảy ra tình trạng thiếu sót bên ngoài hàng hóa mà thuyền trưởng có thể ghi chú vào vận đơn làm cho vận đơn có thể trở thành không sạch và không được ngân hàng chấp nhận thanh toán, người gởi hàng buộc phải thương lượng với thuyền trưởng và làm giấy bảo đảm, cam kết bồi thường tổn thất của người chuyên chở nếu người nhận hàng khiếu nại hàng không đúng như ghi trên vận đơn.

Song việc làm giấy bảo đảm này không được các tòa án quốc tế công nhận rộng rãi là hợp pháp, việc cam kết có thể gây hậu quả nặng nề nên người gởi hàng cần cân nhắc kỹ.

Bảo lãnh để nhận hàng

Vì vận đơn cần xuất trình cho tàu để nhận hàng nhưng không đến kịp lúc tàu đến giao hàng, người nhận bị buộc phải yêu cầu ngân hàng hỗ trợ làm giấy bảo lãnh để có thể nhận được hàng từ người chuyên chở (BankerÙs indemnity).

Bảo đảm đóng góp tổn thất chung

Theo quy tắc York-Antwerp 1990, chủ hàng có tài sản trong chuyến tàu gặp tổn thất chung phải ký cam kết đóng góp tổn thất chung (Average bond) và ứng tiền đóng vào tài khoản chung để làm quỹ xử lý tổn thất chung mới được nhận hàng của mình còn trên tàu.

Nhưng nếu hàng hóa đã được bảo hiểm, chủ hàng sẽ yêu cầu công ty bảo hiểm đứng ra làm thư bảo lãnh (Letter of indemnity or letter of guarantee) gởi cho người chuyên chở để có thể nhanh chóng mang hàng về.

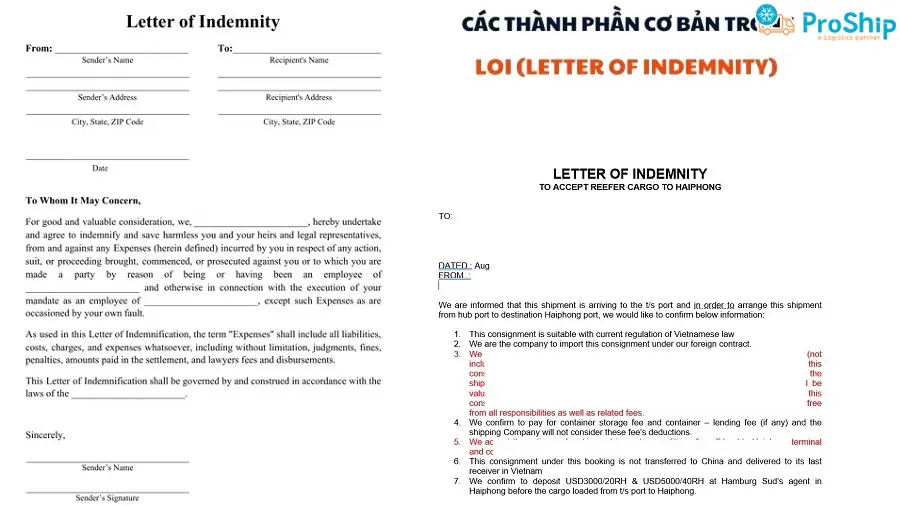

Thành phần của Thư bảo lãnh bồi thường (LOI) trong vận tải quốc tế

Các thành phần trong LOI gồm:

Thông tin các bên liên quan

- Tên đầy đủ, địa chỉ chi tiết của bên yêu cầu phát hành LOI (thường là người nhập khẩu hoặc người nhận hàng);

- Tên đầy đủ, địa chỉ chi tiết của bên phát hành LOI (thường là ngân hàng hoặc công ty bảo hiểm);

- Tên đầy đủ, địa chỉ chi tiết của bên thụ hưởng LOI (thường là hãng tàu hoặc người vận chuyển).

Lý do phát hành, nội dung bồi thường

- Nêu rõ lý do cụ thể dẫn đến việc phát hành LOI như: yêu cầu nhận hàng khi chưa có vận đơn gốc, giải phóng hàng hóa bị tạm giữ…;

- Liệt kê chi tiết các thiệt hại, tổn thất mà bên phát hành LOI cam kết bồi thường trong trường hợp xảy ra rủi ro.

Ngày phát hành, thời hạn hiệu lực

- Ghi rõ ngày, tháng, năm phát hành LOI;

- Xác định thời hạn hiệu lực của LOI, đảm bảo phù hợp với thỏa thuận giữa các bên.

Chữ ký, con dấu

- LOI phải có chữ ký của người đại diện theo pháp luật của bên phát hành và bên thụ hưởng;

- Đóng dấu (nếu có) của các bên liên quan để đảm bảo tính pháp lý của văn bản.

Các điều kiện, điều khoản

- Nêu rõ các điều kiện tiên quyết để LOI có hiệu lực, ví dụ cung cấp các giấy tờ chứng minh thiệt hại, thời hạn thông báo khi xảy ra sự cố…;

- Liệt kê các trường hợp LOI bị vô hiệu hoặc bị hủy bỏ.

Cam kết bồi thường

- Khẳng định trách nhiệm bồi thường của bên phát hành LOI đối với bên thụ hưởng khi xảy ra các sự kiện đã được quy định rõ trong nội dung;

- Nêu rõ phương thức bồi thường (tiền mặt, chuyển khoản…) và thời hạn thanh toán.

Rủi ro trong LOI (Letter of Indemnity) là gì?

Rủi ro của Letter of indemnity là gì trong xuất nhập khẩu logistics? Đó là:

Rủi ro về pháp lý

Không phải lúc nào LOI cũng có giá trị pháp lý rõ ràng tại tất cả các quốc gia hoặc trong mọi hoàn cảnh. Nếu xảy ra tranh chấp, LOI có thể không được tòa án công nhận, dẫn đến khó khăn trong việc thực thi các quyền lợi bồi thường.

Rủi ro lừa đảo

Một số bên lạm dụng LOI để thực hiện các hành vi gian lận như phát hành Letter of Indemnity giả hoặc không có khả năng bồi thường, dẫn đến rủi ro cao cho các bên liên quan.

Thiếu sự rõ ràng trong các điều khoản

Nếu khi đàm phán thỏa thuận các điều khoản trong LOI (Letter of Indemnity) không cẩn thận, các điều khoản có thể không rõ ràng hoặc gây hiểu lầm, có thể dẫn đến tranh chấp giữa các bên liên quan khi có vấn đề phát sinh xảy ra.

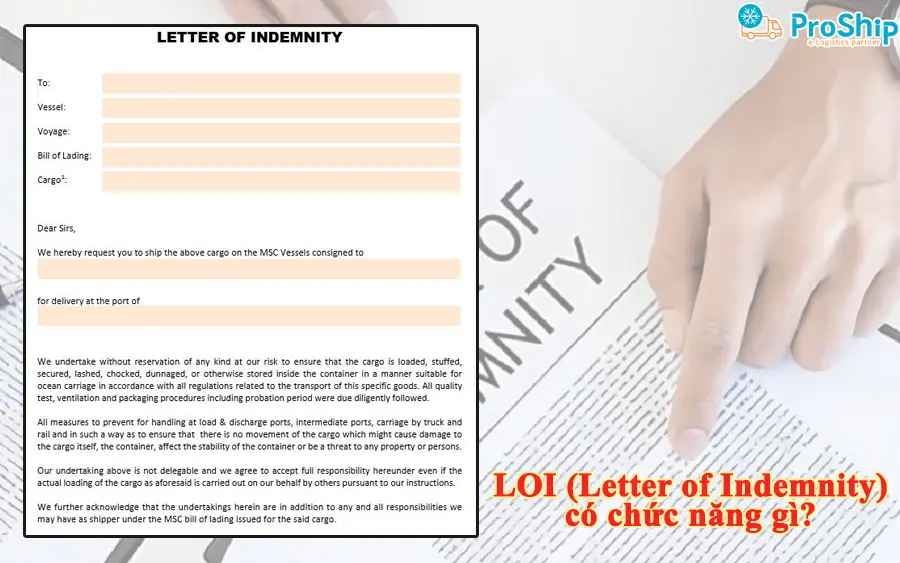

LOI (Letter of Indemnity) có chức năng gì?

Chức năng của letter of indemnity là gì? Letter of Indemnity (LOI) là một thư cam kết được sử dụng trong các giao dịch thương mại, đặc biệt là trong vận tải hàng hải. LOI có các chức năng:

Đảm bảo tuân thủ hợp đồng

LOI cung cấp một cơ chế pháp lý, các điều khoản bồi thường rõ ràng để đảm bảo các bên tuân thủ các điều khoản đã thỏa thuận trong hợp đồng.

Đảm bảo rủi ro tài chính

LOI (Letter of Indemnity) đảm bảo rằng bên A sẽ được bồi thường nếu có bất kỳ tổn thất nào phát sinh do việc giao hàng hoặc không thực hiện đúng các điều khoản như đã thỏa thuận ban đầu.

Tăng cường sự tin tưởng hợp tác giữa các bên

Letter of Indemnity giúp tăng cường sự cam kết về việc thực hiện đúng các điều khoản và điều kiện trong hợp đồng, xây dựng sự tin tưởng giữa các bên.

Giảm thiểu tranh chấp pháp lý

LOI (Letter of Indemnity) đóng vai trò như một thỏa thuận pháp lý đã được cam kết giữa các bên. Giúp giảm thiểu việc tranh chấp giữa các bên liên quan bằng cách xác định rõ trách nhiệm và các biện pháp bồi thường nếu vi phạm.

Proship Logistics chúng tôi đã làm rõ letter of indemnity là gì thông qua bài chia sẻ trên. Tóm lại, LOI không chỉ là công cụ pháp lý mà còn là cầu nối giữa các bên trong chuỗi cung ứng, giúp tăng cường sự minh bạch và tin cậy. Mọi thắc mắc về Dịch vụ vận chuyển hàng hóa, các hoạt động xuất nhập khẩu Đa phương thức, chứng từ, giấy tờ liên quan,…liên hệ ngay 0909 344 247 để được giải đáp.