x Các tư nhân, DN mới tham gia vào quá trình sản xuất – kinh doanh, phân phối hàng hóa chưa rành về hóa đơn giá trị gia tăng là gì? Quy định ra sao?

x Bạn muốn biết về nội dung cần có trên hóa đơn giá trị gia tăng cũng như thời điểm nên lập hóa đơn, các hình thức thông dụng của hóa đơn GTGT?

x Bạn thắc mắc giữa Hóa đơn bán hàng với Hóa đơn giá trị gia tăng có giống nhau không? Làm cách nào để phân biệt đúng hai loại hóa đơn này?

Hóa đơn giá trị gia tăng là phương tiện gián tiếp hỗ trợ Nhà nước quản lý hoạt động kinh doanh, từ đó tính thuế thu hàng năm. Trong khuôn khổ bài viết này, PROSHIP.VN sẽ giải đáp hóa đơn giá trị gia tăng là gì cùng những quy định liên quan tới hóa đơn GTGT dùng trong mỗi Doanh nghiệp. Theo đó, nếu đơn vị nào chưa có nhiều kinh nghiệm, kỹ năng lập hóa đơn GTGT nên tham khảo, áp dụng sao cho chuẩn xác và tuân thủ đúng thời hạn lập hóa đơn.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Hóa đơn giá trị gia tăng: Khái niệm, nội dung, các hình thức và thời điểm lập hóa đơn

Hóa đơn giá trị gia tăng là gì?

Hóa đơn giá trị gia tăng là loại hóa đơn quen thuộc đối với mỗi Doanh nghiệp, Công ty, đây cũng là loại hóa đơn cần thiết và quan trọng. Hóa đơn giá trị gia tăng (hay được gọi phổ biến bằng cái tên“Hóa đơn đỏ”) thực chất là một loại chứng từ do người bán lập, ghi nhận thông tin bán hàng hóa, cung ứng dịch vụ cho bên mua, sử dụng dịch vụ theo quy định của pháp luật. Hành động này thường được nhắc đến bằng cụm từ “xuất hóa đơn”.

* Lưu ý: Khi nhắc đến hóa đơn giá trị gia tăng chúng ta sẽ thường nghĩ hay tới hóa đơn đỏ nhưng bản chất đây không phải là một loại hóa đơn. Bởi lẽ gọi hóa đơn đỏ là vì màu sắc của loại hóa đơn. Hóa đơn bán hàng trực tiếp cũng có màu đỏ (hồng) như vậy.

Nội dung cần có trên hóa đơn GTGT

Các nội dung bắt buộc trên hóa đơn giá trị gia tăng:

- Tên hóa đơn;

- Tên liên hóa đơn;

- Tên, địa chỉ, mã số thuế của người bán;

- Tên, địa chỉ, mã số thuế của người mua;

- Tên hàng hóa, dịch vụ; đơn vị tính; số lượng; đơn giá hàng hóa, dịch vụ; thành tiền ghi bằng số và bằng chữ;

- Số thứ tự hóa đơn;

- Ký hiệu mẫu số hóa đơn và ký hiệu hóa đơn;

- Người mua, người bán ký và ghi rõ họ tên, dấu người bán (nếu có) và ngày, tháng, năm lập hóa đơn;

- Hình thức thể hiện trên hóa đơn.

Các hình thức của hóa đơn GTGT

Loại hóa này theo mẫu do Bộ tài chính ban hành và hướng dẫn thực hiện, áp dụng cho các tổ chức cá nhân kê khai và tính thuế theo phương pháp khấu trừ. Hóa đơn giá trị gia tăng được thể hiện qua rất nhiều hình thức như:

- Loại hóa đơn điện tử: Hình thức của hóa đơn này chính là tập hợp các thông điệp dữ liệu điện tử về bán hàng hóa và cung ứng dịch vụ. Họa đơn điện tử được tạo, lập và gửi nhận, quản lý theo đúng quy định tại Luật Giao dịch điện tử và các văn bản hướng dẫn thi hành;

- Loại hóa đơn tự in: Hình thức này sẽ do các công ty, tổ chức tự in trên các thiết bị máy tính, tin học,…;

- Loại hóa đơn in: Là hình thức hóa đơn được các công ty, tổ chức đặt in để sử dụng. Hoặc do cơ quan thuế in theo mẫu và cấp cho các công ty, tổ chức kinh doanh.

Thời điểm lập hóa đơn giá trị gia tăng

Theo quy định tại Điều 9 Nghị định 123/2020/NĐ-CP, thời điểm lập hóa đơn giá trị gia tăng được xác định như sau:

- Thời điểm lập hóa đơn đối với bán hàng hóa (bao gồm cả bán tài sản nhà nước, tài sản tịch thu, sung quỹ nhà nước và bán hàng dự trữ quốc gia) là thời điểm chuyển giao quyền sở hữu hoặc quyền sử dụng hàng hóa cho người mua, không phân biệt đã thu được tiền hay chưa thu được tiền;

- Thời điểm lập hóa đơn đối với cung cấp dịch vụ là thời điểm hoàn thành việc cung cấp dịch vụ không phân biệt đã thu được tiền hay chưa thu được tiền. Trường hợp người cung cấp dịch vụ có thu tiền trước hoặc trong khi cung cấp dịch vụ thì thời điểm lập hóa đơn là thời điểm thu tiền (không bao gồm trường hợp thu tiền đặt cọc hoặc tạm ứng để đảm bảo thực hiện hợp đồng cung cấp các dịch vụ: kế toán, kiểm toán, tư vấn tài chính, thuế; thẩm định giá; khảo sát, thiết kế kỹ thuật; tư vấn giám sát; lập dự án đầu tư xây dựng);

- Trường hợp giao hàng nhiều lần hoặc bàn giao từng hạng mục, công đoạn dịch vụ thì mỗi lần giao hàng hoặc bàn giao đều phải lập hóa đơn cho khối lượng, giá trị hàng hóa, dịch vụ được giao tương ứng.

>>Xem thêm: Commodity Market là gì?

Những quy định của hóa đơn giá trị gia tăng và lưu ý khi lập hóa đơn

Quy định của hóa đơn giá trị gia tăng GTGT

Hóa đơn giá trị gia tăng là một loại hóa đơn vẫn được áp dụng hiện nay. Trong quá trình lập và sử dụng hóa đơn này vẫn có thể phát sinh nhiều lỗi sai sót. Hóa đơn GTGT còn có một số quy định sau:

- Các nội dung buộc phải có trên hóa đơn GTGT:

Theo quy định, trên hóa đơn giá trị gia tăng cần phải có các thông tin như tên, địa chỉ cùng mã số thuế của người bán, người mua. Đồng thời cần kèm thêm các thông tin như danh mục hàng hóa dịch vụ, giá trị tính thuế GTGT, ngày thực hiện giao dịch, tổng giá trị của hàng hóa dịch vụ và giá trị thuế GTGT, thuế suất GTGT. Hóa đơn giá trị gia tăng có những thông tin này vì hóa đơn có giá trị về pháp lý. Đồng thời đây cũng là căn cứ để khấu trừ thuế.

- Báo cáo về việc sử dụng hóa đơn GTGT:

Theo quy định, hàng quý, các tổ chức hoặc cá nhân bán hàng cần phải có trách nhiệm nộp báo cáo việc sử dụng hóa đơn giá trị gia tăng cho các cơ quan thuế. Trừ các đối tượng được cơ quan thuế cấp hóa đơn thì không cần nộp.

Đối với Công ty, Doanh nghiệp vừa thành lập, các doanh nghiệp nếu có các hành vi vi phạm thì không được sử dụng hóa đơn tự in. Các doanh nghiệp nếu thuộc loại rủi ro cao về thuế thuộc diện mua hóa đơn của cơ quan thuế theo hướng dẫn tại Điều 11 Thông tư số 39/2014/TT-BTC thực hiện nộp Báo cáo tình hình sử dụng hóa đơn theo tháng. Nếu công ty đã nộp báo cáo việc sử dụng hóa đơn giá trị gia tăng theo tháng thì không cần nộp báo cáo theo quý. Nếu công ty doanh nghiệp sử dụng hai loại hóa đơn trong cùng một kỳ thì trong lúc báo cáo sẽ làm trên cùng một báo cáo.

Đối với các loại hóa đơn thu cước như hóa đơn tiền điện, tiền nước, thu cước dịch vụ viễn thông, hóa đơn thu phí dịch vụ của các ngân hàng, vé vận tải hành khách của các đơn vị vận tải, các loại tem, vé, thẻ và một số trường hợp khác theo hướng dẫn của Bộ Tài chính không phải báo cáo đến từng số hóa đơn mà báo cáo theo số lượng (tổng số) hóa đơn theo mẫu 3.9 Phụ lục 3 ban hành kèm theo Thông tư số 39/2014/TT-BTC; trong đó không cần điền dữ liệu vào các cột chi tiết từ số đến số, chỉ điền dữ liệu vào các cột số lượng hóa đơn.

Những lưu ý khi lập hóa đơn giá trị gia tăng

Dưới đây là những điều cần lưu ý khi lập hóa đơn giá trị gia tăng:

- Để đảm bảo ý nghĩa hóa đơn GTGT, các tổ chức cung cấp dịch vụ có thể phát hành hóa đơn không nhất thiết phải đầy đủ chữ ký, dấu đỏ của người cung cấp hay người mua dịch vụ, hàng hóa nếu đó là các loại hóa đơn điện, nước, dịch vụ viễn thông hay các loại dịch vụ ngân hàng đáp ứng điều kiện;

- Những đơn vị như siêu thị, trung tâm thương mại được thành lập bởi quy định pháp luật không nhất thiết phải cung cấp hóa đơn giá trị gia tăng nếu không được yêu cầu bởi người mua là các đơn vị kế toán;

- Chỉ xuất hóa đơn ngay tại thời gian diễn ra giao dịch và đảm bảo chính xác tuyệt đối nội dung giao dịch. Tránh tuyệt đối việc thất lạc hay đánh mất hóa đơn giá trị gia tăng. Các đơn vị có thể chuyển đổi việc xuất hóa đơn giấy sang hóa đơn điện tử để đảm bảo tính an toàn và bảo mật tốt hơn;

- Chỉ xuất hóa đơn với những mặt hàng kinh doanh đã được đăng ký kinh doanh theo quy định. Đảm bảo ghi chính xác tuyệt đối mức thuế suất áp dụng theo quy định với những dịch vụ, hàng hóa được bán ra.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

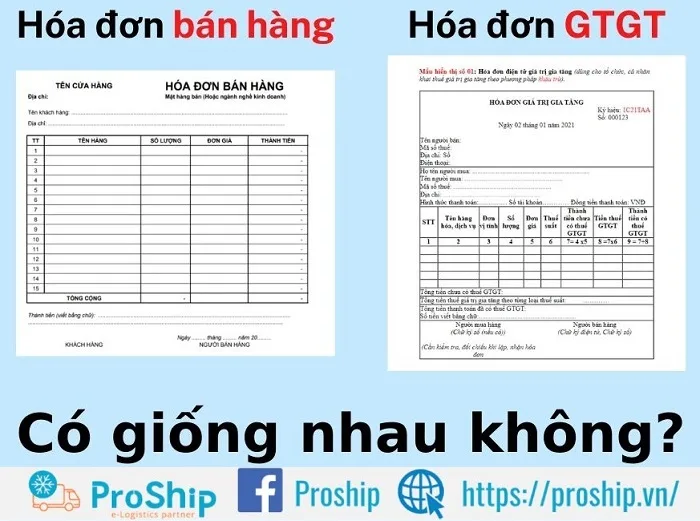

Hóa đơn bán hàng và hóa đơn giá trị gia tăng có giống nhau không?

Hóa đơn giá trị gia tăng là gì và những quy định cần biết khi lập hóa đơn này đã được Proship chia sẻ. Tiếp theo là giải đáp thắc mắc về sự khác nhau giữa Hóa đơn bán hàng và hóa đơn GTGT. Hai loại hóa đơn này đều phổ biến trong doanh nghiệp nhưng không giống nhau. Hóa đơn bán hàng và hóa đơn GTGT đều lập sau khi DN bán và xuất hàng. Việc phân biệt chúng rất quan trọng với kế toán để công tác kê khai, hoạch toán cho DN đạt hiệu quả.

Dưới đây là cách phân biệt hóa đơn bán hàng và hóa đơn GTGT. Không chỉ khác nhau về mẫu hóa đơn giá trị gia tăng và hóa đơn bán hàng mà còn:

- Về đối tượng lập hóa đơn:

| Hóa đơn bán hàng | Doanh nghiệp khai, tính thuế giá trị gia tăng theo phương pháp trực tiếp trong các hoạt động sau:

|

| Hóa đơn giá trị gia tăng | Các doanh nghiệp khai, tính thuế giá trị gia tăng theo phương pháp khấu trừ trong các hoạt động sau:

|

- Về đối tượng phát hành hóa đơn:

| Hóa đơn bán hàng | Doanh nghiệp/ tổ chức phải lên cơ quan thuế để mua |

| Hóa đơn giá trị gia tăng | Doanh nghiệp/ tổ chức có thể tự tin, hóa đơn điện tử, hóa đơn đặt in |

- Về thuế suất hóa đơn:

| Hóa đơn bán hàng | Không có dòng thuế xuất và tiền thuế thể hiện đầy đủ trên hóa đơn. |

| Hóa đơn giá trị gia tăng | Có dòng thuế và tiền thuế thể hiện đầy đủ trên hóa đơn. |

- Về hình thức kê khai hóa đơn:

| Hóa đơn bán hàng | Kê khai hóa đơn đầu ra, không kê khai hóa đơn đầu vào |

| Hóa đơn giá trị gia tăng | Phải kê khai cả hóa đơn đầu ra và hóa đơn đầu vào đủ điều kiện khấu trừ. |

- Về chữ ký trên hóa đơn:

| Hóa đơn bán hàng | Chỉ có chữ ký của người bán hàng hóa |

| Hóa đơn giá trị gia tăng | Bao gồm cả chữ ký của người bán và chữ ký của giám đốc hoặc người được giám đốc ủy quyền. |

- Về thuế thu nhập doanh nghiệp:

Hóa đơn bán hàng hay hóa đơn GTGT nếu hợp lệ, hợp lý và hợp pháp đều được ghi nhận vào chi phí tính thuế thu nhập doanh nghiệp.

- Về thuế giá trị gia tăng:

Doanh nghiệp kê khai thuế GTGT theo phương pháp khấu trừ:

| Hóa đơn đầu vào là hóa đơn bán hàng | Không được khấu trừ nên chỉ cần kê khai vào Chỉ tiêu 23 trên Tờ khai 01/GTGT (hoặc không cần kê khai vì không có thuế GTGT) |

| Hóa đơn đầu vào là hóa đơn GTGT | Trong trường hợp đủ điều kiện khấu trừ, được khấu trừ và kê khai vào Chỉ tiêu 25 trên tời khai 01/GTGT |

Doanh nghiệp kê khai thuế GTGT theo phương pháp trực tiếp:

| Hóa đơn đầu vào là hóa đơn bán hàng | Không cần phải kê khai, chỉ hoạch toán -> Những doanh nghiệp kê khai thuế theo phương pháp trực tuếp chỉ phải kê khai những hóa đơn bán hàng đầu ra (Đầu vào không cần kê khai) |

| Hóa đơn đầu vào là hóa đơn GTGT | Không cần kê khai hóa đơn đầu vào, phần thuế GTGT hoạch toán vào nguyên giá của hàng hóa, tài sản, chi phí.Minh hoạ: Công ty X mua bàn ghế văn phòng: Trị giá 10 triệu, tiền thuế là 1 triệu, tổng phải trả là 11 triệu (Hóa đơn GTGT và công ty A kê khai thuế theo phương pháp trực tiếp)

Chỉ cần hạch toán như sau: Nợ TK 153…: 11 triệu Có 111: 11 triệu |

PROSHIP LOGISTICS đã cập nhật thông tin cần biết về Hóa đơn giá trị gia tăng là gì, nội dung cần có trên hóa đơn,…cùng những quy định liên quan tới hóa đơn dùng trong Doanh nghiệp. Dựa vào hóa đơn GTGT, các đơn vị kinh doanh hàng hóa/sản phẩm sẽ dễ dàng thống kê các chi phí cần phải đóng thuế theo luật định cho Cơ quan Nhà nước. Hãy tiếp tục theo dõi và cập nhật các tin bài về hóa đơn bán hàng, hóa đơn trực tiếp, hóa đơn VAT,…và liên hệ ngay 0909 344 247 khi có nhu cầu sử dụng Dịch vụ vận chuyển hàng bưu kiện, vận chuyển xe máy, vận chuyển ô tô, vận chuyển container đi Bắc Nam giá rẻ.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung