x Bạn là DN, chủ hàng cần biết thủ tục giải quyết bảo hiểm hàng vận chuyển đường biển?

x Bạn cần biết chắc có nên mua bảo hiểm hàng vận chuyển đường biển không?

x Bạn muốn tìm hiểu Đơn vị vận tải biển nào uy tín, giá rẻ, an toàn, hiệu quả?

Proship chúng tôi là một trong những Đơn vị cung cấp Dịch vụ vận tải hàng đường biển trọn gói giá tốt với bảo hiểm hàng hóa theo đúng quy định, giúp khách hàng cảm thấy an tâm khi giao phó toàn bộ tài sản, kiện hàng quan trọng cho chúng tôi. Cùng với đó, Proship.vn sẽ đưa ra những lý do chính đáng nhất để chứng tỏ tầm quan trọng của bảo hiểm hàng hóa vận chuyển bằng đường biển để quý khách hàng sớm có quyết định nên hay không lựa chọn một Công ty bảo hiểm uy tín nhất hiện nay.

🚢 Hotline Liên Hệ Vận Chuyển Container Đường Biển

🧭 Miền Trung

Proship – Đơn vị vận tải biển uy tín có bảo hiểm hàng hóa trọn gói GIÁ TỐT NHẤT

Vận chuyển hàng hóa đường biển nội địa, quốc tế của Proship có giá thành vận chuyển thấp, khối lượng hàng hóa vận chuyển lớn, hàng hóa có thể tránh được những va chạm, rung lắc khi vận chuyển, hàng hóa vận tải biển luôn đa dạng, phong phú về chủng loại,…Chúng tôi hiện đang cung cấp các Dịch vụ vận tải hàng lẻ (LCL), hàng nguyên Container (FCL), bảo hiểm hàng hóa, hàng dự án, bốc và dỡ hàng vào Container, bao bì và đóng gói sản phẩm,…

Tại các Công ty vận tải biển uy tín như Proship chúng tôi, đã có nhiều năm hoạt động trong lĩnh vực vận tải biển Logistics, luôn muốn cung cấp đến khách hàng gói dịch vụ tốt nhất, đồng thời các điều khoản liên quan tới bảo hiểm hàng hóa cũng rất được xem trọng, cung cấp thông tin rõ ràng, mức đền bù đưa ra rất cao. Đây là điểm mà doanh nghiệp cần chú ý tới trong quá trình lựa chọn một đơn vị uy tín, chất lượng.

Các mặt hàng phù hợp với vận tải đường biển nội địa Proship

- Các loại hàng hóa có nhu cầu vận chuyển lớn và đa dạng (gạo, cà phê, hàng gia dụng, quần áo, giày dép, hóa chất, máy móc,…)

- Vận chuyển các mặt hàng có khối lượng lớn, cồng kềnh

- Vận chuyển hàng nguyên kiện Container nội địa bằng đường biển,…

Những ưu điểm của phương thức mà công ty vận tải đường biển nội địa Proship

- Cung cấp giá cước vận chuyển tốt, cạnh tranh nhất thị trường

- Cung cấp Dịch vụ vận tải đa phương thức, các tuyến đường biển nội địa được khai thác hiệu quả trong nhiều năm và có được những uy tín, niềm tin nhất định từ các đối tác

- Nắm bắt giá cả, cập nhật lịch tàu thường xuyên, mang đến các tuyến đường vận chuyển giá tốt, dịch vụ chất lượng nhất với thủ tục hiệu quả & đơn giản

- Kết hợp với hệ thống vận tải bằng đường bộ, Proship sẽ vận chuyển các đơn hàng đi khắp các tỉnh trên cả nước một cách nhanh chóng, linh hoạt nhất

- Có bảo hiểm hàng đường biển trọn gói đầy đủ, uy tín cho toàn bộ hàng hóa của quý khách.

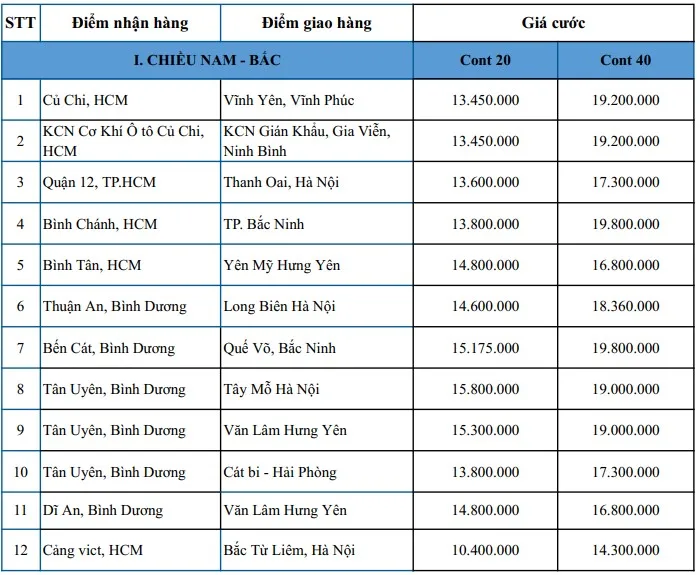

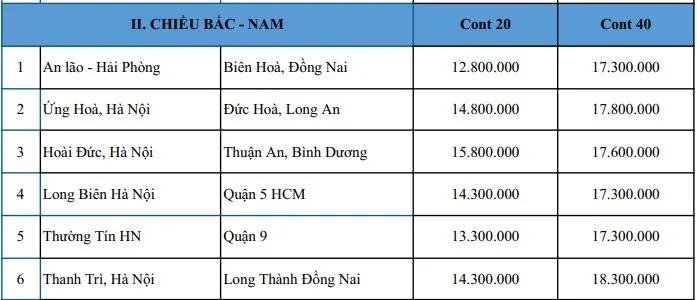

BẢNG GIÁ CƯỚC CONTAINER DOOR TO DOOR ĐƯỜNG BIỂN

Quý khách hàng có thể tham khảo Giá vận chuyển Container Đường Biển Nội Địa Ở ĐÂY

Có nên mua bảo hiểm hàng hóa vận chuyển bằng đường biển không?

Bảo hiểm hàng hóa là loại hợp đồng nhằm bảo vệ người gửi hàng được bồi thường tổn thất nếu hàng hóa bị mất mát, hư hỏng do các rủi ro, tai nạn tàu hàng xảy ra trong quá trình giao nhận, được quy định trong hợp đồng bảo hiểm. Vận chuyển hàng hoá qua đường biển đồng nghĩa với việc doanh nghiệp không biết tình trang hàng hóa của mình như thế nào, trong khi không có bất kỳ người nào đi cùng để áp tải hàng hóa dài ngày, thế nên dịch vụ bảo hiểm hàng hóa chính là giải pháp bảo vệ tối ưu hơn cả. Có nên mua bảo hiểm hàng vận chuyển đường biển không?

Những lý do nhấn mạnh về tầm quan trọng của loại bảo hiểm này

- Bồi thường thiệt hại, rủi ro: Đây là tác dụng chính của bảo hiểm bù đắp về mặt tài chính để khắc phục hậu quả của rủi ro, đảm bảo lợi ích của người mua bảo hiểm trước những hiểm họa ngẫu nhiên mà con người chưa thể chế ngự được như các sự cố xảy ra do yếu tố thời tiết, thiên tai, chiến tranh…

- Đề phòng và hạn chế tổn thất về tài chính: Bảo hiểm là một hoạt động kinh doanh, muốn hiệu quả, các Công ty bảo hiểm luôn phải theo dõi, thống kê, phân tích những trường hợp xấu sẽ xảy ra để đưa ra biện pháp đề phòng, hạn chế tối đa tổn thất.

- Tạo sự an toàn tuyệt đối: Bảo hiểm hàng hóa giúp doanh nghiệp yên tâm khi vận chuyển hàng đường xa, người gửi có thể kiểm soát được toàn bộ lộ trình vận chuyển của đơn hàng nên rất an toàn.

Có 2 loại là hợp đồng bảo hiểm mở và hợp đồng bảo hiểm chuyến

- Hợp đồng bảo hiểm mở: Là hợp đồng bảo hiểm mà người bảo hiểm sẽ nhận bảo hiểm cho một khối lượng hàng vận chuyển trong nhiều chuyến kế tiếp nhau, trong một thời gian nhất định (thường là một năm) hoặc nhận bảo hiểm cho một khối lượng hàng hóa vận chuyển nhất định không tính thời gian

- Hợp đồng bảo hiểm chuyến: Đây là loại hợp đồng bảo hiểm cho một chuyến hàng được vận chuyển từ địa điểm này đến một địa điểm khác được ghi trong hợp đồng bảo hiểm. Ở loại hợp đồng này, người bảo hiểm chỉ chịu trách nhiệm về hàng hóa trong phạm vi một chuyến. Hợp đồng này thường dùng bảo hiểm cho những lô hàng nhỏ, lẻ tẻ, không có kế hoạch chuyên chở nhiều lần. Nó có thể là hợp đồng hành trình, hợp đồng thời gian, hợp đồng hỗn hợp, hợp đồng định giá hoặc hợp đồng không định giá.

🚢 Hotline Liên Hệ Vận Chuyển Container Đường Biển

🧭 Miền Trung

Bảo hiểm hàng đường biển chi trả bồi thường trong các điều kiện nào?

Các Công ty bảo hiểm sẽ chi trả phí bồi thường bảo hiểm hàng đường biển theo các điều kiện sau:

- Tàu chở hàng bị mắc cạn, bị cháy, va đập với các phương tiện vận tải trên biển khác gây hỏng hóc, đắm, thủng nghiêm trọng

- Ném hàng ra khỏi tàu trong quá trình bốc dỡ gây hỏng hóc, thất thoát

- Hàng hóa bị mất do tàu thuyền và các phương tiện vận chuyển bị mất tích

- Bốc dỡ hàng tại một cảng nơi gặp nạn, nơi đang xảy ra chiến tranh

- Các rủi ro đặc biệt như hàng không giao, giao thiếu mất cắp hoặc bị cướp

- Tổn thất chung và các chi phí liên quan (chi phí cứu nạn, chi phí giám định, chi phí khiếu nại tố tụng…)

Những quy định về thủ tục giải quyết bảo hiểm đường biển

Khi xảy ra sự cố thuộc phạm vi bảo hiểm xử lý, giải quyết, cần thực hiện theo các thủ tục

- Triển khai mọi biện pháp có thể coi là hợp lý trong phạm vi quyền hạn và trách nhiệm nhằm ngăn ngừa hoặc giảm nhẹ tổn thất

- Cần tách riêng hàng hóa gặp nạn và hàng còn nguyên vẹn, tháo bỏ bao bì và hong khô hàng hóa (chỉ thực hiện khi không làm tăng mức độ hư hại hàng hóa)

- Nếu nhận thấy sự cố nằm trong phạm vi được hưởng bảo hiểm, phải báo ngay cho phía Công ty bảo hiểm yêu cầu giám định tổn thất

- Thống nhất về thời gian & địa điểm với người giám định, đảm bảo trong thời gian sớm nhất khi hiệu lực bảo hiểm vẫn còn và đến địa điểm gần nhất có thể

- Đảm bảo mọi quyền khiếu nại người chuyên chở, người nhận ký gửi hàng hóa hay một bên thứ ba khác được duy trì và thực hiện một cách thỏa đáng.

Khi vận chuyển hàng hóa trên biển, có một vài vấn đề mà các chủ hàng cần phải lưu ý

- Hàng hóa phải được mua bảo hiểm đầy đủ

- Độ uy tín, tận tâm và chuyên nghiệp của đơn vị vận tải

- Thời gian hàng giao đến nơi được nêu cụ thể trong bản hợp đồng

- Phải có hợp đồng rõ ràng khi thuê dịch vụ (trong đó có những điều khoản ràng buộc trách nhiệm của đơn vị vận tải).

Những thông tin về lý do nên mua bảo hiểm hàng hóa vận chuyển bằng đường biển mà Proship đã vừa cập nhật, chia sẻ, chắc chắn sẽ giúp các Doanh nghiệp, các chủ hàng có thêm kiến thức để hiểu hết tầm quan trọng của loại bảo hiểm vận tải biển này. Mọi vấn đề bạn quan tâm thắc mắc, vui lòng liên hệ qua hotline 0909 344 247 để được hỗ trợ, tư vấn giải đáp thêm nhé.

🚢 Hotline Liên Hệ Vận Chuyển Container Đường Biển

🧭 Miền Trung