x Các DN, cơ sở kinh doanh hàng hóa/sản phẩm cần tìm hiểu về thuế VAT?

x Các Cá nhân, DN chưa biết chính xác cách tính thuế VAT thế nào?

x Bạn có nhu cầu nhập hàng về Việt Nam, cần tìm Nhà vận chuyển uy tín?

Thuế VAT là loại thuế quan trọng, giúp cân bằng Ngân sách Nhà nước, đóng vai trò lớn trong xây dựng và phát triển đất nước. Sau đây, Proship.vn giải đáp kiến thức về thuế VAT là gì, cách tính thuế giá trị gia tăng VAT, các quy định về thuế VAT đối với hàng hóa, các văn bản pháp quy về thuế GTGT,…Đồng thời, Công ty Cổ phần Proship cũng giới thiệu Dịch vụ xuất nhập khẩu hàng hóa bằng container giá rẻ với việc tư vấn rõ ràng cho khách về thuế VAT. Mời update thông tin bên dưới.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Thuế VAT là gì? Có đặc điểm gì?

Hiện nay, loại thuế VAT này đã và đang được áp dụng rộng rãi trên nhiều quốc gia, trong đó có Việt Nam. Đây là loại thuế không còn quá xa lạ khi nhắc đến. Nhưng để thực sự hiểu rõ về loại thuế này thì chắc chắn không phải ai cũng biết. Vậy cụ thể, thuế VAT là gì?

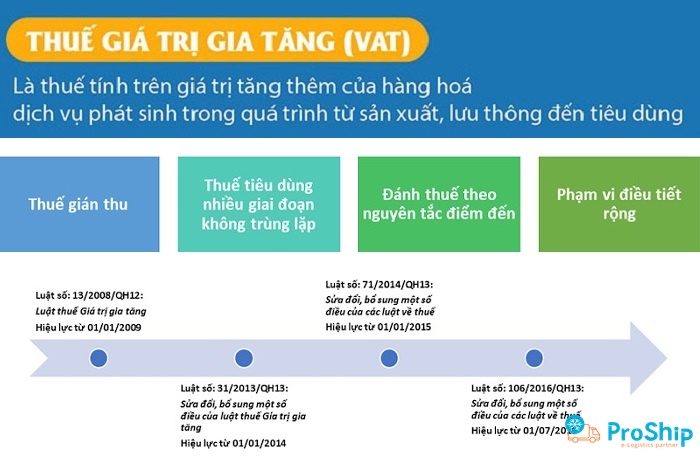

Thực tế, khái niệm chi tiết về thuế giá trị gia tăng đã được nêu rõ tại Điều 2 của Luật thuế giá trị gia tăng 2008. Theo đó, thuế giá trị gia tăng được định nghĩa: “Thuế giá trị gia tăng là thuế tính trên giá trị tăng thêm của hàng hóa, dịch vụ phát sinh trong quá trình từ sản xuất, lưu thông đến tiêu dùng”. Như vậy, có thể thấy, đây là loại giá được áp dụng thu trên phần giá trị tăng thêm của hàng hóa mà không thu với toàn bộ giá trị của hàng hóa, dịch vụ.

Ngoài khái niệm được đưa ra trong Luật thuế giá trị gia tăng 2008, trên Wikipedia (Bách khoa toàn thư mở) cũng có tổng hợp thông tin về loại thuế này. Căn cứ vào đó, bạn có thể hiểu về thuế giá trị gia tăng như sau:

Thuế giá trị gia tăng (VAT – Value Added Tax) là một dạng của thuế thương vụ, là một loại thuế gián thu được đánh vào người tiêu dùng cuối cùng. Tuy nhiên, người tiêu dùng cuối cùng không phải là người đem nộp thuế VAT cho cơ quan thu mà người trực tiếp nộp sẽ là các doanh nghiệp. Nói một cách dễ hiểu thì các Công ty, Doanh nghiệp, cơ sở kinh doanh,…sẽ thay người tiêu dùng nộp thuế giá trị gia tăng thông qua việc cộng thuế vào giá bán mà người tiêu dùng phải thanh toán khi mua hàng và sử dụng dịch vụ của họ.

Thuế VAT (thuế giá trị gia tăng) có những đặc điểm sau:

- Thuế VAT là một loại thuế gián thu: Thuế GTGT được thu vào khâu tiêu thụ của hàng hóa, dịch vụ. Đối tượng nộp thuế VAT là người bán hàng hóa, cung ứng dịch vụ. Đối tượng chịu VAT là người tiêu thụ sản phẩm, dịch vụ cuối cùng;

- Thuế VAT là thuế tiêu dùng nhiều giai đoạn không trùng lặp: Thuế VAT nhắm vào tất cả các giai đoạn luân chuyển hàng hóa, dịch vụ đến tiêu thụ sản phẩm. Tuy nhiên chỉ tính trên GTGT mỗi giai đoạn luân chuyển hàng hóa, dịch vụ;

- Thuế VAT là sắc thuế có tính lũy thoái so với thu nhập: Thuế VAT được tính trên giá bán của hàng hóa, dịch vụ mà người đóng thuế (người tiêu dùng hàng hóa, dịch vụ). Vì thế, khi thu nhập của người tiêu dùng tăng lên thì tỷ lệ thuế VAT phải trả trong giá mua so với thu nhập của họ sẽ giảm đi;

- Thuế VAT được đánh theo nguyên tắc điểm đến: Thuế VAT căn cứ vào thân phận cư trú của người tiêu dùng hàng hóa, dịch vụ mà không dựa vào nguồn gốc tạo ra hàng hóa, dịch vụ. Quyền đánh thuế VAT thuộc về quốc gia – nơi mà hàng hóa, dịch vụ tiêu thụ được sản xuất ra;

- Thuế VAT có phạm vi điều tiết rộng: Thuế VAT đánh vào hầu hết các hàng hóa, dịch vụ phục vụ đời sống con người. Số lượng hàng hóa, dịch vụ thuộc diện miễn thuế VAT theo thông lệ quốc tế thường rất ít.

Các văn bản pháp quy về Thuế giá trị gia tăng VAT

Để giúp các Cá nhân, Doanh nghiệp nắm được thông tin về thuế giá trị gia tăng, các Cơ quan có thẩm quyền đã ban hành một số văn bản pháp quy, quy định chi tiết về loại thuế này. Theo đó, có thể kể đến một số loại văn bản như:

- Luật thuế giá trị gia tăng số 13/2008/QH12 được Quốc hội ban hành ngày 03/06/2008 và có hiệu lực từ ngày 01/01/2009. Văn bản này được sửa đổi, bổ sung bởi nhiều văn bản Luật khác, gồm có: Luật số 31/2013/QH13 ngày 19/06/2013; Luật số 71/2014/QH13 ngày 26/11/2014; Luật số 106/2016/QH13 ngày 06/04/2016;

- Luật hợp nhất số 01/VBHN-VPQH do Văn phòng Quốc hội ban hành ngày 28/04/2016 hợp nhất Luật thuế Giá trị gia tăng;

- Nghị định số 209/2013/NĐ-CP do Chính phủ ban hành ngày 18/12/2013 để Quy định chi tiết và hướng dẫn thi hành một số điều Luật Thuế giá trị gia tăng;

- Nghị định số 12/2015/NĐ-CP do Chính phủ ban hành ngày 12/02/2015 để Quy định chi tiết Thi hành Luật sửa đổi, bổ sung một số điều của các Luật về thuế và Sửa đổi, bổ sung một số điều của các Nghị định về thuế;

- Nghị định số 100/2016/NĐ-CP do Chính phủ ban hành ngày 01/07/2016 để Quy định chi tiết và hướng dẫn thi hành một số điều của Luật sửa đổi, bổ sung một số điều của Luật thuế Giá trị gia tăng, Luật thuế tiêu thụ đặc biệt và Luật quản lý thuế;

- Nghị định số 146/2017/NĐ-CP do Chính phủ ban hành ngày 15/12/2017 Sửa đổi, bổ sung một số điều của Nghị định số 100/2016/NĐ-CP ngày 01 tháng 7 năm 2016 và Nghị định số 12/2015/NĐ-CP ngày 12 tháng 02 năm 2015 của Chính phủ;

- Thông tư số 219/2013/TT-BTC do Bộ Tài chính ban hành ngày 31/12/2013 để Hướng dẫn thi hành Luật thuế Giá trị gia tăng và Nghị định số 209/2013/NĐ-CP ngày 18/12/2013 của Chính phủ quy định chi tiết và hướng dẫn thi hành một số điều Luật thuế Giá trị gia tăng;

- Ngoài ra còn một số văn bản pháp quy khác như Thông tư số 26/2015/TT-BTC do Bộ Tài chính ban hành ngày 27/02/2015; Thông tư số 130/2016/TT-BTC do Bộ Tài chính ban hành ngày 12/08/2016; Thông tư số 25/2018/TT-BTC do Bộ Tài chính ban hành ngày 16/03/2018 và nhiều văn bản liên quan khác.

Quy định của thuế VAT đối với hàng hóa thế nào?

Để quá trình kê khai và nộp thuế GTGT chuẩn xác cần biết rõ các đối tượng chịu thuế và không chịu thuế. Cụ thể như sau:

Đối tượng không phải chịu thuế GTGT

Các đối tượng không chịu mức thuế GTGT khá rộng và được quy định dựa trên các Thông tư 219/2013/TT-BTC, Thông tư 26/2015/TT-BTC, Thông tư 130/2016/TT-BT. Có thể liệt kê một số trường hợp cơ bản như:

- Sản phẩm là giống vật nuôi, giống cây trồng, bao gồm trứng giống, con giống, cây giống, hạt giống, tinh dịch, phôi, vật liệu di truyền;

- Sản phẩm trồng trọt (bao gồm cả sản phẩm trồng rừng), chăn nuôi, nuôi trồng thuỷ sản chưa chế biến thành các sản phẩm khác hoặc chỉ sơ chế thông thường của các cá nhân, tổ chức tự sản xuất và bán ra;

- Sản phẩm muối được sản xuất từ nước biển, muối mỏ tự nhiên, muối tinh, muối i-ốt mà thành phần chính là Na-tri-clo-rua (NaCl);

- Tưới, tiêu nước; cày, bừa đất; nạo vét kênh, mương nội đồng phục vụ sản xuất nông nghiệp; dịch vụ thu hoạch sản phẩm nông nghiệp;

- Chuyển quyền sử dụng đất;

- Nhà ở thuộc sở hữu Nhà nước do Nhà nước bán cho người đang thuê;

- Bảo hiểm nhân thọ, bảo hiểm sức khoẻ, bảo hiểm người học, các dịch vụ bảo hiểm khác liên quan đến con người; bảo hiểm vật nuôi, bảo hiểm cây trồng, các dịch vụ bảo hiểm nông nghiệp khác; bảo hiểm tàu, thuyền, trang thiết bị và các dụng vụ cần thiết khác phục vụ trực tiếp đánh bắt thuỷ sản; tái bảo hiểm;

- Dịch vụ bưu chính, viễn thông công ích và internet phổ cập theo chương trình của Chính phủ;

- Các Dịch vụ tài chính, ngân hàng, kinh doanh chứng khoán,…

Đối tượng phải chịu thuế GTGT

Theo khoản 4 Điều 10 Thông tư số 219/2013/TT-BTC, đối tượng chịu thuế GTGT là “Hàng hóa, dịch vụ dùng cho sản xuất, kinh doanh và tiêu dùng ở Việt Nam (bao gồm cả hàng hóa, dịch vụ mua của tổ chức, cá nhân ở nước ngoài)”.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Các phương pháp tính thuế VAT là gì?

Hiện nay, có 2 cách tính thuế VAT được áp dụng đối với các Doanh nghiệp. Phương pháp này sẽ do Doanh nghiệp đăng ký từ khi mới thành lập:

Tính thuế trực tiếp

Thuế VAT phải nộp = Tỷ lệ % x doanh thu

* Trong đó:

- Tỷ lệ phần trăm tùy vào mức mà Nhà nước quy định riêng đối với từng loại hàng hóa dịch vụ.

- Doanh thu chính là tổng tiền các sản phẩm thực tế mà được ghi trên hóa đơn hàng hóa đối với các sản phẩm phải chịu thuế VAT bao gồm cả các khoản phí thu thêm.

Tính thuế khấu trừ

Thuế VAT phải nộp = Thuế VAT đầu ra – Thuế VAT đầu vào được khấu trừ

* Trong đó:

Thuế VAT đầu ra: Tổng thuế VAT của các hàng hóa và dịch vụ được thể hiện ở trên hóa đơn VAT xuất ra và được tính bằng công thức sau:

- Thuế VAT đầu ra ghi trên hóa đơn = Giá tính thuế bán ra x thuế suất các loại hàng hóa dịch vụ do nhà nước quy định.

- Thuế VAT đầu vào = Tổng thuế GTGT của các loại hàng hóa dịch vụ mua vào ghi ở trên hóa đơn VAT mua vào.

>>Xem thêm: E logistic là gì?

Đơn vị nào nhận xuất nhập khẩu hàng hóa có tư vấn cho khách về Thuế VAT từng mặt hàng/nhóm hàng Chuẩn xác, Chuyên nghiệp?

Nhằm đáp ứng nhu cầu xuất nhập khẩu hàng hóa bằng container tăng cao từ thị trường, Công ty Cổ phần Proship tự hào là một trong những đơn vị tiên phong trong lĩnh vực E-Logistics. Với mô hình vận tải đa phương thức, chúng tôi ứng dụng công nghệ 4.0 vào từng khâu trong các hoạt động vận hành, kinh doanh. Proship trang bị sẵn container 20 feet, 40 feet, 45 feet; xe tải 2 tấn, 5 tấn, 8 tấn và 15 tấn, xe nâng xe cẩu cùng hệ thống kho bãi tại TPHCM, Bình Dương, Đồng Nai, Đà Nẵng, Hà Nội. Chúng tôi sẽ mang lại các giải pháp Vận tải, XNK phù hợp, đáp ứng mọi nhu cầu của khách hàng là Cá nhân/Doanh nghiệp.

Trong trường hợp Đơn vị kinh doanh hàng hóa nào đang gặp phải vướng mắc về vấn đề thuế VAT giá trị gia tăng được áp riêng cho từng loại hàng/nhóm hàng, Proship với đội ngũ nhân viên chuyên trách tậm tâm, giàu kinh nghiệm sẽ hỗ trợ quý vị từ A-Z, trực tiếp trao đổi tư vấn kỹ càng trước khi chính thức ký kết Hợp đồng vận chuyển hàng hóa bằng container (kể cả hàng ghép hay nguyên chuyến). Thời gian là yếu tố quyết định thành bại trong mỗi chuyến hàng, vậy nên chúng tôi sẽ cố gắng đốc thúc mọi khâu để làm sao giao hàng kịp thời cho khách.

Ngoài vận chuyển hàng khô, hàng dự án công trình, hàng rời, hàng bưu kiện,…PROSHIP còn nhận vận chuyển container lạnh mặt hàng rau củ quả, trái cây, thực phẩm, thủy hải sản, mỹ phẩm, thuốc,…đảm bảo đáp ứng đúng tiêu chí: “Chuyên nghiệp – An toàn – Tiết kiệm – Giao tận nơi”. Với hệ thống container bảo quản lạnh đạt chuẩn yêu cầu giúp sản phẩm luôn trong trạng thái nguyên vẹn, tươi ngon và tốt nhất như khi nhận hàng.

Lợi ích khi chọn Dịch vụ gửi hàng, XNK hàng hóa bằng container Proship

- Thời gian vận chuyển nhanh, an toàn, lịch chạy tàu/xe cố định;

- Vận chuyển khối lượng lớn và đa dạng các loại hàng hóa;

- Giá cước vận chuyển containmer, vận chuyển đa phương thức ổn định và cạnh tranh;

- Thủ tục hải quan thuận tiện, khai báo một lần từ điểm xuất phát đến điểm kết thúc;

- Khả năng kết nối với các điểm đến nằm sâu trong nội địa xa hệ thống cảng biển;

- Theo dõi lịch trình hàng hóa Online trên toàn tuyến đường vận chuyển;

- Phương thức chuyển – giao hàng linh hoạt, phù hợp với mọi khách hàng;

- Chính sách bồi hoàn thỏa đáng khi xảy ra sự cố thất thoát, thất lạc, hư hại hàng của khách.

Các Dịch vụ vận tải, e-Logistics tại Proship

- Vận chuyển đường bộ bằng xe container và xe tải;

- Vận chuyển hàng bằng đường hàng không;

- Vận chuyển container đường biển;

- Vận chuyển container bằng đường sắt;

- Vận chuyển hàng hóa bằng container lạnh;

- Vận chuyển hàng lẻ, hàng rời, hàng đặc thù, hàng siêu trường siêu trọng;

- Vận chuyển hàng dự án kết hợp đa phương thức.

Trên đây là toàn bộ nội dung giải thích thuế VAT là gì, cách tính thuế VAT cũng như một số vấn đề pháp lý liên quan. Quý Doanh nghiệp đang kinh doanh hàng xuất, hàng nhập từ nước ngoài về Việt Nam nhưng còn lúng túng hoặc chưa có nhiều kinh nghiệm về việc áp thuế giá trị gia tăng ra sao cho mặt hàng/nhóm hàng của mình nên lưu lại thông tin hữu ích trên nhằm phục vụ hiệu quả cho công việc giao thương, thông quan tại cửa khẩu Hải quan…Và để được báo giá, cung cấp Dịch vụ vận chuyển hàng XNK bằng container, liên hệ ngay PROSHIP theo số 0909 344 247.