x Các chủ hàng, doanh nghiệp xuất nhập khẩu chuẩn bị làm tờ khai hải quan thông quan hàng hóa nhưng chưa hiểu rõ Tờ khai hải quan là gì? Cần chuẩn bị những loại chứng từ, hồ sơ, tài liệu gì liên quan?

x Bạn chưa biết cách khai tờ hải quan như thế nào mới chuẩn xác, hợp lệ?

x Bạn chưa có kinh nghiệm ghi tiêu thức trong tờ khai và cách nhận biết tình trạng phân luồng tờ khai hàng hóa ra sao?

Trong khuôn khổ bài viết này, Proship.vn chúng tôi sẽ giải đáp mọi thắc mắc liên quan như tờ khai hải quan là gì, số tờ khai hải quan là gì, cách khai tờ khai sao cho chuẩn, cách chuẩn bị tài liệu thế nào,…từ đây các chủ hàng cũng biết được các mức độ phân luồng tờ khai theo quy định hiện hành ra sao.

Tờ khai hải quan là gì?

Tờ khai hải quan là gì? Tờ khai hải quan là văn bản mà chủ hàng phải kê khai thông tin về hàng hóa đó để lực lượng hải quan kiểm tra khi hàng hóa được xuất nhập khẩu vào một quốc gia. Thuật ngữ “tờ khai hải quan” trong tiếng Anh là “Customs Declaration”.

Vậy, số tờ khai hải quan là gì? Là số thứ tự của số đăng ký tờ khai hàng ngày theo từng loại hình nhập khẩu tại từng Chi cục Hải quan do công chức Hải quan ghi gồm: số tờ khai, ký hiệu loại hình nhập khẩu, ký hiệu Chi cục Hải quan đăng ký theo trật tự: Số tờ khai/NK/loại hình/đơn vị đăng ký tờ khai.

Bộ tờ khai hải quan bao gồm tài liệu gì?

Tài liệu cần chuẩn bị cho một bộ tờ khai hải quan là gì? Căn cứ Điều 24 Luật Hải quan 2014 quy định:

Hồ sơ hải quan

1. Hồ sơ hải quan gồm:

a) Tờ khai hải quan hoặc chứng từ thay thế tờ khai hải quan;

b) Chứng từ có liên quan.

Tùy từng trường hợp, người khai hải quan phải nộp hoặc xuất trình hợp đồng mua bán hàng hóa, hóa đơn thương mại, chứng từ vận tải, chứng từ chứng nhận xuất xứ hàng hóa, giấy phép xuất khẩu, nhập khẩu, văn bản thông báo kết quả kiểm tra hoặc miễn kiểm tra chuyên ngành, các chứng từ liên quan đến hàng hóa theo quy định của pháp luật có liên quan.

2. Chứng từ thuộc hồ sơ hải quan là chứng từ giấy hoặc chứng từ điện tử. Chứng từ điện tử phải bảo đảm tính toàn vẹn và khuôn dạng theo quy định của pháp luật về giao dịch điện tử.

3. Hồ sơ hải quan được nộp, xuất trình cho cơ quan hải quan tại trụ sở cơ quan hải quan.

4. Bộ trưởng Bộ Tài chính quy định mẫu tờ khai hải quan, việc sử dụng tờ khai hải quan và chứng từ thay thế tờ khai hải quan, các trường hợp phải nộp, xuất trình chứng từ có liên quan quy định tại khoản 1 Điều này.

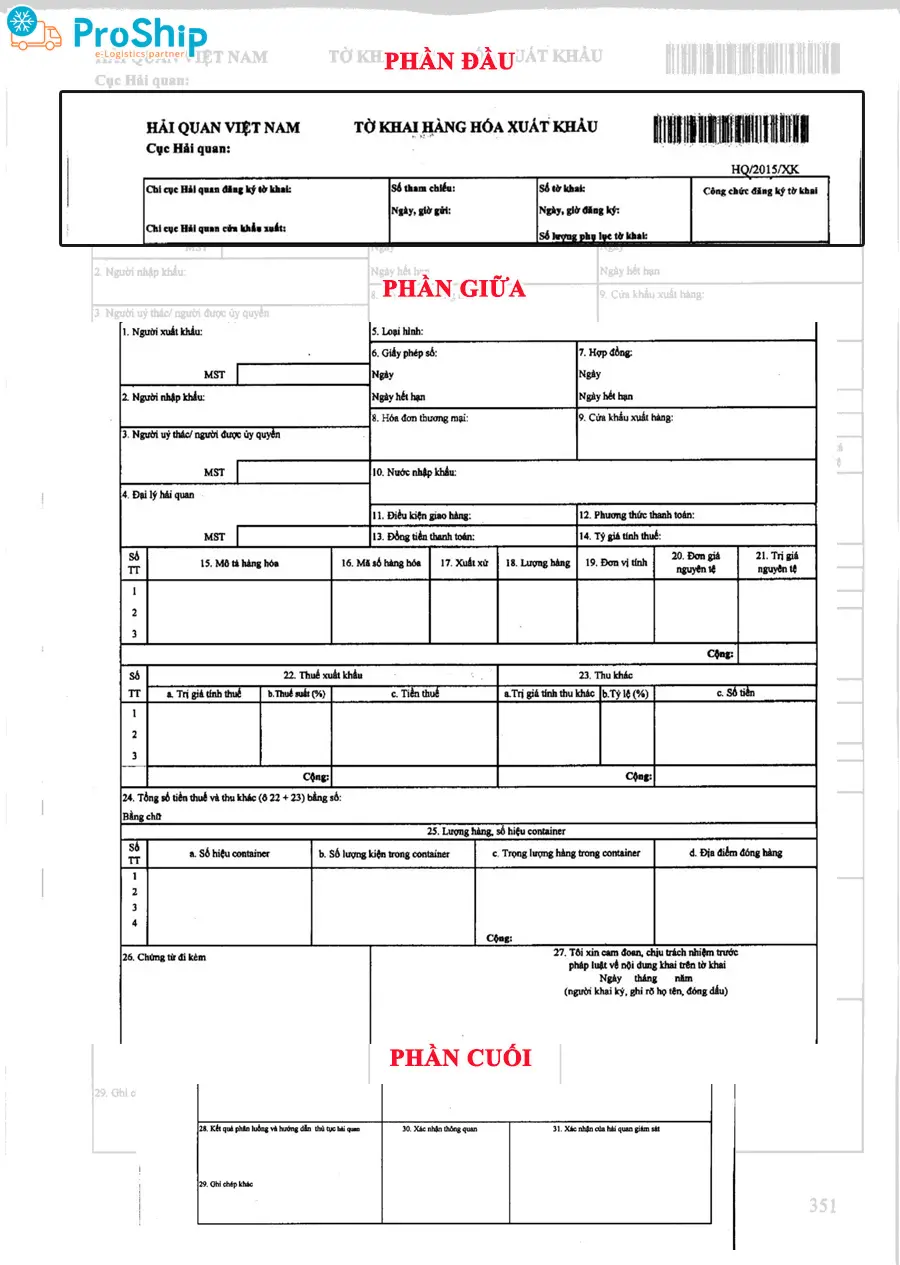

Cách ghi tiêu thức trong tờ khai thế nào?

Proship hướng dẫn cách ghi tiêu thức chuẩn trong tờ khai như sau:

Góc trái của tờ khai

Người khai hải quan ghi rõ tên Chi cụ Hải quan đang ký tờ khai, Chi cục hải quan cửa khẩu xuất khẩu.

Ở phần giữa của tờ khai

- Số tham chiếu và ngày giờ gửi:

Là số do hệ thống cấp tự động cho mỗi tờ khai khi người khai hải quan gửi dữ liệu khai báo hải quan điện tử tới hệ thống để đăng ký kê khai hàng hóa xuất khẩu.

- Số tờ khai, ngày giờ đăng ký:

Phần này là số thứ tự của số đăng ký tờ khai hằng ngày theo từng loại hình xuất khẩu. Nếu cần ghi thủ công, công chức Hải quan sẽ ghi đủ số tờ khai, ký hiệu loại hình xuất khẩu, ký hiệu Chi cục hải quan đăng ký,…

Phần bên phải tờ khai

- Phương thức thủ công:

Công chức hải quan sẽ tiếp nhận đăng ký tờ khai hàng hóa xuất khẩu ký tên và đóng dấu công chức.

- Phương thức điện tử:

Tự động sẽ ghi tên hoặc số ký hiệu của công chức đã tiếp nhận tờ khai.

Cách khai tờ khai hải quan hàng xuất khẩu

Bạn đã biết số tờ khai hải quan là gì. Vậy, các Doanh nghiệp, chủ hàng đã biết cách khai tờ hải quan hàng xuất khẩu thế nào chưa? Proship xin trình bày qua 8 bước cơ bản sau:

Bước 1: Đăng nhập, truy cập vào phần mềm Ecus

Sau khi đăng nhập, truy cập vào phần mềm Ecus, chọn vào mục “hệ thống” trên menu của phần mềm. Tiếp đến kích chọn mục “chọn doanh nghiệp xuất khẩu” để nhập các thông số về tài khoản khai báo và nhấn nút chọn.

Bước 2: Thiết lập hệ thống

Trước khi bắt đầu khai báo, bạn cần thiết lập hệ thống các thông số cần thiết để kết nối đến hệ thống hải quan: Chọn “hệ thống -> thiết lập thông số khai báo VNACCS -> nhập các thông tin -> ghi -> kiểm tra kết nối”.

Bước 3: Khởi tạo tờ khai xuất khẩu

Sau khi đã thiết lập hệ thống xong bạn cần đăng ký mới tờ khai xuất khẩu bằng cách chọn vào “tờ khai hải quan” -> đăng ký tờ khai xuất khẩu.

Bước 4: Điền các thông tin vào tờ khai hải quan

Các thông tin cần điền trong tờ khai hải quan gồm:

- Mã loại hình;

- Cơ quan hải quan;

- Mã bộ phận xử lý;

- Mã hiệu phương thức vận chuyển;

- Thông tin về đơn vị xuất nhập khẩu trên tờ khai hải quan;

- Thông tin vận đơn của tờ khai hải quan;

- Thông tin hóa đơn của lô hàng xuất khẩu;

- Thuế, bảo lãnh trên tờ khai hải quan;

- Thông tin vận chuyển.

Bước 5: Nhập thông tin vào mục “thông tin container”

Nhập thông tin địa điểm xếp hàng và danh sách container, thông thường một tờ khai xuất có thể nhập tối đa 50 số container khác nhau.

Bước 6: Điền các thông tin vào “danh sách hàng”

Tiến hành khai thông tin tên hàng hóa, nhãn hiệu, model, mã HS, khối lượng đơn vị tính, xuất xứ, mã biểu thuế XNK, thuế suất VAT, đơn giá hóa đơn,…

Bước 7: Truyền tờ khai hải quan xuất khẩu

Sau khi kiểm tra chính xác các thông tin trên tờ khai điện tử, tiến hành khai trước thông tin tờ khai (EDA) bằng cách đăng nhập vào chữ ký số của công ty và nhận về số tờ khai là thông tin tờ khai. Tiếp đến, người khai đăng ký chính thức tờ khai với cơ quan Hải quan, chọn mã nghiệp vụ “3” để khai chính thức tờ khai.

Bước 8: Nhận kết quả phân luồng, in ra tờ khai hải quan xuất khẩu

Khi đã hoàn thành tờ khai, tờ khai sẽ được đưa vào để tiến hành các thủ tục thông quan hàng hóa. Tiếp tục nhập vào “4 để lấy kết quả phân luồng, thông quan”.

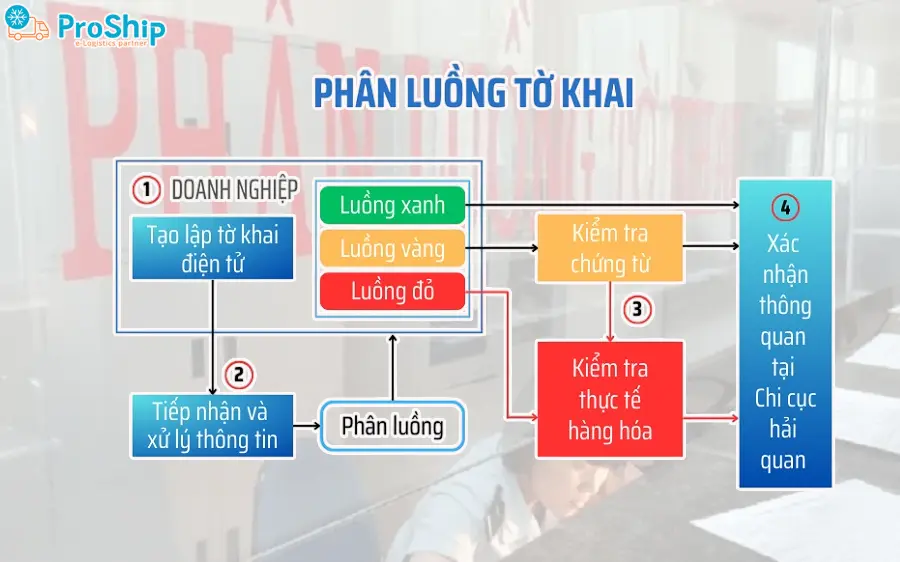

Các mức độ phân luồng tờ khai hải quan

Có 3 mức độ phân luồng là luồng xanh, luồng đỏ, luồng vàng:

Luồng Xanh

Tờ khai hải quan luồng xanh dành cho các doanh nghiệp chấp hành tốt các quy định pháp luật về hải quan. Hải quan sẽ MIỄN kiểm tra chi tiết hồ sơ và MIỄN kiểm tra chi tiết hàng hóa giúp hàng hóa nhanh chóng được xuất nhập khẩu.

Luồng Vàng

Khi tờ khai hải quan của doanh nghiệp được trả về kết quả là luồng vàng, các hải quan sẽ kiểm tra chi tiết hồ sơ nhưng không kiểm tra chi tiết hàng hóa.

Luồng Đỏ

Khi tờ khai hải quan của doanh nghiệp được trả về kết quả đỏ, hải quan sẽ kiểm tra chi tiết hồ sơ và hàng hóa trước khi cho thông luồng để XNK ra vào nước đó.

Trên đây là những kiến thức hữu ích nhằm giúp bạn biết được tờ khai hải quan là gì, số tờ khai hải quan là gì, cách khai tờ khai hải quan thế nào cho chuẩn, hồ sơ chuẩn bị khai tờ hải quan là gì,…Các doanh nghiệp, chủ hàng chưa có kinh nghiệm nên áp dụng ngay vào tiến trình XNK và mọi thắc mắc, liên hệ ngay 0909 344 247 để được giải đáp.