Proship.vn chuyên cung cấp dịch vụ khai hải quan trọn gói giá rẻ, uy tín tốt nhất thị trường với việc nhận khai hàng xuất, hàng nhập tại Cảng Cát Lái, Cửa khẩu, Sân bay Tân Sơn Nhất theo quy trình chuyên nghiệp, thủ tục nhanh – gọn – lẹ, không tốn quá nhiều công sức của các Chủ hàng/Doanh nghiệp.

Theo đó, các công việc liên quan gồm: Vận chuyển Quốc tế – Khai báo hải quan – Làm thủ tục hải quan thông quan tờ khai – Vận chuyển Nội địa giao hàng tận nơi, Proship Logistics sẽ thay khách hàng đảm nhiệm. Tận tâm – Chu đáo – Trách nhiệm – Chuẩn xác là phương châm hoạt động của chúng tôi khi thực hiện khai hải quan hàng XNK (kể cả với vai trò là Đơn vị khai thuê hay Đại lý hải quan chuyên trách).

📝 Hotline Liên Hệ Khai Báo Hải Quan

Dịch vụ khai báo hải quan trọn gói uy tín tại Proship Logistics

CÔNG TY CỔ PHẦN PROSHIP tự hào là đơn vị hàng đầu trong lĩnh vực Vận tải – Logistics uy tín tại khu vực TPHCM/Hà Nội/Đà Nẵng, với dịch vụ khai báo hải quan trọn gói giá rẻ nhanh chóng, uy tín tốt nhất. Đội ngũ nhân sự của Proship không chỉ chuyên nghiệp, am hiểu rõ mọi vấn đề khúc mắc Quý khách hàng thường gặp mà còn có kinh nghiệm chuyên môn trong việc làm thủ tục hải quan cho nhiều mặt hàng khác nhau (từ hàng tiêu dùng tới hàng sản xuất – kinh doanh, hàng công nghiệp thực phẩm, hàng dự án).

Dịch vụ KBHQ trọn gói chuyên nghiệp mà Proship Logistics cung cấp gồm 2 hình thức chính, đó là:

- Dịch vụ Khai thuê hải quan: Với hình thức này, Nhà cung cấp dịch vụ Proship sẽ tiến hành hoàn tất các thủ tục hải quan cho bạn. Tên pháp nhân của Nhà cung cấp sẽ không xuất hiện trên bất kỳ chứng từ hải quan nào.

- Đại lý hải quan chuyên trách: Với hình thức này, Nhà cung cấp dịch vụ Proship sẽ sử dụng tên pháp nhân và chữ ký số của mình để hoàn thành các thủ tục. Đồng thời sẽ chịu trách nhiệm sao y chứng từ và nộp hồ sơ đầy đủ lên Cơ quan hải quan.

=> Lưu ý: Cả hai hình thức trên đều có ưu và nhược điểm riêng, tùy nhu cầu mà có sự lựa chọn sao cho hợp lý nhất. Khai thuê hải quan mang lại sự tiện lợi cho khách hàng song nhược điểm là Nhà cung cấp Dịch vụ chúng tôi sẽ không xuất hiện và chịu trách nhiệm trong quá trình thủ tục nên có thể đem lại rủi ro trong một số trường hợp.

ĐẶC BIỆT, khi hợp tác với Đơn vị xuất nhập khẩu FadoExpress, PROSHIP LOGISTICS tự tin với nền tảng tiềm lực sẵn có cùng kinh nghiệm khai hải quan lâu năm sẽ hoàn thành các công việc liên quan tới hải quan tại SB Tân Sơn Nhất, Cảng Cát Lái cho Doanh nghiệp XNK. Trong vai trò mới là Đại lý, phía Chủ hàng/Doanh nghiệp sẽ không phải dùng chữ ký số của mình để duyệt ký (từ xa), hay gửi giấy khống như trước đây. Thay vào đó, Đại lý khai hải quan chúng tôi sẽ dùng chữ ký số hợp lệ của mình để khai và truyền tờ khai cho lô hàng Sea/hàng Air xuất, nhập của quý khách. Điều này sẽ góp phần giúp Doanh nghiệp tiết kiệm hiệu quả về thời giờ, công sức lẫn chi phí so với việc sử dụng Dịch vụ khai thuê hải quan.

Dịch vụ KBHQ trọn gói của Proship cam kết gì với khách hàng?

Cam kết của Proship Logistics:

- Cam kết chi phí thấp, sẵn sàng phục vụ khách 24/7;

- Dịch vụ thông quan hàng gấp;

- Xử lý nhanh các lô hàng khó;

- Tính chuyên nghiệp và uy tín cao;

- Giao hàng nhanh, đúng hẹn và tận nơi;

- Nhân viên chứng từ, giao nhận hiện trường OPS giàu kinh nghiệm, nhiệt huyết, trách nhiệm cao;

- Dịch vụ trọn gói và không phát sinh thêm chi phí.

Đối tượng khách hàng của Proship khi khai HQ tại cảng biển, sân bay

Proship Logistics hướng tới các đối tượng khách hàng sau khi khai HQ hàng Sea, hàng Air xuất/nhập:

- Khách hàng có nhu cầu sử dụng Dịch vụ Hải quan Logistics trọn gói;

- Các Công ty xuất khẩu, nhập khẩu vào ra các Khu công nghiệp, Khu phi thuế quan;

- Các Công ty xuất khẩu, nhập khẩu qua các Sân bay, Cảng biển Việt Nam và Quốc tế.

Loại hình khai hải quan hàng xuất, hàng nhập có thể thực hiện

Nhằm nâng cao năng lực hoạt động khai hải quan xuất nhập khẩu, Proship đã và đang lên kế hoạch triển khai thực hiện các loại hình KBHQ sau:

- Loại hình xuất nhập khẩu Kinh Doanh;

- Loại hình xuất nhập khẩu sản xuất xuất khẩu;

- Loại hình xuất nhập khẩu gia công;

- Loại hình tạm nhập tái xuất, tạm xuất tái nhập;

- Loại hình quá cảnh;

- Loại hình xuất nhập khẩu tại chỗ;

- Loại hình xuất nhập khẩu phi mậu dịch;

- Loại hình xuất nhập khẩu đầu tư có thuế, miễn thuế.

Các mặt hàng nhận khai hải quan trọn gói tại SB Tân Sơn Nhất và Cảng Cát Lái

Dưới đây là các mặt hàng Proship có thể khai hải quan tại SB Tân Sơn Nhất:

- Nhóm mặt hàng thiết bị chuyên dụng: Thiết bị y tế; Thiết bị công nghiệp, thiết bị ngành hàng không, quốc phòng; Thiết bị máy in màu, ngành in ấn,…;

- Nhóm hàng thực phẩm thường, thực phẩm bảo vệ sức khỏe;

- Nhóm mặt hàng thực phẩm: thịt bò, thịt trâu, thịt xông khói, rau củ các loại; hải sản tươi sống: tôm, cá, cua, ốc, mực,…;

- Mặt hàng đồ chơi trẻ em, thiết bị điện tử gia dụng;

- Nhóm hàng phân bón, thuốc bảo vệ thực vật,…;

- Linh kiện điện tử, phụ tùng máy móc công nghiệp,…;

- Mỹ phẩm (hàng thương mại, không phải hàng xách tay);

- Hàng thủ công mỹ nghệ: mây tre đan,…

Dưới đây là các mặt hàng Proship có thể khai hải quan tại Cảng Cái Lái:

- Sản phẩm phục vụ xây dựng;

- Sản phẩm bằng sắt, thép;

- Hàng y tế, hàng hóa chất, hàng thực phẩm;

- Hàng hải sản tươi sống, và hàng đông lạnh;

- Hàng máy móc cũ, hàng máy móc mới, các linh kiện trong dây chuyền sản xuất, hàng phục vụ cho công trình,…

Địa chỉ khai hải quan tại cảng Cát Lái và SB Tân Sơn Nhất

Tại Cảng Cát Lái

KBHQ tại Cảng Cát Lái (Địa chỉ: Chi cục hải quan cửa khẩu cảng Sài Gòn Khu vực 1, Cổng B, Khu Cảng Cát Lái, Lê Phụng Hiểu, Phường Cát Lái, Quận 2).

Tại SB Tân Sơn Nhất

- Kho TCS: 46 – 48 Hậu Giang, Phường 4, Quận Tân Bình, Tp. Hồ Chí Minh.

- Kho SCSC: 30 Phan Thúc Duyện, Phường 4, Quận Tân Bình TP. Hồ Chí Minh.

Bảng giá dịch vụ khai báo hải quan cho hàng hóa xuất nhập khẩu tại sân bay Tân Sơn Nhất, Nội Bài, Đà Nẵng...

|

STT |

Luồng tờ khai hải quan |

Giá (vnđ) |

|

1 |

Tờ khai luồng xanh |

700.000 – 1.400.000 |

|

2 |

Tờ khai luồng vàng |

1.200.000 – 1.700.000 |

|

3 |

Tờ khai luồng đỏ |

1.800.000 – 2.400.000 |

Bảng giá dịch vụ khai báo hải quan tại cảng biển quốc tế

Khai báo hải quan cho hàng hóa xuất nhập khẩu đường biển ghép container LCL

|

STT |

Luồng tờ khai hải quan |

Giá (vnđ) |

|

1 |

Tờ khai luồng xanh |

800.000 – 1.300.000 |

|

2 |

Tờ khai luồng vàng |

1.200.000 – 2.200.000 |

|

3 |

Tờ khai luồng đỏ |

1.900.000 – 2.900.000 |

Khai báo hải quan cho hàng hóa xuất nhập khẩu đường biển nguyên container FCL cont 20’

|

STT |

Luồng tờ khai hải quan |

Giá (vnđ) |

|

1 |

Tờ khai luồng xanh |

600.000 – 1.000.000 |

|

2 |

Tờ khai luồng vàng |

1.200.000 – 2.000.000 |

|

3 |

Tờ khai luồng đỏ |

2.000.000 – 3.000.000 |

Khai báo hải quan cho hàng hóa xuất nhập khẩu đường biển nguyên container FCL cont 40’

|

STT |

Luồng tờ khai hải quan |

Giá (vnđ) |

|

1 |

Tờ khai luồng xanh |

600.000 – 1.000.000 |

|

2 |

Tờ khai luồng vàng |

1.200.000 – 2.200.000 |

|

3 |

Tờ khai luồng đỏ |

2.200.000 – 3.200.000 |

Hồ Chí Minh

Số 161/1-3 Cộng Hòa, P. 12, Q. Tân Bình, TP. HCM

Doanh nghiệp được lợi gì khi chọn dịch vụ khai báo hải quan trọn gói giá rẻ tại Proship?

Các Cá nhân, DN chuyên kinh doanh hàng xuất/nhập đường biển, đường hàng không tin chọn Dịch vụ KBHQ trọn gói tại Proship sẽ nhận lại nhiều lợi ích thiết thực như:

- Đại lý hải quan Proship sẽ chịu trách nhiệm nội dung khai trên Tờ khai HQ cùng với DN XNK;

- Đại lý KBHQ Proship thay mặt DN làm thủ tục xuất nhập khẩu hàng hóa theo hợp đồng ký kết giữa 2 bên;

- Tên và mã số của Đại lý Hải quan chúng tôi sẽ thể hiện trên Tờ khai và Hệ thống Hải quan;

- Hoàn thành tiến trình KBHQ theo tiêu chí: “Nhanh chóng – Chính xác – Giá rẻ – Chuyên nghiệp”;

- Không đặt mục tiêu cung cấp Dịch vụ GIÁ RẺ NHẤT mà là chất lượng đảm bảo chi phí HỢP LÝ NHẤT;

- Khách hàng được tư vấn tận tình về chứng từ, quy trình thủ tục, áp mã HS,…bởi đội ngũ nhân viên có nghiệp vụ hải quan;

- Nắm rõ quy trình thông quan các loại hàng hóa tại Cảng Cát Lái và các cảng biển, sân bay,…;

- Có đủ phương tiện cần thiết để phục vụ hiệu quả cho hoạt động Logistics;

- Cam kết bảo mật thông tin hàng hóa + thông tin khách cung cấp khi sử dụng Dịch vụ KBHQ tại Cảng Cát Lái, SB Tân Sơn Nhất;

- Am hiểu, cập nhật các Thông tư, Nghị định hải quan,…mới nhất để tư vấn cho khách hàng;

- Kỹ năng xử lý nhanh các lô hàng XNK khó khai hải quan tại SB Tân Sơn Nhất, Cảng Cát Lái, các Cửa khẩu,…;

- Chính sách đền bù thiệt hại thỏa đáng cho khách nếu xảy ra tình trạng chậm trễ trong KBHQ;

- Cam kết giao hàng tận nơi cho khách theo yêu cầu (chuẩn xác về thời gian và địa điểm);

- Có VP đại diện tại TPHCM/Hà Nội/Đà Nẵng, thuận lợi cho nhu cầu thuê Dịch vụ khai báo hải quan trọn gói của khách.

📝 Hotline Liên Hệ Khai Báo Hải Quan

Các mã hàng hóa xuất nhập khẩu, doanh nghiệp cần biết khi khai hải quan

Proship xin lưu ý với Doanh nghiệp là KHÔNG PHẢI loại hàng hóa nào cũng được thông quan, kể cả quá trình xuất hay nhập khẩu, các mã hàng cũng là một điều kiện cần thiết trong việc khai báo hải quan. Dưới đây là các loại mã hàng hóa ĐƯỢC PHÉP và DỄ DÀNG xuất, nhập khẩu cần biết:

Mã loại hàng hóa nhập khẩu cập nhật mới nhất

| Mã hàng | Tên hàng hóa |

| A11 | Nhập hàng kinh doanh tiêu dùng |

| A12 | Nhập hàng kinh doanh sản xuất |

| A21 | Chuyển hàng thành tiêu thụ nội địa từ nguồn hàng tạm nhập |

| A31 | Nhập khẩu hàng hóa đã xuất khẩu |

| A41 | Nhập hàng của các doanh nghiệp thực hiện quyền nhập khẩu |

| A42 | Thay đổi mục đích sử dụng hàng hóa hoặc chuyển thành tiêu thụ nội địa từ các loại hình khác, trừ tạm nhập |

| A43 | Nhập khẩu hàng hoá thuộc diện ưu đãi thuế |

| A44 | Nhập khẩu hàng hóa tại nơi được miễn thuế |

| E11 | Nhập nguyên liệu của doanh nghiệp được chế xuất từ nguồn nước ngoài |

| E13 | Nhập hàng hoá khác vào doanh nghiệp chế xuất |

| E15 | Nhập nguyên liệu và vật tư của doanh nghiệp chế xuất từ nội địa |

| E21 | Nhập nguyên liệu hoặc vật tư để gia công cho thương nhân nước ngoài |

| E23 | Nhập nguyên liệu gia công từ hình thức hợp đồng khác chuyển sang |

| E31 | Nhập nguyên liệu sản xuất trong xuất khẩu |

| E33 | Nhập nguyên liệu vào trong kho bảo thuế |

| E41 | Nhập sản phẩm được thuê gia công ở nước ngoài |

| G11 | Tạm nhập hàng kinh doanh và tạm nhập tái xuất |

| G12 | Tạm nhập máy móc và thiết bị phục vụ dự án có thời hạn |

| G13 | Tạm nhập trong trường hợp miễn thuế |

| G51 | Tái nhập hàng hóa khi đã tạm xuất |

| C11 | Hàng hoá nước ngoài gửi tại kho ngoại quan |

| C21 | Hàng đưa được vào khu phi thuế quan |

| H11 | Các loại hàng nhập khẩu khác |

Mã loại hàng hóa xuất khẩu cập nhật mới nhất

| Mã hàng | Tên hàng hóa |

| B11 | Xuất kinh doanh |

| B12 | Xuất sau quá trình đã tạm xuất |

| B13 | Xuất khẩu hàng hóa đã nhập khẩu |

| E42 | Xuất khẩu sản phẩm của doanh nghiệp chế xuất |

| E52 | Xuất sản phẩm hoặc hàng hoá gia công cho doanh nghiệp nước ngoài |

| E54 | Xuất nguyên liệu gia công từ hợp đồng này sang hợp đồng khác |

| E62 | Xuất sản phẩm trong sản xuất xuất khẩu |

| G21 | Tái xuất hàng hoá kinh doanh tạm nhập tái xuất |

| G22 | Tái xuất máy móc phục vụ dự án có thời hạn |

| G24 | Tái xuất khác |

| G61 | Tạm xuất hàng hoá |

| C12 | Hàng hóa từ kho ngoại quan xuất ra nước ngoài |

| C22 | Hàng hóa được đưa ra khu phi thuế quan |

| H21 | Xuất khẩu các loại hàng khác |

Proship Logistics liệt kê các loại chi phí dịch vụ khai báo hải quan trọn gói hiện nay

Chi phí Cảng, Sân bay:

- Phí đóng, rút hàng hóa tại cảng;

- Phí nâng hạ container tại cảng;

- Phí xếp dỡ hàng hóa tại kho đối với hàng lẻ;

- Phí chuyển container sang bãi kiểm hóa, bãi lấy mẫu kiểm tra chuyên ngành;

- Phí lưu kho tại cảng, sân bay;

- Phí lao vụ tại sân bay đối với hàng air.

Chi phí với Hãng vận chuyển:

- Phí nhận lệnh giao hàng D/O đối với hàng nhập;

- Phí phát hành B/L đối với hàng xuất;

- Phí khác đối với hàng lẻ: THC, CFS, CIC, EBS, BAF, Labor fee, Handling fee,…;

- Phí khác đối với hàng nguyên container: THC, EBS, CIC, Seal, Telex release,…

Chi phí vận tải nội địa:

Phí vận chuyển hàng hóa từ Cảng/Sân bay đến kho Khách hàng hay ngược lại.

Phí và lệ phí của các cơ quan kiểm tra chuyên ngành:

- Kiểm tra chất lượng hàng hóa nhập khẩu;

- Kiểm tra vệ sinh an toàn thực phẩm nhập khẩu;

- Kiểm dịch thực vật/động vật;

- Kiểm tra hiệu suất năng lượng;

- Kiểm tra văn hóa phẩm;

- Chứng nhận hợp quy, công bố hợp quy.

Thuế nhập nhẩu, xuất khẩu (nếu có thỏa thuận).

Phí xếp dỡ hàng hóa tại kho Khách hàng.

>>Xem thêm: Khai báo hải quan tại sân bay và cửa khẩu

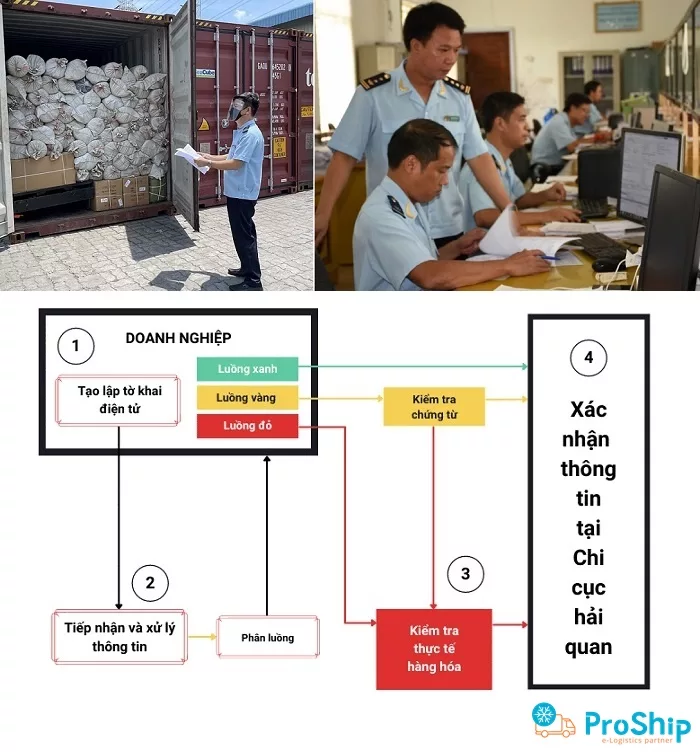

Quy trình khai hải quan hàng xuất, nhập tại cảng Cát Lái và sân bay Tân Sơn Nhất của Proship

Quy trình khai hải quan tại sân bay Tân Sơn Nhất

Đối với hàng nhập khẩu

Tùy từng loại hàng hóa mà thủ tục hải quan sẽ khác nhau nhưng quy trình khai hải quan tại SB Tân Sơn Nhất được thực hiện bởi Proship cơ bản gồm các bước:

- Bước 1: Khách hàng có nhu cầu sử dụng dịch vụ, liên hệ và Proship sẽ báo giá Dịch vụ KBHQ cho hàng nhập khẩu tại Sân bay TSN cho khách;

- Bước 2: Kiểm tra trước các vấn đề liên quan đến hàng hóa như mã HS, thuế nhập khẩu, thuế nhập khẩu ưu đãi đặc biệt nếu có C/O, giấy phép nhập khẩu chuyên ngành (nếu có), dự kiến phân luồng hải quan (xanh/vàng/đỏ), dự kiến khả năng kiểm hóa (nếu có),…và các tình huống có thể xảy ra cũng như cách xử lý để giảm thiểu rủi ro khi thực hiện khai báo và làm thủ tục hải quan;

- Bước 3: Kiểm tra lại bộ chứng từ cho chính xác, truyền nháp tờ khai hải quan điện tử và gửi cho khách hàng, kiểm tra lại trước khi truyền tờ khai chính thức;

- Bước 4: Khai báo hải quan điện tử chính thức, thông báo kết quả phân luồng;

- Bước 5: Đội hiện trường làm các thủ tục để thông quan tờ khai;

- Bước 6: Thông báo kế hoạch và giao hàng đến tận kho của khách hàng;

- Bước 7: Xuất hóa đơn giá trị gia tăng, bàn giao các chứng từ hóa đơn liên quan trực tiếp lô hàng.

Đối với hàng xuất khẩu

Bước 1: Kiểm tra chính sách mặt hàng, chính sách thuế: Tiến hành kiểm tra chính sách Nhà nước có khuyến khích, hạn chế hay cấm xuất khẩu mặt hàng này hay không và chịu thuế xuất khẩu hay không. Một số mặt hàng bị áp thuế là khoáng sản (than, đá, quặng, kim loại quý,…), lâm sản (gỗ, sản phẩm gỗ),…

Bước 2: Chuẩn bị các chứng từ liên quan như:

- Giấy giới thiệu;

- Hợp đồng thương mại (Purchase Order or Contract) (nếu có);

- Phiếu đóng gói (Packing List);

- Hóa đơn thương mại (Invoice);

- Booking;

- Giấy tờ khác theo yêu cầu của Hải quan (nếu có).

* Lưu ý: Trường hợp hàng hóa của là loại đặc thù, phải kiểm tra chuyên ngành, khách hàng cần chuẩn bị thêm những giấy tờ riêng theo quy định hiện hành. Chẳng hạn như gỗ hay sản phẩm từ gỗ, bạn phải chuẩn bị thêm Bảng kê lâm sản có dấu xác nhận của kiểm lâm,…

Bước 3: Mang hàng ra cân tại các kho hàng (TCS/SCSC), khi có phiếu cân hàng thì dùng trọng lượng trên phiếu để khai báo Hải quan.

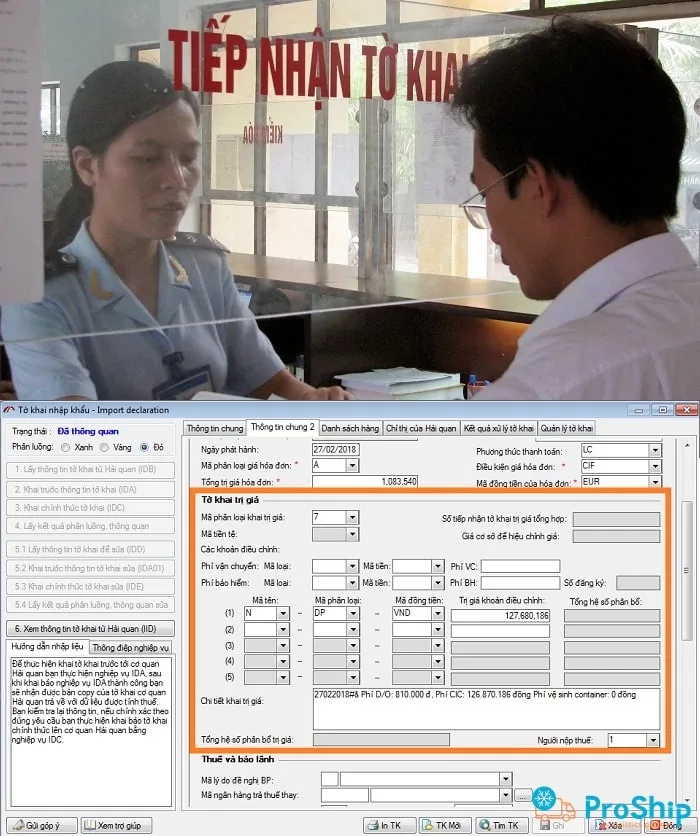

Bước 4: Thực hiện khai tờ khai hải quan bằng phần mềm hải quan điện tử.

Bước 5: Làm thủ tục hải quan xuất khẩu tại Chi cục Hải quan cửa khẩu sân bay quốc tế Tân Sơn Nhất

Bước 6: Thông quan và thanh lý tờ khai.

Bước 7: Xuất hóa đơn giá trị gia tăng, bàn giao các chứng từ hóa đơn liên quan trực tiếp lô hàng.

Quy trình khai hải quan tại cảng Cát Lái và các cảng biển lớn

- Bước 1: Khách hàng có nhu cầu sử dụng dịch vụ, liên hệ và Proship sẽ báo giá Dịch vụ KBHQ tại Cảng Cát Lái và các cảng biển lớn khác.

- Bước 2: Kiểm tra trước các vấn đề liên quan đến tính hợp lệ của bộ chứng từ nhập khẩu (hợp đồng, invoice, packing list, vận đơn,…) hàng hóa như mã HS, thuế suất nhập khẩu thông thường, thuế suất nhập khẩu ưu đãi, thuế suất nhập khẩu ưu đãi đặc biệt (nếu có C/O), giấy phép nhập khẩu chuyên ngành (nếu có), dự kiến phân luồng hải quan (xanh/vàng/đỏ), dự kiến khả năng kiểm hóa (nếu có),…và các tình huống có thể xảy ra cũng như cách xử lý để giảm thiểu rủi ro khi thực hiện khai báo và làm thủ tục hải quan.

- Bước 3: Lên tờ khai nháp gửi khách hàng kiểm tra sau khi có đủ các chứng từ phục vụ việc khai Hải quan. Khai báo hải quan (lên tờ khai nháp gửi khách hàng kiểm tra) và truyền dữ liệu điện tử trên phần mềm VNACCS tới hệ thống Hải quan điện tử;

- Bước 4: Chuẩn bị bộ chứng từ hoàn chỉnh chuyển cho khách ký (ký số hoặc trực tiếp), đính kèm trực tuyến lên hệ thống V5 – nhận kết quả thông báo kết quả phân luồng tờ khai.

- Bước 5: Đội hiện trường tại Cảng Cát Lái làm thủ tục Hải quan, thủ tục kiểm tra chuyên ngành (nếu có) để thông quan tờ khai;

- Bước 6: Thông báo kế hoạch vận chuyển và giao hàng nguyên cont, nguyên chì với hàng FCL và nguyên đai – nguyên kiện với hàng LCL đến tận kho của khách hàng;

- Bước 7: Xuất hóa đơn dịch vụ của Proship bàn giao các chứng từ hóa đơn liên quan trực tiếp lô hàng.

Proship Logistics cung cấp thông tin cần biết về dịch vụ khai báo hải quan trọn gói giá rẻ tốt nhất thị trường, phục vụ hiệu quả cho nhu cầu thông quan hàng xuất, hàng nhập của các Doanh nghiệp hiện nay. Từ đây, nếu các đơn vị kinh doanh chưa có nhiều kinh nghiệm về nghiệp vụ hải quan, chuẩn bị thủ tục giấy tờ cần thiết cho lô hàng của mình ra sao cũng như chưa nắm cách thức KBHQ như thế nào cho hợp lệ – Liên hệ ngay Hotline 0909 344 247 để được tư vấn và báo giá trực tiếp.