x Các doanh nghiệp xuất nhập khẩu cần tìm hiểu và cập nhật về nhiều loại thuế, trong đó có thuế Anti Dumping Duty?

x Bạn muốn tìm hiểu về thời hạn, điều kiện và các nguyên tắc quan trọng khi áp dụng thuế Anti dumping duty?

x Bạn quan tâm tới các hoạt động và phương pháp tính thuế Anti dumping duty hiện nay?

Anti dumping duty là gì, quy tắc và điều kiện áp dụng ra sao sẽ được Proship.vn chúng tôi giải đáp một cách ngắn gọn nhưng súc tích, dễ hiểu trong khuôn khổ bài chia sẻ dưới đây. Đồng thời, các phương pháp tính Thuế Anti dumping duty thông dụng nhất áp dụng hiện nay cũng được chia sẻ để các nhà nhập khẩu, nhà xuất khẩu hiểu rõ về Thuế chống bán phá giá.

Anti-dumping duty là gì?

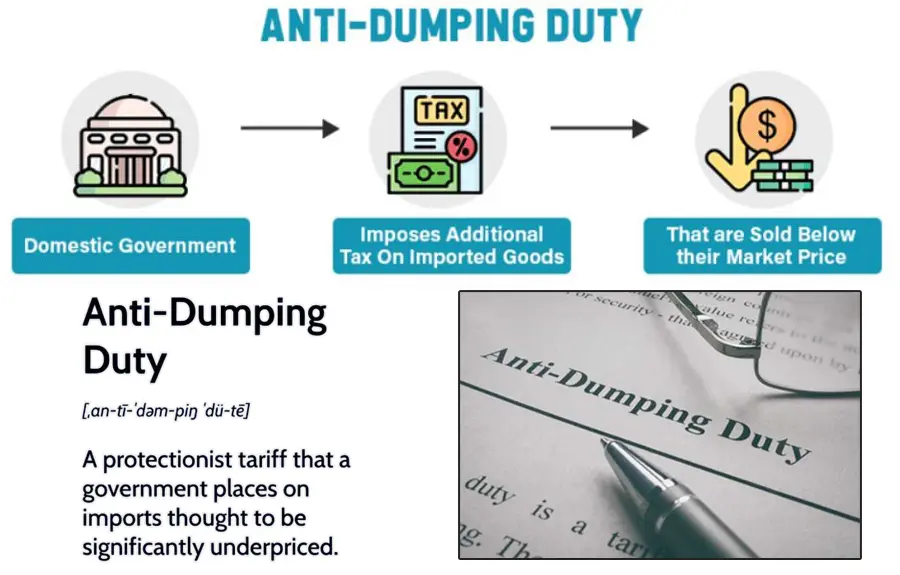

Anti dumping duty là gì? Anti dumping duty là Thuế chống bán phá giá là khoản thuế bổ sung bên cạnh thuế nhập khẩu thông thường, do Cơ quan có thẩm quyền của nước nhập khẩu ban hành, đánh vào sản phẩm nước ngoài bị bán phá giá vào nước nhập khẩu.

Đây là loại thuế nhằm chống lại việc bán phá giá và loại bỏ những thiệt hại do việc hàng nhập khẩu bán phá giá gây ra.

Thời hạn, điều kiện và quy tắc áp Thuế chống bán phá giá Anti dumping duty

Thời hạn, điều kiện và các nguyên tắc áp dụng Anti dumping duty là gì? Đó là:

Thời hạn áp dụng thuế chống bán phá giá

Thời hạn áp dụng thuế chống bán phá giá không quá 05 năm, kể từ ngày quyết định áp dụng có hiệu lực. Trường hợp cần thiết, quyết định áp dụng thuế chống bán phá giá có thể được gia hạn. (Điều 12 Luật Thuế xuất khẩu, Thuế nhập khẩu)

Điều kiện áp dụng Thuế chống bán phá giá Anti dumping duty

Điều kiện áp dụng thuế Anti dumping duty:

- Việc bán phá giá hàng hóa là nguyên nhân gây ra hoặc đe dọa gây ra thiệt hại đáng kể cho ngành sản xuất trong nước hoặc ngăn cản sự hình thành của ngành sản xuất trong nước;

- Hàng hóa nhập khẩu bán phá giá tại Việt Nam và biên độ bán phá giá phải được xác định cụ thể.

Quy tắc áp dụng thuế chống bán phá giá Anti dumping duty

Quy tắc áp dụng thuế Anti dumping duty:

- Việc áp dụng thuế chống bán phá giá được thực hiện khi đã tiến hành Điều tra và căn cứ vào kết luận Điều tra theo quy định pháp luật;

- Thuế chống bán phá giá chỉ áp dụng ở mức độ cần thiết, hợp lí nhằm ngăn ngừa/hạn chế thiệt hại đáng kể cho ngành sản xuất trong nước;

- Việc áp dụng thuế chống bán phá giá không được gây thiệt hại đến lợi ích kinh tế – xã hội trong nước;

- Thuế chống bán phá giá được áp dụng đối với hàng hóa bán phá giá vào Việt Nam.

Hoạt động của Thuế chống bán phá giá Anti dumping duty

Cùng Proship tìm hiểu về hoạt động của Thuế chống bán phá giá Anti dumping duty thông qua thủ tục áp thuế và vai trò của WTO trong các biện pháp chống bán phá giá sau:

Thủ tục áp đặt thuế chống bán phá giá

Hiểu quy trình áp đặt Thuế chống bán phá giá giúp bạn thấy cách Chính phủ bảo vệ các ngành công nghiệp trong nước.

- Giai đoạn 1 – Điều tra bắt đầu:

Quá trình này bắt đầu khi một ngành công nghiệp trong nước khiếu nại, tuyên bố rằng hàng hóa nhập khẩu đang được bán với giá thấp không công bằng.

- Giai đoạn 2 – Xác định bán phá giá:

Các cơ quan chức năng so sánh giá xuất khẩu của hàng hóa với giá trị bình thường của họ trên thị trường nhà xuất khẩu. Nếu giá xuất khẩu thấp hơn, việc bán phá giá sẽ được xác nhận.

- Giai đoạn 3 – Đánh giá chấn thương:

Các nhà điều tra phân tích xem hàng hóa bán phá giá có gây hại cho ngành công nghiệp trong nước hay không. Điều này gồm đánh giá doanh số bị mất, giảm lợi nhuận hoặc các tác động kinh tế khác.

- Giai đoạn 4 – Tính thuế:

Sau khi bán phá giá và chấn thương được chứng minh, Chính Quyền tính thuế Chống bán phá giá. Thuế này dựa trên biên độ bán phá giá – chênh lệch giữa giá xuất khẩu và giá trị bình thường.

Vai trò WTO trong các biện pháp chống bán phá giá

Tổ Chức Thương mại thế giới (WTO) đóng vai trò quan trọng trong việc điều chỉnh mức thuế chống bán phá giá hoạt động thế nào? Thỏa thuận Chống bán phá giá của WTO cung cấp một khuôn khổ toàn cầu để điều tra và áp đặt các nhiệm vụ này.

WTO yêu cầu các nước thành viên tiến hành điều tra kỹ lưỡng trước khi áp đặt Thuế chống bán phá giá. Các cuộc điều tra này phải chứng minh cả bán phá giá và thương tích, tuân thủ các quy tắc thủ tục được nêu trong thỏa thuận.

Phương pháp tính Thuế chống bán phá giá Anti dumping duty

Phương pháp tính Thuế chống bán phá giá Anti dumping duty là gì? Đó là:

Tính thuế Anti dumping duty – Biên độ bán phá giá

Biên độ bán phá giá đo lường sự khác biệt giữa giá bình thường của sản phẩm trên thị trường nội địa và giá xuất khẩu tại nước nhập khẩu.

Tính toán này giúp xác định xem một sản phẩm đang được bán với giá thấp không công bằng. Bạn có thể hỏi nhà chức trách tính toán lề này thế nào. Họ sẽ so sánh giá xuất khẩu với giá bình thường bằng các kỹ thuật số khác nhau.

Tính thuế Anti dumping duty – Xác định thuế suất

Sau khi chính quyền thiết lập biên độ bán phá giá và biên độ thương tích, họ tính toán tỷ lệ Thuế chống bán phá giá. Các mức giá này nhằm thu hẹp khoảng cách giữa giá xuất khẩu và giá bình thường, đảm bảo cạnh tranh công bằng. Các phương pháp thống kê kiểm tra D của Cohen và W-W thường được sử dụng.

Tính thuế Anti dumping duty – Biên độ chấn thương

Biên độ chấn thương đánh giá tác hại gây ra cho các ngành công nghiệp trong nước bằng cách bán phá giá hàng nhập khẩu. Nó tập trung vào tác động kinh tế như giảm lợi nhuận, mất doanh số, hoặc mất việc làm.

Để tính lợi nhuận này, các nhà điều tra phân tích chi phí hạ cánh của hàng hóa Nhập khẩu, gồm giá xuất khẩu cộng với vận chuyển và Thuế hải quan. Sau đó họ so sánh chi phí này với giá của các sản phẩm trong nước tương tự.

Nếu hàng nhập khẩu rẻ hơn đáng kể sẽ cho thấy thương tích tiềm năng. Lợi nhuận này đóng vai trò quan trọng trong việc xác định cách tính thuế Chống bán phá giá, vì nó đảm bảo rằng thuế áp đặt giải quyết thiệt hại thực tế gây ra cho các doanh nghiệp địa phương.

Proship Logistics đã giải đáp Anti dumping duty là gì và những kiến thức liên quan tới Thuế chống bán phá giá gồm điều kiện, thời hạn, nguyên tắc áp thuế, phương pháp tính thuế để các doanh nghiệp, nhà xuất khẩu, nhà nhập khẩu tiện tham khảo. Liên hệ ngay 0909 344 247 để được chúng tôi giải đáp mọi thắc mắc và báo giá nhanh các Dịch vụ vận chuyển hàng đa phương thức trọn gói giá rẻ.