x Các Tổ chức, Cá nhân, DN, Cơ sở kinh doanh có nhu cầu nhập khẩu bình chữa cháy về Việt Nam cho nhiều mục đích khác nhau?

x Bạn mới nhập khẩu thiết bị chữa cháy về nước lần đầu và chưa rành về thủ tục hải quan, cách xin giấy phép, đóng thuế ra sao,…?

x Bạn cần tới sự hỗ trợ của Đơn vị ủy thác XNK chuyên nghiệp, tận tâm, uy tín nhằm đẩy nhanh tiến trình thông quan hàng hóa?

Do mặt hàng bình chữa cháy là mặt hàng mang tính đặc thù, cần phải đảm bảo các quy định nghiêm ngặt trong quá trình vận chuyển và nhập khẩu. Với kinh nghiệm nhiều năm trong lĩnh vực XNK, Proship.vn xin chia sẻ nhanh thủ tục nhập khẩu bình chữa cháy mới nhất 2023 để các Doanh nghiệp đang có nhu cầu kinh doanh, sử dụng thiết bị phòng cháy chữa cháy thông dụng này tiện tham khảo.

Song song đó, Proship Logistics cũng giới thiệu Dịch vụ Ủy thác xuất nhập khẩu tại sân bay/cửa khẩu/cảng biển toàn quốc trọn gói giá rẻ của đơn vị mình. Bạn quan tâm và có nhu cầu sử dụng dịch vụ có thể lựa chọn chúng tôi trong vai trò là Đơn vị khai thuê hải quan hoặc Đại lý hải quan chuyên trách. Dù ở vai trò nào, Proship cũng sẽ đáp ứng tốt nhất, nhanh nhất mọi yêu cầu của quý vị.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Nhu cầu sử dụng và nhập khẩu bình cứu hỏa hiện nay

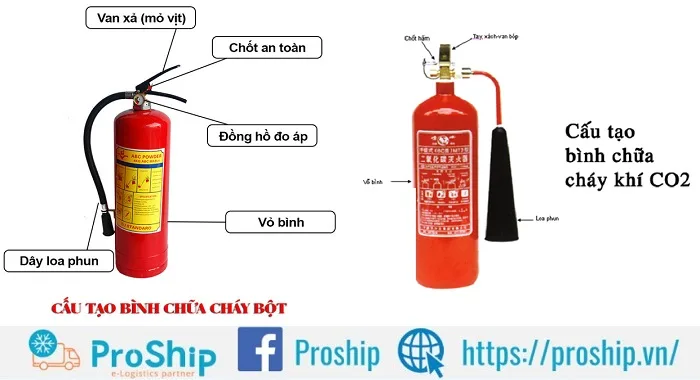

Bình cứu hỏa là thiết bị khá phổ biến trong phòng cháy chữa cháy, được sử dụng trong tình huống khẩn cấp để dập tắt hoặc kiểm soát các đám cháy nhỏ hoặc diễn ra bất ngờ. Thông thường, bình chữa cháy là một thiết bị cầm tay hình trụ tròn có van áp suất, bên trong có chứa những hóa chất giúp dập tắt lửa. Thân bình cứu hỏa được làm bằng thép đúc và sơn màu đỏ. Cụm van làm bằng hợp kim đồng có cấu tạo kiểu van 1 chiều. Loa phun được làm bằng kim loại hoặc cao su, nhựa cứng được gắn với khớp nối bộ van qua một ống thép cứng hoặc ống xifong mềm.

Trên thị trường hiện có nhiều loại bình chữa cháy, trong đó tiêu biểu nhất là bình chữa cháy dạng bọt, dạng khí và dạng bột. Phần lớn các loại bình chữa cháy đều có thiết kế hình trụ tròn màu đỏ nổi bật với phần van màu đen. Loa phun được làm bằng kim loại hoặc cao su, nhựa cứng gắn liền với phần bình. Các cá nhân, doanh nghiệp hiện nay thường sử dụng bình chữa cháy dạng bột hoặc dạng khí nhiều hơn. Với không gian hẹp, kín, người ta thường dùng bình bột để chữa cháy còn với không gian ngoài trời, dùng bình khí sẽ hiệu quả hơn. Với bình bằng khí, người dùng nên chú ý để không bị bỏng lạnh trong quá trình chữa cháy.

Do nhu cầu mua bình chữa cháy của người dân tăng lên nhanh chóng nên để đáp ứng nhu cầu tiêu thụ trong nước đã có không ít Doanh nghiệp nhập khẩu bình chữa cháy từ nước ngoài để kinh doanh nhằm đảm bảo chất lượng, an toàn và tính hiệu quả cao nhất. Tuy nhiên, thủ tục nhập khẩu bình chữa cháy vẫn luôn là vấn đề được không ít Doanh nghiệp, Cơ sở kinh doanh đặc biệt quan tâm bởi mặt hàng đặc thù này luôn kèm theo những quy định riêng. Muốn biết đó là quy định gì, mời cập nhật nội dung bên dưới cùng Proship.

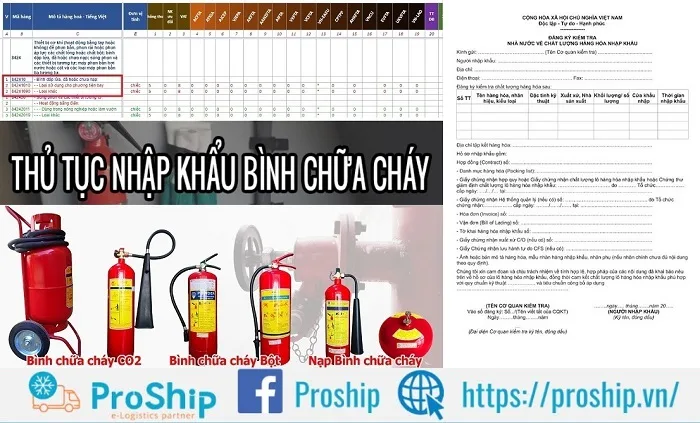

Cập nhật thủ tục nhập khẩu thiết bị bình chữa cháy về Việt Nam chi tiết mới nhất 2023

Hiện nay có nhiều thắc mắc đặt ra như Cách làm thủ tục nhập khẩu thiết bị chữa cháy thế nào? Có cần xin giấy phép nhập khẩu không? Quy trình nhập khẩu ra sao? Mã HS Code và thuế nhập khẩu mặt hàng này bao nhiêu?…

Sau đây, Proship Logistics sẽ cập nhật nhanh Thủ tục nhập khẩu bình chữa cháy cùng những kiến thức liên quan cho Doanh nghiệp, các cơ sở kinh doanh – nhập hàng nắm bắt kịp thời một vài điều chỉnh bổ sung đối với mặt hàng này khi nhập khẩu vào thị trường Việt Nam:

Quy định pháp luật về nhập khẩu bình cứu hỏa

Căn cứ theo Nghị định 187/2013/NĐ-CP, mặt hàng này không bị cấm hay hạn chế nhập khẩu, do đó chủ hàng được nhập khẩu như hàng thông thường. Theo Thông tư 08/2019/TT-BCA, thay thế cho 14/2012/TT-BCA, Bình cứu hỏa thuộc Danh mục hàng hóa có khả năng gây mất an toàn, thuộc trách nhiệm quản lý của Bộ Công an. Do đó, khi làm thủ tục nhập khẩu bình cứu hỏa, chủ hàng phải đăng ký kiểm tra chất lượng hàng nhập khẩu.

Trước khi thông quan, các loại Bình chữa cháy sau khi nhập khẩu phải đăng ký kiểm tra chất lượng Nhà nước:

- Bình chữa cháy tự động kích hoạt: bình bột loại treo;

- Bình chữa cháy xách tay;

- Bình chữa cháy có bánh xe.

Mã HS và thuế suất nhập khẩu bình chữa cháy

Mã HS Code bình chữa cháy

Bình cứu hỏa có mã HS thuộc: Chương 84: Lò phản ứng hạt nhân, nồi hơi, máy và trang thiết bị cơ khí; các bộ phận của chúng:

- 8424 – Thiết bị cơ khí (hoạt động bằng tay hoặc không) để phun bắn, phun rải hoặc phun áp lực các chất lỏng hoặc chất bột; bình dập lửa, đã hoặc chưa nạp; súng phun và các thiết bị tương tự; máy phun bắn hơi nước hoặc cát và các loại máy phun bắn tia tương tự.

- 842410 – Bình dập lửa, đã hoặc chưa nạp.

- 84241090 – Loại khác.

Để xác định chi tiết hơn mã HS bạn cần căn cứ vào:

- Tài liệu kỹ thuật, tính chất và thành phần cấu tạo và thực tế của hàng hóa NK;

- Danh mục hàng hoá xuất khẩu, nhập khẩu Việt Nam ban hành kèm theo Thông tư số 103/2015/TT-BTC của Bộ Tài chính;

- 6 quy tắc áp mã HS tại Phụ lục 2 ban hành kèm Thông tư số 49/2010/TT-BTC của Bộ Tài chính hướng dẫn phân loại hàng hóa XNK.

Thuế suất nhập khẩu bình chữa cháy

Khi nhập khẩu bình cứu hỏa về Việt Nam, người nhập khẩu cần nộp thuế đầy đủ. Dưới đây là Biểu thuế nhập khẩu bình chữa cháy mới nhất 2023:

- Thuế giá trị gia tăng VAT: 10%;

- Thuế nhập khẩu AK: 0%;

- Thuế nhập khẩu thông thường: 0%;

- Thuế nhập khẩu từ Trung Quốc có Chứng nhận xuất xứ Form E: 0%;

- Thuế nhập khẩu từ các thị trường Thái Lan, Malaysia, Indonesia có chứng nhận xuất xứ Form D: 0%;

- Thuế nhập khẩu từ Hàn Quốc có chứng nhận xuất xứ Form AK: 0%;

- Thuế nhập khẩu từ Nhật Bản và các nước ASEAN có chứng nhận xuất xứ Form AJ: 0%.

Quy trình thủ tục nhập khẩu bình chữa cháy

Thủ tục nhập khẩu thiết bị phòng cháy chữa cháy luôn là vấn đề được cơ quan, doanh nghiệp hoạt động trong lĩnh vực PCCC & CHCN quan tâm. Do vậy, cách thức thực hiện việc nhập khẩu bình chữa cháy theo đúng quy định hiện hành sẽ gồm các bước sau:

Bước 1: Hàng nhập về cảng, làm đơn đăng ký KIỂM TRA NHÀ NƯỚC bên Chi cục tiêu chuẩn đo lường chất lượng

Để có thể làm thủ tục nhập khẩu thiết bị bình chữa cháy, chủ hàng cần chuẩn bị những giấy tờ sau:

- Hợp đồng (Contract);

- Danh mục hàng hóa (Packing list);

- Giấy chứng nhận hợp quy hoặc Giấy chứng nhận chất lượng lô hàng hóa nhập khẩu hoặc Chứng thư giám định chất lượng lô hàng hóa nhập khẩu;

- Giấy chứng nhận Hệ thống quản lý (nếu có);

- Hóa đơn (Invoice);

- Vận đơn (Bill of Lading);

- Tờ khai hàng hóa nhập khẩu;

- Giấy chứng nhận xuất xứ C/O (nếu có);

- Giấy Chứng nhận lưu hành tự do CFS;

- Ảnh hoặc bản mô tả hàng hóa, mẫu nhãn hàng nhập khẩu, nhãn phụ (nếu nhãn chính chưa đủ nội dung theo quy định).

Bước 2: Đăng ký chứng nhận hợp quy tại tổ chức được chỉ định

Sau khi đã chuẩn bị đầy đủ chứng từ doanh nghiệp nộp tại trung tâm nghiên cứu ứng dụng Khoa học kĩ thuật phòng cháy chữa cháy – Trường đại học PCCC – Bộ Công An.

Bước 3: Mở tờ khai hải quan và xin đưa hàng về bảo quản, sau đó lấy mẫu thử nghiệm

* Lưu ý: Lô hàng đầu tiên nhập khẩu trung tâm sẽ cử người về kiểm tra thực tế kho bảo quản và lấy mẫu đi thử nghiệm.

Bước 4: Nộp chứng nhận trên cho chi cục tiêu chuẩn đo lường chất lượng là hoàn tất (trong vòng 15 ngày)

Doanh nghiệp tiến hành nộp kết quả cho chi cục tiêu chuẩn đo lường chất lượng, tự up lên cổng cửa và gửi lại tờ khai đã thông quan, nhận tem QR để dán lên sản phẩm trước khi đưa hàng ra thị trường. Hồ sơ cần chuẩn bị mở tờ khai hải quan gồm:

- Bill (vận tải đơn);

- Invoice (hóa đơn thương mại);

- Packinglist (quy cách đóng gói);

- Contract (hợp đồng thương mại);

- C/O (chứng nhận xuất xứ hàng hóa);

- Catalogue (hình ảnh sản phẩm);

- Đơn đề nghị mang hàng về bảo quản (theo mẫu 09, Phụ lục 5, Thông tư 38/2015/TT-BTC).

Lưu ý về nhãn mác khi nhập khẩu hàng hóa

Về thông tin nhãn mác dán trên thiết bị cần ghi rõ và đầy đủ thông tin theo quy định hiện hành. Nhãn trên thiết bị bắt buộc phải thể hiện các nội dung sau:

- Tên hàng hóa;

- Tên và địa chỉ của tổ chức, cá nhân chịu trách nhiệm về hàng hóa;

- Xuất xứ hàng hóa;

- Tính năng và hướng dẫn sử dụng.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Một vài lưu ý khi làm thủ tục hải quan nhập khẩu bình chữa cháy

Về khai báo thủ tục hải quan, các Doanh nghiệp cần chủ động rà soát, chuẩn bị đủ các loại chứng từ, hồ sơ liên quan đến hàng hóa nhập khẩu. Doanh nghiệp cần thường xuyên đối chiếu, kiểm tra trước hồ sơ, chứng từ khai hải quan để khai báo chính xác về tên hàng, chủng loại, số lượng, trọng lượng, chất lượng, trị giá, xuất xứ, mã số, thuế suất…Bên cạnh đó, Doanh nghiệp cũng cần đối chiếu, kiểm tra chính sách quản lý về hàng hóa xuất nhập khẩu, chính sách thuế hay thông tin hàng hóa đã khai báo…để kịp thời khai bổ sung trong thời gian được quy định khi phát hiện có sai sót, nhầm lẫn.

Tóm lại, thủ tục nhập khẩu bình chữa cháy tuy không phức tạp nhưng nếu người nhập khẩu còn non kinh nghiệm về chuẩn bị các hồ sơ, giấy tờ sẽ dễ mắc phải các lỗi sai thông tin trên chứng từ. Đối với những Đơn vị, Cá nhân đã có kinh nghiệm có thể sẽ quen với việc thông quan hàng hóa. Còn đối với những Đơn vị, Cá nhân chưa từng làm hoặc mới làm thủ tục nhập khẩu sẽ thấy khó khăn.

=> Vậy nên, để không mất thời gian, Doanh nghiệp có thể tìm một Đơn vị trung gian thay mình xử lý thủ tục thông quan hàng hóa…Khi thuê Dịch vụ ủy thác như vậy, họ sẽ đứng ra chịu trách nhiệm thực hiện nhập khẩu trọn gói cho Doanh nghiệp và xử lý các vấn đề phát sinh một cách nhanh chóng và kịp thời.

>>Xem thêm: Thủ tục xuất khẩu than Gáo dừa

Đơn vị nào nhận ủy thác xuất nhập khẩu tại cửa khẩu, sân bay, cảng biển Chuyên nghiệp, Uy tín, Tốt nhất hiện nay?

Hiện nay, việc ủy thác xuất nhập khẩu tại PROSHIP được thực hiện trên đa dạng các phương thức vận tải như: đường biển, đường bộ, đường hàng không, đường sắt. Công ty Cổ phần Proship chúng tôi tự hào là Đơn vị Ủy thác xuất nhập khẩu hàng kinh doanh, tiêu dùng, hàng sản xuất công – nông nghiệp, hàng dự án,…tại tất cả các sân bay như Tân Sơn Nhất/Nội Bài/Đà Nẵng,…; các cửa khẩu như Cha Lo, Lao Bảo, La Lay, Móng Cái, Hữu Nghị,…và các cảng biển như Cảng Cát Lái/Đà Nẵng/Hải Phòng/Chân Mây,…

Phương châm hoạt động: “Uy tín đặt lên hàng đầu – Chuyên nghiệp về nghiệp vụ hải quan – Chuẩn xác về thời gian thông quan – Nhanh chóng về giao hàng tận nơi – Đảm bảo về tính an toàn hàng hóa”. Chúng tôi đang sở hữu đội ngũ nhân sự được đào tạo bài bản về nghiệp vụ chuyên môn, mở tờ khai, phân luồng tờ khai,…nên sẽ trực tiếp tư vấn cũng như giải đáp thắc mắc mọi vấn đề liên quan tới thủ tục quy trình nhập khẩu hàng hóa (bao gồm cả thủ tục nhập khẩu bình chữa cháy). Đồng thời, Proship Logistics còn có sự kết nối, liên kết với phía hải quan, có văn phòng đại diện tại các vị trí thuận lợi cùng trang thiết bị hỗ trợ hiện đại,…là những điều kiện CẦN và ĐỦ để thực hiện việc khai hải quan cho Chủ hàng/Doanh nghiệp.

Đối với vai trò là Đơn vị khai thuê hải quan, Proship KHÔNG XUẤT HIỆN trên bất kỳ chứng từ nào của bộ hồ sơ khai quan. Nhiệm vụ của Đơn vị thực hiện khai thuê HQ cửa khẩu/sân bay/cảng biển chúng tôi là lên tờ khai bằng phần mềm riêng rồi dùng Token Khách hàng để ký tờ khai, dùng giấy giới thiệu của chủ hàng làm thủ tục hải quan. Phía Chủ hàng/DN phải dùng CHỮ KÝ SỐ của mình để duyệt ký (từ xa), hay gửi giấy khống…Đối với Cơ quan hải quan, Đơn vị khai thuê hàng xuất nhập khẩu chúng tôi là Người của Chủ hàng.

Trong vai trò là Đại lý khai báo hải quan, phía chúng tôi sẽ dùng CHỮ KÝ SỐ hợp lệ để khai hải quan và chịu trách nhiệm nội dung khai trên tờ khai hải quan cùng với Doanh nghiệp XNK; Thay mặt Doanh nghiệp làm thủ tục xuất nhập hàng hóa theo Hợp đồng KBHQ cửa khẩu/sân bay/cảng biển ký kết giữa 2 bên; Tên, mã số của Đại lý hải quan Proship được thể hiện trên tờ khai và trên hệ thống hải quan.

Lý do nên chọn Dịch vụ khai báo hải quan, Dịch vụ ủy thác XNK tại Proship

Các Cá nhân, DN kinh doanh hàng Sea XNK nên chọn Dịch vụ khai hải quan trọn gói của Proship bởi sự chuyên nghiệp và uy tín:

- Hoàn thành tiến trình khai hải quan theo tiêu chí: “Nhanh chóng – Chính xác – Giá rẻ – Chuyên nghiệp”;

- Không đặt mục tiêu cung cấp Dịch vụ khai hải quan trọn gói GIÁ RẺ NHẤT mà đảm bảo chi phí HỢP LÝ NHẤT;

- Nắm rõ quy trình thông quan hàng hóa tại các sân bay/cửa khẩu/cảng biển toàn quốc;

- Kỹ năng xử lý nhanh các lô hàng XNK khó khai hải quan tại các cảng biển/sân bay/cửa khẩu;

- Khách hàng được tư vấn tận tình về chứng từ, quy trình thủ tục, áp mã HS,…bởi đội ngũ nhân viên có nghiệp vụ HQ;

- Có đủ phương tiện cần thiết để phục vụ hiệu quả cho hoạt động Logistics;

- Am hiểu, cập nhật các Thông tư, Nghị định hải quan,…mới nhất để tư vấn cho khách hàng;

- Cam kết bảo mật thông tin hàng hóa + thông tin khách cung cấp khi sử dụng Dịch vụ KBHQ sân bay/cửa khẩu/cảng biển;

- Chính sách đền bù thiệt hại thỏa đáng cho khách nếu xảy ra tình trạng chậm trễ trong KBHQ;

- Cam kết giao hàng tận nơi cho khách theo yêu cầu (chuẩn xác về thời gian và địa điểm);

- Có VP đại diện tại TPHCM/Hà Nội/Đà Nẵng, thuận lợi cho nhu cầu thuê Dịch vụ khai hải quan trọn gói của DN.

Loại hình khai hải quan tại sân bay, cửa khẩu, cảng biển toàn quốc

Các loại hình khai hải quan tại Cửa khẩu

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại cửa khẩu:

- Loại hình quá cảnh;

- Loại hình nhập khẩu quà biếu tặng, hàng phi mậu dịch;

- Loại hình nhập khẩu gia công;

- Loại hình xuất khẩu kinh doanh;

- Loại hình xuất nhập khẩu sản xuất xuất khẩu;

- Loại hình xuất nhập khẩu tại chỗ;

- Loại hình tạm nhập tái xuất;

- Loại hình tạm xuất tái nhập;

- Loại hình xuất khẩu đầu tư có thuế, miễn thuế.

Các loại hình khai hải quan tại Sân bay

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại sân bay:

- Dịch vụ khai báo loại hình kinh doanh, phi mậu dịch;

- Dịch vụ khai báo loại hình sản xuất xuất khẩu, loại hình gia công, đầu tư, xuất nhập khẩu tại chỗ;

- Dịch vụ khai báo loại hình quá cảnh, hàng đầu tư miễn thuế;

- Loại hình xuất nhập khẩu tại chỗ, nhập và xuất vào khu công nghiệp, miễn thuế,…

Các loại hình khai hải quan tại Cảng biển

Proship đang trong kế hoạch triển khai các loại hình khai hải quan sau tại cảng biển:

- Dịch vụ khai báo hải quan loại hình sản xuất xuất khẩu, đầu tư – gia công;

- Dịch vụ khai báo hải quan loại hình nhập kinh doanh – A11, nhập phi mậu dịch – H11,…;

- Loại hình xuất kinh doanh: B11;

- Loại hình xuất nhập khẩu tại chỗ (bán hàng vào khu chế xuất)…;

- Tạm nhập tái xuất, tạm xuất tái nhập,…

Dịch vụ khác Proship cung cấp khi khai báo hải quan trọn gói

Proship còn nhận tư vấn, cung cấp dịch vụ khác song song với Dịch vụ KBHQ tại các cửa khẩu/sân bay/cảng biển như:

- Phân tích phân loại hàng hóa;

- Dịch vụ kiểm dịch thực vật/động vật (khoảng 700.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ kiểm tra vệ sinh an toàn thực phẩm;

- Dịch vụ kiểm tra chất lượng, giám định hàng hóa;

- Dịch vụ xin chứng nhận xuất xứ (Certificate Of Origin – C/O) (khoảng từ 1.000.000 – 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy chứng nhận hợp quy, công bố hợp quy (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố mỹ phẩm (khoảng 2.500.000 triệu – 3.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin công bố thực phẩm thông thường (khoảng 2.000.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường);

- Dịch vụ xin giấy phép các bộ ngành;

- Dịch vụ hun trùng (khoảng 350.000 VNĐ) (lưu ý: giá sẽ thay đổi theo thời giá thị trường).

Đối tượng khách hàng khai hải quan tại Proship

Khách hàng mục tiêu mà Proship đang tập trung hướng tới phục vụ, đó là:

- Khách hàng có nhu cầu sử dụng Dịch vụ Hải quan Logistics trọn gói;

- Các Công ty xuất khẩu, nhập khẩu vào ra các Khu công nghiệp, Khu phi thuế quan;

- Các Công ty xuất khẩu, nhập khẩu qua các Cửa khẩu, Sân bay, Cảng biển Việt Nam và Quốc tế.

Thông tin cần biết về Thủ tục nhập khẩu bình chữa cháy mới nhất 2023 đã được Proship Logistics cập nhật. Từ đây, các Doanh nghiệp hoặc Tổ chức nào đang gặp vướng mắc về cách khai báo hàng nhập khẩu, xin chứng nhận xuất xứ, điều kiện nhập hàng, quy định về nhãn mác, thuế nhập khẩu,…nên tham khảo áp dụng đúng quy định để việc thông quan lô hàng diễn ra mau chóng và hợp lệ. Khi có nhu cầu thuê Dịch vụ ủy thác nhập khẩu, Dịch vụ khai hải quan trọn gói giá rẻ, liên hệ ngay 0909 344 247 để được đáp ứng tốt nhất.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung