x Importing and importing enterprises as declarations and procedures for KBHQ want to learn about electronic customs declarations is the type of declaration like?

x You want to know what the content on the electronic declaration includes? What types of online customs declarations are the most common?

x You are interested and want to find out whether the electronic customs declaration is interested and inadequate?

If your owners and import -export enterprises are interested and ask as above. Let's explore with the customs agent Proship.vn , find out what the electronic customs declaration is? What is the content on the electronic declaration? How is online electronic customs declaration process?, ... through the content of the following sharing.

What is electronic customs declaration? When is the Customs Application Deadline?

What is the concept of electronic customs declaration and the customs declarants must submit relevant documents when the following content is answered:

What is electronic customs declaration?

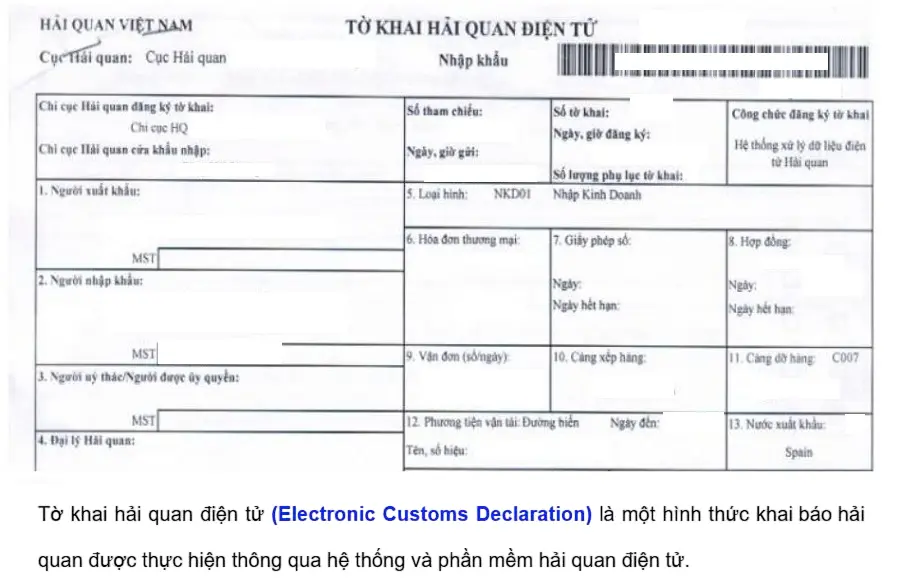

Electronic Customs Declaration is a form of customs declaration made through electronic customs systems and software.

Instead of declaring on paper, the person who declared the software to fill out the information about the goods and the data transfer of this declaration to the customs office for customs clearance.

When did the KBHQ have to submit relevant vouchers of the customs dossier?

Pursuant to Article 25 of the 2014 Customs Law as follows:

Deadline for customs submission

1. The deadline for submission of customs declarations is prescribed as follows:

a) For goods exported, submitted after gathering goods at the location of the customs declarator informed and at least 04 hours before the means of transport exit; For exported goods sent by courier service, the latest at least 2 hours before the means of transportation;

b) For goods imported, submitted before the day of goods to the border gate or within 30 days from the date of goods to the border gate;

c) The time limit for submitting customs declarations for means of transport shall comply with the provisions of Clause 2, Article 69 of this Law.

2. Customs declarations are valid for customs procedures within 15 days from the date of registration.

3.

a) In case of electronic customs declaration, when the customs office conducts the customs dossier inspection, the actual inspection of goods, the customs declarants submit paper documents of the customs dossier, except for the documents already in the national one -door information system;

b) In case of declaration of paper customs declarations, customs declarants must submit or present relevant documents when registering customs declarations.

Assess the advantages and disadvantages when declaring electronic customs

Advantages and disadvantages when electronic customs declarations are? That is:

Advantages when electronic customs declaration

Advantages of electronic customs declaration:

- Shorten the time of customs clearance, from data transmission, information receiving information and division of declarations, steps are automatically taken;

- Saving travel costs, saving working time for customs and import -export enterprises;

- Businesses do not need to go to the customs office, just a computer connected to the Internet, can sit anywhere to complete the declaration.

Disadvantages when electronic customs declaration

The electronic customs declaration still has a few disadvantages:

- Hardware errors affect the declaration process;

- Software errors may occur in several cases;

- The wrong enterprise is very difficult to edit halfway but have to wait until the last minute and time -consuming;

- Disadvantages for the State in tax control (there are many cases where businesses take advantage of electronic customs to escape tax obligations).

Content and types of electronic customs declaration

The following content discusses what electronic customs declaration is, including what and how many types of electronic customs declaration:

Basic content of the customs declaration

On electronic customs declarations, including the following:

- Part 1: Number of declarations, classification codes, type codes, branch codes, date of registration of declaration;

- Part 2: Name and address of the exporter and import;

- Part 3: Detailed information of shipments such as bill, location of storage, loading and unloading locations, transportation means, date of departure, quantity of goods, ...;

- Part 4: Commercial invoice, invoice value ...;

- Part 5: Tax and iron tax this part after entering the details of items, the system automatically exports;

- Part 6: The part for the customs system returns;

- Part 7: The notes on the customs declaration;

- Part 8: List of goods.

Types of electronic customs declaration

Types of electronic customs declarations include:

- Imported and exported goods to perform processing contracts with foreign traders or processing abroad;

- Goods brought or brought to export processing enterprises and priority enterprises;

- Imported and exported goods according to the type of goods trading;

- Import and export goods according to the type of imported materials to produce exports;

- Goods brought/offered bonded warehouses;

- Import -export goods to implement investment projects;

- Goods business by temporary import for re -export;

- Import and export goods on the spot;

- Import and export goods, transfer border gates;

- Goods have been exported but returned;

- Goods have been imported but must be paid.

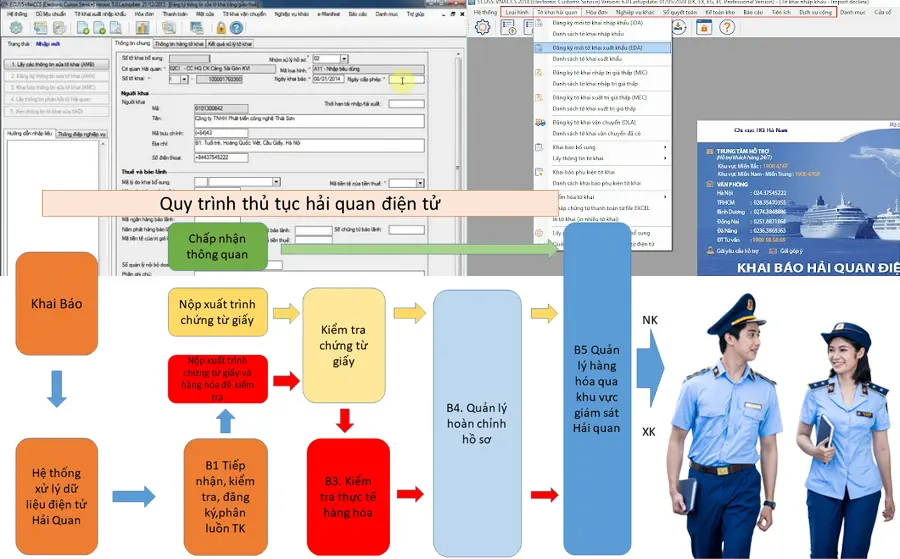

How is electronic customs declaration process?

Besides understanding whatever electronic customs declaration, it is necessary to grasp the electronic processing process including the following steps:

Step 1

Export information (EDA). The declaration must declare the necessary export information by the EDA professional before registering the export declaration. After the system has received and granted numbers, the information of the export export version will be stored on the VNACCS system.

Step 2

Register for export declarations. After receiving the EDC declaration registration screen, the declarator needs to check the reported information. If it is accurate and sure, send it to the system to register for the declaration. If errors, must be modified using EDB.

Step 3

Check the conditions for registration of the declaration.

Step 4

Dividing, checking and clearing shipments. The system will automatically divide the declarations into green, red and red. Depending on the case, the declarator will have specific instructions on how to perform the test and process later.

Step 5

Revise and supplement in customs clearance.

What is the electronic customs declaration and how the electronic customs declaration process is carried out, the advantages and disadvantages when the online KBHQ is, ... has been answered by Proship Logistics above. Any questions, please contact 0909 344 247 for advice and quotation of customs declaration services, customs declaration services, and the best cheap import and export service package only available at Proship Logistics.