x Bạn là doanh nghiệp XNK, nhà nhập khẩu, nhà xuất khẩu cần tìm hiểu về thủ tục khai báo trên tờ khai Import declaration và Export declaration?

x Bạn muốn tìm hiểu về nội dung, vai trò của tờ khai nhập khẩu Import declaration và tờ khai xuất khẩu Export declaration?

x Bạn thắc mắc về quy trình khai trên tờ khai hải quan nhập khẩu Import declaration và tờ khai hải quan xuất khẩu Export declaration thế nào?

Cùng Proship.vn chúng tôi cập nhật kiến thức liên quan nhằm làm rõ thuật ngữ Export declaration là gì? Import declaration là gì? Tờ khai Export declaration và Import declaration quy định những gì, đóng vai trò gì?,…và cách thức khai trên hai loại tờ khai xuất nhập khẩu này ra sao sau đây.

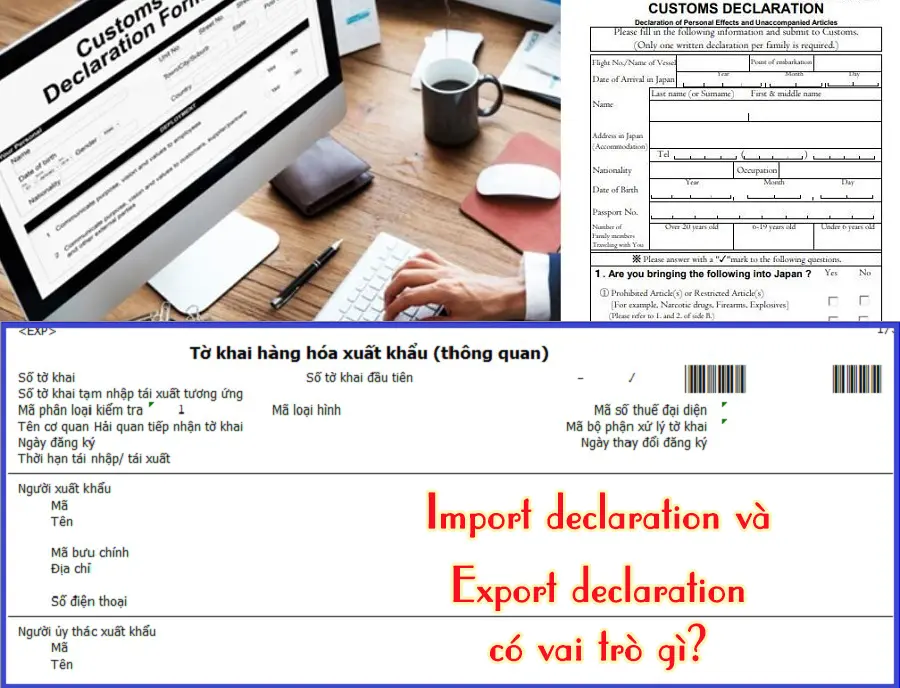

Customs Declaration, Import, Export Declaration là gì? Customs Declaration có vai trò gì?

Thông tin sau sẽ giúp bạn hiểu rõ Customs Declaration, Import, Export Declaration là gì:

Customs Declaration là gì?

Customs Declaration là Tờ khai hải quan, là loại văn bản bắt buộc trong thủ tục xuất nhập khẩu. Trong đó, người chủ hàng sẽ kê khai chi tiết thông tin về hàng hóa để cơ quan hải quan kiểm tra và quản lý khi hàng hóa khi qua biên giới.

Vai trò của tờ khai hải quan trong thủ tục hải quan

Tờ khai hải quan đóng vai trò:

- Cung cấp đầy đủ thông tin hàng hóa như: tên hàng, số lượng, giá trị, xuất xứ, phương thức vận chuyển,…giúp cơ quan hải quan nắm rõ thông tin để thực hiện các thủ tục kiểm tra, đánh giá và tính thuế;

- Giúp Cơ quan hải quan kiểm soát hoạt động xuất nhập khẩu, ngăn chặn hàng hóa cấm, hàng giả, hàng kém chất lượng và các hành vi buôn lậu;

- Dựa trên thông tin trên tờ khai hải quan, cơ quan hải quan sẽ tính toán và thu các loại thuế, phí hải quan theo quy định;

- Dữ liệu từ các tờ khai hải quan được sử dụng để thống kê hoạt động xuất nhập khẩu của quốc gia, phục vụ cho việc hoạch định chính sách.

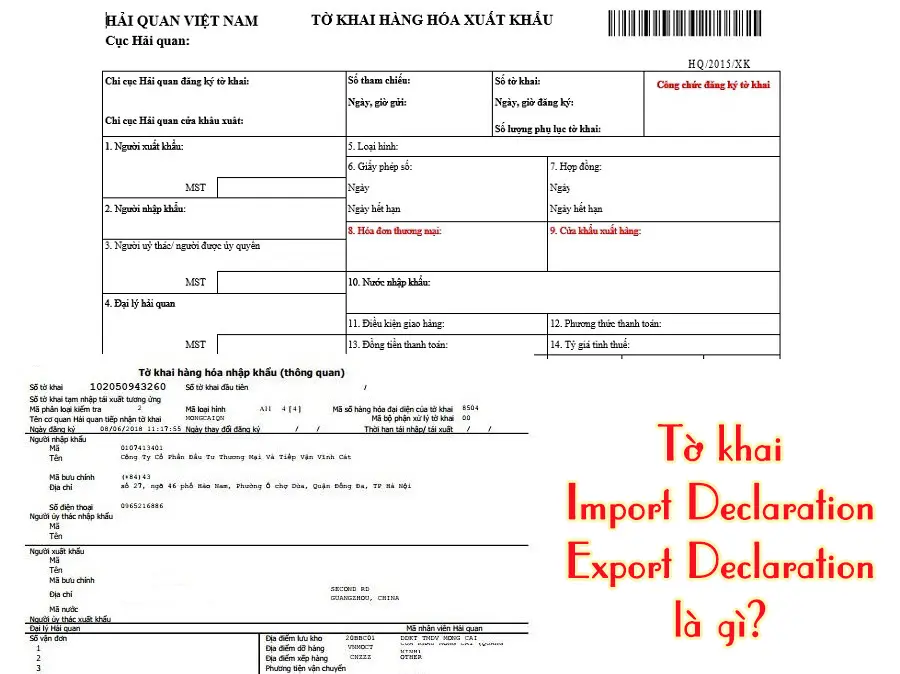

Export declaration là gì?

Export declaration là gì? Export Declaration là Tờ khai xuất khẩu, là văn bản do người xuất khẩu hoặc đại diện hợp pháp của họ kê khai đầy đủ, trung thực thông tin về lô hàng xuất khẩu theo quy định của pháp luật Việt Nam.

Import declaration là gì?

Import declaration là gì? Import declaration (còn gọi là “tờ khai nhập khẩu”) là tài liệu chính thức mà người khai hải quan phải nộp cho Cơ quan hải quan khi nhập khẩu hàng hóa vào một quốc gia.

Nội dung trên tờ khai Export declaration và Import declaration

Trên tờ khai Export declaration và Import declaration gồm các nội dung sau:

Nội dung Tờ khai xuất khẩu Export declaration

Tờ khai Export declaration gồm các thông tin:

- Thông tin về người xuất khẩu: Tên, địa chỉ, mã số thuế, số điện thoại, email.

- Thông tin về người nhận hàng: Tên, địa chỉ, mã số thuế (nếu có), số điện thoại, email.

- Thông tin về phương tiện vận chuyển: Loại phương tiện, tên phương tiện, số hiệu phương tiện, quốc tịch phương tiện.

- Thông tin về lô hàng: Số lượng, khối lượng, giá trị CIF, đơn vị tính, mã hàng hóa theo HS, mô tả hàng hóa, nước xuất khẩu, nước nhập khẩu.

- Thông tin về hợp đồng mua bán: Số hợp đồng, ngày lập hợp đồng, giá trị hợp đồng.

- Thông tin về phương thức thanh toán: Loại hình thanh toán, điều kiện thanh toán.

- Thông tin về bảo hiểm hàng hóa: Công ty bảo hiểm, số hiệu hợp đồng bảo hiểm, giá trị bảo hiểm.

- Ký tên và đóng dấu: Người xuất khẩu hoặc đại diện hợp pháp của họ ký tên, đóng dấu trên Tờ khai.

Nội dung Tờ khai xuất khẩu Import declaration

Tờ khai Import declaration gồm các thông tin:

- Thông tin lô hàng: tên hàng hóa, số lượng, giá trị, mã số HS, nguồn gốc hàng hóa, đơn vị đo lường,…;

- Thông tin người nhập khẩu: tên, địa chỉ, mã số thuế,…;

- Thông tin phương tiện vận chuyển: loại phương tiện, số vận đơn,…;

- Thông tin các loại thuế, lệ phí phải nộp: thuế nhập khẩu, thuế tiêu thụ đặc biệt, thuế GTGT (VAT),…

Tờ khai hàng nhập khẩu Import declaration và xuất khẩu Export declaration có vai trò gì?

Cùng tìm hiểu vai trò của tờ khai xuất khẩu Export declaration là gì và tờ khai nhập khẩu import declaration là gì sau đây:

Vai trò của tờ khai hàng nhập khẩu Import declaration

Cơ quan hải quan sử dụng Tờ khai hàng nhập khẩu Import declaration để:

- Phát hiện gian lận:

Đối chiếu thông tin tờ khai với các nguồn dữ liệu khác để phát hiện các hành vi gian lận thương mại (khai báo sai mã HS, khai báo giá trị thấp,…).

- Thực hiện thông quan hàng hóa:

Xác minh thông tin, kiểm tra chứng từ, tính toán và thu thuế, cho phép hàng hóa được thông quan hoặc từ chối nhập khẩu.

- Kiểm soát rủi ro:

Phân loại mức độ rủi ro của lô hàng dựa trên thông tin từ tờ khai, từ đó quyết định hình thức kiểm tra phù hợp (kiểm tra hồ sơ, kiểm tra thực tế, kiểm tra chuyên ngành,…).

- Xây dựng cơ sở dữ liệu:

Tổng hợp thông tin từ các tờ khai tạo thành cơ sở dữ liệu về hoạt động xuất nhập khẩu, phục vụ công tác phân tích, dự báo và hoạch định chính sách.

Vai trò của tờ khai hàng nhập khẩu Export declaration

Tờ khai xuất khẩu Export declaration đóng vai trò quan trọng trong:

- Thủ tục hải quan:

Là cơ sở để cơ quan hải quan thực hiện các thủ tục hải quan xuất khẩu như kiểm tra, giám sát, cấp phép cho hàng hóa xuất khẩu.

- Thống kê xuất khẩu:

Cung cấp dữ liệu cho việc thống kê xuất khẩu hàng hóa, phục vụ công tác quản lý kinh tế – xã hội của Nhà nước.

- Kiểm soát xuất khẩu:

Giúp cơ quan hải quan quản lý, giám sát hoạt động xuất khẩu hàng hóa, đảm bảo tuân thủ các quy định của pháp luật.

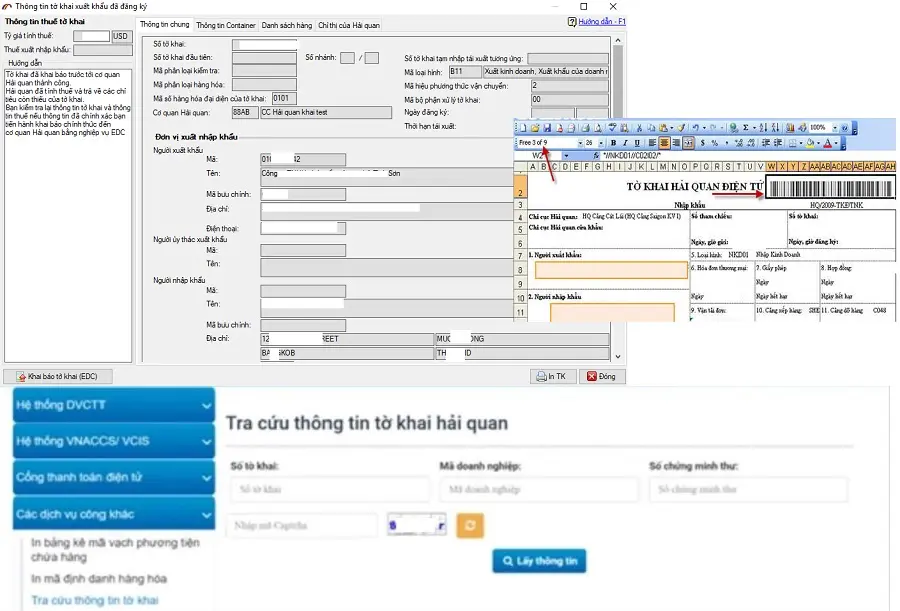

Quy trình khai tờ khai Export declaration và Import declaration

Proship sẽ cập nhật tóm tắt quy trình thực hiện khai tờ khai Import declaration và Export declaration như sau:

Quy trình khai báo Tờ khai xuất khẩu Export declaration

Quy trình khai Tờ khai Export Declaration như sau:

- Bước 1: Chuẩn bị dữ liệu khai báo Tờ khai;

- Bước 2: Truy cập hệ thống hải quan điện tử Việt Nam hoặc điền thông tin vào mẫu tờ khai giấy;

- Bước 3: Khai báo thông tin trên tờ khai theo hướng dẫn;

- Bước 4: Kiểm tra và xác nhận thông tin khai báo;

- Bước 5: Nộp tờ khai điện tử hoặc giấy tại cơ quan hải quan.

Quy trình khai báo Tờ khai nhập khẩu Import declaration

Quy trình khai Tờ khai Import Declaration hàng nhập khẩu:

- Bước 1: Xác định loại hàng hoá nhập khẩu;

- Bước 2: Kiểm tra toàn bộ chứng từ hàng hóa;

- Bước 3: Khai và truyền tờ khai hải quan;

- Bước 4: Lấy lệnh giao hàng;

- Bước 5: Chuẩn bị một bộ hồ sơ hải quan đầy đủ;

- Bước 6: Nộp các loại thuế và hoàn tất thủ tục hải quan.

Cách tra cứu thông tin tờ khai hải quan mới nhất

Các bước thực hiện tra cứu tờ khai hải quan:

- Bước 1: Truy cập vào Website: https://www.customs.gov.vn;

- Bước 2: Chọn mục “Tra cứu thông tin tờ khai hải quan”;

- Bước 3: Nhập các thông tin bắt buộc như Số tờ khai, Mã số doanh nghiệp, Ngày đăng ký;

- Bước 4: Bấm “Tra cứu” để xem thông tin chi tiết tờ khai.

Proship Logistics đã giải đáp Export declaration là gì, Import declaration là gì và hai loại tờ khai này đóng vai trò quan trọng ra sao trong hoạt động xuất nhập khẩu hàng hóa nói chung. Mọi thắc mắc, Quý doanh nghiệp có thể liên hệ 0909 344 247 để được giải đáp cũng như tư vấn các giải pháp vận chuyển hàng hóa đa phương thức đi Bắc Nam và Quốc tế trọn gói giá rẻ tốt nhất.