x Các doanh nghiệp XNK, đơn vị khai thuê hải quan, Đại lý KBHQ,…cần tìm hiểu Thủ tục hải quan là gì và quy định liên quan?

x Bạn muốn biết hồ sơ làm thủ tục hải quan gồm những gì? Địa điểm làm thủ tục hải quan ở đâu? Quy trình thế nào?

x Bạn cần biết đối tượng phải làm thủ tục hải quan là những ai? Lỗi thường gặp khi làm thủ tục hải quan là gì?

Proship.vn sẽ giải đáp nhanh thủ tục hải quan là gì và kiến thức liên quan để các đối tượng phải thực hiện thủ tục thông quan nắm rõ. Đồng thời, chúng tôi cũng chỉ ra các lỗi thường gặp khi làm thủ tục hải quan để cá nhân, doanh nghiệp,…tránh mắc phải làm chậm trễ kế hoạch thông quan hàng hóa.

ĐỌC THÊM: Giá vận chuyển Container Bắc Nam

Thủ tục hải quan là gì? Ai phải làm thủ tục thông quan?

Khái niệm thủ tục hải quan

Thủ tục hải quan là gì? Thủ tục hải quan là các công việc mà người khai hải quan và công chức hải quan phải thực hiện theo quy định của Luật này đối với hàng hóa, phương tiện vận tải.

Thủ tục hải quan gồm việc kiểm tra, xác minh thông tin, thu thuế hải quan,…Địa bàn hoạt động gồm các vị trí và khu vực cửa khẩu biên giới, cảng biển, khu vực lưu giữ hàng hóa, khu chế xuất, và các điểm làm thủ tục hải quan.

Đối tượng phải làm thủ tục thông quan

Theo Điều 5 Nghị định 08/2015/NĐ-CP của Chính phủ, những đối tượng phải làm thủ tục hải quan gồm:

- Các doanh nghiệp cung cấp dịch vụ chuyển phát quốc tế, trừ những chủ hàng có yêu cầu khác;

- Các đại lý, đơn vị cung cấp dịch vụ khai thuê hải quan;

- Các chủ phương tiện vận chuyển xuất/nhập cảnh hoặc quá cảnh; cá nhân được chủ phương tiện ủy quyền làm thủ tục;

- Các chủ lô hàng XNK. Nếu chủ lô hàng là thương nhân nước ngoài sẽ làm thủ tục tại đại lý chuyên về thủ tục thông quan/hải quan;

- Đơn vị cung cấp dịch vụ quá cảnh hàng hóa;

- Cá nhân được chủ hàng ủy quyền khi hàng hóa là quà tặng, quà biếu, hành lý được gửi trước hoặc hành lý gửi sau khi chủ sở hữu đã xuất/nhập cảnh.

Hồ sơ làm thủ tục hải quan gồm những gì? Địa điểm làm thủ tục hải quan ở đâu?

Bộ hồ sơ hải quan gồm những gì?

Bộ hồ sơ làm thủ tục hải quan là gì? Hồ sơ hải quan là tập hợp các tài liệu và thông tin cần thiết để thực hiện thủ tục hải quan khi nhập/xuất hàng hóa. Hồ sơ hải quan gồm:

- Tờ khai hải quan hoặc chứng từ thay thế tờ khai hải quan:

Là tài liệu mô tả chi tiết hàng hóa, giá trị và các thông tin khác liên quan. Tờ khai hải quan có thể là giấy tờ giấy hoặc điện tử.

- Chứng từ liên quan:

Hợp đồng mua bán hàng hóa, hóa đơn thương mại, chứng từ vận tải, chứng từ chứng nhận xuất xứ hàng hóa, giấy phép XNK và các văn bản khác liên quan đến hàng hóa.

Địa điểm làm thủ tục hải quan

Điều 22 Luật Hải quan 2014 quy định địa điểm làm thủ tục hải quan:

1. Địa điểm làm thủ tục hải quan là nơi cơ quan hải quan tiếp nhận, đăng ký và kiểm tra hồ sơ hải quan, kiểm tra thực tế hàng hóa, phương tiện vận tải.

2. Địa điểm tiếp nhận, đăng ký và kiểm tra hồ sơ hải quan là trụ sở Cục Hải quan, trụ sở Chi cục Hải quan.

3. Địa điểm kiểm tra thực tế hàng hóa gồm:

- Địa điểm kiểm tra tại khu vực cửa khẩu đường bộ, ga đường sắt liên vận quốc tế, cảng hàng không dân dụng quốc tế; bưu điện quốc tế;

- Cảng biển, cảng thủy nội địa có hoạt động XNK, xuất cảnh, nhập cảnh, quá cảnh; cảng XNK được thành lập trong nội địa;

- Trụ sở Chi cục Hải quan;

- Địa điểm kiểm tra tập trung theo quyết định của Tổng cục trưởng Tổng cục Hải quan;

- Địa điểm kiểm tra tại cơ sở sản xuất, công trình; nơi tổ chức hội chợ, triển lãm;

- Địa điểm kiểm tra tại khu vực kho ngoại quan, kho bảo thuế, địa điểm thu gom hàng lẻ;

- Địa điểm kiểm tra chung giữa Hải quan Việt Nam với Hải quan nước láng giềng tại khu vực cửa khẩu đường bộ;

- Địa điểm khác do Tổng cục trưởng Tổng cục Hải quan quyết định trong trường hợp cần thiết;

- Cơ quan, tổ chức, cá nhân có thẩm quyền khi quy hoạch, thiết kế xây dựng liên quan đến cửa khẩu đường bộ, ga đường sắt liên vận quốc tế, cảng hàng không dân dụng quốc tế;

- Cảng biển, cảng thủy nội địa có hoạt động XNK, xuất cảnh, nhập cảnh, quá cảnh;

- Cảng xuất khẩu, nhập khẩu hàng hóa được thành lập trong nội địa;

- KKT, KCN, khu phi thuế quan và các địa điểm khác có hoạt động XNK, xuất cảnh, nhập cảnh, quá cảnh có trách nhiệm bố trí địa điểm làm thủ tục hải quan và nơi lưu giữ hàng XNK đáp ứng yêu cầu kiểm tra, giám sát hải quan theo quy định Luật Hải quan 2014.

NÊN ĐỌC: Nhận vận chuyển Container lạnh uy tín, giá tốt

Các lỗi thường gặp khi làm thủ tục hải quan

Các doanh nghiệp lưu ý một số lỗi thường gặp:

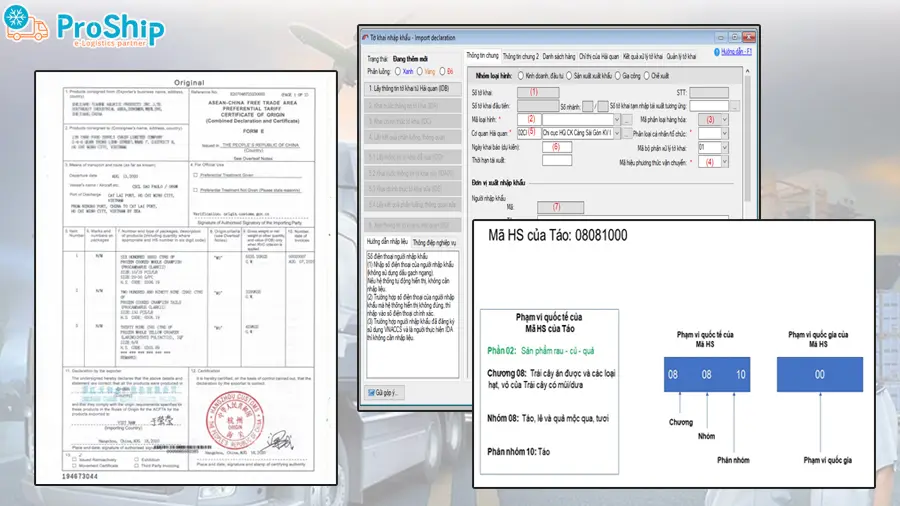

Sử dụng mã HS code không chính xác

Người làm thủ tục hải quan cần tuân thủ nguyên tắc áp dụng HS code. Tuy nhiên, những chủ hàng luôn có suy nghĩ áp dụng HS code với mức thuế suất thấp nhất cho hàng hóa còn đơn vị hải quan thì ngược lại. Vì vậy, người kê khai hải quan phải cẩn thận khi áp mã HS code.

Thông tin trên bộ chứng từ không chính xác

Một số lỗi sai thông tin chứng từ phổ biến như: sai chính tả, sai trọng lượng hàng hóa, số lượng mặt hàng, điều kiện không khớp,…Một khi sai sót, chủ hàng có nguy cơ tổn thất nhiều tiền bạc, thời gian và công sức do khai sai hoặc nhầm lẫn địa điểm giao hàng, số cont, tàu chở hàng.

Lỗi C/O thường gặp

Lỗi này nếu sai sót sẽ khiến C/O bị từ chối và doanh nghiệp phải chịu thuế suất KHÔNG ƯU ĐÃI. Nếu C/O được cấp bởi bên thứ 3 thì số hóa đơn phải là số của người bán và phải được đánh dấu vào ô “Third Party Invoicing”. Nếu C/O mắc các lỗi nêu trên thì cơ quan Hải quan sẽ từ chối, không xem xét và chấp nhận.

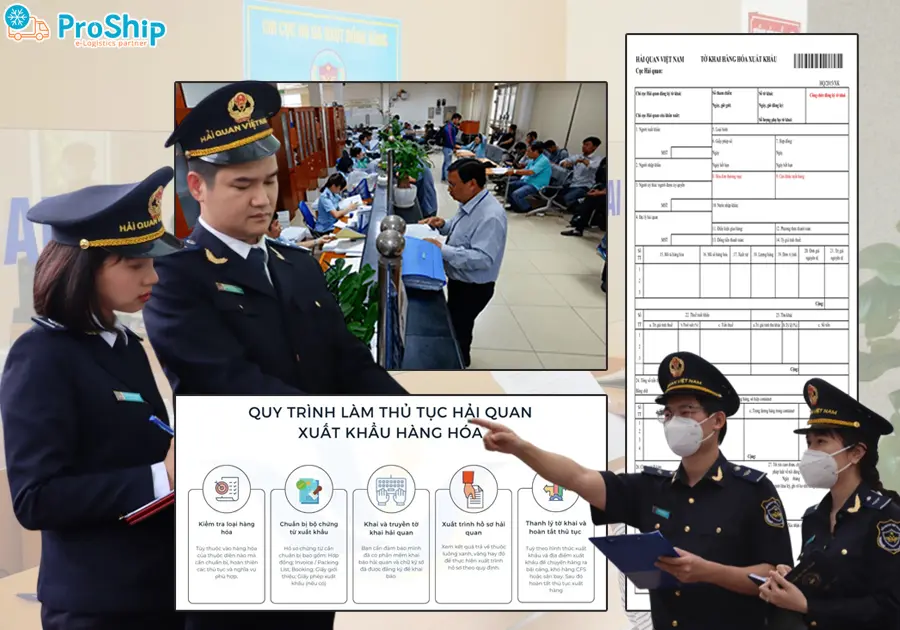

Quy trình làm thủ tục hải quan ra sao?

Quy trình làm thủ tục hải quan theo quy định:

- Bước 1: Khai, nộp tờ khai hải quan; nộp hoặc xuất trình chứng từ thuộc hồ sơ HQ theo quy định tại Điều 24 Luật Hải quan 2014;

- Bước 2: Đưa hàng hóa, phương tiện vận tải đến địa điểm quy định để kiểm tra thực tế hàng hóa, phương tiện vận tải;

- Bước 3: Nộp thuế, thực hiện các nghĩa vụ tài chính khác theo quy định pháp luật về thuế, phí, lệ phí và quy định khác của pháp luật có liên quan.

Điều 21 Luật Hải quan 2014 quy định khi làm thủ tục HQ, Cơ quan hải quan, Công chức hải quan có trách nhiệm:

- Tiếp nhận và đăng ký hồ sơ hải quan;

- Kiểm tra hồ sơ hải quan và kiểm tra thực tế hàng hóa, phương tiện vận tải;

- Tổ chức thu thuế và các khoản thu khác theo quy định của pháp luật về thuế, phí, lệ phí và quy định khác của pháp luật có liên quan;

- Quyết định việc thông quan hàng hóa, giải phóng hàng hóa, xác nhận phương tiện vận tải đã hoàn thành thủ tục hải quan.

Proship Logistics đã làm rõ khái niệm thủ tục hải quan là gì, hồ sơ làm thủ tục hải quan gồm những gì, quy trình làm thủ tục hải quan ra sao, lỗi thường gặp khi làm thủ tục hải quan,…để các đối tượng bắt buộc phải thực hiện thông quan tham khảo và áp dụng vào tiến trình xuất nhập khẩu. Mọi thắc mắc liên quan, liên hệ ngay 0909 344 247.