x Bạn là doanh nghiệp, nhà bán lẻ,…cần tìm hiểu về phương pháp FIFO trong quản lý kho hàng xuất nhập khẩu?

x Bạn cần cập nhật về ưu nhược điểm của nguyên tắc FIFO trong quản lý kho là gì?

x Bạn chưa hiểu rõ về sự khác nhau giữa FIFO với LIFO là gì? Nên chọn phương pháp quản kho nào là tối ưu nhất trong hoạt động logistics, XNK?

Hãy cùng Proship.vn chúng tôi cập nhật mới về định nghĩa nguyên tắc FIFO là gì? FIFO có ưu nhược điểm gì? Giữa FIFO và LIFO có gì khác nhau và nên chọn phương pháp nào để giúp tối ưu chi phí, thời gian?,…Song song đó, Proship Logistics cũng đưa ví dụ để các nhà bán lẻ, doanh nghiệp dễ hình dung về FIFO.

FIFO là gì, viết tắt của từ gì? Ví dụ về FIFO?

Nội dung sau sẽ giúp doanh nghiệp bạn hiểu rõ nguyên tắc fifo là gì:

FIFO là gì?

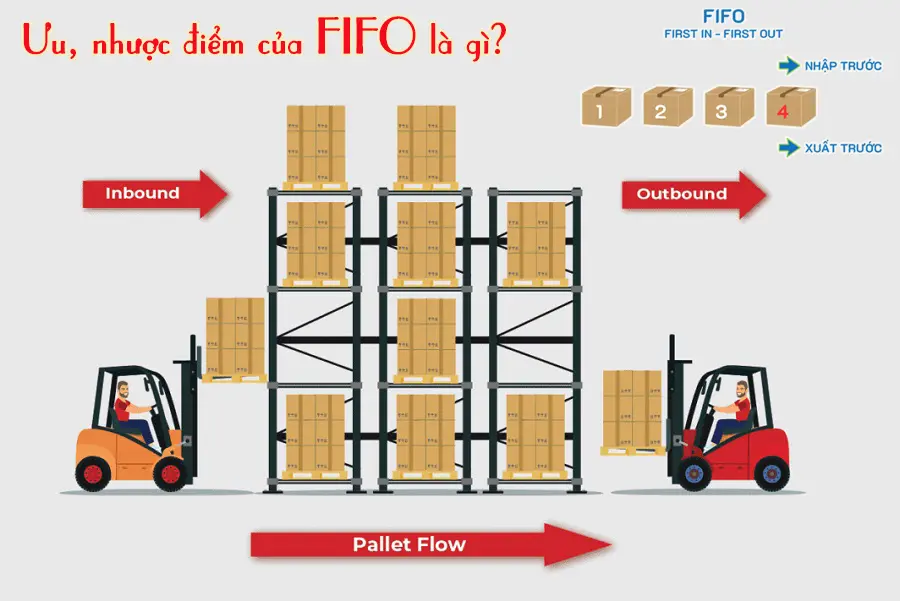

Nguyên tắc FIFO hay First In First Out, là nguyên tắc nhập xuất hàng tuân theo nguyên tắc các lô hàng được nhập trước sẽ được xuất trước. Đây được xem là một phương pháp để quản lý hàng hóa với phương thức là hàng nào nhập về kho trước sẽ ưu tiên xuất kho trước.

Mục tiêu của phương pháp quản lý này nhằm đạt được mức luân chuyển hàng hóa tốt nhất trong kho. Như vậy, hạn chế tối đa được những hư hỏng hoặc quá hạn dùng của những sản phẩm có trong kho hàng.

Ví dụ về FIFO

Ví dụ về cách nguyên tắc FIFO được áp dụng để tính toán giá hàng tồn kho:

Giả sử một mẫu sản phẩm mới sắp ra mắt và cửa hàng quần áo X đã nhập trước 100 chiếc áo phông với mức giá 50.000 VNĐ/chiếc vào tháng 2/2023. Vì vậy, tổng giá vốn hàng tồn kho ban đầu là 5.000.000 VNĐ.

Sau đó, chủ cửa hàng nhập thêm lần lượt 60 chiếc với mức giá 55.000 VNĐ/chiếc và 65 chiếc áo với mức giá 60.000 VNĐ/chiếc vào 2 tháng tiếp theo. Khi đó tổng hàng tồn kho được trình bày chi tiết trong bảng sau:

| Tháng | Số lượng | Giá (VNĐ/chiếc) |

| 2 | 50 chiếc | 50.000 |

| 3 | 55 chiếc | 55.000 |

| 4 | 60 chiếc | 60.000 |

Trong tháng 5, cửa hàng bán bán tổng cộng 80 chiếc áo. Theo nguyên tắc FIFO, giá vốn hàng bán được tính toán như sau: 50 x 50.000 + 30 x 55.000 = 4.150.000 VNĐ. Còn lại 85 chiếc áo chưa bán ra được tính vào hàng tồn kho.

Cửa hàng có thể dựa vào giá vốn hàng bán để tính toán được lợi nhuận của cửa hàng trong tháng đó bằng cách lấy doanh thu bán được trừ đi giá vốn hàng bán.

Ưu điểm của FIFO nhập trước, xuất trước

Ưu điểm của nguyên tắc FIFO là gì? Trong số các doanh nghiệp nhỏ, thậm chí một số nhà bán lẻ lớn hơn, FIFO là phương pháp kế toán hàng tồn kho được sử dụng rộng rãi nhất vì mang đến một số lợi ích thiết thực như:

FIFO cung cấp rõ về chi phí hàng tồn kho

Phương pháp FIFO cung cấp cho doanh nghiệp bức tranh rõ ràng nhất về chi phí hàng tồn kho thực tế. Khi bạn bán hàng tồn kho cũ nhất trước tiên, dòng chi phí dự kiến và dòng hàng hóa thực tế sẽ cho bạn bức tranh chính xác nhất về chi phí và lợi nhuận của doanh nghiệp.

FIFO có độ chính xác cao

Nếu bạn đang muốn so sánh việc quản lý hàng tồn kho của doanh nghiệp mình với các doanh nghiệp khác, thì việc sử dụng phương pháp FIFO sẽ cung cấp cho bạn bức tranh tốt nhất về hệ thống hàng tồn kho của bạn. Điều này là do phương pháp này được sử dụng rộng rãi nhất trong nhiều loại hình kinh doanh.

FIFO giảm sự lỗi thời

Các doanh nghiệp bán hàng tồn kho của họ bằng phương pháp FIFO sẽ có thể xóa hàng tồn kho cũ trước khi nó trở nên lỗi thời. Sau khi làm xong, họ có thể bán khoảng không quảng cáo mới hơn của mình. Điều này cũng cho phép họ giảm tải bất kỳ hàng hóa dễ hư hỏng nào mà không khiến chúng bị hỏng.

FIFO giảm tác động của lạm phát

Một trong những lợi thế lớn nhất của việc sử dụng phương pháp nhập trước xuất trước là giảm tác động của lạm phát lên chi phí hàng tồn kho của bạn. Bán hàng tồn kho cũ hơn được sản xuất khi lạm phát và chi phí thấp hơn sẽ tối đa hóa lợi nhuận thu được từ hàng tồn kho.

Nhược điểm của FIFO nhập trước, xuất trước

Vậy, ngoài ưu điểm thì nhược điểm của nguyên tắc FIFO là gì? Đó là:

FIFO phức tạp khi quản lý hàng hóa lâu năm

Với các doanh nghiệp có hàng không có hạn sử dụng, FIFO dễ dẫn đến việc các sản phẩm cũ hơn không được bán ra, khiến hàng tồn kho dài hạn và gây khó khăn trong việc quản lý.

FIFO không tối ưu trong môi trường giá tăng

Khi giá cả nguyên vật liệu hoặc sản phẩm tăng lên, FIFO có thể dẫn đến việc ghi nhận chi phí thấp hơn so với giá thị trường hiện tại. Điều này có thể làm tăng lợi nhuận tính thuế, dẫn đến việc phải trả thuế cao hơn.

So sánh phương pháp FIFO (nhập trước xuất trước) và LIFO (Nhập sau xuất trước)

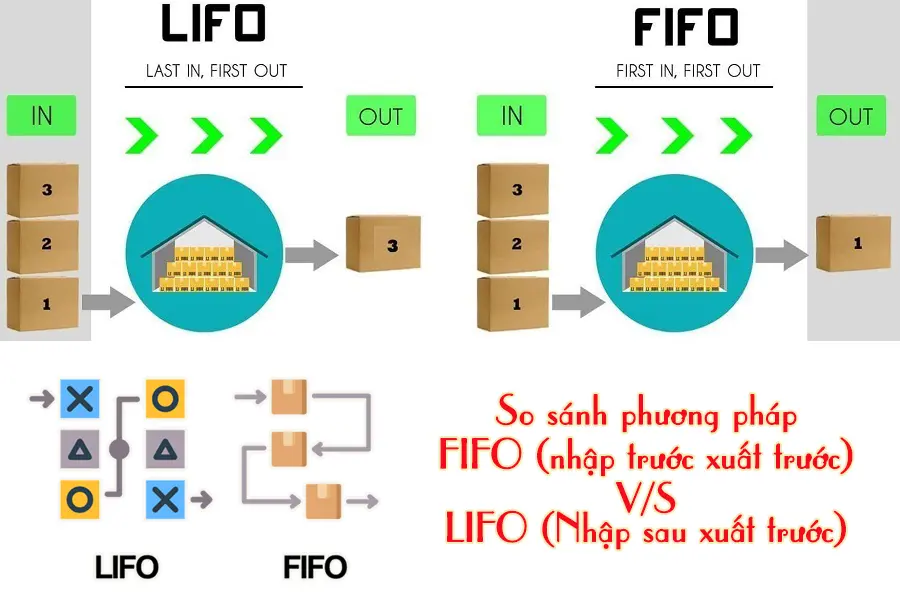

Muốn biết giữa FIFO và LIFO nên chọn phương pháp nào, giữa chúng có gì khác nhau, cùng cập nhật kiến thức sau:

Chọn phương pháp FIFO hay LIFO?

Khi chọn giữa FIFO và LIFO, doanh nghiệp cần cân nhắc các nhược điểm cùng với lợi ích của từng phương pháp. FIFO thường được ưu tiên trong các ngành có sản phẩm có hạn sử dụng ngắn và cần quản lý hàng tồn kho liên tục.

Trong khi đó, LIFO có thể phù hợp hơn với các ngành công nghiệp mà giá trị hàng tồn kho có xu hướng tăng lên theo thời gian, dù nó có thể gây ra những phức tạp nhất định trong quản lý tài chính.

Sự khác nhau giữa FIFO và LIFO

Bảng thống kê sau sẽ giúp các doanh nghiệp hiểu được sự khác nhau cơ bản giữa nguyên tắc Lifo so với nguyên tắc Fifo là gì:

| Tiêu chí | Phương pháp FIFO (First In First Out) | Phương pháp LIFO (Last In First Out) |

| Phù hợp sử dụng | Dòng sản phẩm có hạn sử dụng ngắn hoặc chúng dễ bị hư hỏng. | Hàng hoá có hạn sử dụng lâu, thời gian lưu trữ được tính bằng năm. |

| Mặt hàng | Dòng sản phẩm về thời trang như giày dép, túi xách. | Ngành công nghiệp, trang thiết bị, linh kiện điện tử. |

| Ưu điểm |

|

|

| Nhược điểm |

|

|

Nguyên tắc fifo là gì và những kiến thức cần biết về FIFO trong xuất nhập khẩu đã được Proship Logistics cập nhật đầy đủ, chi tiết nhất ở trên. Đây cũng là hình thức quản lý được lựa chọn sử dụng nhiều hiện nay. Song mỗi phương thức dù là FIFO hay LIFO đều có ưu nhược điểm riêng nên tùy loại hàng hóa và chiến lược kinh doanh cụ thể của doanh nghiệp mà chọn cho phù hợp.

Quý doanh nghiệp có nhu cầu thuê kho ngoại quan Bonded Warehouse hoặc sử dụng Dịch vụ fulfillment kho ngoại quan,…Liên hệ ngay 0909 344 247 để được hỗ trợ tốt nhất về dịch vụ.