x Bạn là người nhập khẩu, hay người xuất khẩu đang tham gia vào các giao dịch, thanh toán quốc tế cần tìm hiểu kỹ phương thức L/C At Sight?

x Các cá nhân, tổ chức, doanh nghiệp xuất nhập khẩu chưa nắm được quá trình thanh toán và phát hành At Sight LC thế nào? Có phức tạp không?

x Và các nhà xuất khẩu, nhà nhập khẩu cũng cần biết trong LC At Sight gồm những nội dung gì? Các bên tham gia trong quá trình thanh toán L/C này là những ai?

Proship.vn chúng tôi sẽ chuyển tải nhanh kiến thức cần biết về LC at sight là gì? Các bên tham gia phát hành At sight L/C gồm những ai? Quy trình phát hành L/C at sight được tiến hành ra sao?,…để các doanh nghiệp, người xuất khẩu, nhập khẩu nắm bắt kịp thời về phương thức thanh toán thông dụng này.

Thanh toán L/C At Sight là gì?

LC at sight là gì? L/C At Sight là Thư tín dụng phổ biến nhất hiện nay và là loại L/C trả ngay, KHÔNG THỂ HỦY NGANG.

Người bán sẽ được thanh toán khi xuất trình bộ chứng từ đầy đủ, phù hợp và ngân hàng sẽ xử lý chứng từ tối đa 5 ngày làm việc. Người mua có bất lợi là nếu không có sẵn tiền thanh toán và thường tìm nguồn tài trợ từ bên ngoài (chủ yếu là từ Ngân hàng Mở).

NÊN XEM: Hỗ trợ vận chuyển Container nội địa giá tốt

Các bên tham gia trong thanh toán At Sight L/C

Hình thức thanh toán LC at sight là gì đã được làm rõ ở trên. Vậy, các bên tham gia trong thanh toán At sight L/C gồm những ai? Proship giải đáp như sau:

Người xuất khẩu (Beneficiary – Seller)

Là người bán, người hưởng lợi thư tín dụng, có quyền nhận thanh toán khi xuất trình bộ chứng từ hợp lệ theo yêu cầu của At Sight L/C.

Người nhập khẩu (Applicant – Buyer)

Người mua, người yêu cầu ngân hàng mở At Sight L/C để cam kết thanh toán cho bên xuất khẩu.

Ngân hàng thông báo thư tín dụng (Advising Bank)

Là ngân hàng tại quốc gia của người xuất khẩu, có nhiệm vụ thông báo L/C cho người xuất khẩu.

Ngân hàng phát hành (Issuing Bank)

Là ngân hàng do người nhập khẩu yêu cầu để mở L/C, cam kết thanh toán cho người xuất khẩu khi chứng từ phù hợp với điều kiện của thư tín dụng.

Ngân hàng xác nhận (Confirming Bank), ngân hàng chiết khấu (Negotiating bank), ngân hàng trả tiền (Reimbursing Bank)

Tùy từng trường hợp các ngân hàng này có thể có hoặc không tham gia vào quy trình thanh toán At Sight L/C.

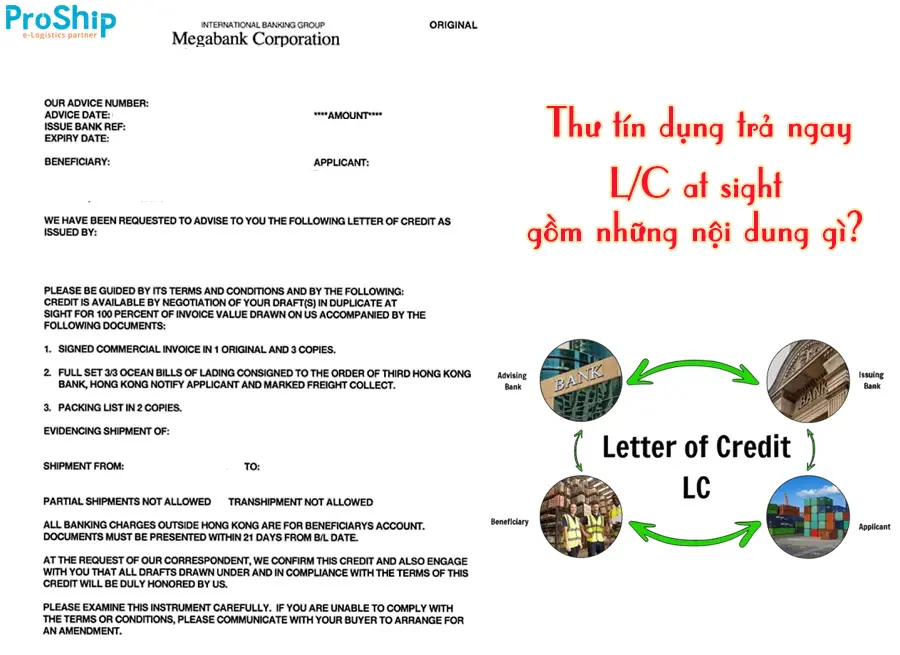

L/C at sight bao gồm những nội dung gì?

Nội dung lc at sight là gì, gồm những gì? Nội dung trên L/C At Sight bao gồm:

Thông tin cơ bản

Thông tin cơ bản gồm:

- Số hiệu LC;

- Tên và địa chỉ của người mua (người yêu cầu phát hành L/C) và người bán (người hưởng lợi);

- Số tiền thanh toán được chỉ định trong một loại tiền tệ cụ thể;

- Mô tả chi tiết về hàng hóa hoặc dịch vụ được giao dịch, bao gồm số lượng, thông số kỹ thuật, chất lượng và giá trị.

Thời hạn và địa điểm giao hàng

Quy định thời hạn, địa điểm giao hàng:

- Thời gian cuối cho việc giao hàng hoặc dịch vụ;

- Địa điểm hoặc cảng giao nhận hàng hóa.

Thời hạn của L/C

Ngày hết hạn của L/C, sau ngày này L/C không còn hiệu lực.

Chứng từ yêu cầu

Danh sách các chứng từ cần thiết để nhận thanh toán như hóa đơn thương mại, vận đơn, chứng nhận xuất xứ, chứng từ kiểm tra hoặc bất kỳ chứng từ đặc biệt nào khác theo yêu cầu của thương vụ.

Điều kiện thanh toán

Điều khoản thanh toán “At Sight”, là thanh toán ngay lập tức sau khi các chứng từ hợp lệ được trình lên ngân hàng.

Ngân hàng phát hành và ngân hàng thông báo/xác nhận

Tên và thông tin của ngân hàng phát hành L/C và ngân hàng thông báo hoặc xác nhận (nếu có).

Các điều khoản và điều kiện khác

Bất kỳ yêu cầu hoặc điều kiện đặc biệt nào khác liên quan đến giao dịch.

Chữ ký và con dấu

Chữ ký, con dấu của ngân hàng phát hành để xác nhận tính hợp pháp của L/C.

Quy định về sự tuân thủ

Điều khoản tuân thủ các quy định quốc tế như Quy tắc Thống nhất về Thư Tín Dụng (UCP) của Phòng Thương mại Quốc tế.

XEM THÊM: Dịch vụ vận chuyển Container Lạnh uy tín

L/C trả ngay và L/C trả chậm có gì khác nhau? Quy trình phát hành At sight L/C ra sao?

Cùng Proship tìm hiểu sự khác nhau giữa L/C trả chậm với L/C trả ngay và quy trình các bước phát hành LC At sight:

Phân biệt L/C At sight trả ngay và L/C Deferred trả chậm

Tham khảo bảng sau để hiểu rõ sự khác biệt giữa LC trả ngay và LC trả chậm:

| Tiêu chí so sánh | L/C trả ngay (At Sight L/C) | L/C trả chậm (Deferred L/C) |

| Thời gian thanh toán | Ngay sau khi người xuất khẩu xuất trình bộ chứng từ hợp lệ. | Sau một khoảng thời gian nhất định từ 30 – 90 ngày, kể từ ngày giao hàng/xuất trình chứng từ. |

| Tính chất thanh toán | Thanh toán ngay khi chứng từ được ngân hàng xác nhận hợp lệ. | Thanh toán thực hiện vào ngày đáo hạn đã thỏa thuận trước. |

| Rủi ro cho người bán | Thấp, vì người bán nhận tiền ngay sau khi hoàn thành nghĩa vụ giao hàng và xuất trình chứng từ hợp lệ. | Cao hơn, vì phải chờ đến ngày đáo hạn mới nhận được tiền, tiềm ẩn rủi ro bên mua không thanh toán đúng hạn. |

| Lợi ích cho người mua | Không có thời gian trì hoãn thanh toán, phải thanh toán ngay sau khi chứng từ được xác nhận. | Người mua có thêm thời gian gom tiền, thu hồi vốn sau khi nhận hàng, giúp tối ưu dòng tiền. |

| Chi phí | Không phát sinh chi phí lãi suất hoặc phí chậm trả. | Người mua có thể phải chịu thêm chi phí lãi suất do ngân hàng ứng vốn cho người bán trong thời gian chờ thanh toán. |

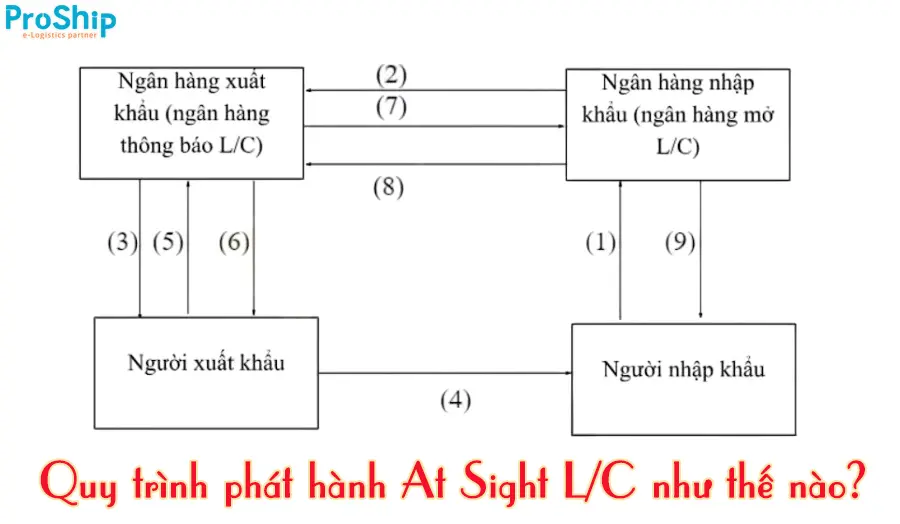

Quy trình phát hành At Sight L/C

Quy trình phát hành LC at sight như sau:

- Bước 1:

Nhà nhập khẩu và xuất khẩu ký hợp đồng.

- Bước 2:

Nhà nhập khẩu đề nghị Ngân hàng bên nhập khẩu phát hành LC cho người thụ hưởng là nhà xuất khẩu.

- Bước 3:

Ngân hàng phát hành sẽ lập LC và thông qua Ngân hàng đại lý của mình ở đầu xuất khẩu thông báo thư tín dụng đã được mở.

- Bước 4:

Ngân hàng thông báo (bên nhà xuất khẩu) sẽ thông báo cho nhà xuất khẩu nội dung LC và kiểm tra xem đã khớp các điều kiện thỏa thuận trên Hợp đồng chưa và đề nghị xác nhận, đồng thời gửi bản gốc LC cho nhà xuất khẩu.

- Bước 5:

Nhà xuất khẩu chấp nhận LC.

- Bước 6:

Sau khi giao hàng, nhà xuất khẩu lập bộ chứng từ theo yêu cầu của LC và xuất trình thông qua Ngân hàng thông báo cho Ngân hàng mở LC đề nghị thanh toán.

- Bước 7:

Ngân hàng mở LC kiểm tra tính hợp lệ của bộ chứng từ, nếu hợp lệ thì tiến hành thanh toán cho nhà xuất khẩu, nếu không phù hợp thì từ chối thanh toán và trả lại Hồ sơ cho nhà xuất khẩu.

- Bước 8:

Ngân hàng mở LC đòi tiền nhà nhập khẩu và chuyển bộ chứng từ gốc cho nhà nhập khẩu sau khi đã nhận xác nhận thanh toán hoặc đã thanh toán.

- Bước 9:

Nhà nhập khẩu kiểm tra chứng từ, nếu thấy phù hợp thì tiến hành thanh toán hoặc chấp nhận thanh toán. Nếu không phù hợp nội dung LC thì có quyền từ chối thanh toán.

LC at sight là gì và những kiến thức quan trọng về Thanh toán trả ngay mà Proship Logistics vừa trình bày ở trên, hi vọng sẽ là nguồn tham khảo hữu ích cho các nhà xuất khẩu, nhập khẩu,…Mọi thắc mắc về các Phương thức thanh toán quốc tế trong xuất nhập khẩu hoặc nếu có nhu cầu sử dụng các dịch vụ vận chuyển hàng đa phương thức giá rẻ, liên hệ ngay 0909 344 247 để được hỗ trợ.