x Doanh nghiệp bạn chuyên kinh doanh hàng XNK muốn biết mã hs code là gì?

x Bạn cần nắm rõ vai trò, cách tra cứu mã hs code trong giao thương hàng hóa?

x Bạn mong muốn tìm được Công ty vận tải Quốc tế giá rẻ, chuyên nghiệp?

PROSHIP.VN với kinh nghiệm nhiều năm hoạt động Vận tải, Logistics sẽ giải đáp nhanh mọi vấn đề mà các Cá nhân, Doanh nghiệp đặt ra ở trên để từ đó hiểu thêm về thuật ngữ mã HS Code và áp mã chuẩn xác, tránh sai xót không đáng có trong quá trình xuất/nhập khẩu. Cùng với đó, chúng tôi cũng nêu bật các điểm mạnh, lợi thế Dịch vụ vận chuyển hàng Liên vận Quốc tế bằng container đường sắt giá rẻ, an toàn. Bạn đang có nhu cầu gửi hàng tiêu dùng, kinh doanh đi giao thương nên cân nhắc tìm đến.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

Mã HS code là gì? Cấu trúc ra sao?

Mã hs code là gì? HS Code là thông tin được sử dụng rất nhiều trong các chứng từ xuất nhập khẩu hàng hóa. Chúng ta có thể thường xuyên thấy HS Code trong các tờ khai hải quan, chứng nhận nguồn gốc xuất xứ CO/CQ, hóa đơn thương mại,…Có thể nói HS Code là dữ liệu cơ bản nhưng quan trọng bậc nhất đối với những ai đang làm hàng hóa xuất nhập. Nó tác động trực tiếp đến thuế, giá cả hàng hóa xuất/nhập. HS Code được viết tắt của cụm từ “Harmonized System Codes” – Dịch nôm na ra Tiếng Việt là Hệ thống hài hòa mô tả và mã hóa hàng hóa (mà khi đi học lý thuyết chúng ta đã có thể nghe). Đây là mã phân loại hàng hóa được Tổ chức Hải quan thế giới quy định, nhằm xác định thuế suất xuất nhập khẩu hàng hóa, các quy chế lương thưởng,… áp dụng cho mọi quốc gia trên thế giới.

Mục tiêu khi sử dụng mã HS Code đó là nhằm phân loại các loại hàng hóa thành một hệ thống chuẩn, với danh sách mã số cho các loại hàng hóa được áp dụng ở tất cả các quốc gia. Việc này tạo điều kiện cho việc thống nhất “ngôn ngữ hàng hóa chung” giúp đơn giản hóa công việc cho các Cá nhân, Tổ chức khi thực hiện các Hiệp ước, Hiệp định thương mại Quốc tế. Dựa vào mã HS Code, các Cơ quan hải quan sẽ tiến hành áp các thuế xuất nhập khẩu phù hợp cho từng loại hàng hóa. Ngoài ra, Nhà nước cũng dựa vào HS Code để thống kê và báo cáo về lưu lượng xuất nhập thực tế qua các nhóm hàng, loại hàng chi tiết.

Ví dụ, khi một Doanh nghiệp nhập khẩu hàng hóa, nếu áp sai mã HS code, lúc hàng về đến kho/ cảng, mở tờ khai và nộp thuế xong thì hải quan cho biết là bị sai mã HS code, cần áp mã HS khác, cần kiểm tra chất lượng, công bố hợp quy và nộp thêm thuế. Vì không có sự chuẩn bị trước để chuẩn bị giấy tờ nên doanh nghiệp sẽ mất thời gian làm các thủ tục hơn, phải nộp thuế nhiều lần và chờ vào thuế, phát sinh lưu kho bãi và gây chậm tiến độ giao hàng.

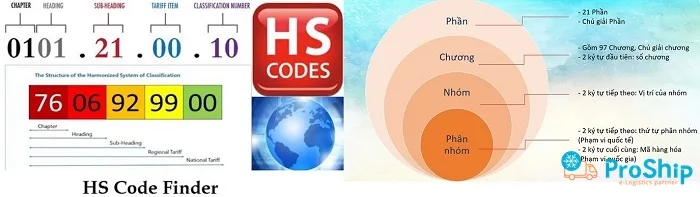

Cấu trúc chính của một mã HS, bao gồm:

- Phần: Trông mã HS Code có đến 22 phần, mỗi phần sẽ có 1 chú giải riêng;

- Chương: được quy định là 2 số đầu trong mã, mô tả tổng quát về loại hàng hóa. Tổng cộng theo quy định có 97 chương quốc tế. Chương 98 và 99 là dành cho các quốc gia, mỗi chương sẽ có chú giải chi tiết;

- Nhóm: Bao gồm 2 ký tự sau chương, thể hiện phân loại nhóm sản phẩm;

- Phân nhóm: Bao gồm 2 ký tự sau nhóm, thể hiện phân nhóm chi tiết dưới nhóm;

- Phân nhóm phụ: các ký tự sau cùng thể hiện phân nhóm phụ do mỗi quốc gia quy định.

Lấy ví dụ về một mã HS Code là: 65061010. Khi nhìn vào mã HS code, chúng ta có thể lấy được các thông tin sau:

- 65: Thể hiện Chương – Mũ, các vật đội đầu khác cùng bộ phận của chúng;

- 06: Thể hiện Nhóm – Mũ, các vật đội đầu khác, đã hoặc chưa lót hoặc trang trí;

- 10: Thể hiện Phân nhóm – Mũ bảo hộ;

- 10: Thể hiện Phân nhóm phụ của Quốc gia.

Mã HS Code có vai trò gì? Tra cứu như thế nào?

PROSHIP sẽ tiếp tục chia sẻ về vai trò, tầm quan trọng cũng như cách tra cứu mã HS code chuẩn nhất sau khi đã giúp bạn làm rõ khái niệm thuật ngữ mã hs code là gì. Cụ thể như sau:

Vai trò của mã Hs code

Hs code giúp người mua, người bán thống nhất tên gọi, tính chất, tác dụng và phân loại sản phẩm thông qua một dãy các chữ số, giúp xóa bỏ rào cản ngôn ngữ, tránh những sai lầm đáng tiếc trong giao thương quốc tế. Hs code là cơ sở để Cơ quan Chính phủ như hải quan, thuế, phòng thương mại xác định rõ loại mặt hàng và hai bên mua và bán đang gia thương, từ đó:

- Quản lý và giám sát danh mục hàng hóa được phép, hạn chế và cấm xuất nhập khẩu;

- Quản lý thuế xuất nhập khẩu;

- Thiết lập hạn ngạch xuất nhập khẩu cho một số sản phẩm nhất định;

- Thu thập số liệu và thống kê thương mại trong nước và xuất nhập khẩu;

- Tạo điều kiện cho việc đàm phán, ký kết và thực thi các thỏa thuận thương mại.

Tầm quan trọng của việc phân loại HS Code

* Đối với Doanh nghiệp:

- HS Code đảm bảo việc tuân thủ luật pháp trong nước và quốc tế của Doanh nghiệp;

- Giảm nguy cơ bị xử phạt gây tốn kém chi phí;

- Giúp doanh nghiệp tránh khỏi việc trì trệ trong khâu giao hàng, công tác giám định gặp nhiều khó khăn;

- Giúp Doanh nghiệp hưởng nhiều lợi ích từ các FTA.

* Đối với Chính phủ:

- Thực thi luật pháp trong nước và các Hiệp ước quốc tế;

- Là công cụ xác định các loại hàng hóa xuất nhập khẩu để thu thuế và các nghĩa vụ khác;

- Hỗ trợ cho việc phân tích các chiến lược vi mô và vĩ mô, đàm phán Thương mại quốc tế.

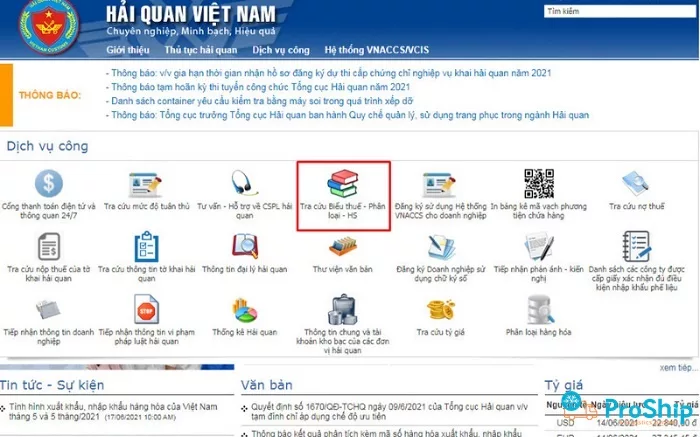

Hướng dẫn cách tra mã HS Code

Vì mã HS đại diện cho nhiều thông tin như vậy nên quá trình tra cứu cần phải chính xác và đúng trình tự. Dưới đây là một số cách tra cứu mã code được sử dụng phổ biến hiện nay:

- Dựa theo bộ chứng từ cũ: Là cách thức truyền thống và đơn giản nhất cho doanh nghiệp hoặc cơ quan khi tiến hành tra cứu. Chỉ cần dựa vào tờ khai hải quan và đối chiếu trực tiếp. Việc tra cứu này không mất quá nhiều thời gian vì các Công ty cũng phải làm thủ tục hải quan và trong đó có đầy đủ thông tin mã code hàng hóa;

- Dựa vào biểu thuế xuất nhập khẩu: Cách thức tra cứu này nhanh và tiết kiệm thời gian hơn rất nhiều. Chỉ cần tải file excel biểu thuế xuất nhập khẩu sau đó ấn tổ hợp Ctrl F và nhập mã thuế trên hàng;

- Dựa vào website tra cứu mã HS: Hiện có rất nhiều Website cho mọi người tra cứu nhưng một trong những địa chỉ được mọi người sử dụng nhiều nhất đó là Hải Quan Việt Nam. Bạn chỉ truy cập vào trang web, vào phần Tra cứu biểu thuế – Phân loại – HS, sau đó nhập mã đơn hàng vào;

- Liên hệ với người đi trước: Nếu Doanh nghiệp cảm thấy chưa chắc chắn về thông tin mà mình tìm hiểu được, có thể liên hệ với người thân quen hoặc những doanh nghiệp đã có kinh nghiệm để thực hiện đơn giản, dễ dàng hơn.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung

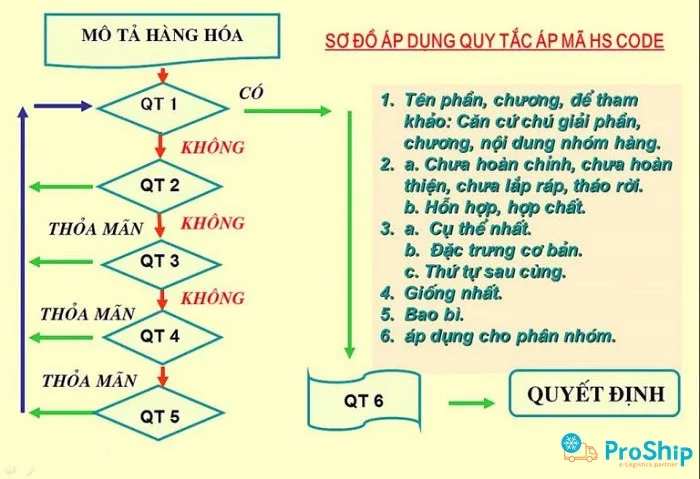

PROSHIP chia sẻ quy tắc tra cứu mã HS Code trong Thủ tục hải quan

Áp mã HS Code cho hàng hóa là việc làm cơ bản và quan trọng trong quá trình làm thủ tục hải quan. Tuy nhiên, để áp dụng đúng mã HS là một công đoạn khá phức tạp và rắc rối. Do đó sau đây, Proship sẽ chia sẻ đến quý Doanh nghiệp quy tắc tra cứu mã HS này như sau:

Quy tắc 1: Chú giải chương và tên định danh

Tên của Phần, Chương hoặc Phân chương được đưa ra nhằm mục đích giúp việc tra cứu diễn ra dễ dàng. Quy tắc 1 chỉ mang tính định hướng khái quát, chưa đủ để phân loại hàng hóa, cần đi tiếp những quy tắc tiếp theo.

Quy tắc 2: Sản phẩm chưa hoàn thiện và hợp chất cùng nhóm

* Quy tắc 2a: Sản phẩm chưa hoàn thiện

Để áp dụng quy tắc 2a, một mặt hàng ở dạng chưa hoàn chỉnh hoặc chưa hoàn thiện nhưng có đặc tính cơ bản của sản phẩm thì phải xem xét mặt hàng đó có hình dạng cơ bản theo cấu tạo của thiết kế, bản vẽ,…và đã có các bộ phận chính của sản phẩm hay chưa.

Nếu hàng hóa ở dạng chưa lắp ráp hoặc tháo rời, phải hiểu là, hàng hóa đó muốn thành sản phẩm hoàn chỉnh chỉ cần lắp ráp đơn giản (bắt vít, vặn ốc, bắn đinh,…) mà không cần phải trải qua quá trình gia công quá phức tạp khác (cắt, mài, gò, hàn,…) mới tiến hành áp dụng quy tắc 2a.

Lưu ý, đối với “Phôi”, đây là những sản phẩm chưa sẵn sàng đưa ra sử dụng, có hình dáng bên ngoài gần giống với với hàng hóa hoàn thiện, chỉ sử dụng vào mục đích duy nhất là hoàn thiện nó thành sản phẩm hoàn chỉnh của chính nó. Khi đó, phôi được áp mã như sản phẩm hoàn chỉnh, không áp dụng quy tắc 2a.

* Quy tắc 2b: Hỗn hợp và hợp chất của các nguyên liệu hoặc các chất

Chỉ áp dụng quy tắc này cho sản phẩm là hỗn hợp của nguyên liệu hoặc chất liệu. Hàng hóa làm toàn bộ bằng một loại nguyên liệu hay một chất, hoặc làm một phần bằng nguyên liệu hay chất đó được phân loại trong cùng nhóm. Khi trong một sản phẩm (hỗn hợp các chất) có thêm một chất nằm ngoài phạm vi mô tả của nhóm hàng đó, làm mất đi đặc tính cơ bản của hàng hóa sẽ phải xem xét áp dụng quy tắc 3.

Quy tắc 3: Hàng hóa thoạt nhìn có thể phân loại vào nhiều nhóm

* Quy tắc 3a: Cụ thể nhất

Phải xem xét, phân định được nhóm hàng có mô tả cụ thể, đặc trưng, chi tiết nhất. Khi hàng hóa được mô tả ở nhiều nhóm, nhóm nào có mô tả cụ thể nhất sẽ được ưu tiên hơn các nhóm có mô tả khái quát.

* Quy tắc 3b: Đặc trưng cơ bản

Những hàng hóa hỗn hợp được cấu thành từ nhiều nguyên liệu hoặc sản phẩm, mỗi nguyên liệu hoặc sản phẩm có thể thuộc nhiều nhóm, nhiều chương khác nhau, nếu không phân loại được theo Quy tắc 3(a), ta tiến hành phân loại theo nguyên liệu hoặc sản phẩm cấu thành tạo ra đặc tính cơ bản của chúng. Lúc này, quy tắc 3b sẽ được áp dụng. Tóm lại, quy tắc 3b áp dụng khi:

- Hàng hóa là hỗn hợp của nhiều nguyên liệu, nhiều chất mà quy tắc 2(b) không phân loại được;

- Hàng hóa có cấu tạo từ nhiều nguyên liệu khác nhau;

- Hàng hóa có cấu tạo từ nhiều thành phần khác nhau;

- Hàng hóa được đóng gói ở dạng bộ để bán lẻ

* Quy tắc 3c: Thứ tự sau cùng

Khi không áp dụng được Quy tắc 3a hoặc 3b, hàng hóa sẽ được phân loại theo Quy tắc 3c. Theo Quy tắc này thì hàng hóa sẽ được phân loại vào nhóm có thứ tự sau cùng trong số các nhóm cùng được xem xét để phân loại.

Quy tắc 4: Phân loại theo hàng hóa giống chúng nhất

Nếu hàng hóa không thể phân loại theo đúng các Quy tắc trên đây thì được phân loại vào nhóm phù hợp với loại hàng hóa giống chúng nhất.

Quy tắc 5: Hộp đựng, bao bì

Áp dụng cho hàng hóa là bao bì, hộp, túi có cấu tạo đặc biệt, phù hợp cho việc chứa đựng hàng hóa và đi kèm với hàng hóa khi bán. Quy tắc 5 được chia làm 2 loại:

* Quy tắc 5a: Hộp, túi, bao và các loại bao bì chứa đựng tương tự

Quy tắc 5a thường là các loại hộp, túi, bao và các loại bao bì tương tự, thích hợp hoặc có hình dạng đặc biệt để chứa đựng hàng hóa hoặc bộ hàng hóa được xác định, có thể dùng trong thời gian dài và đi kèm với sản phẩm khi bán, chẳng hạn như bao đựng máy ảnh, máy quay phim, hộp đựng nhạc cụ, bao súng, hộp đựng dụng cụ vẽ, hộp tư trang,….Tuy nhiên, quy tắc này không áp dụng cho các loại hộp, túi, bao và bao bì có tính chất cơ bản nổi trội hơn so với hàng hóa mà nó chứa đựng.

* Quy tắc 5b: Bao bì thông thường

Bao bì thường được dùng để đóng gói, chứa đựng hàng hóa, được nhập đồng thời với hàng (túi nilon, hộp carton,…) được phân loại vào Quy tắc 5b. Lưu ý, quy tắc này không áp dụng cho bao bì bằng kim loại có thể tái sử dụng.

Quy tắc 6: Cách thức phân loại và so sánh

Việc phân loại hàng hóa vào các phân nhóm của một nhóm phải phù hợp theo nội dung của từng phân nhóm, đồng thời phù hợp với các chú giải của phân nhóm và chú giải của chương có liên quan. Khi so sánh một sản phẩm ở các nhóm hoặc các phân nhóm khác nhau thì phải so sánh cùng cấp độ.

>>Xem thêm: NVOCC là gì?

Dịch vụ vận tải hàng hóa Chuyên tuyến container Việt Nam – Trung Quốc – Mông Cổ – Kazakhstan – Nga – Châu Âu tại PROSHIP có an toàn không?

Nhận thấy nhu cầu chuyển gửi hàng Việt Nam – Quốc tế, Châu Âu bằng container đường sắt liên vận đang tăng cao về nhu cầu, PROSHIP.VN chúng tôi với năng lực vận tải lớn, quy trình vận hành – kinh doanh chuyên nghiệp, luôn có sự kết nối chặt chẽ giữa các bên liên quan (như Tổng Công ty đường sắt Việt Nam VNR) cung cấp ra thị trường “Dịch vụ vận chuyển hàng Chuyên tuyến container Việt Nam – Trung Quốc – Mông Cổ – Kazakhstan – Nga – Châu Âu” Giá rẻ, An toàn, Hiệu quả cao, đáp ứng mọi yêu cầu khách gửi hàng.

Đặc biệt, Proship sẽ tối giản hóa mọi quy trình giúp quý khách chuyển hàng đi Quốc tế một cách đơn giản và nhanh chóng nhất nên quý vị có thể theo dõi đơn hàng của mình mọi lúc mọi nơi. Ngoài hàng khô, hàng bưu kiện, hàng dự án công trình,…chúng tôi còn nhận vận chuyển Container lạnh hàng thủy hải sản, trái cây, rau củ quả với thiết bị làm lạnh, bảo quản lạnh đạt chuẩn yêu cầu xuất đi Quốc tế giao thương.

Và còn áp dụng hình thức giảm 25-30% chi phí Logistics trong chuỗi cung ứng lạnh của DN. Mã hs code là gì hay các vấn đề liên quan tới nghiệp vụ xuất nhập khẩu, Logistics cũng được nhân viên Proship nắm rất rõ để tư vấn cho khách trước khi chính thức ký kết Hợp đồng vận chuyển. Do đó bạn hoàn toàn có thể an tâm tin tưởng gửi hàng số lượng lớn tại đây.

Mục tiêu của Proship với tuyến Việt – Nga

- Tổ chức chạy các đoàn tàu chuyên container (BT) giữa Việt Nam (Ga Yên Viên) – Liên Bang Nga (Ga Vorsino-Moscow);

- Tần xuất chạy: 2->3 chuyến/tuần;

- Leadtime: ~ 20-25 ngày (tùy điểm đến);

- Blocktrain (BT): 20-23 container/BT;

- Hành trình: Ga Yên Viên Đồng Đăng Bằng Tường -> Mãn Châu Lý (Trung Quốc) Zabaikalsk (Nga) Vorsino (Moscow).

* Từ Ga quốc tế Yên Viên, kết nối tuyến vào đường sắt Á – Âu để đến LB Nga theo 02 tuyến chính:

- Tuyến 1: Ga Yên Viên -> Ga Đồng Đăng (Lạng Sơn) -> Thành Đô (Trung Quốc) -> Kazakhstan -> LB Nga;

- Tuyến 2: Ga Yên Viên -> Ga Đồng Đăng (Lạng Sơn) -> Nam Ninh (Trung Quốc) -> Mãn Châu Lý (Trung Quốc) -> Zabaikalsk (LB Nga) -> Moscow (LB Nga).

* ĐẶC BIỆT, “Dịch vụ vận chuyển hàng hóa từ Ga Kép, Bắc Giang đi Nội địa và Quốc tế” với lịch trình tàu chạy như sau:

- Vận chuyển container đường sắt Nội địa trên tuyến Kép – Yên Viên – Đà Nẵng – Sóng Thần (và ngược lại): 1 chuyến hàng/ngày;

- Vận chuyển hàng hóa đường sắt Liên vận Quốc tế trên tuyến Kép – Đồng Đăng – Bằng Tường – Nam Ninh (và ngược lại): 2 chuyến hàng/ngày.

Dịch vụ vận chuyển hàng bằng container liên vận Quốc tế Proship với những ưu điểm phải kể đến

- Cước phí vận chuyển hàng hóa bằng container đường sắt liên vận luôn rẻ, ổn định;

- Lịch trình tàu hàng đường sắt cố định, xuyên suốt và rõ ràng;

- Hỗ trợ nhận hàng tận nơi, nhận gửi hàng từ 63 tỉnh thành trên toàn quốc đi các nước;

- Hỗ trợ đóng gói hàng hóa cẩn thận, theo tiêu chuẩn hàng xuất khẩu;

- Hỗ trợ làm thủ tục hải quan thông quan từ Việt Nam – Trung Quốc, Mông Cổ, Kazakhstan, Nga, Châu Âu;

- Bảo hiểm hàng hóa, cam kết giao hành đúng hẹn, nhanh chóng, an toàn;

- Đội ngũ nhân viên nhiệt tình, chu đáo, sẵn sàng hỗ trợ khách 24/7;

- Cơ sở hạ tầng đường sắt đầy đủ, trang thiết bị hỗ trợ vận tải container hiện đại;

- Đầu tư các toa xe chuyên dụng đường sắt như 170 Toa xe P chuyên chở xăng dầu, các loại hàng hóa chất lỏng, 150 Toa xe Mc chuyên chở các loại Container, 15 Toa xe Mcc chuyên chở Container lạnh, 50 Toa xe H thành cao mở nóc chuyên chở các loại hàng linh kiện, Container, 20 Toa xe NR chuyên chở ô tô,…;

- Thanh toán linh hoạt, quy trình đơn giản và thuận tiện cho khách;

- Khách hàng có thể theo dõi quá trình vận đơn với công nghệ số hiện đại;

- Thời gian vận chuyển container khô/lạnh đường sắt nhanh chuẩn xác;

- Chính sách bồi thường 100% giá trị hàng nếu để thất thoát, hư hại do lỗi Nhà vận chuyển.

Cách thức giao nhận hàng hóa linh hoạt tại các nước

- Vận chuyển Container từ Ga tới Ga;

- Vận chuyển hàng hóa Container từ Ga tới Kho;

- Vận tải Container từ Kho tới Kho;

- Các dịch vụ đi kèm khác nếu khách hàng yêu cầu.

Quy trình vận tải hàng hóa bằng container đường sắt Proship

- Bước 1: Tiếp nhận thông tin hàng hóa từ Quý khách hàng qua Hotline hoặc Email;

- Bước 2: Tiến hành khảo sát đơn hàng của khách;

- Bước 3: Gửi báo giá nhanh, chi tiết cho khách hàng tham khảo;

- Bước 4: Khi đôi bên thỏa thuận, ký hợp đồng chính thức và tiến hành quá trình vận chuyển;

- Bước 5: Theo dõi và cập nhật cho khách hàng lộ trình di chuyển của đơn hàng;

- Bước 6: Cuối cùng giao hàng cho khách, thanh toán và kết thúc hợp đồng.

Dịch vụ tiện ích cung cấp khi gửi hàng Liên vận Quốc tế

- Dịch vụ vận chuyển hàng hóa đi Quốc tế bằng container đường sắt;

- Ủy thác xuất nhập khẩu;

- Hỗ trợ tư vấn đóng gói hàng hóa;

- Làm thủ tục hải quan;

- Bảo hiểm hàng hóa,…

Tóm lại, HS code là thuật ngữ phổ biến, có tính thông dụng trong Ngành logistics và Xuất nhập khẩu. Hi vọng thông qua bài chia sẻ kiến thức trên đã giúp quý bạn đọc biết được mã hs code là gì, vai trò quan trọng của mã hs code ra sao cũng như cách tra cứu – áp mã này như thế nào chuẩn nhất. Từ đây, nếu Doanh nghiệp hoặc đơn vị kinh doanh nào có nhu cầu chuyển gửi hàng hóa bằng container tuyến liên vận Quốc tế muốn tiết kiệm chi phí, thời giờ, công sức, gia tăng tính hiệu quả an toàn cao có thể liên hệ với Công ty Cổ phần Proship theo Hotline bên dưới để được tư vấn giải pháp và báo giá dịch vụ nhanh tốt nhất.

📦 Hotline Liên Hệ Vận Chuyển

🧭 Miền Trung