x Doanh nghiệp bạn có những lô hàng, kiện hàng nhập khẩu bắt buộc phải thực hiện khai tờ khai trị giá hải quan theo quy định?

x Bạn muốn biết cách xác định trị giá hải quan hàng xuất, hàng nhập?

x Bạn cần biết căn cứ nào để xác định, kiểm tra chuẩn xác trị giá hải quan? Dựa trên cơ sở dữ liệu nào?

Proship.vn chúng tôi sẽ tổng hợp kiến thức liên quan về trị giá hải quan là gì? Có hay không phương pháp xác định trị giá hải quan? Đối tượng khai tờ khai trị giá hải quan gồm những ai? Trường hợp khai báo sai trị giá hải quan có bị phạt không và mức phạt bao nhiêu?…sẽ được làm rõ sau đây.

Trị giá hải quan: Định nghĩa, đối tượng khai tờ khai

Hiểu đúng về trị giá hải quan

Trị giá hải quan là gì? Trị giá hải quan được quy định theo Điều 86 Luật Hải quan 2014:

- Trị giá sử dụng để làm căn cứ tính thuế xuất, nhập hàng hóa và hỗ trợ việc thống kê hàng hóa hải quan về sau;

- Trị giá HQ dành cho các mặt hàng XK thì giá bán sẽ tính đến cửa khẩu xuất (chưa tính phần: phí bảo hiểm và phí vận chuyển hàng quốc tế);

- Trị giá HQ mặt hàng nhập khẩu là giá thực DN phải trả tính đến cửa khẩu nhập đầu tiên, căn cứ Pháp luật Việt Nam và điều ước Quốc tế mà nước ta là thành viên.

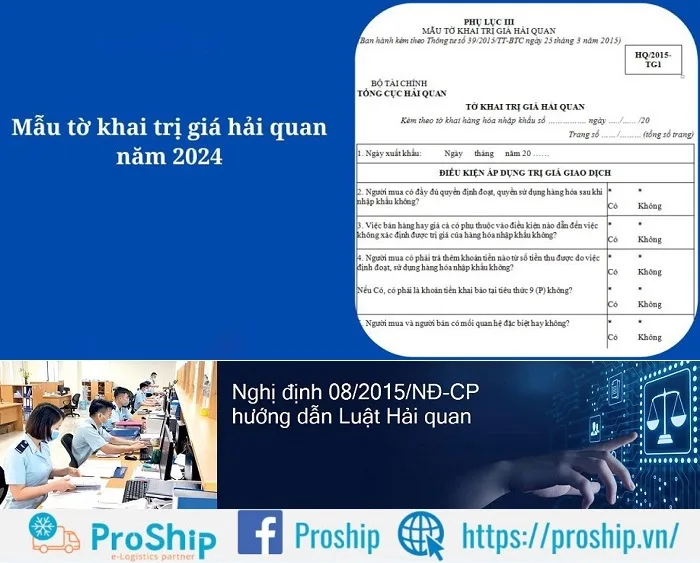

Đối tượng khai tờ khai trị giá hải quan

Theo Điều 18 Thông tư 39/2015/TT-BTC, hàng hóa nhập khẩu phải khai trị giá hải quan trên tờ khai trị giá HQ, ngoại trừ:

- Hàng hóa thuộc đối tượng không chịu thuế, miễn thuế, xét miễn thuế theo quy định tại Luật Thuế xuất khẩu, thuế nhập khẩu;

- Hàng hóa NK theo loại hình nhập nguyên liệu để sản xuất hàng XK;

- Hàng hóa nhập khẩu không có hợp đồng mua bán hoặc không có hóa đơn thương mại;

- Hàng hóa đủ điều kiện áp dụng phương pháp trị giá giao dịch quy định tại khoản 3 Điều 6 Thông tư 39/2015/TT-BTC, đồng thời đã khai đủ thông tin trị giá HQ trên tờ khai hàng nhập khẩu của Hệ thống thông quan điện tử VNACCS và Hệ thống này tự động tính trị giá hải quan.

Cách xác định trị giá hải quan hàng xuất, nhập chuẩn nhất

Cách xác định trị giá hải quan hàng xuất khẩu

Giá bán hàng hóa được xác định trên hợp đồng, hóa đơn thương mại và các tài liệu liên quan tính tới cửa khẩu xuất đầu tiên.

Nếu không thể xác định được trị giá để tính thuế xuất khẩu sẽ kiểm tra dữ liệu hải quan cùng thời điểm và lấy trị giá thấp nhất từ hai trị giá hàng xuất khẩu giống nhau hoặc tương tự để áp dụng làm trị giá tính thuế xuất khẩu.

Cách xác định trị giá hải quan hàng nhập khẩu

Phương pháp xác định trị giá tính thuế nhập khẩu là áp dụng sáu phương pháp tuần tự, dừng lại ở phương pháp xác định được trị giá hải quan, tính đến giá thực tế phải trả tới cửa khẩu nhập đầu tiên.

>>Xem thêm: In mã vạch hải quan là gì?

Khai sai trị giá hải quan có bị phạt không?

Căn cứ Điều 8 Nghị định 128/2020/NĐ-CP có quy định về việc xử phạt vi phạm hành chính trong lĩnh vực hải quan. Vậy, nếu khai sai trị giá hải quan, cá nhân, Doanh nghiệp sẽ bị xử phạt vi phạm hành chính như sau:

1. Phạt tiền từ 1.000.000 – 2.000.000 đồng với một trong các hành vi sau:

- Khai sai thực tế về lượng (tang vật có trị giá trên 10.000.000 đồng), tên hàng, chủng loại, xuất xứ hàng hóa là hàng viện trợ nhân đạo, viện trợ không hoàn lại đã được cấp có thẩm quyền phê duyệt;

- Khai sai thực tế về lượng (tang vật có trị giá trên 10.000.000 đồng), tên hàng, chủng loại, chất lượng, trị giá hải quan, xuất xứ, mã số hàng hóa nhập khẩu thuộc đối tượng chịu thuế nhưng không làm ảnh hưởng đến số thuế phải nộp; trừ trường hợp quy định tại điểm a khoản 1, khoản 2 Điều này;

- Không khai trên tờ khai hải quan mối quan hệ đặc biệt giữa người mua và người bán theo quy định của pháp luật hải quan mà không ảnh hưởng đến trị giá hải quan.

2. Phạt tiền từ 2.000.000 – 4.000.000 đồng với hành vi khai sai so với thực tế về lượng (tang vật có trị giá trên 10.000.000 đồng), tên hàng, chủng loại, chất lượng, trị giá hải quan, xuất xứ hàng hóa và thuộc một trong các trường hợp sau:

- Hàng hóa quá cảnh, chuyển khẩu, hàng hóa trung chuyển;

- Hàng hóa sử dụng, tiêu hủy trong khu phi thuế quan.

3. Phạt tiền từ 3.000.000 – 5.000.000 đồng với hành vi khai sai so với thực tế về lượng (tang vật có trị giá trên 10.000.000 đồng), tên hàng, chủng loại, chất lượng, trị giá hải quan, xuất xứ hàng hóa xuất khẩu, nhập khẩu thuộc đối tượng miễn thuế, đối tượng không chịu thuế theo quy định của pháp luật, trừ trường hợp quy định tại điểm a khoản 1 và điểm d khoản 4 Điều này.

4. Phạt tiền từ 5.000.000 – 10.000.000 đồng với một trong các hành vi:

- Khai sai số lượng vận đơn chủ, vận đơn thứ cấp trên bản khai hàng hóa của hồ sơ phương tiện vận tải xuất cảnh, nhập cảnh, quá cảnh;

- Khai sai số lượng hành khách trên danh sách hành khách của hồ sơ phương tiện vận tải xuất cảnh, nhập cảnh, quá cảnh;

- Khai sai số lượng kiện hành lý trên bản khai hành lý của hồ sơ phương tiện vận tải xuất cảnh, nhập cảnh, quá cảnh;

- Khai sai thực tế về lượng (tang vật có trị giá trên 10.000.000 đồng), tên hàng, chủng loại, xuất xứ hàng hóa đưa vào kho ngoại quan, kho bảo thuế; hàng hóa từ kho ngoại quan, kho bảo thuế đưa ra nước ngoài.

Câu hỏi thường gặp nhất về trị giá hải quan

Căn cứ kiểm tra, xác định trị giá hải quan là gì?

Căn cứ để kiểm tra, xác định giá hải quan quy định và ban hành tại Khoản 1 Điều 21 Nghị định 08/2015/NĐ-CP. Việc kiểm tra, xác định giá trị hải quan căn cứ theo:

- Chứng từ, các tài liệu liên quan đến hàng hóa;

- Hồ sơ hải quan lô hàng;

- Thực tế lô hàng.

Cơ sở dữ liệu trị giá hải quan là gì?

Cơ sở dữ liệu trị giá hải quan là thông tin có liên quan đến việc xác định trị giá hải quan của những mặt hàng xuất – nhập ở nước ta. Cơ sở dữ liệu này do Cơ quan hải quan thu thập, phân loại, tổng hợp theo tiêu chí chung và quy định của Bộ Tài chính.

Tổng cục Hải quan là đơn vị xây dựng tập trung thống nhất các dữ liệu của trị giá hải quan và thường xuyên cập nhật theo từng thời điểm. Cơ sở dữ liệu trị giá HQ thể hiện được những rủi ro về trị giá hàng hóa trong ngành XNK của cả nước.

Trị giá hải quan là gì, các đối tượng bắt buộc khai tờ khai trị giá hải quan, cách xác định chuẩn xác trị giá hải quan cùng căn cứ kiểm tra và xác định trị giá hải quan,…đã được làm rõ. Quý doanh nghiệp quan tâm nên lưu lại bài chia sẻ để phục vụ hiệu quả cho hoạt động XNK. Và nếu có nhu cầu sử dụng các dịch vụ vận tải giá rẻ tại Proship Logistics, liên hệ ngay 0909 344 247.