x Doanh nghiệp bạn vừa nhận được quyết định kiểm tra sau thông quan (KTSTQ) cho lô hàng vừa nhập khẩu?

x Bạn thắc mắc không hiểu lô hàng của mình đã thực hiện việc xuất trình hồ sơ và thông quan rồi thì tại sao lại phải cần kiểm tra?

x Bạn muốn biết mức phạt khi vi phạm KTSTQ là bao nhiêu? Quy trình thực hiện kiểm tra sau khi thông quan gồm mấy bước, có phức tạp không?

Proship.vn chúng tôi sẽ giải đáp thắc mắc một số vấn đề liên quan như kiểm tra sau thông quan là gì? Kiểm tra sau thông quan là kiểm tra những gì? Ai có thẩm quyền quyết định kiểm tra sau thông quan,…và những điều cần biết sau khi doanh nghiệp nhận được quyết định KTSTQ.

Kiểm tra sau thông quan: Khái niệm và trường hợp kiểm tra

Sau đây là khái niệm KTSTQ và các trường hợp kiểm tra cần biết:

Khái niệm kiểm tra sau thông quan

Kiểm tra sau thông quan là gì? KTSTQ là quá trình nhân viên Hải quan kiểm tra tính trung thực hợp lý và độ tin cậy của các thông tin chủ hàng đã khai với hải quan thông qua việc kiểm tra các chứng từ thương mại hải quan, chứng từ kế toán, ngân hàng của các lô hàng đã thông quan. Những chứng từ này do các chủ thể (Cá nhân/Công ty) liên quan trực tiếp hay gián tiếp đến thương mại quốc tế lưu giữ.

Có 2 trường hợp là: kiểm tra tại Doanh nghiệp, hoặc tại Cơ quan hải quan (Chi cục làm tờ khai).

Các trường hợp kiểm tra sau thông quan

Cụ thể, tại Điều 78 Luật Hải quan 2014 quy định các trường hợp kiểm tra sau thông quan gồm:

- Kiểm tra việc tuân thủ pháp luật của người khai hải quan;

- Kiểm tra khi có dấu hiệu vi phạm pháp luật hải quan và quy định khác của pháp luật liên quan đến quản lý xuất khẩu, nhập khẩu;

- Với các trường hợp không thuộc quy định tại khoản 1 Điều 78 Luật Hải quan 2014 thì việc kiểm tra sau thông quan được thực hiện trên cơ sở áp dụng quản lý rủi ro.

Kiểm tra sau thông quan là kiểm tra những giấy tờ, tài liệu nào?

Kiểm tra sau thông quan được quy định tại Điều 77 Luật Hải quan 2014 như sau:

Kiểm tra sau thông quan

1. Việc kiểm tra sau thông quan nhằm đánh giá tính chính xác, trung thực nội dung các chứng từ, hồ sơ mà người khai hải quan đã khai, nộp, xuất trình với cơ quan hải quan; đánh giá việc tuân thủ pháp luật hải quan và các quy định khác của pháp luật liên quan đến quản lý xuất khẩu, nhập khẩu của người khai hải quan.

2. Kiểm tra sau thông quan được thực hiện tại trụ sở cơ quan hải quan, trụ sở người khai hải quan.

Trụ sở người khai hải quan bao gồm trụ sở chính, chi nhánh, cửa hàng, nơi sản xuất, nơi lưu giữ hàng hóa.

3. Thời hạn kiểm tra sau thông quan là 05 năm kể từ ngày đăng ký tờ khai hải quan.

Vậy tóm lại, kiểm tra sau thông quan là kiểm tra những gì? Kiểm tra sau thông quan là kiểm tra hồ sơ hải quan, sổ kế toán, chứng từ kế toán và các chứng từ khác, tài liệu, dữ liệu có liên quan đến hàng hóa; kiểm tra thực tế hàng hóa trong trường hợp cần thiết và còn điều kiện sau khi hàng hóa đã được thông quan.

Ai có quyền quyết định kiểm tra sau thông quan tại trụ sở người KBHQ? Mức phạt vi phạm KTSTQ thế nào?

Dưới đây là Cơ quan có thẩm quyền đưa ra quyết định KTSTQ và mức vi phạm phải chịu khi KTSTQ cần biết:

Quyền quyết định KTSTQ tại trụ sở người KBHQ

Kiểm tra sau thông quan là gì? Kiểm tra sau thông quan là kiểm tra những gì?…đã được Proship đề cập ở trên. Vậy, ai có thẩm quyền ra quyết định kiểm tra sau thông quan tại trụ sở người KBHQ?

Thẩm quyền quyết định kiểm tra sau thông quan tại trụ sở người khai hải quan được quy định tại Điều 80 Luật Hải quan 2014 như sau:

Kiểm tra sau thông quan tại trụ sở người khai hải quan

1. Thẩm quyền quyết định kiểm tra sau thông quan:

a) Tổng cục trưởng Tổng cục Hải quan, Cục trưởng Cục Kiểm tra sau thông quan quyết định kiểm tra sau thông quan trong phạm vi toàn quốc;

b) Cục trưởng Cục Hải quan quyết định kiểm tra sau thông quan trong địa bàn quản lý của Cục.

Trường hợp kiểm tra doanh nghiệp không thuộc phạm vi địa bàn quản lý được phân công, Cục Hải quan báo cáo Tổng cục Hải quan xem xét phân công đơn vị thực hiện kiểm tra.

Việc kiểm tra đánh giá tuân thủ pháp luật của người khai hải quan thực hiện theo kế hoạch kiểm tra sau thông quan hàng năm do Tổng cục trưởng Tổng cục Hải quan ban hành.

2. Thời hạn kiểm tra sau thông quan:

a) Thời hạn kiểm tra sau thông quan được xác định trong quyết định kiểm tra, nhưng tối đa là 10 ngày làm việc. Thời gian kiểm tra được tính từ ngày bắt đầu tiến hành kiểm tra; trường hợp phạm vi kiểm tra lớn, nội dung phức tạp thì người đã ký quyết định kiểm tra có thể gia hạn một lần không quá 10 ngày làm việc;

…

Mức phạt vi phạm kiểm tra sau thông quan

Mức phạt vi phạm khi kiểm tra sau thông quan là gì? Theo Điều 11 Nghị định 128/2020/NĐ-CP quy định về các mức phạt với hành vi vi phạm kiểm tra sau thông quan. Có nhiều mức phạt cho từng hành vi cụ thể được tóm gọn như sau:

- Phạt tiền từ 1 triệu – 80 triệu tùy vào lỗi vi phạm và giá trị tang vật;

- Buộc tiêu hủy trong trường hợp là các văn hóa phẩm độc hại;

- Buộc dán tem “Vietnam duty not paid” theo quy định với hành vi vi phạm;

- Hàng hóa bắt buộc phải đưa ra lãnh thổ nước Việt Nam, buộc tái xuất trong thời gian thi hành quyết định.

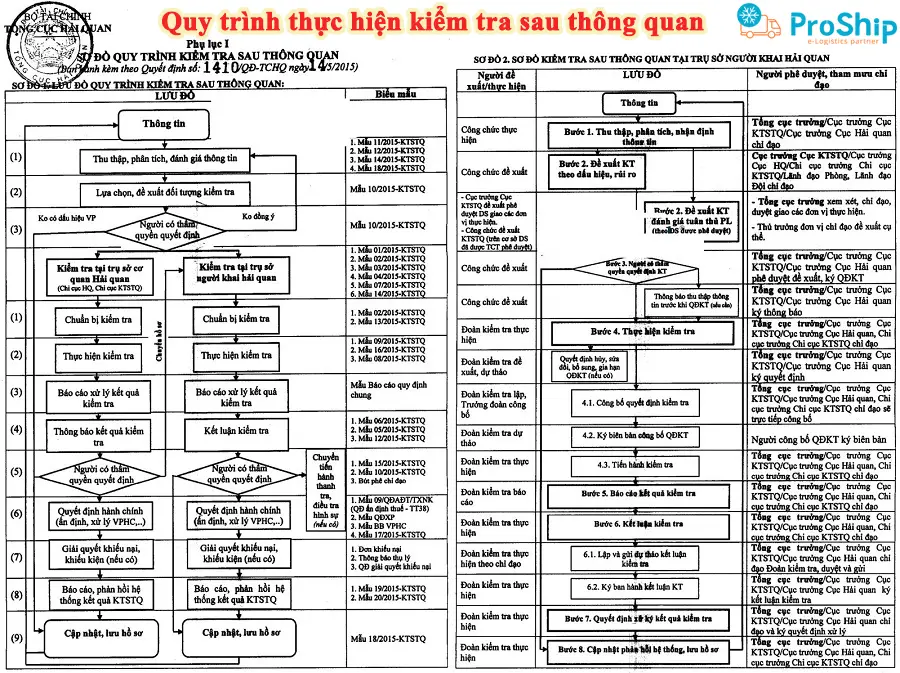

Quy trình thực hiện kiểm tra sau thông quan

Sau đây là quy trình cơ bản thực hiện việc kiểm tra sau thông quan:

- Bước 1: Cơ quan Hải quan sẽ tiến hành thu thập, phân tích, nhận định thông tin;

- Bước 2: Cơ quan Hải quan sẽ đề xuất kiểm tra theo dấu hiệu, rủi ro;

- Bước 3: Người có thẩm quyền của Chi cục Hải quan sẽ ra quyết định kiểm tra và có kế hoạch kiểm tra cụ thể;

- Bước 4: Thực hiện kiểm tra, rà soát chứng từ có liên quan và kiểm tra hàng hóa trực tiếp tại doanh nghiệp;

- Bước 5: Sau quá trình kiểm tra cơ quan Hải quan đưa ra Dự thảo Kết quả kiểm tra;

- Bước 6: Doanh nghiệp cần giải trình, phản hồi nếu không đồng ý với Kết quả kiểm tra;

- Bước 7: Cơ quan Hải quan đưa ra Kết luận kiểm tra;

- Bước 8: Đưa ra quyết định xử lý theo quy định của pháp luật.

Kiểm tra sau thông quan là gì, kiểm tra sau thông quan là kiểm tra những gì, quy trình thực hiện kiểm tra sau thông quan thế nào, mức phạt khi vi phạm KTSTQ bao nhiêu,…đã được giải đáp ở trên. Proship Logistics chúng tôi là một trong những đơn vị KBHQ, Ủy thác XNK, Đại lý hải quan chuyên trách uy tín, Quý doanh nghiệp đang gặp vướng mắc trong quá trình thông quan hàng hóa, liên hệ ngay 0909 344 247 để được tư vấn và cung cấp dịch vụ giá tốt nhất.