x Bạn có nhu cầu nhập khẩu thiết bị đèn Led chiếu sáng về Việt Nam để buôn bán, kinh doanh, tiêu dùng,…?

x Bạn chưa có nhiều kinh nghiệm về vấn đề làm thủ tục, dán nhãn năng lượng, làm hồ sơ công bố SP hợp quy,…?

x Bạn muốn biết thuế suất nhập khẩu đèn Led bao nhiêu? Mã HS Code tương ứng là gì? Đơn vị nào nhận ủy thác XNK mặt hàng này?

Đèn Led là một trong những mặt hàng được nước ta nhập khẩu nhiều nhất nên thiết bị này đã và đang chiếm lĩnh thị trường Việt Nam so với các loại đèn khác. Sau đây, Proship.vn sẽ chia sẻ nhanh thủ tục nhập khẩu đèn led cho Quý DN thực sự quan tâm nhưng chưa có nhiều kinh nghiệm làm thủ tục hải quan – thông quan đèn Led có thể tham khảo. Bên cạnh đó, phía chúng tôi còn là Đơn vị Ủy thác XNK – khai báo hải quan nhiều mặt hàng (trong đó có thiết bị đèn Led nhập khẩu). Giá cả phải chăng đi kèm với chất lượng DV tốt, uy tín, an toàn sẽ mang tới sự hài lòng tuyệt đối cho mọi Chủ hàng/DN.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Tổng quan nhu cầu nhập khẩu thiết bị đèn Led hiện nay

LED (Viết tắt của cụm từ “Light Emitting Diode”), nghĩa là Điốt phát quang, các sản phẩm chiếu sáng LED tạo ra ánh sáng hiệu quả hơn đến 90% so với bóng đèn sợi đốt. Đèn LED là vật dụng không còn xa lạ trong đời sống chúng ta. Nhắc đến đèn LED, chúng ta nhắc đến những lợi ích chiếu sáng phong phú. Do thiết bị đèn LED có tuổi thọ cao, chất lượng ánh sáng tốt nên được người dùng khá ưa chuộng.

Hiện nay, trên thị trường có rất nhiều sản phẩm chiếu sáng và một loại có các thông số kỹ thuật riêng. Trong đó, các sản phẩm sáng LED là các sản phẩm chiếu sáng thông dụng sử dụng công nghệ đi-ốt phát sáng – LED. LED là loại đèn thế hệ mới với nguyên lý chiếu sáng dựa trên hoạt động của các diot phát quang. Cùng với hoạt động nhập khẩu đèn LED diễn ra khá sôi động và thiết bị này lại có khá nhiều chủng loại khác nhau tương ứng với mã HS CODE khác nhau như:

- Đèn dây LED;

- Đèn LED rọi ray;

- Đèn led âm trần;

- Đèn tuýp led;

- Đèn Bulb LED;

- Đèn pha LED;

- Đèn LED panel;

- Đèn đường.

Việc nhập khẩu đèn LED có thể đòi hỏi phải chú ý đến nhiều yếu tố và thực hiện một loạt các thủ tục hải quan cần thiết. Đèn LED khi làm thủ tục nhập khẩu được chia thành các loại sau:

- Đèn LED nhập khẩu phải dán nhãn tiết kiệm năng lượng;

- Đèn led nhập khẩu phải được kiểm tra chất lượng;

- Đèn led thông thường nhập khẩu: Đèn năng lượng mặt trời, đèn led pin, đèn led nguyên chiếc.

Xác định xem sản phẩm đèn led của bạn có rơi vào bất kỳ hoặc tất cả những điều trên không. Sau đó phải xác định chính xác những Thông tư và Quy định nào mà sản phẩm của bạn sẽ phải tuân theo…Dưới đây là nội dung chính của thủ tục nhập khẩu đèn led, mã HS, thuế nhập khẩu, chính sách nhập khẩu, kiểm tra chất lượng, dán nhãn năng lượng đèn led mà Proship Logistics muốn chia sẻ đến quý bạn đọc.

Proship Logistics hướng dẫn thủ tục nhập khẩu đèn Led về Việt Nam chi tiết nhất 2023

Đèn led là mặt hàng thông quan có thủ tục xuất nhập khẩu phức tạp hơn so với các loại hàng hóa khác trên thị trường. Do đó, trước khi tìm hiểu thủ tục nhập khẩu đèn led, các Doanh nghiệp cần nắm chắc một số thông tin cơ bản về thiết bị chiếu sáng này…Sau đây, Proship Logistics xin chia sẻ tất tất tật những kiến thức, thông tin quan trọng về thủ tục hải quan nhập khẩu thiết bị đèn Led về nước để buôn bán, kinh doanh, tiêu dùng:

Các thông tư liên quan về nhập khẩu đèn LED

Doanh nghiệp khi có nhu cầu làm thủ tục thông quan hàng hóa là đèn Led, cần phải tìm hiểu các thông tư và công văn cơ bản sau:

- Quyết định 04/2017/QĐ-TTg ngày 09/03/2017 của Thủ tướng Chính phủ “Quy định danh mục phương tiện, thiết bị phải dán nhãn năng lượng”,

- Công văn số 1786/TCHQ-GSQL ngày 11/03/2016 của Tổng cục Hải quan hướng dẫn quy trình thực hiện dán nhãn năng lượng và kiểm tra hiệu suất năng lượng tối thiểu.

- Thông tư 36/2016/TT-BCT ngày 28/12/2016 của Bộ công thương hướng dẫn thực hiện dán nhãn năng lượng đối với 1 số mặt hàng

- Quyết định 4889/QĐ-BCT ngày 27/12/2018 của Bộ công thương công bố Tiêu chuẩn Việt Nam và hướng dẫn công bố hiệu suất năng lượng và dán nhãn năng lượng đèn LED

- Thông tư 08/2019/BKHCN ngày 25/9/2019 ban hành Quy chuẩn kỹ thuật Quốc gia (QCVN 19/2019/BKHCN ) về sản phẩm chiếu sáng bằng công nghệ LED

- Căn cứ theo quyết định 3810/QĐ- BKHCN ngày 18/12/2019 của Bộ Khoa học và Công nghệ, mặt hàng đèn LED phải kiểm tra chất lượng theo QCVN 19/2019/BKHCN.

- Và một số văn bản khác.

Mã HS và thuế suất nhập khẩu đèn LED

Mã HS đèn LED

Ứng với mỗi loại đèn LED có một mã HS riêng. Mời các bạn tham khảo các mã HS sau:

| Mã HS | Mô tả hàng hóa |

| 85395210 | – – – Loại đầu đèn ren xoáy |

| 85395290 | – – – Loại khác |

| 94051191 | – – – – Đèn rọi |

| 94051199 | – – – – Loại khác |

| 94054110 | – – – Đèn pha |

| 94054130 | – – – Đèn tín hiệu không nhấp nháy dùng cho sân bay; đèn dùng cho phương tiện giao thông đường sắt, đầu máy, tàu thủy, phương tiện bay, hoặc hải đăng, bằng kim loại cơ bản |

| 94054140 | – – – Loại khác được sử dụng ở nơi công cộng hoặc đường phố lớn; loại chiếu sáng bên ngoài khác |

Thuế suất nhập khẩu đèn LED

Thuế suất nhập khẩu đèn LED phụ thuộc vào HS Code. Thuế suất nhập khẩu tham khảo năm 2023 cho bóng đèn led như sau:

- Thuế NK thông thường: 5%;

- Thuế NK ưu đãi: 0%;

- Thuế VAT: 10%.

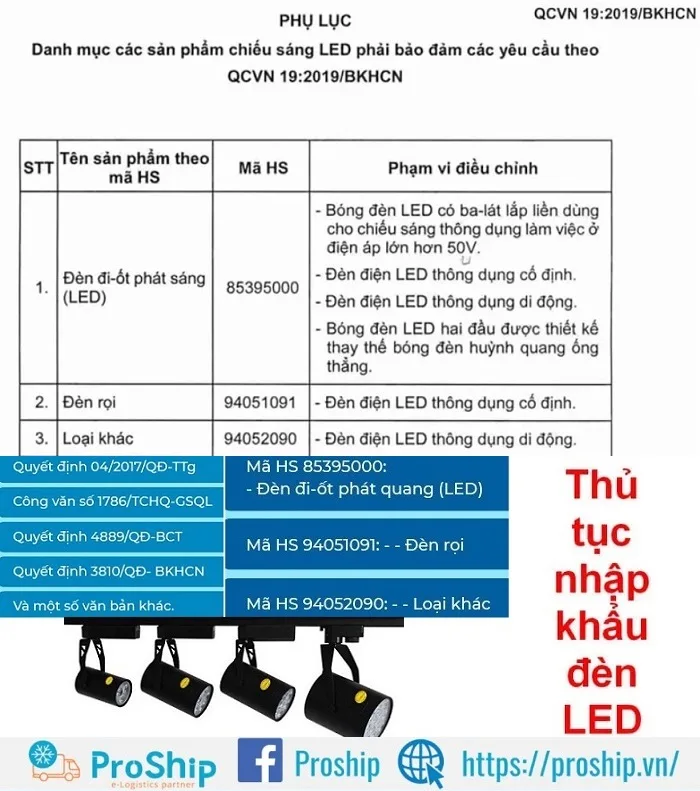

Các sản phẩm phải làm chứng nhận hợp quy

Theo đó, các sản phẩm phải đáp ứng các yêu cầu theo QCVN 19:2019/BKHCN sẽ phải tiến hành kiểm tra chất lượng Nhà nước để làm giấy chứng nhận hợp quy trước khi nhập khẩu đèn LED đó, bao gồm các loại đèn sau:

| STT | Tên sản phẩm theo mã HS | Mã HS | Phạm vi điều chỉnh |

| 1. | Đèn đi-ốt phát sáng (LED) | 85395000 | – Bóng đèn LED có ba-lát lắp liền dùng cho chiếu sáng thông dụng làm việc ở điện áp lớn hơn 50V. – Đèn điện LED thông dụng cố định. – Đèn điện LED thông dụng di động. – Bóng đèn LED hai đầu được thiết kế thay thế bóng đèn huỳnh quang ống thẳng. |

| 2. | Đèn rọi | 94051091 | – Đèn điện LED thông dụng cố định. |

| 3. | Loại khác | 94052090 | – Đèn điện LED thông dụng di động. |

* Lưu ý: Quy chuẩn này KHÔNG áp dụng với đèn trên các phương tiện giao thông vận tải, thiết bị chiếu sáng trong công trình chiếu sáng, thiết bị chiếu sáng trong các phương tiện quảng cáo hoặc phương tiện chiếu sáng đặc thù như đèn phòng mổ,…

Các loại chứng từ, hồ sơ cần chuẩn bị khi nhập khẩu đèn Led

Hồ sơ đăng ký dán nhãn năng lượng và làm hợp quy

Các loại hồ sơ đăng ký dán nhãn năng lượng và làm hợp quy sản phẩm gồm:

- Đơn đăng ký công bố về dán nhãn năng lượng;

- Bản công bố hợp chuẩn theo mẫu của bộ Khoa học và Công nghệ;

- Mẫu nhãn năng lượng dự kiến;

- Giấy tờ khai hàng hóa nhập khẩu;

- Invoice;

- Kết quả thử nghiệm hiệu suất năng lượng;

- Giấy đăng ký kinh doanh;

- Tiêu chuẩn áp dụng và kết quả chứng nhận bản sao;

- C/O;

- Catalogue và một số chứng từ quan trọng khác.

Hồ sơ làm thủ tục Hải quan nhập khẩu đèn led

Thủ tục Hải quan cho nhập khẩu đèn led khá phức tạp. Về cơ bản bất cứ đèn led nào doanh nghiệp cũng phải xuất trình các loại giấy tờ và chứng từ sau:

- Hóa đơn thương mại (Commercial Invoice);

- Phiếu đóng gói hàng hóa (Packing List);

- Vận đơn đường biển (Bill of Lading);

- Hợp đồng thương mại (Sales Contract);

- Giấy chứng nhận nguồn gốc xuất xứ hàng hóa (C/O);

- Tờ khai Hải quan;

- Đơn đăng ký công bố dán nhãn năng lượng;

- Bản công bố hợp chuẩn;

- Giấy đăng ký kiểm tra chất lượng.

Quy trình làm thủ tục nhập khẩu đèn LED

Bước 1: Đăng ký kiểm tra chất lượng

Kiểm tra chất lượng là thủ tục bắt buộc phải thực hiện đối với một số mặt hàng đèn LED sau thông quan. Do đó, nếu nhập khẩu đèn LED phải kiểm tra chất lượng sau thông quan thì doanh nghiệp cần thực hiện đăng ký theo hướng dẫn. Về hồ sơ đăng ký kiểm tra chất lượng, bạn cần chuẩn bị một số giấy tờ sau:

- Đơn đăng ký kiểm tra chất lượng theo mẫu;

- Hợp đồng mua hàng (Sales contract);

- Hóa đơn thương mại (Commercial invoice);

- Phiếu đóng gói hàng hóa chi tiết (Packing list): 1 bản chụp;

- Vận tải đơn (Bill of Lading): bản gốc hoặc bản chụp;

- Giấy chứng nhận xuất xứ (C/O): bản chụp của các tổ chức cá nhân nhập khẩu;

- Và một số giấy tờ khác (nếu có).

Bước 2: Đăng ký kiểm nghiệm hiệu suất năng lượng

Đây là bước được thực hiện với những mặt hàng đèn LED phải tiến hành kiểm nghiệm hiệu suất năng lượng khi đưa ra lưu thông trên thị trường. Về hồ sơ đăng ký doanh nghiệp cần thực hiện theo hướng dẫn của Cơ quan có thẩm quyền.

Bước 3: Mở tờ khai hải quan

Doanh nghiệp tiến hành mở tờ khai hải quan (có thể mở tờ khai điện tử), điền đầy đủ thông tin cần thiết để thực hiện hoạt động thông quan hàng hóa. Về bộ hồ sơ hải quan, người khai hải quan cần xuất trình một số giấy tờ sau:

- Tờ khai hải quan nhập khẩu theo mẫu;

- Hóa đơn thương mại (Commercial Invoice);

- Phiếu đóng gói hàng hóa (Packing List);

- Vận đơn (Bill of Lading);

- Hợp đồng thương mại (Sales Contract);

- Giấy chứng nhận nguồn gốc xuất xứ hàng hóa – C/O;

- Và một số giấy tờ khác.

Bước 4: Thử nghiệm, làm chứng nhận hợp quy

Sau khi xin kéo hàng về kho, doanh nghiệp có thể mang mẫu đến trung tâm kiểm nghiệm để kiểm tra về chất lượng, hiệu suất năng lượng của loại đèn nhập về để làm chứng nhận hợp quy cho sản phẩm.

Bước 5: Đăng ký dán nhãn năng lượng

Theo quy định Khoản 1, Điều 5, Thông tư 36/2016/TT-BCT thì “Trước khi đưa phương tiện, thiết bị ra thị trường, doanh nghiệp sản xuất nhập khẩu phương tiện, thiết bị đó phải lập 01 bộ hồ sơ đăng ký dán nhãn năng lượng và gửi về Bộ Công Thương..”. Theo đó, doanh nghiệp nhập khẩu cần chuẩn bị hồ sơ xin dán nhãn năng lượng cho sản phẩm gồm một số giấy tờ sau:

- Giấy công bố nhãn dán năng lượng cho sản phẩm đèn LED;

- Kết quả thử nghiệm do tổ chức thử nghiệm cấp cho model đèn LED;

- Tài liệu chứng minh phòng thử nghiệm nước ngoài đã đáp ứng đủ Điều kiện (Đối với trường hợp việc thử nghiệm dán nhãn năng lượng được thực hiện bởi tổ chức thử nghiệm nước ngoài);

- Mẫu nhãn dán năng lượng dự kiến.

Bước 6: Tiến hành công bố hợp quy

Căn cứ vào Thông tư 08/2019/TT-BKHCN và Quy chuẩn QCVN 19:2019/BKHCN thì các sản phẩm đèn LED khi nhập khẩu đều phải làm hợp quy, kiểm tra chất lượng trước khi bán ra ngoài thị trường.

Về hồ sơ xin công bố hợp quy doanh nghiệp cần chuẩn bị một số giấy tờ như:

- Bản công bố hợp chuẩn theo mẫu của Bộ Khoa học và Công nghệ;

- Giấy đăng ký kinh doanh (Bản sao);

- Tiêu chuẩn áp dụng (Sao y bản chính);

- Kết quả chứng nhận (Sao y bản chính).

Bước 7: Dán nhãn năng lượng, tem hợp quy trước khi đưa sản phẩm ra thị trường

Cuối cùng, trước khi lưu thông đèn LED ra ngoài thị trường, doanh nghiệp tiến hành dán nhãn năng lượng, tem hợp quy và một số tem phụ khác (nếu có) cho sản phẩm.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Proship Logistics – Đơn vị Ủy thác xuất nhập khẩu hàng đường biển, đường bộ, đường hàng không Uy tín, Chuyên nghiệp, Giá rẻ

PROSHIP LOGISTICS là đơn vị chuyên cung cấp Dịch vụ Ủy thác xuất nhập khẩu, Dịch vụ khai thuê hải quan giá rẻ và là Đại lý hải quan chuyên nghiệp, uy tín hàng đầu hiện nay. Chúng tôi đang sở hữu đội ngũ nhân sự được đào tạo bài bản về nghiệp vụ chuyên môn, mở tờ khai, phân luồng tờ khai,…nên sẽ trực tiếp tư vấn cũng như giải đáp thắc mắc mọi vấn đề liên quan tới thủ tục quy trình nhập khẩu hàng hóa (bao gồm cả thủ tục nhập khẩu đèn led). Đồng thời, Công ty Cổ phần Proship cũng có mối liên hệ mật thiết với phía hải quan liên quan cùng trang thiết bị hỗ trợ việc vận chuyển – giao nhận đầy đủ,…do đó tiến trình thông quan hàng hóa luôn đảm bảo nhanh chóng, kịp thời tại cảng biển, sân bay hoặc cửa khẩu đường bộ.

Trong vai trò là Đại lý khai báo hải quan, phía chúng tôi sẽ dùng CHỮ KÝ SỐ hợp lệ để khai hải quan và chịu trách nhiệm nội dung khai trên tờ khai hải quan cùng với Doanh nghiệp XNK; Thay mặt Doanh nghiệp làm thủ tục xuất nhập hàng hóa theo Hợp đồng KBHQ cửa khẩu/sân bay/cảng biển ký kết giữa 2 bên; Tên, mã số của Đại lý hải quan Proship được thể hiện trên tờ khai và trên hệ thống hải quan.

Đối với vai trò là Đơn vị khai thuê hải quan, Proship KHÔNG XUẤT HIỆN trên bất kỳ chứng từ nào của bộ hồ sơ khai quan. Nhiệm vụ của Đơn vị thực hiện khai thuê HQ cửa khẩu/sân bay/cảng biển chúng tôi là lên tờ khai bằng phần mềm riêng rồi dùng Token Khách hàng để ký tờ khai, dùng giấy giới thiệu của chủ hàng làm thủ tục hải quan. Phía Chủ hàng/DN phải dùng CHỮ KÝ SỐ của mình để duyệt ký (từ xa), hay gửi giấy khống…Đối với Cơ quan hải quan, Đơn vị khai thuê hàng xuất nhập khẩu chúng tôi là Người của Chủ hàng.

Proship nhận khai hải quan tại các sân bay, cảng biển, cửa khẩu toàn quốc

Khai hải quan tại tất cả các Sân bay

- Sân bay Quốc tế Tân Sơn Nhất – Hồ Chí Minh;

- Sân bay Quốc tế Nội Bài – Hà Nội;

- Sân bay Quốc tế Đà Nẵng – Đà Nẵng;

- Sân bay Quốc tế Vân Đồn – Quảng Ninh;

- Sân bay Quốc tế Cát Bi – Hải Phòng;

- Sân bay Quốc tế Vinh – Nghệ An;

- Sân bay Quốc tế Phú Bài – Huế;

- Sân bay Quốc tế Cam Ranh – Khánh Hòa;

- Sân bay Quốc tế Liên Khương – Lâm Đồng;

- Sân bay Quốc tế Phù Cát – Bình Định;

- Sân bay Quốc tế Cần Thơ – Cần Thơ;

- Sân bay Quốc tế Phú Quốc – Kiên Giang,…

Khai hải quan tại tất cả các Cảng biển

- Cảng Cát Lái;

- Cảng Cái Lân;

- Cảng Ninh Phúc;

- Cảng Hải Phòng;

- Cảng Nghi Sơn;

- Cảng Cửa Lò;

- Cảng Vũng Áng;

- Cảng Chân Mây;

- Cảng Tiên Sa;

- Cảng Kỳ Hà;

- Cảng Dung Quất;

- Cảng Quy Nhơn;

- Cảng Ba Ngòi;

- Cảng Nha Trang;

- Cảng Vũng Tàu;

- Cảng Phú Mỹ;

- Cảng Sài Gòn;

- Cảng Cần Thơ;

- Cảng An Thới,…

Khai hải quan tại tất cả các Cửa khẩu

- Cửa khẩu Móng Cái;

- Cửa khẩu Hữu Nghị;

- Cửa khẩu Tà Lùng;

- Cửa khẩu Thanh Thủy;

- Cửa khẩu Lào Cai;

- Cửa khẩu Tây Trang;

- Cửa khẩu Chiềng Bông;

- Cửa khẩu Na Mèo;

- Cửa khẩu Mường Chanh;

- Cửa khẩu Nậm Cắn;

- Cửa khẩu Cầu Treo;

- Cửa khẩu Cha Lo;

- Cửa khẩu Lao Bảo;

- Cửa khẩu La Lay;

- Cửa khẩu Bờ Y;

- Cửa khẩu Gánh Đa;

- Cửa khẩu Lệ Thanh;

- Cửa khẩu Hoa Lư;

- Cửa khẩu Xa Mát;

- Cửa khẩu Mộc Bài;

- Cửa khẩu Dinh Bà;

- Cửa khẩu Thường Phước;

- Cửa khẩu Vĩnh Xương;

- Cửa khẩu Tịnh Biên;

- Cửa khẩu Hà Tiên;

- Cửa khẩu Bình Hiệp,…

Loại hình khai hải quan tại sân bay, cửa khẩu, cảng biển toàn quốc

Các loại hình khai hải quan tại Sân bay

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại sân bay:

- Dịch vụ khai báo loại hình kinh doanh, phi mậu dịch;

- Dịch vụ khai báo loại hình sản xuất xuất khẩu, loại hình gia công, đầu tư, xuất nhập khẩu tại chỗ;

- Dịch vụ khai báo loại hình quá cảnh, hàng đầu tư miễn thuế;

- Loại hình xuất nhập khẩu tại chỗ, nhập và xuất vào khu công nghiệp, miễn thuế,…

Các loại hình khai hải quan tại Cửa khẩu

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại cửa khẩu:

- Loại hình quá cảnh;

- Loại hình nhập khẩu quà biếu tặng, hàng phi mậu dịch;

- Loại hình nhập khẩu gia công;

- Loại hình xuất khẩu kinh doanh;

- Loại hình xuất nhập khẩu sản xuất xuất khẩu;

- Loại hình xuất nhập khẩu tại chỗ;

- Loại hình tạm nhập tái xuất;

- Loại hình tạm xuất tái nhập;

- Loại hình xuất khẩu đầu tư có thuế, miễn thuế.

Các loại hình khai hải quan tại Cảng biển

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại cảng biển:

- Dịch vụ khai báo hải quan loại hình sản xuất xuất khẩu, đầu tư – gia công;

- Dịch vụ khai báo hải quan loại hình nhập kinh doanh – A11, nhập phi mậu dịch – H11,…;

- Loại hình xuất kinh doanh: B11;

- Loại hình xuất nhập khẩu tại chỗ (bán hàng vào khu chế xuất)…;

- Tạm nhập tái xuất, tạm xuất tái nhập,…

Ưu điểm Dịch vụ ủy thác XNK, khai báo hải quan trọn gói tại Proship

Các Cá nhân, DN kinh doanh hàng hóa XNK nên chọn Dịch vụ khai hải quan trọn gói của Proship bởi sự chuyên nghiệp và uy tín:

- Không đặt mục tiêu cung cấp Dịch vụ khai hải quan GIÁ RẺ NHẤT mà đảm bảo chi phí HỢP LÝ NHẤT;

- Hoàn thành tiến trình KBHQ theo tiêu chí: “Nhanh chóng – Chính xác – Giá rẻ – Chuyên nghiệp”;

- Kỹ năng xử lý nhanh các lô hàng XNK khó khai HQ tại cảng biển/sân bay/cửa khẩu;

- Nắm rõ quy trình thông quan hàng hóa tại các sân bay/cửa khẩu/cảng biển toàn quốc;

- Có đủ phương tiện cần thiết để phục vụ hiệu quả cho hoạt động Logistics;

- Am hiểu, cập nhật các Thông tư, Nghị định hải quan,…mới nhất để tư vấn cho khách hàng;

- Khách hàng được tư vấn về chứng từ, quy trình thủ tục, áp mã HS,…bởi đội ngũ nhân viên có nghiệp vụ HQ;

- Cam kết bảo mật thông tin hàng hóa + thông tin khách cung cấp khi sử dụng Dịch vụ KBHQ sân bay/cửa khẩu/cảng biển;

- Có VP đại diện tại TPHCM/Hà Nội/Đà Nẵng, thuận lợi cho nhu cầu thuê Dịch vụ khai hải quan trọn gói của DN;

- Cam kết giao hàng tận nơi cho khách theo yêu cầu (chuẩn xác về thời gian và địa điểm);

- Chính sách đền bù thiệt hại thỏa đáng cho khách nếu xảy ra tình trạng chậm trễ trong KBHQ.

>>Xem thêm: Thủ tục nhập khẩu bình chữa cháy

Các dịch vụ khác Proship cung cấp khi khai hải quan trọn gói

Proship còn nhận tư vấn, cung cấp dịch vụ khác song song với Dịch vụ KBHQ tại các cửa khẩu/sân bay/cảng biển như:

- Phân tích phân loại hàng hóa;

- Dịch vụ kiểm dịch thực vật/động vật (khoảng 700.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ kiểm tra vệ sinh an toàn thực phẩm;

- Dịch vụ kiểm tra chất lượng, giám định hàng hóa;

- Dịch vụ xin chứng nhận xuất xứ (Certificate Of Origin – C/O) (khoảng từ 1.000.000 – 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy chứng nhận hợp quy, công bố hợp quy (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố mỹ phẩm (khoảng 2.500.000 triệu – 3.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố thực phẩm thông thường (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy phép các bộ ngành;

- Dịch vụ hun trùng (khoảng 350.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường).

Proship Logistics đã cập nhật nhanh Thủ tục nhập khẩu đèn led về Việt Nam theo quy định hiện hành 2023. Theo đó, nếu Cá nhân hoặc Doanh nghiệp chuyên kinh doanh mặt hàng này nhưng gặp phải một số vướng mắc về chứng từ, thủ tục, cách dán nhãn, công bố hợp quy sản phẩm,…hay còn lăn tăn về thuế suất, mã HS Code tương ứng từng loại đèn nên tham khảo bài chia sẻ trên. Đồng thời, khi cần thuê Đơn vị ủy thác nhập khẩu/xuất khẩu, liên hệ ngay với chúng tôi qua số 0909 344 247 để được hỗ trợ cung cấp và báo giá DV nhanh tốt nhất.