Doanh nghiệp, đơn vị bạn đang có lô hàng chuẩn bị làm thủ tục KBHQ, làm tờ khai hải quan theo quy định nhưng chưa có nhiều kinh nghiệm? Bạn chưa biết cách đọc, cách ghi chép, điền các ký hiệu và số hiệu như thế nào cho chuẩn trên tờ khai hải quan hàng xuất, hàng nhập khẩu? Bạn muốn biết lỗi thường gặp khi điền tờ khai hải quan là gì? Nếu sai, có cách nào khắc phục các lỗi này hay không?

Proship.vn chúng tôi sẽ hướng dẫn bạn Cách đọc ký hiệu và số hiệu trên tờ khai hải quan một cách chi tiết nhất, chuẩn xác nhất mà bất cứ chủ hàng hoặc doanh nghiệp nào cũng cần phải biết để giúp quá trình thông quan hàng xuất, hàng nhập được mau chóng và thuận lợi.

Hướng dẫn cách ghi ký hiệu, số hiệu trên tờ khai hải quan chuẩn nhất

Bạn đã biết cách đọc, ghi ký hiệu và số hiệu trên tờ khai hải quan thế nào chuẩn nhất chưa? Nếu chưa, hãy cùng Proship tìm hiểu hướng dẫn chi tiết dưới đây:

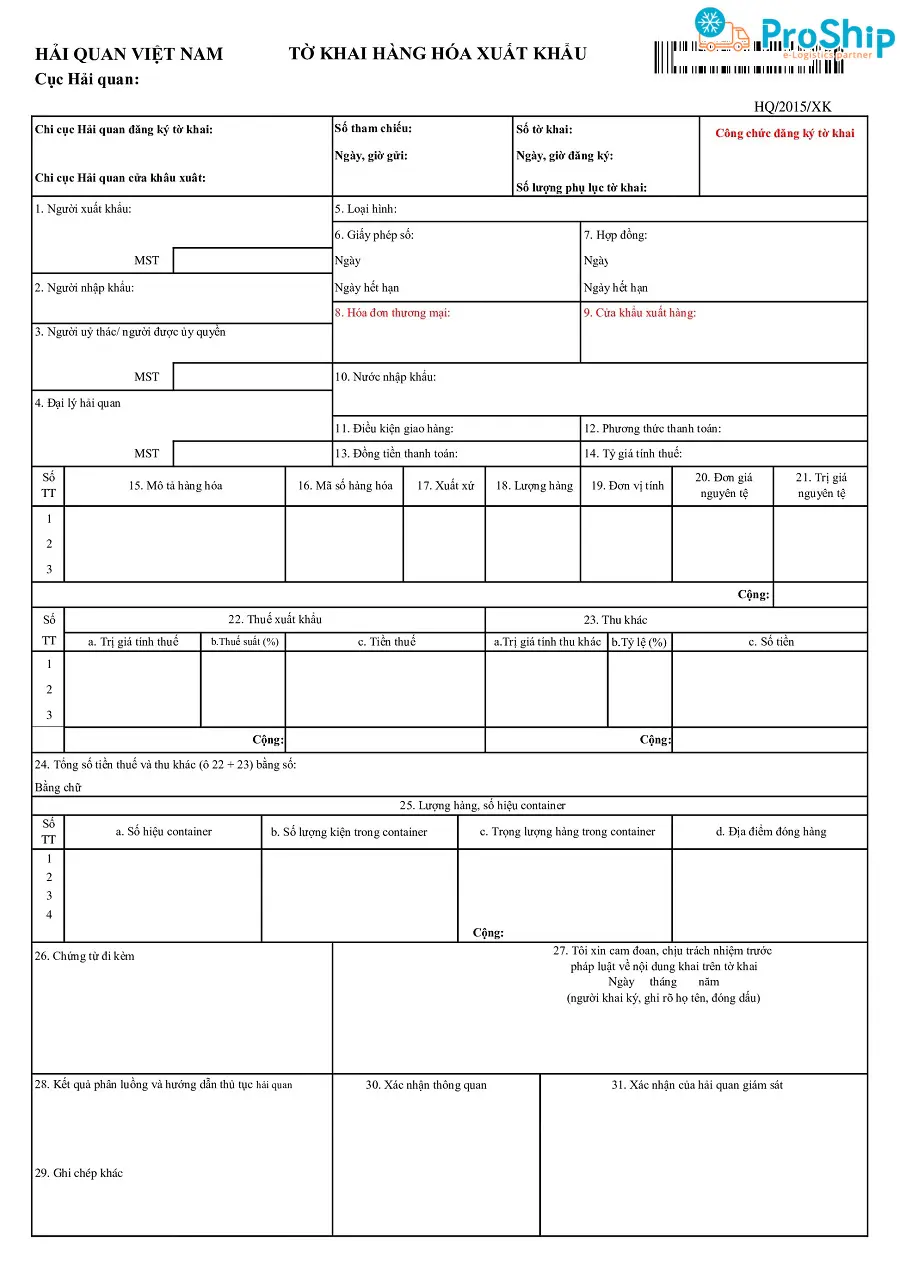

Cách điền, ghi chép thông tin tờ khai hàng xuất khẩu

Ô số 01: Người xuất khẩu

Điền đầy đủ họ và tên, địa chỉ, số điện thoại, số fax, mã số thuế của thương nhân Việt Nam bán hàng cho người mua hàng ở nước ngoài (CCCD/CMT/Hộ chiếu nếu là cá nhân).

Ô số 02: Người nhập khẩu

Điền đầy đủ họ và tên, địa chỉ, số điện thoại, số Fax và mã số thuế (nếu có) của thương nhân nhập khẩu.

Ô số 03: Người ủy thác/người được ủy quyền

Điền họ và tên, địa chỉ, số điện thoại, số fax, mã số thuế của thương nhân ủy thác cho người xuất khẩu hoặc người được ủy quyền hải quan, CCCD/CMT/Hộ chiếu nếu người được ủy quyền là cá nhân.

Ô số 04: Đại lý hải quan

Điền họ và tên, địa chỉ, số điện thoại, số fax, mã số thuế của đại lý hải quan, Số hợp đồng, ngày hợp đồng của đại lý hải quan.

Ô số 05: Ghi rõ loại hình xuất khẩu tương ứng

Ô số 06: Ghi số, ngày, tháng, năm trên giấy phép của các cơ quan quản lý chuyên ngành đối với hàng hóa xuất khẩu và ngày, tháng, năm hết hạn của giấy phép (Nếu có)

Ô số 07:

Ghi số ngày, tháng, năm ký hợp đồng và ngày, tháng, năm hết hạn của hợp đồng hoặc phụ lục hợp đồng (nếu có).

Ô số 08:

Ghi số, ngày, tháng, năm của hoá đơn thương mại (nếu có).

Ô số 09:

Ghi tên cảng, địa điểm nơi hàng hóa được xếp lên phương tiện vận tải để xuất khẩu.

Ô số 10:

Ghi tên nước, vùng lãnh thổ đến cuối cùng được xác định tại thời điểm hàng hóa xuất khẩu, không tính nước, vùng lãnh thổ mà hàng hóa đó quá cảnh.

Ô số 11:

Ghi rõ điều kiện giao hàng mà hai bên mua và bán thỏa thuận trong hợp đồng thương mại.

Ô số 12:

Ghi rõ phương thức thanh toán đã thoả thuận trong hợp đồng thương mại (nếu có).

Ô số 13:

Ghi mã của loại tiền tệ dùng để thanh toán được thỏa thuận trong hợp đồng thương mại (Nếu có).

Ô số 14:

Ghi tỷ giá giữa đơn vị nguyên tệ với tiền Việt Nam áp dụng để tính thuế bằng đồng Việt Nam (Nếu có).

Ô số 15:

Ghi rõ tên hàng, quy cách phẩm chất hàng hóa theo hợp đồng thương mại và tài liệu khác liên quan đến lô hàng.

* Nếu lô hàng có từ 4 mặt hàng trở lên thì ghi như sau:

- Trên tờ khai hải quan ghi: “theo phụ lục tờ khai”.

- Trên phụ lục tờ khai: ghi rõ tên, quy cách phẩm chất từng mặt hàng.

* Nếu lô hàng được áp vào một mã số nhưng trong lô hàng có nhiều chi tiết, nhiều mặt hàng thì ghi tên gọi chung của lô hàng trên tờ khai, được phép lập bản kê chi tiết (không phải khai vào phụ lục).

Ô số 16:

Ghi mã số phân loại theo Danh mục hàng hóa xuất khẩu, nhập khẩu Việt Nam. Nếu lô hàng có từ 04 mặt hàng trở lên thì ghi như sau:

- Trên tờ khai hải quan: không ghi gì.

- Trên phụ lục tờ khai: ghi rõ mã số từng mặt hàng.

Ô số 17:

Ghi tên nước, vùng lãnh thổ nơi hàng hoá được chế tạo ra. Áp dụng mã nước quy định trong ISO. Nếu lô hàng có từ 4 mặt hàng trở lên thì cách ghi tương tự tại ô số 16.

Ô số 18:

Ghi số lượng, khối lượng hoặc trọng lượng từng mặt hàng trong lô hàng thuộc tờ khai hải quan đang khai báo phù hợp với đơn vị tính tại ô số 19. Nếu lô hàng có từ 04 mặt hàng trở lên thì cách ghi tương tự tại ô số 16.

Ô số 20:

Ghi giá của một đơn vị hàng hoá bằng loại tiền tệ đã ghi ở ô số 13, căn cứ vào thoả thuận trong hợp đồng thương mại, hoá đơn, L/C hoặc tài liệu khác liên quan đến lô hàng. Nếu lô hàng có từ 4 mặt hàng trở lên thì ghi tương tự như ô số 16.

Ô số 21:

Ghi trị giá nguyên tệ của từng mặt hàng xuất khẩu, là kết quả của phép nhân (X) giữa “Lượng hàng (ô số 18) và “Đơn giá (ô số 20)”. Nếu lô hàng có từ 4 mặt hàng trở lên thì cách ghi như sau:

- Trên tờ khai hải quan: ghi tổng trị giá nguyên tệ của các mặt hàng khai báo trên phụ lục tờ khai.

- Trên phụ lục tờ khai: Ghi trị giá nguyên tệ cho từng mặt hàng.

Ô số 22:

- Trị giá tính thuế: Ghi trị giá tính thuế từng mặt hàng bằng đơn vị tiền Việt Nam;

- Thuế suất (%): Ghi mức thuế suất tương ứng với mã số xác định tại ô số 16;

- Ghi số thuế xuất khẩu phải nộp của từng mặt hàng.

Nếu lô hàng có từ 4 mặt hàng trở lên thì:

- Trên tờ khai hải quan ghi tổng số thuế xuất khẩu phải nộp tại ô “cộng”;

- Trên phụ lục tờ khai ghi rõ trị giá tính thuế, thuế suất, số thuế xuất khẩu phải nộp cho từng mặt hàng.

Ô số 23:

- Trị giá tính thu khác: Ghi số tiền phải tính thu khác;

- Tỷ lệ %: Ghi tỷ lệ các khoản thu khác theo quy định;

- Số tiền: Ghi số tiền phải nộp.

Nếu lô hàng có từ 4 mặt hàng trở lên thì cách ghi tương tự như ô 22:

Ô số 24:

Tổng số tiền thuế và thu khác (ô 22 + 23), người khai hải quan ghi tổng số tiền thuế xuất khẩu, thu khác, bằng số và bằng chữ

Ô số 25:

Ghi đầy đủ, chính xác Số hiệu container; Số lượng kiện trong container; Trọng lượng hàng trong container; Địa điểm đóng hàng…

Ô số 26:

Liệt kê các chứng từ đi kèm của tờ khai hàng hoá xuất khẩu

Ô số 27:

Ghi ngày/ tháng/ năm khai báo, ký xác nhận, ghi rõ họ tên, chức danh và đóng dấu trên tờ khai.

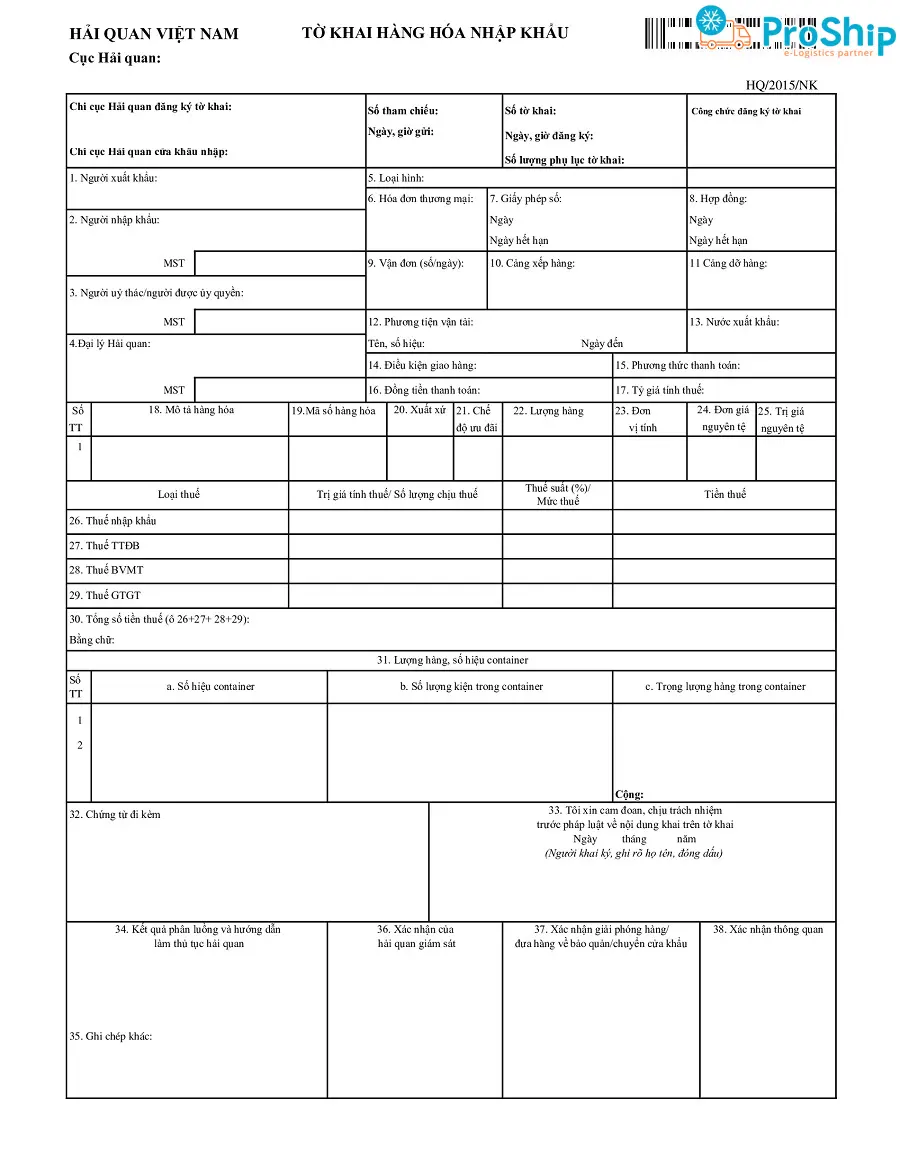

Cách điền, ghi chép thông tin tờ khai hàng nhập khẩu

Ô số 01:

Ghi tên đầy đủ, địa chỉ, số điện thoại, số Fax và mã số (nếu có) của người bán hàng ở nước ngoài bán hàng cho thương nhân Việt Nam.

Ô số 02:

Ghi tên đầy đủ, địa chỉ, số điện thoại, số Fax và mã số thuế của thương nhân nhập khẩu.

Ô số 03:

Người ủy thác/người được ủy quyền.

Ô số 04:

Đại lý hải quan.

Ô số 05:

Ghi rõ loại hình xuất khẩu tương ứng.

Ô số 06:

Ghi số, ngày, tháng, năm của hoá đơn thương mại (nếu có).

Ô số 07:

Ghi số, ngày, tháng, năm giấy phép của cơ quan quản lý chuyên ngành đối với hàng hóa nhập khẩu và ngày, tháng, năm hết hạn của giấy phép.

Ô số 08:

Ghi số ngày, tháng, năm ký hợp đồng và ngày, tháng, năm hết hạn của hợp đồng hoặc phụ lục hợp đồng.

Ô số 09:

Ghi số, ngày, tháng, năm của vận đơn hoặc chứng từ vận tải có giá trị do người vận tải cấp thay thế vận đơn.

Ô số 10:

Ghi tên cảng, địa điểm.

Ô số 11:

Ghi tên cảng/cửa khẩu nơi hàng hóa được dỡ từ phương tiện vận tải xuống.

Ô số 12:

Ghi tên tàu biển, số chuyến bay, số chuyến tàu hỏa, số hiệu và ngày đến của phương tiện vận tải chở hàng hoá nhập khẩu từ nước ngoài vào Việt Nam.

Ô số 13:

Ghi tên nước, vùng lãnh thổ nơi mà từ đó hàng hóa được chuyển đến Việt Nam.

Ô số 14:

Ghi rõ điều kiện giao hàng mà hai bên mua và bán thoả thuận trong hợp đồng thương mại.

Ô số 15:

Ghi rõ phương thức thanh toán đã thoả thuận trong hợp đồng thương mại.

Ô số 16:

Ghi mã của loại tiền tệ dùng để thanh toán (nguyên tệ) được thoả thuận trong hợp đồng thương mại.

Ô số 17:

Ghi tỷ giá giữa đơn vị nguyên tệ với tiền Việt Nam áp dụng để tính thuế bằng đồng Việt Nam

Ô số 18:

Ghi rõ tên hàng, quy cách phẩm chất hàng hóa theo hợp đồng thương mại hoặc các chứng từ khác liên quan đến lô hàng.

Ô số 19:

Ghi mã số phân loại theo Danh mục hàng hóa xuất khẩu, nhập khẩu Việt Nam.

Ô số 20:

Ghi tên nước, vùng lãnh thổ nơi hàng hóa được sản xuất ra.

Ô số 21:

Ghi tên mẫu C/O được cấp cho lô hàng thuộc các Hiệp định Thương mại tự do mà Việt Nam là thành viên.

Ô số 22:

Ghi số lượng, khối lượng hoặc trọng lượng từng mặt hàng trong lô hàng thuộc tờ khai hải quan đang khai báo phù hợp với đơn vị tính tại ô số 23.

Ô số 23:

Ghi tên đơn vị tính của từng mặt hàng theo quy định tại Danh mục hàng hóa xuất khẩu, nhập khẩu hoặc thực tế giao dịch.

Ô số 24:

Ghi giá của một đơn vị hàng hóa (theo đơn vị ở ô số 23) bằng loại tiền tệ đã ghi ở ô số 16.

Ô số 25:

Ghi trị giá nguyên tệ của từng mặt hàng nhập khẩu, là kết quả của phép nhân (x) giữa “Lượng hàng (ô số 22) và “Đơn giá nguyên tệ (ô số 24)”.

Ô số 26:

- Trị giá tính thuế: Ghi trị giá tính thuế của từng mặt hàng bằng đồng Việt Nam.

- Thuế suất (%): Ghi mức thuế suất tương ứng với mã số đã xác định tại ô số 19 theo Biểu thuế áp dụng.

- Ghi số thuế nhập khẩu phải nộp của từng mặt hàng.

Ô số 27:

- Trị giá tính thuế của thuế tiêu thụ đặc biệt là tổng của trị giá tính thuế nhập khẩu và thuế nhập khẩu phải nộp của từng mặt hàng

- Thuế suất %: Ghi mức thuế suất thuế TTĐB tương ứng với mã số hàng hóa được xác định mã số hàng hoá tại ô số 19 theo Biểu thuế TTĐB.

- Tiền thuế: Ghi số thuế TTĐB phải nộp của từng mặt hàng

Nếu lô hàng có từ 02 mặt hàng trở lên thì ghi tương tự ô số 26

Ô số 28:

- Số lượng chịu thuế bảo vệ môi trường của hàng hóa nhập khẩu là số lượng hàng hóa theo đơn vị quy định tại biểu mức thuế Bảo vệ môi trường.

- Mức thuế BVMT của hàng hóa nhập khẩu theo quy định tại biểu mức thuế Bảo vệ môi trường.

- Tiền thuế: Ghi số tiền thuế BVMT phải nộp của từng mặt hàng.

Trường hợp lô hàng có từ 2 mặt hàng trở lên ghi tương tự ô số 26.

Ô số 29:

- Trị giá tính thuế của thuế giá trị gia tăng = Giá thuế nhập khẩu tại cửa khẩu

- Thuế nhập khẩu (nếu có) + Thuế TTĐB (nếu có)+ Thuế BVMT (nếu có).

- Thuế suất %: Tương ứng với mã số hàng hóa được xác định mã số hàng hoá tại ô số 19 theo Biểu thuế GTGT.

- Tiền thuế: Ghi số tiền thuế GTGT phải nộp của từng mặt hàng.

Trường hợp lô hàng có từ 2 mặt hàng trở lên thì cách ghi tương tự ô 26.

Ô số 30:

Tổng số tiền thuế (ô 26 + 27 + 28 + 29), người khai hải quan ghi tổng số tiền thuế nhập khẩu, TTĐB, BVMT và GTGT; bằng chữ.

Ô số 31:

Trường hợp có từ 4 container trở lên thì người ghi cụ thể thông tin trên phụ lục tờ khai hải quan không ghi trên tờ khai.

Ô số 32:

Liệt kê các chứng từ đi kèm của tờ khai hàng hoá nhập khẩu.

Ô số 33:

Ghi ngày/ tháng/ năm khai báo, ký xác nhận, ghi rõ họ tên, chức danh và đóng dấu trên tờ khai.

Những lỗi phổ biến khi điền tờ khai hải quan và cách khắc phục

Như trên, bạn đã biết cách đọc, ghi chép ký hiệu và số hiệu trên tờ khai hải quan sao cho chuẩn xác nhất.

Dưới đây là những lỗi phổ biến thường gặp khi điền tờ khai hải quan cùng nguyên nhân, cách khắc phục hiệu quả nhất:

| Lỗi sai | Nguyên nhân | Cách khắc phục |

| Khai báo sai nhóm hoặc sai mã loại hình | Đối với những người mới bắt đầu khai báo thường dễ bị lỗi này vì không hiểu rõ mục đích của các nhóm loại hình và mã loại hình tương ứng. | Trước khi điền tờ khai, cần tìm hiểu kĩ mục đích kinh doanh xuất nhập khẩu của doanh nghiệp. Khi đã hiểu rõ mục đích đó, hãy chọn đúng nhóm và mã loại hình. Khai báo sai nhóm hoặc mã loại hình là một lỗi không được phép và có thể không được sửa chữa sau này. |

| Khai sai mã hiệu phương thức vận chuyển | Ngay cả những người có kinh nghiệm trong khai báo hải quan có thể mắc lỗi này. Lỗi này có thể xảy ra khi người điền thông tin sao chép từ tờ khai cũ nhưng quên cập nhật mã hiệu phương thức vận chuyển. | Khi khai sai mã hiệu phương thức vận chuyển sẽ không được phép khai bổ sung mà bắt buộc phải hủy tờ khai.

Hãy kiểm tra tất cả chứng từ để xác định chính xác mã hiệu phương thức vận chuyển và so sánh với thông tin đã khai báo trước khi nộp tờ khai chính thức. |

| Khai báo sai tên người nhập khẩu cho tờ khai xuất và sai tên người xuất khẩu cho tờ khai nhập | Khi có một bên thứ ba tham gia vào giao dịch mua bán, người điền thông tin có thể bị nhầm lẫn về thông tin người nhập khẩu và người xuất khẩu. | Để tránh lỗi này, người điền thông tin cần xác định rõ người nhập khẩu và người xuất khẩu trong giao dịch. |

| Khai báo sai số lượng kiện | Do sự đa dạng của hàng hóa và cách đóng gói, người điền thông tin có thể sai lầm khi khai báo số lượng kiện bên trong kiện hàng. | Khi điền tờ khai hải quan, chỉ cần khai báo số lượng kiện tổng cộng, không cần khai báo số lượng chi tiết bên trong kiện hàng. Chi tiết này đã được quản lý bằng số lượng riêng. |

| Khai báo sai mã hàng | Đối với các doanh nghiệp nhập khẩu miễn thuế, cần phải tạo mã cho nguyên liệu và sản phẩm để quản lý. Sai mã có thể xảy ra khi quản lý mã hàng không chính xác. | Hãy kiểm tra và cập nhật mã hàng đúng xác. |

Proship Logistics vừa hướng dẫn bạn cách đọc hiểu, ghi chép, điền chuẩn xác những ký hiệu và số hiệu trên tờ khai hải quan hàng xuất nhập khẩu. Theo đó, nếu doanh nghiệp, chủ hàng nào chưa có kinh nghiệm làm tờ khai hải quan nên lưu lại. Liên hệ ngay 0909 344 247 để được giải đáp mọi thắc mắc liên quan tới KBHQ, tờ khai hải quan, thuê Đại lý hải quan, thuê Dịch vụ Ủy thác xuất nhập khẩu giá rẻ,…