x Do foreign businesses have plans to invest and do trade in Vietnam?

x You do not have much experience in preparing documents for on-site export procedures?

x Private individuals and businesses investing in Vietnam want to know the regulations and legal basis for on-site export procedures?

So, Proship.vn we will help you understand clearly what the concept of on-site export is, what benefits does on-site export bring, is the process of implementing on-site export complicated,... and other ideas. Related information for foreign traders to understand.

What is on-site export, and what products does it include?

On-site export concept

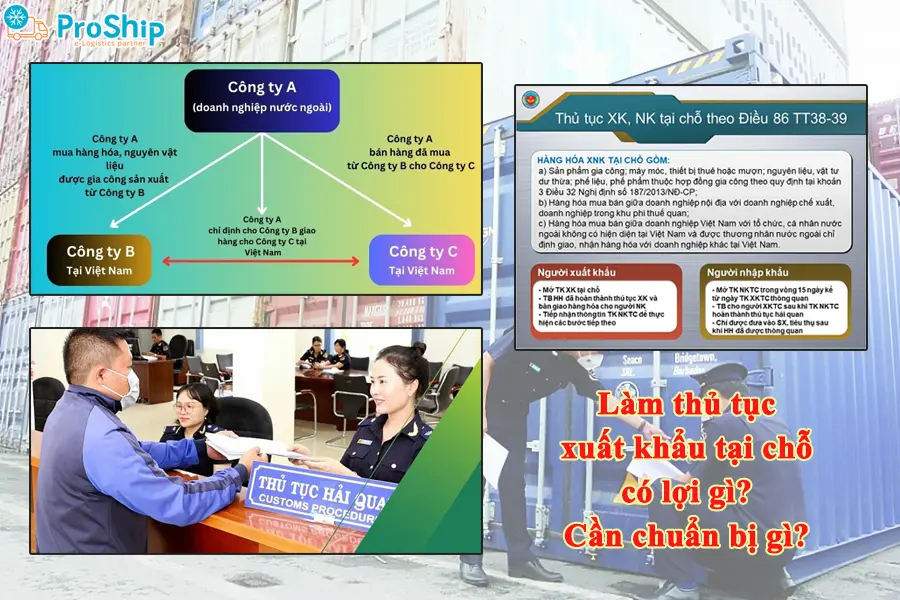

What is local export? On-site export is the case where goods are produced for export to a foreign trader, but the goods will be delivered in Vietnam to a unit designated by the foreign trader. Export enterprises include domestic enterprises and foreign-invested enterprises.

On-site export products

Pursuant to Clause 1, Article 86 of Circular No. 38/2015/TT-BTC stipulates that on-site import and export goods include the following 3 groups:

- Group 1:

Processed products; borrowed or rented machinery and equipment; Excess raw materials, supplies and scraps and waste products under processing contracts according to the provisions of Clause 3, Article 32 of Decree No. 187/2013/ND-CP.

- Group 2:

Goods are traded between domestic enterprises and export processing enterprises or enterprises in non-tariff zones.

- Group 3:

Goods are traded between Vietnamese enterprises and foreign organizations and individuals (not present in Vietnam) that are designated by this foreign trader to deliver or receive goods with another enterprise in Vietnam.

What benefits does on-site export bring? What to prepare?

What are the benefits of on-site exporting? Below are the answers and types of documents that need to be prepared:

Benefits when exporting locally

Besides traditional forms of export, on-site export is the choice of many Vietnamese businesses. This on-site form not only helps businesses save costs and time but also enjoy many export tax incentives.

Legal basis of on-site export procedures

Carry out on-site export procedures based on the following legal bases:

- Customs Law No. 54/2014/QH13 dated June 23, 2014;

- Clause 8, Article 25, Decree No. 08/2015/ND-CP dated January 21, 2015 of the Government detailing and implementing measures of the Customs Law on customs procedures, inspection, supervision and control ;

- Circular No. 38/2015/TT-BTC dated March 25, 2015 regulating customs procedures; customs inspection and supervision; export tax, import tax and tax management on import and export goods.

Customs documents and on-site export procedures

According to Article 16, Clause 3, Article 86 of Circular 38/2015/TT-BTC and Clause 58, Article 1 of Circular 39/2018/TT-BTC, on-site export customs documents include the following documents:

- Customs declaration of exported goods;

- Sales contract

- Commercial invoice;

- Export license;

- Notice of exemption from inspection or notice of specialized inspection results or other documents according to the provisions of law on management and specialized inspection (hereinafter referred to as Certificate of specialized inspection);

- Documents proving that organizations and individuals are eligible to export goods according to the provisions of law on investment;

- Entrustment contract;

- Other relevant documents (depending on each specific case),...

Time limit for on-site export procedures

According to Clause 4, Article 86 of Circular 38/2015/TT-BTC (amended in Clause 58, Article 1 of Circular 39/2018/TT-BTC), the time limit for customs procedures is 15 working days from the date of receipt. Customs clearance of exported goods, on-site importers must complete customs procedures.

Steps to carry out on-site export procedures

What is the concept of on-site export has been answered above. The following is the process of on-site export procedures:

Step 1: Enterprise exports KBHQ

Based on the contract signed with a foreign trader specifying delivery in Vietnam, the exporting enterprise must fully declare the corresponding criteria for the exporting enterprise on the declaration.

Step 2: Importing enterprises carry out on-site import procedures

Go to the Customs Branch where the enterprise carries out procedures to register for on-site import procedures appropriate for the type of import and export when receiving enough goods.

Step 3: Customs Department carries out import procedures

Continue to complete the stages including: submitting declarations, calculating taxes, sealing samples (if any), confirming procedures, handing over to businesses and storing records, and notifying the local Tax Department where Keep track of your business's taxes.

Step 4: Export enterprise

At this time, the exporting enterprise must receive the completed documents and transfer them to the Customs Branch where the export procedures are carried out to register for on-site export procedures.

Step 5: Customs Department carries out export procedures

The Customs Branch will receive customs declarations and other documents in on-site export documents. Then, continue to proceed with the steps to register the declaration according to regulations, suitable for each type of export, import, tax and fee (if any).

Proship Logistics has clarified what the definition of on-site export is ; procedures and procedures; What are the benefits of on-the-spot exporting of goods, etc. Based on this, foreign traders planning to invest and do business in Vietnam can refer to this to know whether on-the-spot exporting really works. complicated or not. If you have any questions, contact 0909 344 247 for answers.