x You are participating in international payment transactions and wishing to learn details about remittance methods?

X You want to know about the characteristics, the participants in the remittance trading, which and what are the obligations?

X and you have not grasped the remittance payment method?

Let Proship.vn find out what remittance is? How is Remittance playing an important role? Which subjects will participate in Remittance? From here, the parties involved in the money transfer transaction will understand what their obligations are.

Remittance in international payment: concepts and characteristics

Let's find out in international payment, what means and what is outstanding:

What does remittance mean?

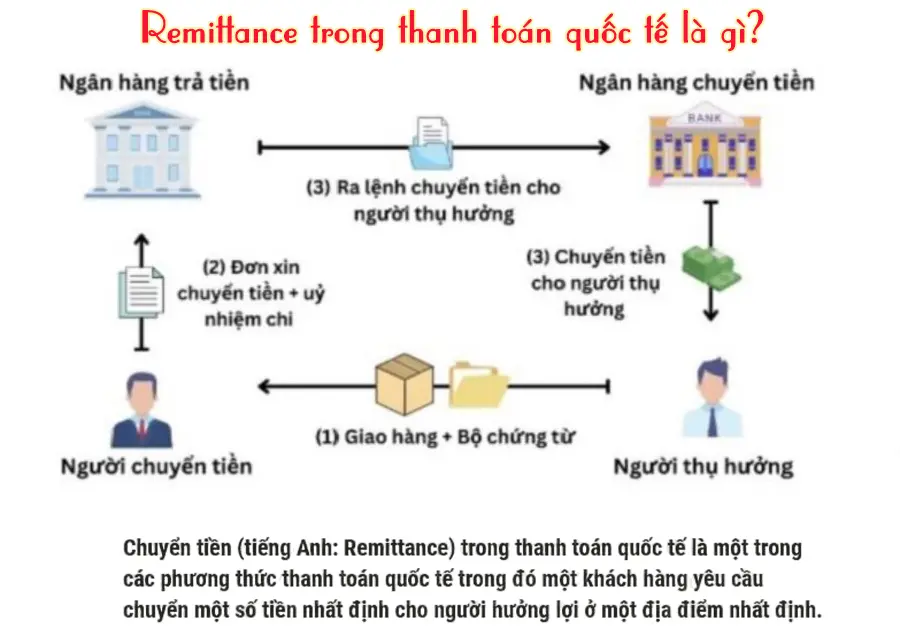

What is remittance? Remittance in international payment is money transfer. This is an international form of transfer, in which the sender asks the bank to serve him to transfer a certain amount to the recipient in another country at a certain location in a certain period of time, according to the instructions of some payment methods.

A complete Remittance is usually an end of one of the payment methods such as:

- Method of collection;

- Bank guarantee method;

- Book recording method;

- Buying letter;

- Backup credit;

- Credit vouchers.

It can be said that with flexibility and convenience, Remittance always plays a particularly important role in promoting global economic development and creating a powerful and stable international payment system.

Characteristics of Remittance

Remittance has a simple characteristic. The transferor and the recipient are the subject of direct payment. When transferring money by bank or post office, these units only play an intermediary in money transfer.

Money transfer units are not bound to any responsibility for the transferor and the recipient. Except for cases where these units converted the wrong money, the transfer information is different from the required money transferor information. At that time, the bank must be responsible for the corresponding compensation and transferred to the recipient.

The popular remittance money transfer methods today

What are the remittance methods? Based on the method of money transfer, there is the following method of money transfer:

Mail transfer (mail transfer)

Mail Transfer is a form of money transfer in which the bank's bankraft (Bank Draft) will be transferred by mail to the bank to pay.

Telegraphic transfer (telegraphic transfer)

Telegraphic Transfer is a form of money transfer in which the payment order of the transfer bank is executed in the content of a telegram deposited to the bank paying by telex or via SWIFT network. The use of Swift networks to increase security and safety for transactions.

With this method, the process is extremely fast, ensuring safety. But the disadvantage of this method is that the cost is higher than the money transfer by mail. Today, most money transfer operations are equal to electricity.

Who participates in the remittance money transfer process? What is Clean Collection and Remittance what is the same?

As above, you can imagine what the basic remittance is. It can be said that any form of money transfer will comply with the basic professional process.

Subjects involved in the money transfer process

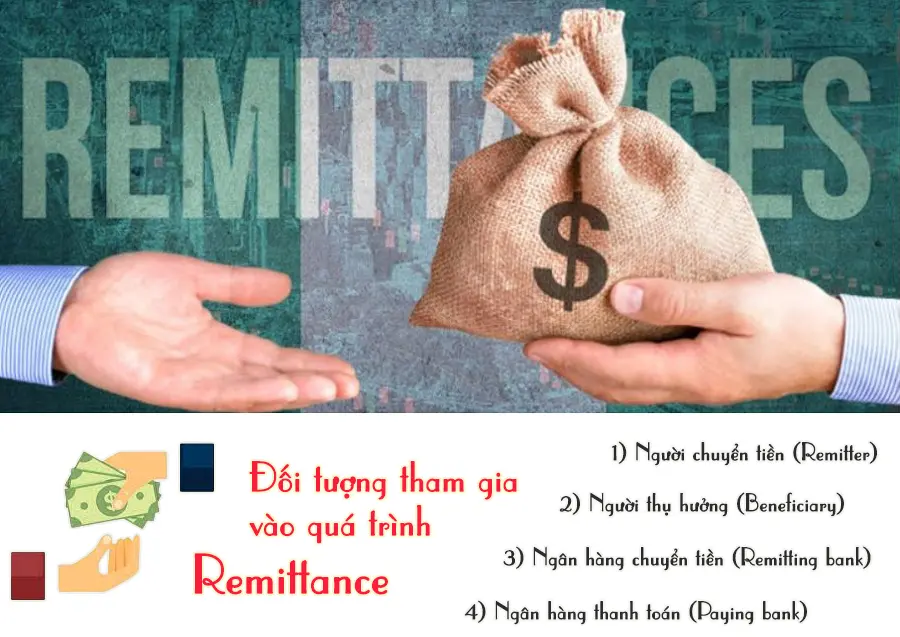

Participants in the remittance transfer process:

- Money transferor ( Remitter):

The person asking the bank to send money abroad (importer, debtor, investor, ...

- Beneficiarry:

The recipient is transferred to the bank (exporter, creditors, ...

- Remission Bank:

The bank shall transfer money at the request of the money transferor (the bank provides the service of the money transferor).

- Payment Bank (Paying Bank):

As a bank receiving money from foreign banks and paying the recipient at the request of the sender (usually the bank serves the recipient, holds the recipient's account).

Compare Clean Collection with Remittance

The similarity between Clean Collection and Remittance:

Both Clean Collection and Remittance methods, exporters also deliver goods and vouchers directly to the exporter.

The difference between Clean Collection and Remittance:

- Clean collection: Clean collection:

Exporters actively claim debt by bill according to the regulation of the bill of exchange. If the importer does not pay the goods, it is necessary to specify the reason. If the reason is unreasonable, it will lead to a lawsuit, so the pressure for the importer in payment in the collection will be higher than the money.

- In transfer (Remittance):

The importer actively pays for the goodwill of the importer whether they transfer money or not. If the product you receive is defective or missing, discount, ... In that case, the importer is more likely to delay or not pay for the goods.

The process of implementing the remittance money transfer process

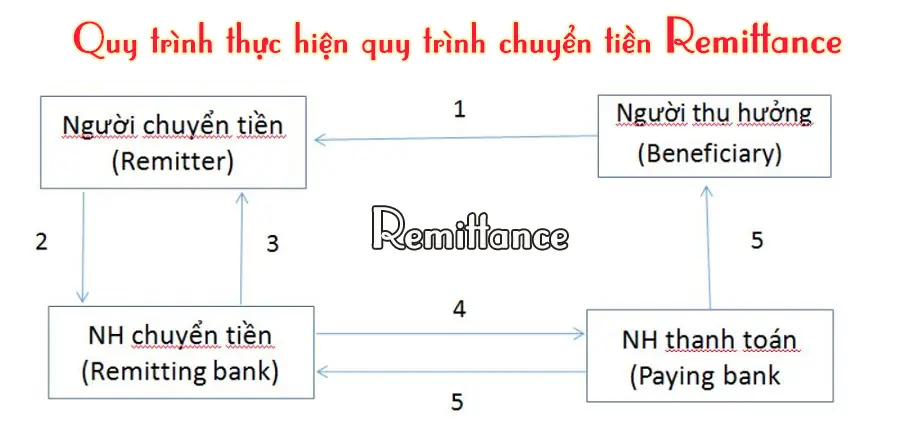

With a commercial transaction, the remittance process consists of the following 5 basic steps:

Step 1

Exporters deliver and provide the importer to fully invoice vouchers of the shipment.

Step 2

The importer conducts money transfer orders, authorizing a bank to transfer money. Cash is extracted from the transfer account or cash transferor to the bank to perform the transaction.

Step 3

The bank checks the money transfer information. If the information is valid or sufficient, the money transfer, send the money transfer certificate to the importer.

Step 4

The bank transfers money to execute the order by mail or by electricity to the beneficiary bank, transferring money to the beneficiary.

Step 5

The bank receives money to record in the beneficiary account. At the same time, will send money to receive money to beneficiaries.

Above are the answers to questions about remittance and characteristics, roles, remittance methods that are popular that participants in the transition process such as transfers, beneficiaries, money transfer banks, payment banks should be updated immediately to apply effectively to international payment transactions.

Any questions about the solutions to transport goods to international quickly, safely, cost savings, contact immediately 0909 344 247 for advice from Proship Logistics and service quotes directly.