x Các hộ kinh doanh, cá nhân, doanh nghiệp, tổ chức,…có nhu cầu nhập khẩu và phân phối các loại máy in tại thị trường Việt Nam?

x Bạn chưa có kinh nghiệm chuẩn bị hồ sơ, chứng từ hợp lệ, cách xin giấy phép nhập khẩu máy in nước ngoài về nước?

x Bạn cần tới sự hỗ trợ của bên thứ ba chuyên lo về việc khai thuê HQ, Đại lý HQ chuyên trách tại cửa khẩu/cảng biển/sân bay?

Đối với những đơn vị, cơ sở chuyên nhập khẩu hoặc có nhu cầu nhập khẩu máy in thì việc nắm rõ thủ tục nhập khẩu máy in là rất quan trọng. Thế nên thông qua bài chia sẻ này, Proship.vn sẽ cập nhật chi tiết thủ tục nhập khẩu các loại máy in về Việt Nam để các DN hoặc Cá nhân tham khảo và áp dụng hiệu quả. Đồng thời, chúng tôi còn nhận khai hải quan trọn gói giá rẻ tại cửa khẩu/cảng biển/sân bay. Bạn quan tâm, có nhu cầu sử dụng DV nên tin chọn để được đảm bảo giá tốt và thông quan nhanh kịp thời.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Nhu cầu sử dụng và nhập khẩu máy in về Việt Nam hiện nay

Hiện nay, máy in là thiết bị phổ biến và quan trọng trong cuộc sống. Cuộc sống ngày càng phát triển thì những yêu cầu về in ấn lại càng cần được nâng cao. Có một số loại máy in thông dụng hiện nay như: Máy in laser, Máy in kim, Máy in phun, Máy in lụa, Máy in typo, Máy in flexo, Máy in offset, Máy in ống đồng.

Máy in có vai trò to lớn trong mọi mặt đời sống. Trong kinh doanh máy in là một công cụ có vai trò rất quan trọng còn hằng ngày thì tờ rơi, báo chí, tấm card, brochure, poster đều là sản phẩm của việc in ấn. Những công cụ này sẽ giúp Doanh nghiệp quảng bá, giới thiệu và truyền những thông tin đến khách hàng. Không chỉ vậy các lĩnh vực giáo dục, y tế, văn hóa,…đều cần đến in ấn để có thể truyền bá thông tin một cách rộng rãi.

Tác dụng của máy in trong thời đại công nghệ số là điều mà không ai có thể phủ nhận, mang đến tính ứng dụng cao, hiệu quả kinh tế vô cùng lớn. Máy in có thể vừa in ấn, vừa sao chụp, scan, có thể sao lưu các văn bản và giấy tờ đã ép plastic như Chứng minh thư nhân dân hay thẻ sinh viên, in số lượng lớn. Ngoài ra, nhiều máy in còn tích hợp cả chức năng fax tải liệu tiện lợi hơn, gia tăng năng suất làm việc cho người dùng.

Trước nhu cầu thị trường máy in ngày càng phát triển và được mua bán khá phổ biến nên ngày càng có không ít Doanh nghiệp nhập khẩu máy in. Song nhiều Doanh nghiệp khi nhập khẩu máy in còn vấp phải những vướng mắc về các thủ tục thông quan hàng hóa. Thủ tục xin cấp giấy phép nhập khẩu máy in (Xin cấp giấy phép nhập khẩu thiết bị in ấn) là một trong những thủ tục cơ sở in, Doanh nghiệp phải tiến hành trước khi làm thủ tục thông quan cho máy in/thiết bị in.

Khi làm thủ tục nhập khẩu máy in được chia ra làm hai loại, đó là:

- Thủ tục nhập khẩu máy in cần xin giấy phép;

- Thủ tục nhập khẩu máy in không cần xin giấy phép.

Hãy cùng Proship tiếp tục cập nhật những vấn đề liên quan khi làm thủ tục nhập khẩu các loại máy in về Việt Nam bên dưới đây nhé.

>>Xem thêm: Thủ tục nhập khẩu đèn led

Thủ tục nhập khẩu máy in như thế nào? Có khó, phức tạp không?

Để nhập khẩu một thiết bị in ấn về Việt Nam, cần có 3 bước (xin giấy phép NK thiết bị in, làm thủ tục hải quan, thông quan hàng hóa). Trong đó, quan trọng nhất là bước xin giấy phép nhập khẩu máy in.

Proship Logistics sẽ chia sẻ tất tần tật những kiến thức, thông tin cần biết về quy trình thủ tục nhập khẩu máy in, đối tượng được nhập khẩu, mã HS và thuế nhập khẩu, chính sách nhập khẩu máy in,…cho các Tư nhân/Doanh nghiệp tham khảo áp dụng:

Chính sách nhập khẩu máy in

Thủ tục nhập khẩu thiết bị máy in được quy định trong các văn bản sau:

- Nghị định 60/2014/NĐ-CP ngày 19/06/2021;

- Thông tư 38/2015/TT-BTC ngày 25/3/2015; sửa đổi bổ sung 39/2018/TT-BTC ngày 20/04/2018;

- Quyết định 2479/QĐ-BTTTT ngày 29/12/2017;

- Thông tư 16/2015/TT-BTTTT ngày 17/06/2015;

- Thông tư 22/2018/TT-BTTTT có hiệu lực từ ngày 13/02/2019 quy định danh mục hàng hóa thiết bị phải xin GPNK máy in theo mã HS.

* Lưu ý: Khi làm thủ tục nhập khẩu sẽ có nhiều văn bản quy định khác nữa, tùy thuộc vào loại máy in mà bạn muốn nhập khẩu về Việt Nam.

Đối tượng được nhập khẩu thiết bị in

Theo quy định tại khoản 2 điều 27 nghị định 60/2014/NĐ-CP quy định về đối tượng nhập khẩu máy in gồm:

- Cơ sở in;

- Doanh nghiệp có chức năng kinh doanh xuất nhập khẩu thiết bị ngành in theo quy định của pháp luật;

- Cơ quan, tổ chức khác có tư cách pháp nhân được phép sử dụng thiết bị in để phục vụ công việc nội bộ.

Tuy nhiên khoản này bị bãi bỏ bởi Điều 3 Nghị định 25/2018/NĐ-CP. Theo đó, đối tượng xin giấy phép nhập khẩu máy in có thể là:

- Doanh nghiệp, tổ chức có tư cách pháp nhân;

- Hộ kinh doanh;

- Chi nhánh của đơn vị;

- Cá nhân phục vụ học tập, nghiên cứu.

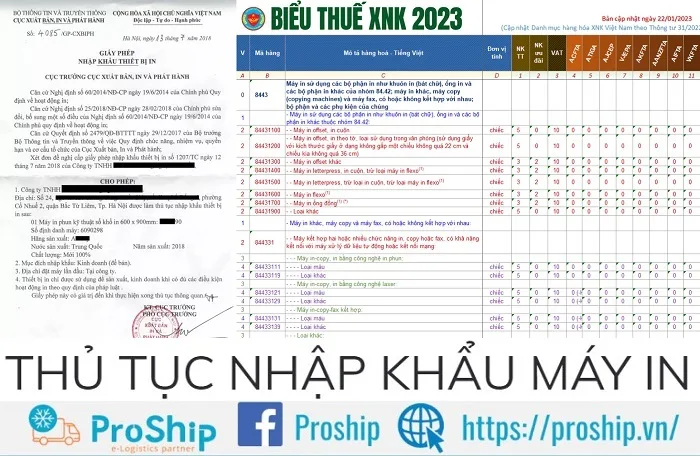

Mã HS và thuế khi nhập khẩu máy in

Khi nhập khẩu Máy in, Nhà nhập khẩu cần nộp các loại thuế sau:

- Thuế VAT: 10%;

- Thuế NK thông thường: 5%;

- Thuế NK ưu đãi: 0%.

Máy in có HS thuộc “Chương 84: LÒ PHẢN ỨNG HẠT NHÂN, NỒI HƠI, MÁY VÀ THIẾT BỊ CƠ KHÍ; CÁC BỘ PHẬN CỦA CHÚNG”. Dưới đây là Bảng cập nhật thuế VAT và thuế nhập khẩu ưu đãi Máy in năm 2023:

| Mã HS | Mô tả | Thuế VAT | Thuế nhập khẩu ưu đãi |

| 8443 | Máy in sử dụng các bộ phận in như khuôn in (bát chữ), ống in và các bộ phận in khác của nhóm 84.42; máy in khác, máy copy (copying machines) và máy fax, có hoặc không kết hợp với nhau; bộ phận và các phụ kiện của chúng. | ||

| – Máy in sử dụng các bộ phận in như khuôn in (bát chữ), ống in và các bộ phận in khác thuộc nhóm 84.42: | |||

| 84431100 | – – Máy in offset, in cuộn | 10 | 0 |

| 84431200 | – – Máy in offset, in theo tờ, loại sử dụng trong văn phòng (sử dụng giấy với kích thước giấy ở dạng không gấp một chiều không quá 22 cm và chiều kia không quá 36 cm) | 10 | 0 |

| 84431300 | – – Máy in offset khác | 10 | 2 |

| 84431400 | – – Máy in letterpress, in cuộn, trừ loại máy in flexo. | 10 | 2 |

| 84431500 | – – Máy in letterpress, trừ loại in cuộn, trừ loại máy in flexo. | 10 | 2 |

| 84431600 | – – Máy in flexo | 10 | 2 |

| 84431700 | – – Máy in ống đồng | 10 | 2 |

| 84431900 | – – Loại khác | 10 | 0 |

| – Máy in khác, máy copy và máy fax, có hoặc không kết hợp với nhau: | |||

| 844331 | – – Máy kết hợp hai hoặc nhiều chức năng in, copy hoặc fax, có khả năng kết nối với máy xử lý dữ liệu tự động hoặc kết nối mạng: | ||

| – – – Máy in-copy, in bằng công nghệ in phun: | |||

| 84433111 | – – – – Loại màu | 10 | 0 |

| 84433119 | – – – – Loại khác | 10 | 0 |

| – – – Máy in-copy, in bằng công nghệ laser: | |||

| 84433121 | – – – – Loại màu | 10 | 0 |

| 84433129 | – – – – Loại khác | 10 | 0 |

| – – – Máy in-copy-fax kết hợp: | |||

| 84433131 | – – – – Loại màu | 10 | 0 |

| 84433139 | – – – – Loại khác | 10 | 0 |

| – – – Loại khác: | |||

| 84433191 | – – – – Máy in-copy-scan-fax kết hợp | 10 | 0 |

| 84433199 | – – – – Loại khác | 10 | 0 |

| 844332 | – – Loại khác, có khả năng kết nối với máy xử lý dữ liệu tự động hoặc kết nối mạng: | ||

| – – – Máy in kim: | |||

| 84433211 | – – – – Loại màu | 10 | 0 |

| 84433219 | – – – – Loại khác | 10 | 0 |

| – – – Máy in phun: | |||

| 84433221 | – – – – Loại màu | 10 | 0 |

| 84433229 | – – – – Loại khác | 10 | 0 |

| – – – Máy in laser: | |||

| 84433231 | – – – – Loại màu | 10 | 0 |

| 84433239 | – – – – Loại khác | 10 | 0 |

| – – – Máy fax: | |||

| 84433241 | – – – – Loại màu | 10 | 0 |

| 84433249 | – – – – Loại khác | 10 | 0 |

| 84433250 | – – – Máy in kiểu lưới dùng để sản xuất các tấm mạch in hoặc tấm mạch dây in | 10 | 0 |

| 84433260 | – – – Máy vẽ (Plotters) | 10 | 0 |

| 84433290 | – – – Loại khác | 10 | 0 |

| 844339 | – – Loại khác: | 10 | 0 |

| 84433910 | – – – Máy photocopy tĩnh điện, hoạt động bằng cách tái tạo hình ảnh gốc trực tiếp lên bản sao (quá trình tái tạo trực tiếp) | 10 | 0 |

| 84433920 | – – – Máy photocopy tĩnh điện, hoạt động bằng cách tái tạo hình ảnh gốc lên bản sao thông qua bước trung gian (quá trình tái tạo gián tiếp) | 10 | 10 |

| 84433930 | – – – Máy photocopy khác kết hợp hệ thống quang học | 10 | 0 |

| 84433940 | – – – Máy in phun | 10 | 5 |

| 84433990 | – – – Loại khác | 10 | 5 |

Hồ sơ hải quan nhập khẩu thiết bị máy in

Khi nhập khẩu máy in các loại về Việt Nam cần chuẩn bị các loại hồ sơ, chứng từ sau:

- Commercial Invoice (Hóa đơn thương mại) – Bản sao của doanh nghiệp, với một số chi cục, cần nộp bản gốc khi lô hàng áp dụng thuế ưu đãi đặc biệt với một số form C/O (vd: Form E);

- Bill of lading (Vận đơn) – Bản sao của doanh nghiệp;

- Giấy giới thiệu – Bản chính;

- Certificate of origin (Giấy chứng nhận xuất xứ) – Bản gốc hoặc bản điện tử trong trường hợp người nhập khẩu muốn được hưởng thuế nhập khẩu ưu đãi đặc biệt;

- Một số trường hợp, thêm: Packing List (Phiếu đóng gói hàng hóa) – Bản sao của doanh nghiệp;

- Với một số chi cục: thêm Bản Thỏa thuận Phát triển Quan hệ đối tác Hải quan – Doanh nghiệp – Bản chính;

- Giấy phép nhập khẩu (nếu máy in muốn nhập có mã HS thuộc phụ lục I thông tư 22/2018/TT-BTTTT).

Các bước làm thủ tục nhập khẩu máy in mới nhất

Thủ tục nhập khẩu thiết bị máy in ấn về Việt Nam khó không? Để nhập khẩu máy in một cách nhanh chóng và suôn sẻ, cần nắm rõ các bước thực hiện như sau:

Bước 1: Chuẩn bị hồ sơ

Để có thể xin giấy phép nhập khẩu máy in, Cá nhân/Doanh nghiệp có nhu cầu nhập khẩu máy in cần chuẩn bị hồ sơ đầy đủ và chi tiết, gồm:

- Chứng từ làm thủ tục hải quan;

- Hợp đồng mua bán;

- Hóa đơn thương mại (Commercial invoice);

- Bản kê hàng hóa (Packing list);

- Vận đơn (Bill of Lading);

- Giấy chứng nhận xuất xứ hàng hóa (Certificate of Origin)

Bước 2: Nộp hồ sơ đề nghị cấp giấy phép nhập khẩu thiết bị in

Tổ chức, cá nhân làm thủ tục nhập khẩu máy in nộp hồ sơ đề nghị cấp giấy phép nhập khẩu thiết bị qua hệ thống dịch vụ công trực tuyến hoặc dịch vụ bưu chính, chuyển phát hoặc nộp trực tiếp tại Cục Xuất bản, Bộ Thông tin và Truyền thông (Đơn đề nghị cấp giấy phép nhập khẩu theo mẫu số 04 tại phụ lục của nghị định số 25/2018/NĐ-CP; Catalogue của các thiết bị in; Bản sao giấy đăng ký kinh doanh.

Bước 3: Chờ phản hồi từ Cơ quan Chính phủ

Trong thời gian 05 ngày làm việc, kể từ ngày nhận đủ hồ sơ, Bộ Thông tin và Truyền thông sẽ cấp giấy phép nhập khẩu thiết bị máy in. Trong trường hợp không cấp giấy phép sẽ có văn bản trả lời nêu rõ lý do.

Bước 4: Nộp hồ sơ thông quan hàng hóa cho hải quan

Sau khi được cấp giấy phép, bạn nộp cho cơ quan Hải quan khi làm thủ tục là có thể thông quan lô hàng máy in nhập khẩu.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Proship Logistics có nhận Ủy thác xuất nhập khẩu hàng hóa ở Cửa khẩu, Sân bay, Cảng biển không?

Công ty Cổ phần Proship chúng tôi tự hào là Đơn vị cung cấp Dịch vụ ủy thác xuất nhập khẩu – Đơn vị khai thuê hải quan – Đại lý khai báo hải quan Chuyên nghiệp, Uy tín, Chất lượng, Giá rẻ tốt nhất. Nhận khai hải quan tại tất cả các sân bay, cửa khẩu và cảng biển trên phạm vi toàn quốc, được sự tín nhiệm cao từ nhiều Tập đoàn, Doanh nghiệp XNK. Proship Logistics sẽ giúp quý khách giải quyết các vướng mắc về thủ tục nhập khẩu hàng hóa nói chung và thủ tục nhập khẩu máy in nói riêng, cùng chia sẻ những khó khăn trong quá trình chuẩn bị nhập khẩu một lô hàng/kiện hàng.

Đối với vai trò là Đơn vị khai thuê hải quan, Proship KHÔNG XUẤT HIỆN trên bất kỳ chứng từ nào của bộ hồ sơ khai quan. Nhiệm vụ của Đơn vị thực hiện khai thuê HQ cửa khẩu/sân bay/cảng biển chúng tôi là lên tờ khai bằng phần mềm riêng rồi dùng Token Khách hàng để ký tờ khai, dùng giấy giới thiệu của chủ hàng làm thủ tục hải quan. Phía Chủ hàng/DN phải dùng CHỮ KÝ SỐ của mình để duyệt ký (từ xa), hay gửi giấy khống,…Đối với Cơ quan hải quan, Đơn vị khai thuê hàng xuất nhập khẩu chúng tôi là Người của Chủ hàng.

Còn trong vai trò là Đại lý khai báo hải quan, phía chúng tôi sẽ dùng CHỮ KÝ SỐ hợp lệ để khai hải quan và chịu trách nhiệm nội dung khai trên tờ khai hải quan cùng với Doanh nghiệp XNK; Thay mặt Doanh nghiệp làm thủ tục xuất nhập hàng hóa theo Hợp đồng KBHQ cửa khẩu/sân bay/cảng biển ký kết giữa 2 bên; Tên, mã số của Đại lý hải quan Proship được thể hiện trên tờ khai và trên hệ thống hải quan.

Mặt hàng Proship nhận KBHQ tại cửa khẩu, sân bay, cảng biển

Các mặt hàng nhận khai hải quan trọn gói tại cửa khẩu, sân bay, cảng biển gồm:

- Nhóm hàng thức ăn thủy sản, thức ăn gia súc, thức an gia cầm;

- Nhóm mặt hàng máy móc ĐÃ QUA SỬ DỤNG (là mặt hàng dễ làm thủ tục hải quan, chứng từ): Máy công nghiệp và dân dụng, xe xúc, đào, ủi, máy tiện, máy phay…;

- Nhóm mặt hàng thiết bị chuyên dụng: Thiết bị Y tế, thiết bị CN, Thiết bị ngành hàng không, quốc phòng, Thiết bị máy in màu, ngành in ấn;

- Nhóm hàng phân bón, thuốc bảo vệ thực vật;

- Hàng thủ công mỹ nghệ: mây tre đan…;

- Linh kiện điện tử, phụ tùng máy móc công nghiệp;

- Mặt hàng phân bón, đồ chơi trẻ em, thang máy, thang cuốn, vât liệu xây dựng, bồn cầu, chén,…và nhiều mặt hàng khác.

Lợi ích khi chọn Dịch vụ ủy thác xuất nhập khẩu tại Proship Logistics

Các Cá nhân, DN kinh doanh nên chọn Dịch vụ ủy thác XNK, khai hải quan trọn gói của Proship bởi sự chuyên nghiệp và uy tín:

- Hoàn thành tiến trình KBHQ theo tiêu chí: “Nhanh chóng – Chính xác – Giá rẻ – Chuyên nghiệp”;

- Không đặt mục tiêu cung cấp Dịch vụ khai hải quan GIÁ RẺ NHẤT mà đảm bảo chi phí HỢP LÝ NHẤT;

- Nắm rõ quy trình thông quan hàng hóa tại các sân bay/cửa khẩu/cảng biển toàn quốc;

- Kỹ năng xử lý nhanh các lô hàng XNK khó khai HQ tại cảng biển/sân bay/cửa khẩu;

- Có đủ phương tiện cần thiết để phục vụ hiệu quả cho hoạt động Logistics;

- Khách hàng được tư vấn về chứng từ, quy trình thủ tục, áp mã HS,…bởi đội ngũ nhân viên có nghiệp vụ HQ;

- Am hiểu, cập nhật các Thông tư, Nghị định hải quan,…mới nhất để tư vấn cho khách hàng;

- Cam kết bảo mật thông tin hàng hóa + thông tin khách cung cấp khi sử dụng Dịch vụ KBHQ sân bay/cửa khẩu/cảng biển;

- Cam kết giao hàng tận nơi cho khách theo yêu cầu (chuẩn xác về thời gian và địa điểm);

- Có VP đại diện tại TPHCM/Hà Nội/Đà Nẵng, thuận lợi cho nhu cầu thuê Dịch vụ khai hải quan trọn gói của DN;

- Chính sách đền bù thiệt hại thỏa đáng cho khách nếu xảy ra tình trạng chậm trễ trong KBHQ.

Dịch vụ khác Proship cung cấp khi khai báo hải quan trọn gói

Proship còn nhận tư vấn, cung cấp dịch vụ khác song song với Dịch vụ KBHQ tại các cửa khẩu/sân bay/cảng biển như:

- Phân tích phân loại hàng hóa;

- Dịch vụ kiểm dịch thực vật/động vật (khoảng 700.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ kiểm tra vệ sinh an toàn thực phẩm;

- Dịch vụ kiểm tra chất lượng, giám định hàng hóa;

- Dịch vụ xin chứng nhận xuất xứ (Certificate Of Origin – C/O) (khoảng từ 1.000.000 – 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy chứng nhận hợp quy, công bố hợp quy (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố mỹ phẩm (khoảng 2.500.000 triệu – 3.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố thực phẩm thông thường (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy phép các bộ ngành;

- Dịch vụ hun trùng (khoảng 350.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường).

Trên đây là thông tin cần biết về Thủ tục nhập khẩu máy in về Việt Nam dành cho các Hộ kinh doanh/DN/Tổ chức/Cá nhân đang có nhu cầu kinh doanh, phân phối các thiết bị in ấn trong nước tiện tham khảo. Và nếu đơn vị bạn chưa có nhiều kinh nghiệm trong vấn đề làm thủ tục nhập khẩu hoặc xin giấy phép – thông quan hàng sao cho nhanh chóng, hợp lệ – Liên hệ ngay với Proship qua số 0909 344 247 hoặc Hotline bên dưới để được đáp ứng nhanh mọi yêu cầu.