Các doanh nghiệp, chủ hàng đang tiến hành làm tờ khai hải quan và cần biết các phương thức thanh toán trên tờ khai hải quan phổ biến hiện nay là gì? Bạn chưa biết các quy định liên quan đối với từng phương thức thanh toán trên tờ khai hải quan thế nào? Bạn lăn tăn việc nếu sai phương thức thanh toán trên tờ khai hải quan sẽ xử lý thế nào, việc điều chỉnh, sửa chữa có rắc rối không,…?

Proship.vn chúng tôi sẽ cập nhật chi tiết các phương thức thanh toán trên tờ khai hải quan phổ biến mà bất cứ cá nhân, doanh nghiệp, chủ hàng nào cũng cần phải biết. Đồng thời, qua đây bạn cũng biết được trong trường hợp sai phương thức thanh toán trên tờ khai sẽ xử lý thế nào để cẩn thận hơn trong khi khai báo.

Các phương thức thanh toán trên tờ khai Hải quan theo Thông tư 39

Sau đây, Proship sẽ liệt kê các phương thức thanh toán trên tờ khai hải quan theo Thông tư 39:

BIENMAU – Biên mậu

Là hoạt động thanh toán trong mua bán trao đổi hàng hóa, dịch vụ qua biên giới giữa thương nhân hai nước theo quy định tại Hiệp định về mua bán trao đổi hàng hoá ở vùng biên giới giữa Chính phủ hai nước.

CAD – Trao chứng từ trả tiền ngay

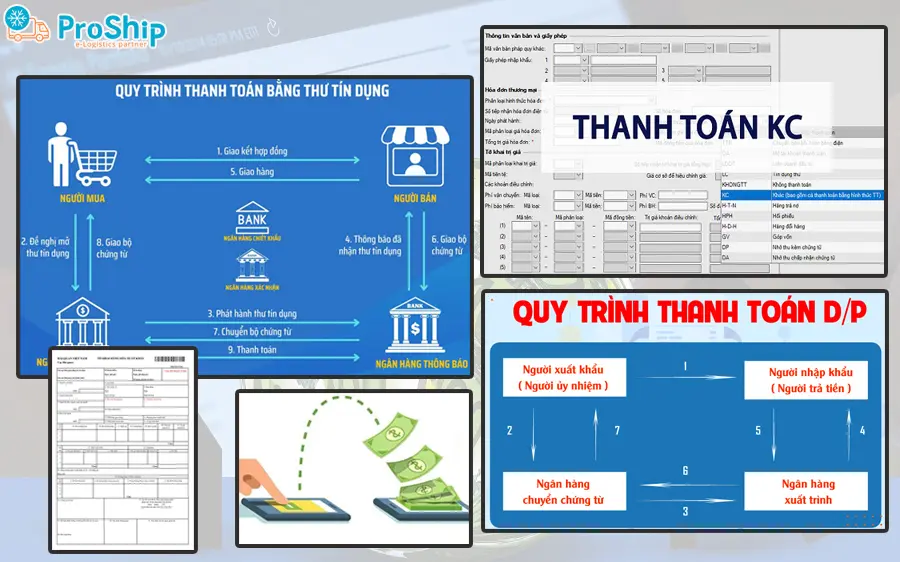

CAD là phương thức thanh toán mà trong đó, người nhập khẩu yêu cầu một ngân hàng mở một tài khoản để thanh toán tiền hàng cho người XK khi người XK đã giao hàng và xuất trình đủ chứng từ.

DA – Chấp nhận thanh toán khi nhận chứng từ

Phương thức này áp dụng khi mua hàng trả tiền sau. Ngân hàng chỉ trao bộ chứng từ gửi hàng cho người mua đi làm thủ tục nhận hàng khi người này ký chấp nhận thanh toán lên hối phiếu do người bán ký phát.

CASH – Tiền mặt

Là phương thức thanh toán mà trong đó người nhập khẩu dùng tiền mặt để trả cho người xuất khẩu. Phương thức này chỉ sử dụng trong trường hợp mua bán qua biên giới.

CANTRU – Cấn trừ, bù trừ

Bù trừ công nợ là giữa hai đơn vị giao dịch mua bán với nhau và cung cấp hàng hóa lẫn nhau, khi đó các đối tượng vừa là người bán vừa là người mua sẽ lập biên bản bù trừ công nợ để cấn trừ cho nhau.

CHEQUE – Séc

Là phương tiện thanh toán được sử dụng tại các nước có hệ thống ngân hàng phát triển cao. SÉC dùng trong thanh toán nội địa và thanh toán quốc tế về hàng hóa, dịch vụ cũng như các chi trả phi mậu dịch khác.

DP – Nhờ thu kèm chứng từ

Phương thức thanh toán này sử dụng khi mua hàng trả tiền ngay, ngân hàng sẽ trao bộ chứng từ cho người mua để làm thủ tục thông quan lô hàng, sau khi người này đã thanh toán toàn bộ tiền hàng.

GV – Góp vốn

Tiêu chí phương thức thanh toán trên tờ khai là : “GV”: Góp vốn.

* Ví dụ: Công ty A (Việt Nam) 100% vốn đầu tư nước ngoài nhập khẩu phụ tùng, máy móc thiết bị đã qua sử dụng từ Chủ đầu tư ở Hàn Quốc về tạo tài sản cố định theo hình thức công ty mẹ góp vốn đầu tư. Công ty A sẽ không thanh toán trị giá của những phụ tùng, máy móc thiết bị nhập khẩu này.

H-D-H – Hàng đổi hàng

Là phương thức thanh toán mà nhà XNK sẽ dùng hàng hóa để trao đổi với nhau, hàng hóa là phương tiện thanh toán chính chứ không phải tiền.

* Ví dụ: Theo thỏa thuận hợp đồng giữa hai bên, Công ty A – Việt Nam nhập máy móc phục vụ cho sản xuất từ Công ty B – Trung Quốc, công ty B không yêu cầu thanh toán số tiền mua máy trên. Thay vào đó, công ty A sẽ phải xuất khẩu trả lại cho công ty B sản phẩm do A sản xuất với trị giá hàng xuất tương đương với trị giá máy móc nhập khẩu.

HPH – Hối phiếu

Hối phiếu là tờ mệnh lệnh trả tiền vô điều kiện do một người ký phát cho người khác, yêu cầu người này: Hoặc khi nhìn thấy hối phiếu, hay một ngày cụ thể trong tương lai; hoặc tại một ngày cụ thể có thể xác định phải trả một số tiền nhất định cho một người nào đó, hoặc theo lệnh của người này trả cho người khác hoặc trả cho người cầm phiếu.

KHONGTT – Không thanh toán

Sử dụng trong các tờ khai phi mậu dịch hoặc các tờ khai tạm nhập tái xuất liên quan đến sửa chữa còn bảo hành mà không phải thanh toán phí sửa chữa,…

LC – Tín dụng thư

Thư tín dụng (Letter of Credit – L/C) do ngân hàng phát hành theo yêu cầu người nhập khẩu, cam kết với người bán về việc thanh toán một khoản tiền nhất định trong một khoảng thời gian nhất định.

LDDT – Liên doanh đầu tư

Là hình thức có vốn góp của Nhà đầu tư Việt Nam theo hợp đồng liên doanh.

OA – Mở tài khoản thanh toán

Ghi sổ (Open Account) là phương thức thanh toán mà Nhà xuất khẩu sẽ mở một tài khoản ghi nợ những khoản tiền hàng và dịch vụ mà họ cung cấp cho nhà nhập khẩu. Nhà nhập khẩu định kỳ thanh toán số tiền phát sinh trên tài khoản bằng chuyển tiền hay bằng séc.

TTR – Chuyển tiền bồi hoàn bằng điện

Phương thức này áp dụng trong thanh toán L/C. Nếu L/C cho phép TTR, người xuất khẩu khi xuất trình bộ chứng từ hợp lệ cho ngân hàng thông báo sẽ được thanh toán ngay. Ngân hàng thông báo sẽ gửi điện đòi tiền cho Ngân hàng phát hành L/C và được hoàn trả số tiền này trong vòng 3 ngày.

KC – Khác

Phương thức thanh toán KC trên tờ khai hải quan chỉ các phương thức thanh toán khác, bao gồm TT.

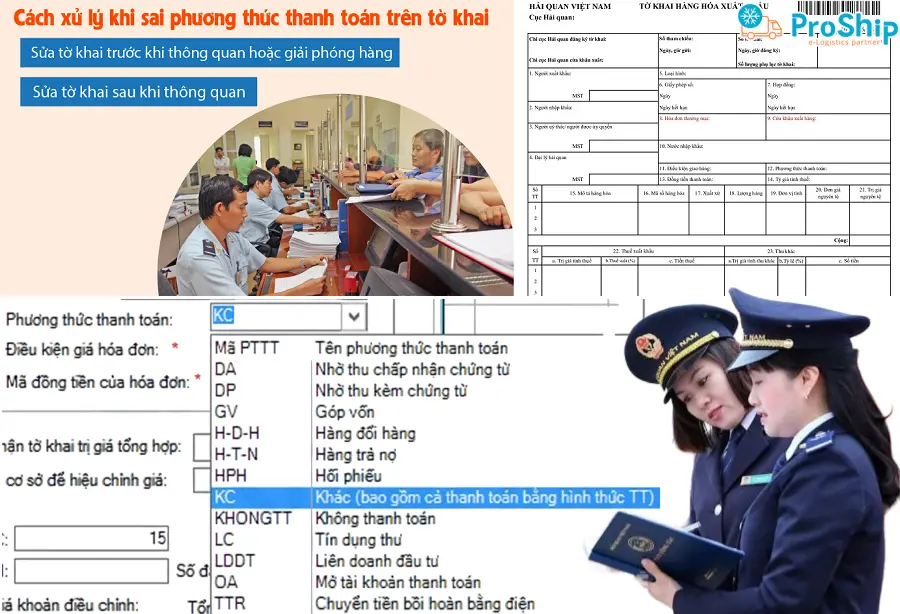

Trường hợp sai phương thức thanh toán, xử lý thế nào?

Nếu sai phương thức thanh toán trên tờ khai hải quan, doanh nghiệp, cá nhân sẽ:

Sửa tờ khai sau khi thông quan

Sau thời điểm cơ quan hải quan kiểm tra hồ sơ và thực tế hàng hóa, người KBHQ thực hiện khai bổ sung. Đồng thời sẽ bị xử lý theo quy định pháp luật về vi phạm hành chính.

Nếu khai hải quan phát hiện ra sai sót ở thời điểm hơn 60 ngày sẽ phải khai bổ sung, bị xử lý theo quy định pháp luật về thuế và xử lý vi phạm hành chính.

Sửa tờ khai trước khi thông quan hoặc giải phóng hàng hóa

Sửa tờ khai trước khi thông quan xảy ra khi người KBHQ phát hiện ra lỗi sai và bổ sung hồ sơ trước thời điểm Cơ quan hải quan kiểm tra hồ sơ hải quan.

Sau thời điểm hải quan kiểm tra hồ sơ, thông tin hàng hóa, nếu người KBHQ phát hiện lỗi sai thì phải thực hiện bổ sung thông tin tờ khai. Đồng thời, cũng phải xử lý theo quy định pháp luật về thuế và vi phạm hành chính. Để bổ sung thông tin, người khai sẽ lấy tờ khai trên ECUS để khai thông tin trên Hệ thống. Bên cạnh đó sẽ nộp thêm các chứng từ liên quan đến việc khai bổ sung qua hệ thống hoặc bằng giấy.

Trong quá trình kiểm tra hồ sơ, thực tế hàng hóa nếu HQ phát hiện tờ khai và hồ sơ hải quan không trùng khớp, người KBHQ phải bổ sung thông tin trong 5 ngày. Nếu quá hạn sẽ bị xử lý vi phạm hành chính.

Proship Logistics chúng tôi đã tổng hợp các phương thức thanh toán trên tờ khai hải quan theo Thông tư 39 cho chủ hàng, doanh nghiệp, tư nhân, tổ chức nắm rõ và hiểu đúng quy định, cách thức áp dụng từng phương thức. Nếu có bất cứ thắc mắc nào, liên hệ ngay 0909 344 247 để được giải đáp và cung cấp các Dịch vụ vận tải Đa phương thức giá rẻ (khi có nhu cầu).