x Các đơn vị kinh doanh, DN xuất/nhập khẩu cần tìm hiểu mã HS Code, cách áp mã, quy tắc áp mã?

x Bạn thắc mắc về cấu trúc mã HS hàng hóa, cơ sở tra mã HS, cách tra cứu mã HS nhanh nhất?

x Bạn chưa có kinh nghiệm làm thủ tục HQ hàng XNK, cần tìm Đại lý KBHQ uy tín, chuyên nghiệp?

Mã HS là thông tin bắt buộc phải điền trong tờ khai hải quan XNK. Loại mã này giúp Cơ quan hải quan kiểm soát được lượng hàng cũng như áp thuế suất cho hàng hóa một cách chuẩn xác. Sau đây, Proship.vn sẽ làm rõ thuật ngữ mã HS Code là gì cũng như 6 quy tắc áp mã HS, cách tra mã HS nhanh…Từ đây, các Doanh nghiệp có thể vận dụng kiến thức về mã HS để phục vụ cho công việc giao thương, hoàn tất thủ tục hải quan hàng xuất, hàng nhập.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

XEM THÊM: Dịch vụ vận chuyển Container giá rẻ

Hiểu đúng về mã HS và cấu trúc mã HS Code hàng hóa

Mã HS hàng hóa là gì?

Mã HS (HS Code) là mã số dùng để phân loại hàng hóa xuất nhập khẩu trên toàn thế giới theo Hệ thống phân loại hàng hóa do Tổ chức Hải quan thế giới WCO phát hành có tên là “Hệ thống hài hòa mô tả và mã hóa hàng hóa” (HS – Harmonized Commodity Description and Coding System). Dựa vào mã số này, Cơ quan hải quan sẽ áp thuế xuất nhập khẩu tương ứng cho doanh nghiệp, đồng thời có thể thống kê được thương mại trong nước và xuất nhập khẩu.

Mục tiêu của Danh mục HS là đảm bảo phân loại hàng hóa có hệ thống; thống nhất mã số áp dụng cho các loại hàng hóa ở tất cả các quốc gia, thống nhất hệ thống thuật ngữ và ngôn ngữ hải quan nhằm giúp mọi người dễ hiểu và đơn giản hóa công việc của các tổ chức, cá nhân có liên quan; tạo điều kiện thuận lợi cho đàm phán các Hiệp ước thương mại cũng như áp dụng các Hiệp ước; Hiệp định này giữa Cơ quan hải quan các nước.

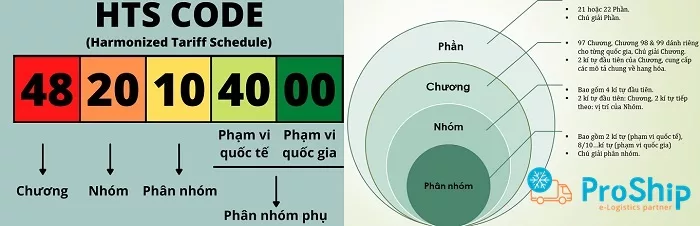

Cấu trúc của mã số HS

Danh mục hàng hóa xuất nhập khẩu Việt Nam được quy định trong Thông tư số 65/2017/TT-BTC ngày 27/06/2017 của Bộ Tài chính xác định mã HS Việt Nam gồm 8 số. Mã HS code được sử dụng quốc tế, bao gồm 8-10 ký tự. Mã HS code được chia thành các phần sau:

- Phần: Mã HS bao gồm 21 hoặc 22 phần, mỗi phần có chú thích riêng;

- Chương: Mã HS bao gồm 97 chương. Trong đó, chương 98 và 99 dành riêng cho từng quốc gia. Mỗi chương đều có chú giải riêng. Hai ký tự đầu mô tả tổng quát về hàng hóa;

- Nhóm: phân chia sản phẩm theo từng nhóm chung, bao gồm 2 ký tự;

- Phân nhóm: được chia ra từ nhóm chung hơn, gồm 2 ký tự;

- Phân nhóm phụ: gồm 2 ký tự. Phân nhóm phụ được mỗi quốc gia quy định để xác định thuế xuất.

* Lưu ý: Phần, Chương, Nhóm, Phân nhóm đầu tiên bao gồm 6 số, mang tính quốc gia, riêng Phân nhóm phụ tùy thuộc từng quốc gia.

Để biết mã HS của từng quốc gia, cần chú ý đặc biệt vào phần Phân nhóm và Phân nhóm phụ. Hiện nay, Việt Nam đang áp dụng mã HS gồm 8 số, trong khi một số quốc gia khác trên thế giới có thể dùng mã HS gồm 10 hoặc 12 số.

* Ví dụ: HS code của Cà phê hòa tan là 2101.20.90, bao gồm 6 chữ số được chia thành 3 nhóm. Phân tích cấu trúc mã này như sau:

- 21: Là mã của nhóm hàng hóa trong danh mục HS, được gọi là “Chương”. 21 là chương đối với nhóm hàng hóa “Sản phẩm của ngành công nghiệp thực phẩm; đồ uống, chất lỏng và bột uống có hàm lượng cồn”.

- 01.20: Là mã của “Mục” trong danh mục HS, mô tả chi tiết hơn về loại hàng hóa. 01.20 là mục đối với “Cà phê, kể cả cà phê hòa tan và chiết xuất cà phê”.

- 90: Đây là mã “Mã phụ” trong danh mục HS, cung cấp thông tin bổ sung về nhóm hàng hóa. 90 thường được sử dụng để chỉ định các sản phẩm tương tự nhưng không rõ ràng nằm trong danh mục HS.

>>Xem thêm: House Bill là gì?

Proship Logistics chia sẻ thông tin chi tiết về mã HS hàng hóa

Proship Logistics đã giải đáp thắc mắc về mã HS Code hàng hóa là gì, cấu trúc mã HS ra sao. Tiếp theo đây sẽ là thông tin cần biết về cơ sở tra mã HS, 6 quy tắc áp mã hs cùng cách tra cứu mã HS nhanh chuẩn xác mà mọi Doanh nghiệp cần phải biết. Cụ thể:

Cơ sở để tra mã HS hàng hóa

- Tên hàng hóa của bạn là gì? Khi các bạn biết được tên hàng hóa của mình thì sẽ biết được nó nằm ở mã chương nào. Tên nó khá là quan trọng bởi vì nếu bạn có tên sai thì khả năng bạn sẽ tra mã HS sai;

- Nắm rõ thông số kĩ thuật của hàng hóa đó;

- Công dụng của loại mặt hàng đó là gì? Sẽ có cơ sở tìm ra được cái mã tiểu mục phù hợp nhất của nó;

- Chất liệu của hàng hóa – Sẽ có những trường hợp là chúng ta không biết là đang up những cái mã nào hợp lý nhất thì chất liệu hàng hóa sẽ là câu trả lời cho các bạn.

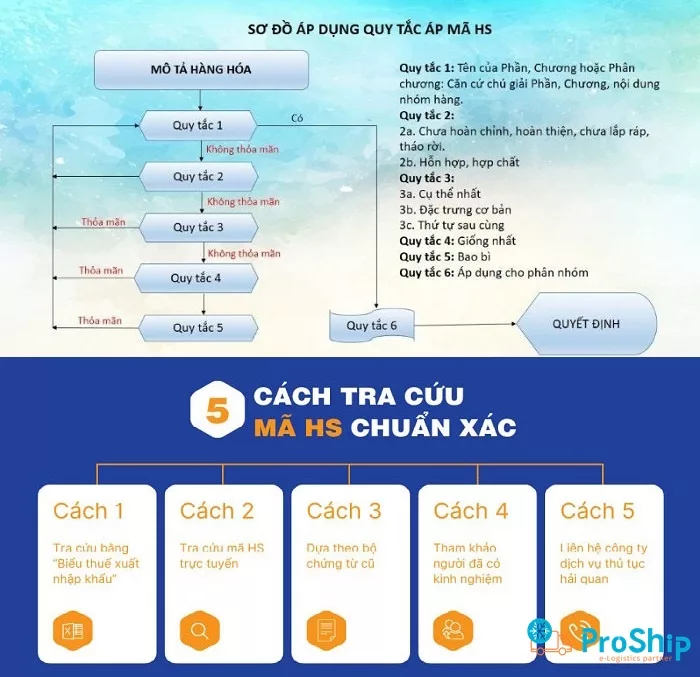

Liệt kê 6 quy tắc áp mã HS Code hàng hóa

Nội dung cơ bản của 6 quy tắc tổng quát như sau:

QUY TẮC 1

“Tên của các Phần, của Chương hoặc của Phân chương được đưa ra chỉ nhằm mục đích dễ tra cứu. Để đảm bảo tính pháp lý, việc phân loại hàng hóa phải được xác định theo nội dung của từng nhóm và bất cứ chú giải của các Phần, Chương liên quan và theo các quy tắc dưới đây nếu các nhóm hoặc các Chú giải đó không có yêu cầu nào khác”.

Nội dung của quy tắc này có một số ý quan trọng:

1. Tên của các Phần, Chương, Phân chương chỉ mang tính định hướng khái quát, chứ chưa đủ để phân loại hàng hóa (xác định mã HS).

2. Các yếu tố quan trọng để phân loại:

2.1 Nội dung cụ thể từng nhóm

2.2 Các chú giải (giải thích) trong các Phần, Chương

3. Nếu dựa vào mục 2 trên không phân loại được, thì mới áp dụng lần lượt các quy tắc tiếp theo.

* Ví dụ: Chương 39 có tên “Plastic và các sản phẩm bằng plastic”. Nhưng mặt hàng đồ chơi trẻ em bằng nhựa không áp vào chương 39 này, mà áp vào chương 95.

QUY TẮC 2

Chia thành 2 quy tắc nhỏ:

- Quy tắc 2a:

“Một mặt hàng được phân loại vào một nhóm hàng thì mặt hàng đó ở dạng chưa hoàn chỉnh hoặc chưa hoàn thiện cũng thuộc nhóm đó, nếu đã có đặc trưng cơ bản của hàng hóa đó khi đã hoàn chỉnh hoặc hoàn thiện. Cũng phân loại như vậy đối với hàng hóa ở dạng hoàn chỉnh hay hoàn thiện hoặc đã có đặc trưng cơ bản của hàng hóa ở dạng hoàn chỉnh hay hoàn thiện (hoặc được phân loại vào dạng hàng hóa đã hoàn chỉnh hay hoàn thiện theo nội dung Quy tắc này), nhưng chưa lắp ráp hoặc tháo rời”.

* Ví dụ: Xe đạp thiếu yên xe, bàn đạp (chưa hoàn chỉnh) vẫn xếp mã xe đạp (87.12). Xe đạp tháo rời, vẫn phân loại vào mã xe đạp

- Quy tắc 2b:

“Một nguyên liệu, một chất được phân loại trong một nhóm nào đó thì hỗn hợp hay hợp chất của nguyên liệu hoặc chất đó với những nguyên liệu hoặc chất khác cũng thuộc nhóm đó. Hàng hóa làm toàn bộ bằng một loại nguyên liệu hay một chất, hoặc làm một phần bằng nguyên liệu hay chất đó được phân loại trong cùng nhóm. Việc phân loại những hàng hóa làm bằng hai loại nguyên liệu hay hai chất trở lên phải tuân theo Quy tắc 3”.

QUY TẮC 3

Khi áp dụng Quy tắc 2(b) hoặc vì bất cứ một lý do nào khác, hàng hóa thoạt nhìn có thể phân loại vào hai hay nhiều nhóm, thì sẽ phân loại như sau:

- Quy tắc 3a:

“Những nhóm có mô tả cụ thể nhất sẽ được ưu tiên hơn các nhóm có mô tả khái quát khi thực hiện việc phân loại hàng hóa. Tuy nhiên, khi hai hay nhiều nhóm mà mỗi nhóm chỉ liên quan đến một phần của nguyên liệu hoặc chất chứa trong hàng hóa là hỗn hợp hay hợp chất, hoặc chỉ liên quan đến một phần của hàng hóa trong trường hợp hàng hóa đó ở dạng bộ được đóng gói để bán lẻ, thì những nhóm này được coi như thể hiện đặc trưng ngang nhau về những hàng hóa nói trên, ngay cả khi một trong số các nhóm đó có mô tả đầy đủ hơn hoặc chính xác hơn về những hàng hóa đó”.

- Quy tắc 3b:

“Những hàng hóa hỗn hợp bao gồm nhiều nguyên liệu khác nhau hoặc những hàng hóa được làm từ nhiều bộ phận cấu thành khác nhau, và những hàng hóa ở dạng bộ để bán lẻ, nếu không phân loại được theo Quy tắc 3(a), thì phân loại theo nguyên liệu hoặc bộ phận cấu thành tạo ra đặc tính cơ bản của chúng”.

Quy tắc 3c:

“Khi hàng hóa không thể phân loại theo Quy tắc 3 (a) hoặc 3(b) nêu trên thì phân loại vào nhóm cuối cùng theo thứ tự đánh số trong số các nhóm tương đương được xem xét”.

QUY TẮC 4

Hàng hóa không thể phân loại theo đúng các Quy tắc trên đây thì được phân loại vào nhóm phù hợp với loại hàng hóa giống chúng nhất.

QUY TẮC 5

Những quy định sau được áp dụng cho những hàng hóa dưới đây:

- Quy tắc 5a:

“Bao đựng máy ảnh, máy quay phim, hộp đựng nhạc cụ, bao súng, hộp đựng dụng cụ vẽ, hộp tư trang và các loại bao hộp tương tự, thích hợp hoặc có hình dạng đặc biệt để chứa hàng hóa hoặc bộ hàng hóa xác định, có thể dùng trong thời gian dài và đi kèm với sản phẩm khi bán, được phân loại cùng với những sản phẩm này. Tuy nhiên, nguyên tắc này không được áp dụng đối với bao bì mang tính chất cơ bản nổi trội hơn so với hàng hóa mà nó chứa đựng”.

- Quy tắc 5b:

“Ngoài Quy tắc 5(a) nêu trên, bao bì đựng hàng hóa được phân loại cùng với hàng hóa đó khi bao bì là loại thường được dùng cho loại hàng hóa đó. Tuy nhiên, nguyên tắc này không áp dụng đối với các loại bao bì mà rõ ràng là phù hợp để dùng lặp lại”.

QUY TẮC 6

“Để đảm bảo tính pháp lý, việc phân loại hàng hóa vào các phân nhóm của một nhóm phải được xác định phù hợp theo nội dung của từng phân nhóm và các chú giải phân nhóm có liên quan, và các Quy tắc trên với những sửa đổi về chi tiết cho thích hợp, trong điều kiện là chỉ có những phân nhóm cùng cấp độ mới so sánh được. Theo Quy tắc này, các chú giải phần và chương có liên quan cũng được áp dụng, trừ khi nội dung mô tả trong phân nhóm có những yêu cầu khác”.

THAM KHẢO THÊM: Dịch vụ vận chuyển Container Lạnh Bắc Nam

Cách tra cứu mã HS

Việc tra cứu mã HS giúp doanh nghiệp xuất nhập khẩu nắm được danh mục hàng hóa xuất khẩu, nhập khẩu Việt Nam, từ đó áp mã HS phù hợp nhất để tiến hành khai báo hải quan điện tử, giúp quá trình thông quan xuất nhập khẩu diễn ra thuận lợi và nhanh chóng. U&I Logistics mách bạn 5 cách đơn giản để tra mã HS như sau:

- Tra cứu Biểu thuế xuất nhập khẩu;

- Tra cứu HS Code trực tuyến;

- Dựa theo bộ chứng từ cũ;

- Tham khảo người đã có kinh nghiệm;

- Liên hệ dịch vụ tra mã HS bên ngoài.

=> Tóm lại, muốn tra cứu cũng như áp mã HS cho hàng hóa một cách chính xác nhất, Doanh nghiệp có thể tham khảo, tìm đến các Công ty chuyên cung cấp Dịch vụ xuất nhập khẩu, khai báo hải quan, Đại lý hải quan chuyên nghiệp như FadoExpress, Proship Logistics để được đảm bảo quá trình thực hiện thủ tục hải quan diễn ra một cách mau chóng và thuận lợi.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Proship Logistics + FadoExpress cung cấp Dịch vụ KBHQ hàng xuất nhập khẩu tại Sân bay Tân Sơn Nhất và Cảng Cát Lái Nhanh chóng, Chuyên nghiệp, Chuẩn xác

Công ty Cổ phần Proship và FadoExpress Chính thức hợp tác với nhau để trở thành Đại lý khai báo hải quan tại Sân bay Tân Sơn Nhất và Cảng Cát Lái, với tiêu chí hoạt động: Thời gian nhanh chóng, tối ưu chi phí, tiết kiệm công sức giúp DN tuân thủ đúng Luật hải quan trong quá trình khai báo hàng hóa. Riêng về Dịch vụ tra cứu mã HS, chỉ cần Doanh nghiệp cung cấp đầy đủ thông tin mặt hàng, mã HS sẽ được xác định một cách cụ thể và chuẩn xác nhất. Chúng tôi tự hào là đơn vị chuyên cung cấp các dịch vụ sau:

- Đại lý hải quan tại Sân bay Tân Sơn Nhất, Cảng Cát Lái;

- Dịch vụ khai thuê hải quan;

- Dịch vụ xin cấp C/O;

- Dịch vụ giao nhận;

- Tư vấn thuế xuất nhập khẩu,…

FadoExpress và Proship Logistics khi hoạt động khai hải quan tại Cảng Cát Lái và Sân bay Tân Sơn Nhất với vai trò là Đại lý khai báo hải quan thì phía các Chủ hàng/Doanh nghiệp không cần phải dùng chữ ký số của mình để duyệt ký (từ xa), hay gửi giấy khống như trước đây. Đơn vị chúng tôi sẽ dùng chữ ký số riêng để khai và truyền tờ khai nên quy trình thực hiện khai hải quan diễn ra nhanh chóng, hợp lệ. Đại lý khai hải quan chúng tôi đảm nhiệm các công việc về Hải quan từ các khâu Vận chuyển Quốc tế – Khai báo hải quan – Làm thủ tục hải quan để thông quan tờ khai – Vận chuyển Nội địa để giao hàng tận nơi cho quý khách.

Đối tượng khách hàng hướng tới khi KBHQ tại SB Tân Sơn Nhất và Cảng Cát Lái

Khách hàng mục tiêu mà Proship Logistics và FadoExpress tập trung hướng tới, đó là:

- Khách hàng có nhu cầu sử dụng Dịch vụ Hải quan Logistics trọn gói;

- Các Công ty xuất khẩu, nhập khẩu vào ra các Khu công nghiệp, Khu phi thuế quan;

- Các Công ty xuất khẩu, nhập khẩu qua các Sân bay, Cảng biển Việt Nam và Quốc tế.

Địa điểm nhận khai hải quan hàng XNK tại Cảng Cát Lái và Sân bay Tân Sơn Nhất

1. KBHQ tại Cảng Cát Lái (Địa chỉ: Chi cục hải quan cửa khẩu cảng Sài Gòn Khu vực 1, Cổng B, Khu Cảng Cát Lái, Lê Phụng Hiểu, Phường Cát Lái, Quận 2);

2. Hàng hóa thông quan đường hàng không, chúng tôi nhận Khai hải quan tại các kho hàng khu vực SB Tân Sơn Nhất:

- Kho TCS: 46 – 48 Hậu Giang, Phường 4, Quận Tân Bình, Tp. Hồ Chí Minh

- Kho SCSC: 30 Phan Thúc Duyện, Phường 4, Quận Tân Bình TP. Hồ Chí Minh.

3. VP đại diện nhận khai báo hải quan tại khu vực TPHCM của FadoExpress và Proship Logistics:

Hồ Chí Minh

Số 161/1-3 Cộng Hòa, P. 12, Q. Tân Bình, TP. HCM

Proship và FadoExpress đang trong kế hoạch triển khai các loại hình KBHQ tại SB Tân Sơn Nhất, Cảng Cát Lái

Các loại hình Dịch vụ KBHQ tại Sân bay Tân Sơn Nhất (có thể thực hiện)

Proship và FadoExpress đang trong kế hoạch triển khai các loại hình khai báo hải quan sau tại sân bay, cửa khẩu toàn quốc để có thể phục vụ khách hàng tốt nhất:

- Dịch vụ khai báo loại hình kinh doanh, phi mậu dịch;

- Dịch vụ khai báo loại hình sản xuất xuất khẩu, loại hình gia công, đầu tư;

- Dịch vụ khai báo Loại hình quá cảnh, hàng đầu tư miễn thuế,…

Các loại hình Dịch vụ KBHQ tại Cảng Cát Lái (có thể thực hiện)

Một số Dịch vụ khai báo hải quan mà chúng tôi có thể thực hiện theo yêu cầu của Doanh nghiệp XNK:

- Dịch vụ khai thuê hải quan trọn gói;

- Dịch vụ khai báo hải quan xuất nhập khẩu từ Hàng lẻ đóng ghép LCL đến Hàng nguyên FCL;

- Dịch vụ vận chuyển hàng hóa với các hình thức linh hoạt, mau chóng, an toàn;

- Dịch vụ xin cấp C/O đầy đủ mẫu, chứng thư kiểm dịch xuất khẩu,…;

- Dịch vụ hoàn thuế cho Doanh nghiệp.

Như vậy, Proship Logistics đã cập nhật kiến thức cần biết về 6 quy tắc áp mã hs hàng hóa, các đơn vị kinh doanh, Doanh nghiệp XNK đang gặp vướng mắc hoặc chưa có kinh nghiệm trong vấn đề áp mã Code nên lưu lại thông tin để vận dụng khi cần. Trong trường hợp quý khách cần tới sự hỗ trợ của Đơn vị chuyên khai báo hải quan tại Sân bay Tân Sơn Nhất và Cảng Cát Lái, hãy tin chọn Đại lý khai hải quan của FadoExpress và Proship để được đáp ứng mọi yêu cầu, giúp đẩy nhanh quá trình thông quan hàng hóa. Chi tiết vui lòng liên hệ 0909 344 247.