x Bạn muốn biết ưu điểm của thanh toán TTR là gì? Có nhược điểm gì?

x Các cá nhân, doanh nghiệp nhập khẩu đã, đang và sẽ phải thực hiện lệnh chuyển tiền, cần tìm hiểu về thanh toán quốc tế TTR?

x Các cá nhân xuất khẩu hàng thuộc diện được hoàn tiền hoặc ngân hàng đại diện cho người nhập khẩu thanh toán TTR cần tìm hiểu quy trình thực hiện thanh toán ra sao?

TTR là một trong những hình thức thanh toán quốc tế phổ biến mà bất cứ ai tham gia vào lĩnh vực XNK đều phải biết. Proship.vn chúng tôi với nhiều năm kinh nghiệm về lĩnh vực vận tải quốc tế, XNK,…sẽ giải đáp nhanh TTR là gì, các bên liên quan tới TTR là ai? Quy trình thanh toán thế nào?…để các bên liên quan hoặc trực tiếp tham gia có thể nắm rõ và hiểu đúng vấn đề.

Thanh toán TTR là gì, các bên liên quan là ai?

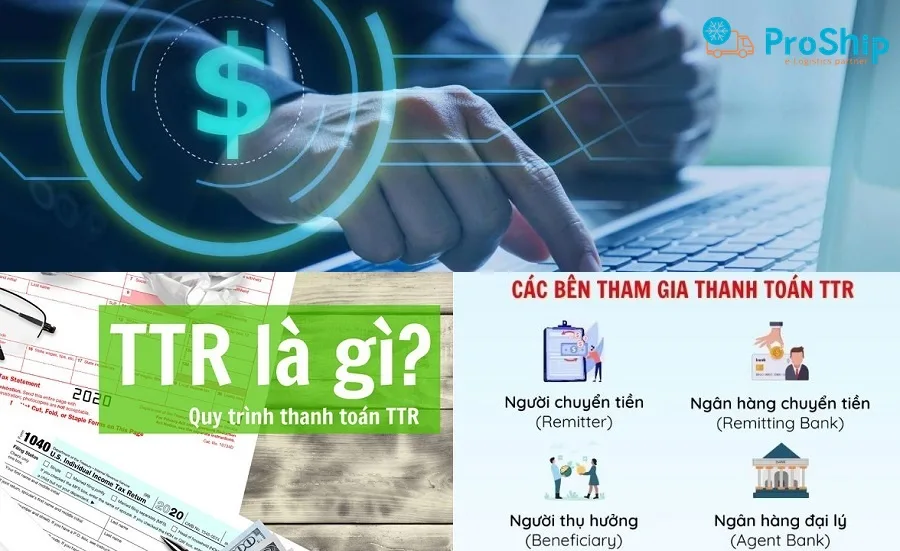

TTR là gì?

TTR là gì? TTR (Telegraphic Transfer Reimbursement) là hình thức thanh toán quốc tế thông qua việc chuyển tiền bằng điện có bồi hoàn, thường áp dụng trong giao dịch thanh toán bằng L/C.

Phương thức thanh toán TTR và chấp nhận thanh toán TTR trong L/C được sử dụng khi doanh nghiệp thực hiện thanh toán. Để thực hiện TTR, doanh nghiệp phải gửi các tài liệu, giấy tờ giao dịch liên quan đến ngân hàng và đảm bảo rằng chúng tuân thủ đúng theo quy định pháp luật.

Sau khi doanh nghiệp xuất nhập khẩu gửi thành công tất cả giấy tờ cần thiết, ngân hàng sẽ phát hành công văn. Một số ngân hàng có thể liên lạc trực tiếp để xác nhận thông tin, sau đó chuyển tiền cho người bán trong vòng 3 ngày kể từ thời điểm xác nhận thông tin.

Nếu L/C không cho phép thực hiện thanh toán TTR, doanh nghiệp XNK sẽ phải đợi cho đến đến khi có đủ bộ chứng từ thanh toán quốc tế và nộp cho ngân hàng để tiến hành xét duyệt. Sau đó, doanh nghiệp phải đợi thêm khoảng 7 ngày làm việc để xác định thanh toán đã được xác nhận hay chưa.

Các bên tham gia phương thức thanh toán TTR

Các bên liên quan đến hình thức thanh toán này thường là:

- Người chuyển tiền: Là những cá nhân, doanh nghiệp nhập khẩu thực hiện lệnh chuyển tiền;

- Người thụ hưởng: Là các cá nhân xuất khẩu hàng hóa, người nằm trong diện được hoàn trả tiền;

- Ngân hàng chuyển tiền: Là ngân hàng đứng ra đại diện cho người nhập khẩu thanh toán theo hình thức TTR;

- Ngân hàng đại lý: Ngân hàng này có mối quan hệ chặt chẽ với ngân hàng chuyển tiền.

Ưu, nhược điểm của thanh toán TTR là gì?

Ưu, nhược điểm của thanh toán TTR là gì? Proship xin chia sẻ như sau:

Ưu điểm của thanh toán TTR

- Thanh toán nhanh:

Thao tác thanh toán TTR tương đối nhanh, chỉ cần bên nhập khẩu gửi lệnh thanh toán, tiền có thể được chuyển trong vòng 1 ngày làm việc.

- Chi phí thấp:

Thanh toán bằng điện diễn ra thông qua hệ thống thanh toán điện tử, giúp giảm đi chi phí so với phương thức truyền thống.

Nhược điểm của thanh toán TTR

- Khó chỉnh sửa:

Do thanh toán TTR diễn ra trong thời gian ngắn, nếu có sai sót xảy ra, việc chỉnh sửa có thể khó khăn. Điều này có thể gây ra rủi ro và các vấn đề liên quan đến đảm bảo tính chính xác và bảo mật của giao dịch thanh toán.

>>Xem thêm: Phí AFR là gì?

Quy trình thanh toán quốc tế TTR như thế nào?

Quy trình thanh toán TTR giúp đảm bảo hiệu quả và tốc độ trong việc thanh toán. Dưới đây là các bước chi tiết:

- Bước 1: Người bán chuẩn bị tài liệu liên quan đến hàng hóa và chuyển chúng cho người mua.

- Bước 2: Người mua nhận giấy tờ, chứng từ và kiểm tra tính chính xác, sự phù hợp với quy định. Nếu tất cả thông tin đều chính xác, người bán sẽ thực hiện quá trình sắp xếp và chuyển hàng.

- Bước 3: Người mua thực hiện thủ tục thanh toán TTR tại ngân hàng sau khi đã nhận được hàng đầy đủ theo kế hoạch.

- Bước 4: Ngân hàng nhận yêu cầu từ khách hàng và đặt lệnh chuyển tiền sang ngân hàng nước ngoài để thanh toán cho người bán.

- Bước 5: Ngân hàng nước ngoài xác nhận và thanh toán cho người bán.

Quy trình thanh toán TTR cũng có thể thay đổi tùy theo điều khoản trả trước hoặc trả sau. Dưới đây là quy trình cho từng trường hợp cụ thể:

Quy trình thanh toán TTR trả trước

Đối với hình thức thanh toán TTR trả trước, quy trình gồm các bước:

- Bước 1: Người mua đến ngân hàng của mình và đặt lệnh chuyển tiền để thanh toán cho người bán;

- Bước 2: Ngân hàng người mua sẽ gửi thông báo nợ đến người mua;

- Bước 3: Ngân hàng người mua tiến hành chuyển tiền đến ngân hàng của người bán;

- Bước 4: Ngân hàng người bán sẽ gửi thông báo đến người bán;

- Bước 5: Người bán giao hàng và các chứng từ hàng hóa liên quan cho người mua.

Quy trình thanh toán TTR trả sau

Đối với hình thức thanh toán TTR trả sau, quy trình gồm các bước:

- Bước 1: Người bán giao hàng và giấy tờ, chứng từ hàng cho người mua;

- Bước 2: Người mua đưa ra lệnh chuyển tiền tại ngân hàng người mua để thanh toán cho người bán;

- Bước 3: Ngân hàng người mua sẽ gửi thông báo nợ đến người mua;

- Bước 4: Ngân hàng người mua thực hiện chuyển tiền đến ngân hàng người bán;

- Bước 5: Ngân hàng người bán sẽ gửi thông báo có đến người bán.

Lưu ý khi sử dụng phương thức thanh toán TTR

TTR là gì và quy trình các bước thanh toán quốc tế TTR ra sao đã được Proship chia sẻ. Ngoài ra, khi sử dụng phương thức thanh toán TTR (Telegraphic Transfer), bạn cần lưu ý:

Giữ các giấy tờ liên quan

Để đảm bảo và có giấy tờ đối soát trong trường hợp hải quan kiểm tra, doanh nghiệp nên giữ các giấy tờ liên quan đến việc mua bán và thanh toán. Đó bao gồm lệnh chuyển tiền và điện chuyển tiền có dấu mộc của ngân hàng, cùng với bộ chứng từ gốc.

Gửi chứng từ gốc đến ngân hàng

Nhà xuất khẩu có trách nhiệm mang bộ chứng từ gốc đi sao y thành một bản khác và chủ động gửi kèm theo lệnh chuyển tiền đồng thời gửi lại cho phía ngân hàng để ngân hàng thực hiện thanh toán bằng cách chuyển khoản.

Thanh toán sau khi nhận hàng và chứng từ gốc

Khi sử dụng phương thức thanh toán TTR trả sau, bên nhập khẩu chỉ thanh toán khi đã nhận đủ hàng kèm theo bộ chứng từ gốc và tờ khai hải quan.

Giữ lại các chứng từ

Giữ lại bản sao của các chứng từ liên quan đến giao dịch TTR, bao gồm biên nhận chuyển tiền và thông tin xác nhận từ ngân hàng. Những chứng từ này có thể hữu ích để tra cứu và xác minh lại giao dịch sau này.

Đảm bảo đủ số tiền trong tài khoản

Nhà nhập khẩu cần đảm bảo có đủ số tiền trong tài khoản để thanh toán theo hoá đơn thương mại.

TTR là gì cùng các bước quy trình hoàn thiện thanh toán TTR trả trước và trả sau đã được chuyển tải đầy đủ tới quý bạn đọc. Theo đó, các bên liên quan có thể tìm hiểu, áp dụng thanh toán quốc tế Telegraphic Transfer Reimbursement một cách chuẩn xác và đúng luật…Khi có nhu cầu cần tư vấn hoặc liên hệ sử dụng dịch vụ vận tải Nội địa và Quốc tế, liên hệ ngay với Proship Logistics qua số 0909 344 247.