x Bạn cần tìm hiểu về nội dung và định dạng của Promissory Note là gì?

x Bạn đang có những giao dịch liên quan tới hối phiếu Promissory Note nhưng chưa hiểu nó là hối phiếu gì? Có chức năng gì?

x Bạn muốn biết Bill of Exchange và Promissory Note có gì khác nhau?

Proship.vn sẽ thông qua bài chia sẻ này để làm rõ thuật ngữ promissory note là gì; chức năng, nhiệm vụ và đặc điểm của promissory note cũng như nội dung của promissory note gồm những gì, định dạng ra sao,…cho những ai đã và đang tham gia vào các giao dịch thương mại quốc tế, thanh toán, phát hành hối phiếu có thể hiểu đúng vấn đề.

XEM THÊM: Vận chuyển Container Bắc Nam giá tốt

Promissory Note là gì? Có chức năng, đặc điểm gì?

Promissory note là gì?

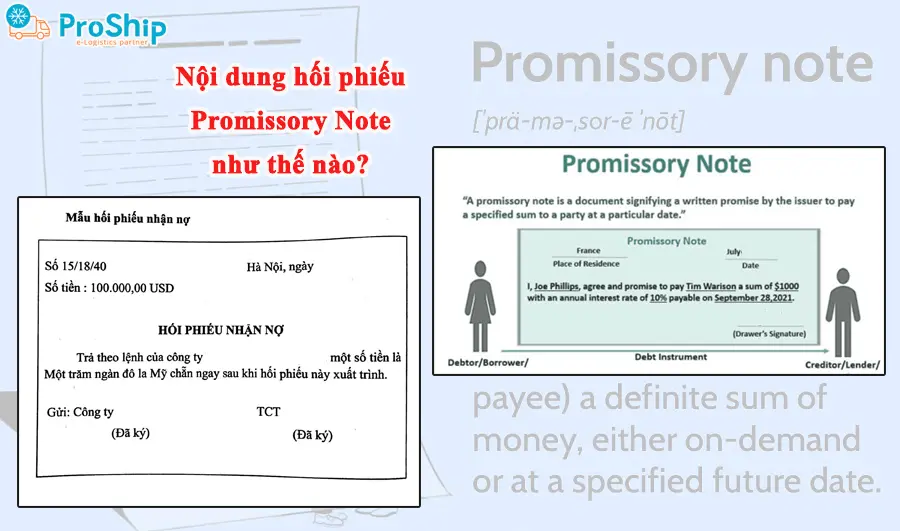

Promissory note là gì? Promissory Note (Hối phiếu nhận nợ) là bản cam kết trả tiền vô điều kiện do người lập phiếu tức người phát hành hối phiếu, hứa sẽ trả một số tiền nhất định vào một thời điểm cụ thể trong tương lai cho người thụ hưởng hoặc trả cho một người khác theo yêu cầu của người thụ hưởng.

Chức năng của Promissory note

Trái với hối phiếu đòi nợ, hối phiếu nhận nợ là cam kết trả tiền, không phải là yêu cầu thanh toán. Với hối phiếu nhận nợ, người lập phiếu có trách nhiệm thanh toán một khoản tiền xác định cho người thụ hưởng được ghi rõ trên hối phiếu.

Ngược lại, hối phiếu đòi nợ là chứng từ mà người ký phát mong muốn nhận được một khoản tiền từ một bên khác. Người ký phát hối phiếu đòi nợ chính là người thụ hưởng, trong khi đó người lập hối phiếu nhận nợ có nghĩa vụ thực hiện thanh toán theo cam kết đã đưa ra.

Đặc điểm của hối phiếu nhận nợ

Đặc điểm nổi bật của hối phiếu nhận nợ:

- Người ký phát hành hối phiếu nhận nợ sẽ là người phát hành;

- Hối phiếu nhận nợ là công cụ hứa trả tiền vô điều kiện do con nợ viết ra để hứa trả một số tiền nhất định cho chủ nợ;

- Hối phiếu nhận nợ là văn bản cam kết thanh toán. Để có giá trị pháp lý và đảm bảo thanh toán, hối phiếu nhận nợ cần được bảo lãnh bởi bên thứ ba có thể là ngân hàng, cam kết sẽ thực hiện việc thanh toán khi đến hạn.

Nội dung, định dạng của Promissory Note

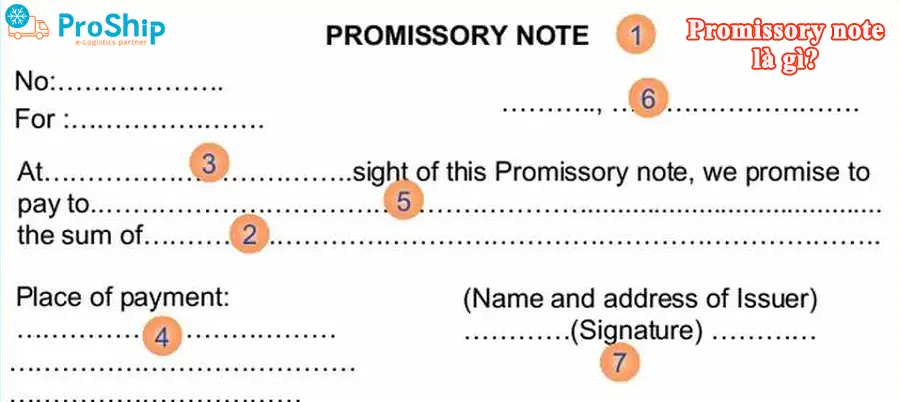

Định dạng, nội dung của hối phiếu nhận nợ promissory note là gì? Cụ thể:

- Tiêu đề ghi ở mặt trước “Hối phiếu nhận nợ”;

- Hứa trả một số tiền nhất định vô điều kiện;

- Địa điểm thanh toán;

- Thời hạn thanh toán của hối phiếu nhận nợ được ghi rõ ràng;

- Tên đối với tổ chức hoặc họ, tên đối với cá nhân của người thụ hưởng được người phát hành chỉ định hoặc yêu cầu thanh toán hối phiếu nhận nợ theo lệnh của người thụ hưởng hoặc yêu cầu thanh toán hối phiếu cho người cầm giữ;

- Ngày và địa điểm nơi ký phát hành;

- Tên đối với tổ chức hoặc họ, tên đối với cá nhân, địa chỉ và chữ ký của người phát hành.

Hối phiếu nhận nợ cần thể hiện đầy đủ các nội dung trên và sẽ KHÔNG CÓ GIÁ TRỊ nếu thiếu một trong các nội dung đó, trừ khi:

- Nếu không có địa điểm thanh toán trên hối phiếu nhận nợ thì địa điểm thanh toán là địa chỉ của người phát hành;

- Nếu trên hối phiếu nhận nợ địa điểm phát hành không được ghi thì địa điểm phát hành là địa chỉ của người phát hành;

- Nếu không đủ chỗ để viết hết thông tin trên hối phiếu nhận nợ thì có thể có thêm tờ phụ đính kèm. Tờ phụ đính kèm sẽ thể hiện nội dung bảo lãnh, chuyển nhượng, cầm cố, nhờ thu. Người đầu tiên lập tờ phụ phải gắn liền tờ phụ với hối phiếu nhận nợ và ký tên trên chỗ giáp lai giữa tờ phụ và hối phiếu nhận nợ.

Việc thanh toán hối phiếu nhận nợ được coi là hoàn thành khi:

- Người phát hành đã thực hiện nghĩa vụ thanh toán toàn bộ số tiền ghi trên hối phiếu nhận nợ cho người thụ hưởng;

- Người thụ hưởng huỷ bỏ hối phiếu nhận nợ;

- Hoặc người phát hành trở thành người thụ hưởng của hối phiếu nhận nợ vào ngày đến hạn thanh toán hoặc sau ngày đó.

NÊN ĐỌC: Dịch vụ vận chuyển Container lạnh giá tốt

Hình thức bảo lãnh hối phiếu đòi nợ thế nào?

“Điều 25. Hình thức bảo lãnh

1. Việc bảo lãnh hối phiếu đòi nợ được thực hiện bằng cách người bảo lãnh ghi cụm từ “bảo lãnh”, số tiền bảo lãnh, tên, địa chỉ, chữ ký của người bảo lãnh và tên người được bảo lãnh trên hối phiếu đòi nợ hoặc trên tờ phụ đính kèm hối phiếu đòi nợ.

2. Trong trường hợp bảo lãnh không ghi tên người được bảo lãnh thì việc bảo lãnh được coi là bảo lãnh cho người ký phát”

Việc bảo lãnh hối phiếu đòi nợ được thực hiện bằng cách người bảo lãnh ghi các nội dung theo quy định trên hối phiếu đòi nợ hoặc trên tờ phụ đính kèm hối phiếu đòi nợ, gồm:

- Cụm từ “bảo lãnh”:

Hối phiếu đòi nợ được ký phát có thể có biện pháp bảo lãnh hoặc không. Trường hợp các bên có thỏa thuận về việc áp dụng biện pháp bảo lãnh thì phải ghi nhận trên hối phiếu.

- Số tiền bảo lãnh:

Người bảo lãnh có thể cam kết bảo lãnh toàn bộ giá trị của hối phiếu hoặc chỉ một phần. Do đó, trên hối phiếu phải ghi rõ số tiền mà người bảo lãnh cam kết bảo lãnh.

- Tên, địa chỉ, chữ ký người bảo lãnh và tên người được bảo lãnh:

Người được bảo lãnh chính là người bị ký phát. Trên hối phiếu phải ghi tên người được bảo lãnh, đảm bảo khi người cho cam kết bảo lãnh của người bảo lãnh. Nếu bảo lãnh không ghi tên người được bảo lãnh thì việc bảo lãnh được coi là bảo lãnh cho người ký phát.

Sự khác biệt giữa Bill of Exchange và Promissory Note

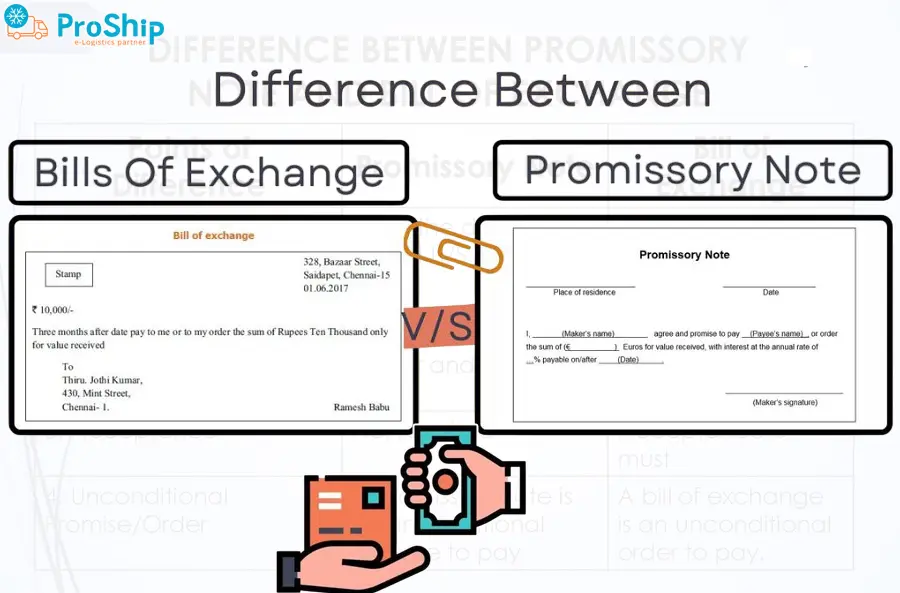

Sự khác biệt giữa Bill of Exchange và Promissory note là gì? Những điểm khác biệt giữa hối phiếu hối đoái và kỳ phiếu:

- Bill of Exchange là công cụ tài chính thể hiện số tiền mà người mua nợ đối với người bán. Promissory Note là tài liệu bằng văn bản, trong đó con nợ hứa với chủ nợ rằng, số tiền đến hạn sẽ được trả vào một ngày cụ thể trong tương lai;

- Bill of Exchange được định nghĩa trong Phần 5 của Đạo luật công cụ chuyển nhượng, năm 1881 trong khi Lưu ý phát hành được xác định trong Mục 4;

- Trong một hóa đơn trao đổi, có ba bên trong khi trong trường hợp ghi chú kỳ hạn, số lượng các bên là 2;

- Chủ nợ tạo ra Bill of Exchange còn Promissory Note được chuẩn bị bởi con nợ;

- Trách nhiệm của người tạo ra hối phiếu là thứ yếu và có điều kiện. Ngược lại, trách nhiệm của người tạo ra giấy ghi nợ là chính và tuyệt đối;

- Bill of Exchange có thể được lập thành bản sao nhưng Promissory Note không thể được lập thành bộ;

- Trong trường hợp hối phiếu, người ký phát và người được trả tiền có thể cùng một người mà không thể thực hiện được trong trường hợp Lưu ý phát hành;

- Thông báo về sự không trung thực của một hóa đơn trao đổi phải được đưa ra cho tất cả các bên liên quan, tuy nhiên, trong trường hợp ghi chú hứa hẹn, thông báo đó không cần phải được đưa ra cho nhà sản xuất.

Promissory note là gì, có chức năng gì, có gì khác so với Bill of Exchange, hình thức bảo lãnh hối phiếu nhận nợ ra sao,…là những kiến thức hữu ích mà Proship Logistics muốn chuyển tải tới các bên liên quan nắm bắt kịp thời. Mọi thắc mắc, liên hệ ngay 0909 344 247 để được giải đáp và tư vấn các giải pháp vận chuyển hàng Đa phương thức giá tốt nhất.